3 European Dividend Stocks To Consider With At Least 4.9% Yield

In a holiday-shortened week, the pan-European STOXX Europe 600 Index edged up slightly, closing just below its recent record high as investors maintained a positive outlook on earnings and economic prospects. Amid this backdrop of cautious optimism in European markets, dividend stocks with robust yields can offer stability and income potential for investors seeking to navigate the current economic landscape.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.08% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.44% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.38% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.99% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.78% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.31% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.81% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.09% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.28% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.18% | ★★★★★★ |

Click here to see the full list of 191 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

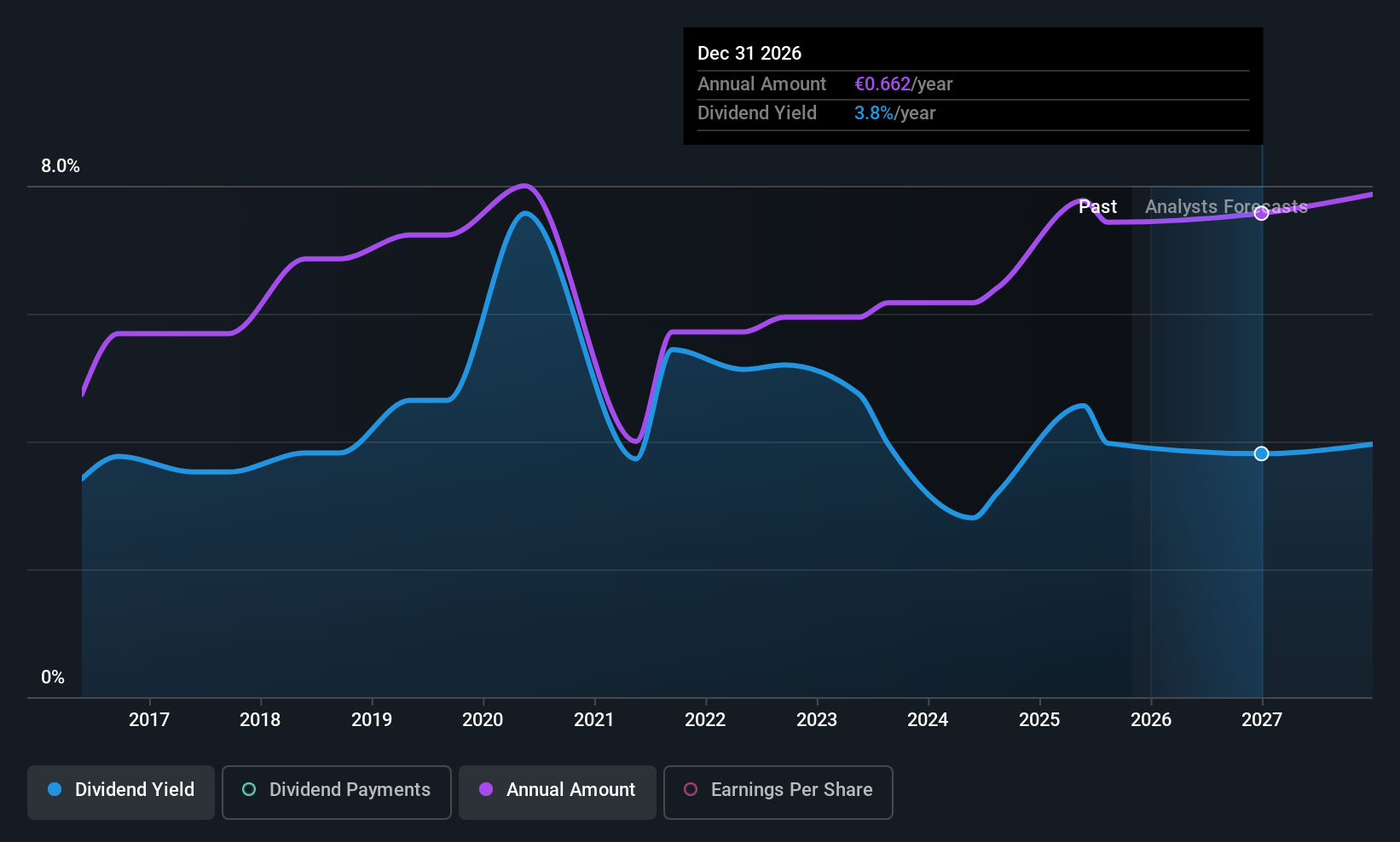

Galp Energia SGPS (ENXTLS:GALP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Galp Energia SGPS is an integrated energy operator with operations in Portugal and internationally, and it has a market cap of €10.17 billion.

Operations: Galp Energia SGPS generates revenue from several segments, including €2.70 billion from Upstream, €10.47 billion from Commercial, €7.80 billion from Industrial & Midstream, and €97 million from Renewables and New Businesses.

Dividend Yield: 4.4%

Galp Energia's dividend payments have grown over the past decade, yet remain volatile and below top-tier yields in Portugal. With a payout ratio of 49.7% and cash payout ratio of 59.8%, dividends are well-covered by earnings and cash flows. Recent strategic agreements with TotalEnergies, including asset swaps and shared exploration costs, could influence future financial stability but currently do not guarantee immediate dividend improvements amidst declining earnings forecasts.

- Click here and access our complete dividend analysis report to understand the dynamics of Galp Energia SGPS.

- Our comprehensive valuation report raises the possibility that Galp Energia SGPS is priced lower than what may be justified by its financials.

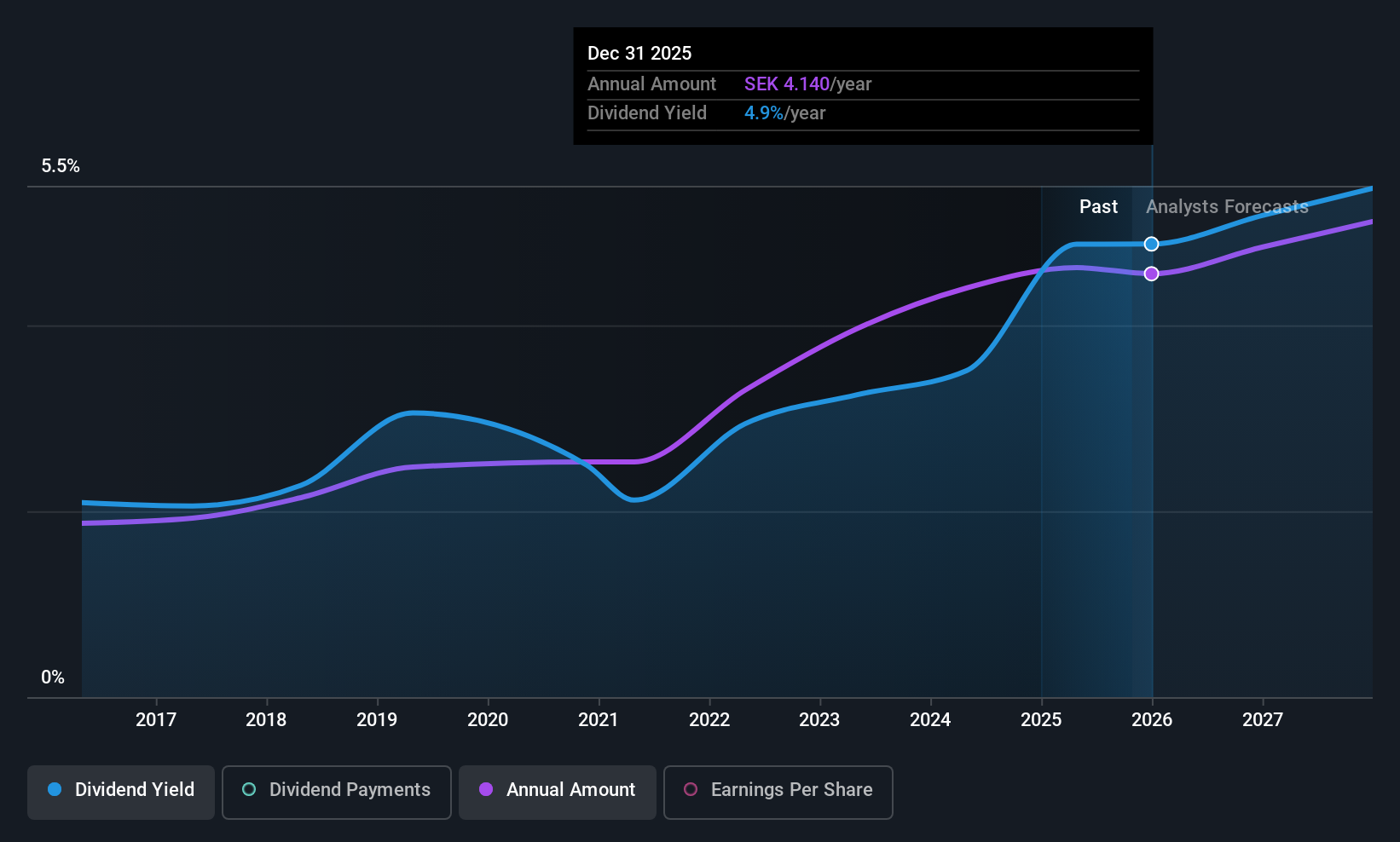

HEXPOL (OM:HPOL B)

Simply Wall St Dividend Rating: ★★★★★★

Overview: HEXPOL AB (publ) is a company that develops, manufactures, and sells polymer compounds and engineered gaskets, seals, and wheels across Sweden, Europe, the United States, the Americas, and Asia with a market cap of SEK30.29 billion.

Operations: HEXPOL AB generates revenue primarily from its HEXPOL Compounding segment, which accounts for SEK18.65 billion, and its HEXPOL Engineered Products segment, contributing SEK1.70 billion.

Dividend Yield: 4.8%

HEXPOL's dividends are well-covered by earnings and cash flows, with a payout ratio of 73.9% and a cash payout ratio of 73.6%. The company offers a high dividend yield of 4.78%, placing it in the top quartile for Swedish dividend payers, and has shown stable growth over the past decade. Despite recent declines in sales and net income, HEXPOL maintains strong financial resources to support its M&A strategy amidst geopolitical uncertainties, potentially enhancing future growth prospects.

- Delve into the full analysis dividend report here for a deeper understanding of HEXPOL.

- Our expertly prepared valuation report HEXPOL implies its share price may be lower than expected.

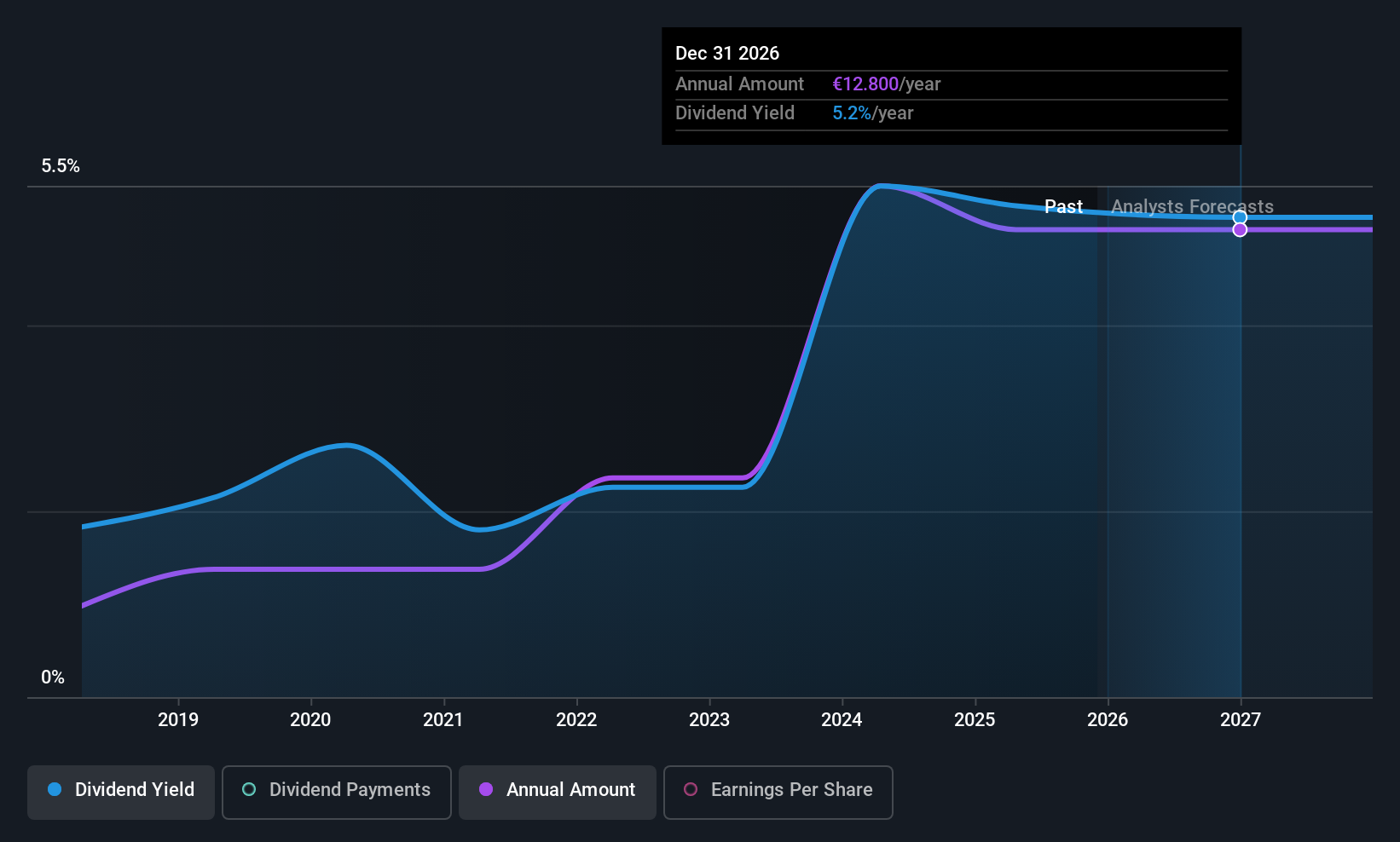

Logwin (XTRA:TGHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Logwin AG is a logistics and transport solutions provider operating in Germany, Austria, other European countries, and the Asia/Pacific region with a market cap of €737.08 million.

Operations: Logwin AG generates its revenue primarily from its Air + Ocean segment, which accounts for €1.24 billion, and the Solutions segment, contributing €252.53 million.

Dividend Yield: 5%

Logwin's dividends are reliably covered by both earnings and cash flows, with payout ratios of 58.6% and 36.6%, respectively. Despite only eight years of dividend history, payments have been stable and growing, placing it in the top quartile for German dividend yields at 5%. The company trades significantly below its estimated fair value, suggesting potential upside. Logwin anticipates 2025 revenues between €1.27 billion and €1.55 billion amid ongoing market challenges.

- Take a closer look at Logwin's potential here in our dividend report.

- Our valuation report here indicates Logwin may be undervalued.

Seize The Opportunity

- Click here to access our complete index of 191 Top European Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal