Asian Growth Companies With High Insider Ownership In January 2026

As of January 2026, the Asian markets are experiencing a period of cautious optimism, with key indices like Japan's Nikkei 225 and China's CSI 300 showing positive momentum amid global economic shifts and AI-driven growth prospects. In this context, identifying growth companies with high insider ownership can be particularly appealing to investors seeking alignment between management interests and shareholder value.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.8% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

We're going to check out a few of the best picks from our screener tool.

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★★☆

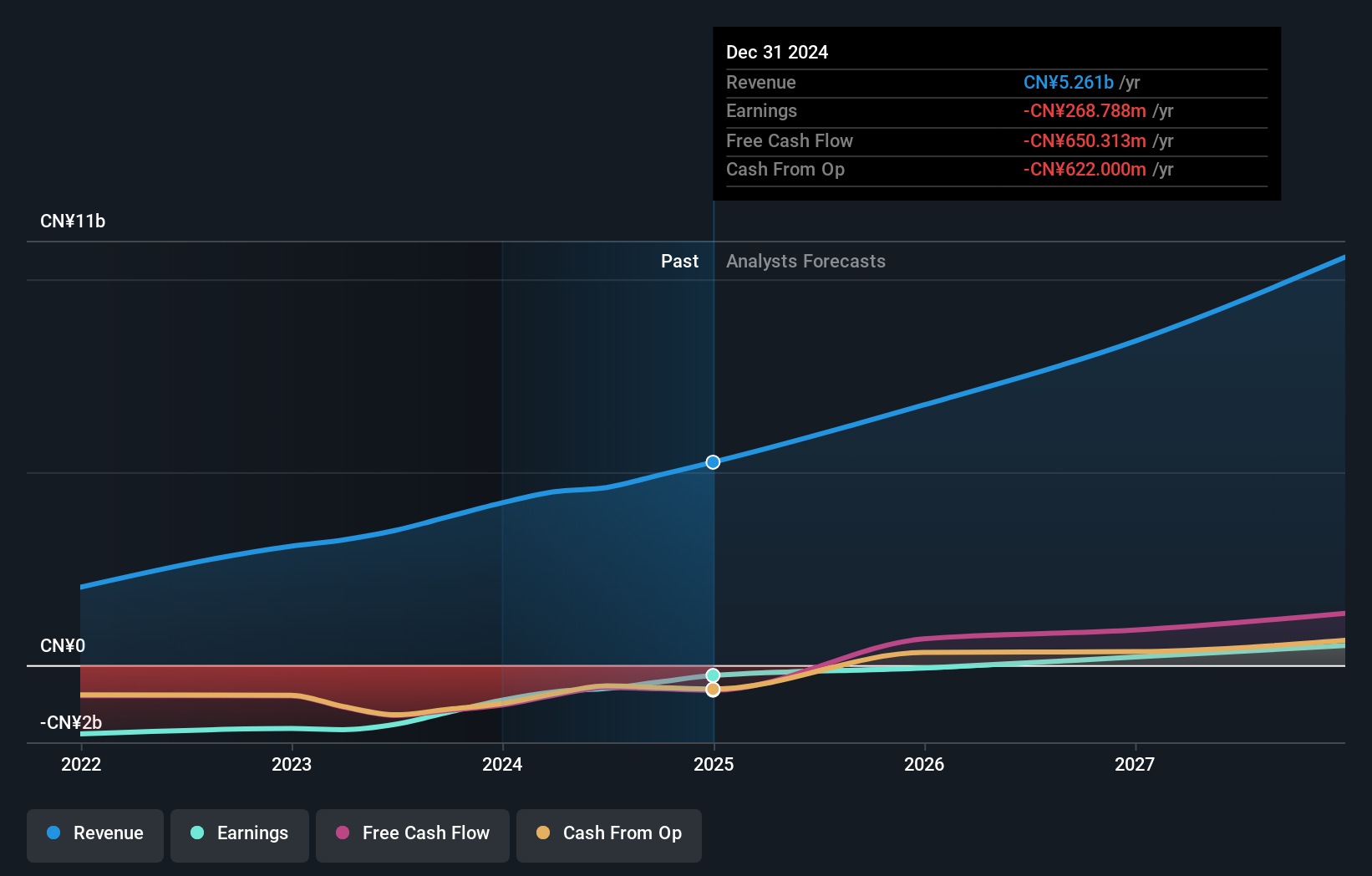

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in China, with a market cap of HK$22.85 billion.

Operations: The company's revenue is primarily derived from its 4ParadigmSage AI Platform at CN¥4.57 billion, followed by Shift Intelligent Solutions at CN¥940.30 million and Sagegpt Aigs Services at CN¥505.70 million.

Insider Ownership: 20.5%

Earnings Growth Forecast: 110.3% p.a.

Beijing Fourth Paradigm Technology is trading at 29.2% below its estimated fair value, with analysts expecting a 75.6% price rise. Earnings have grown 33% annually over five years, and revenue is forecast to grow 26.7% per year, outpacing the Hong Kong market's growth rate of 8.5%. The company recently formed a strategic alliance with Solowin Holdings for blockchain compliance solutions and underwent board changes with Mr. Pan Jialin's appointment as an independent director following Mr. Liu Zhuzhan's resignation.

- Click here and access our complete growth analysis report to understand the dynamics of Beijing Fourth Paradigm Technology.

- Upon reviewing our latest valuation report, Beijing Fourth Paradigm Technology's share price might be too pessimistic.

Dalian BIO-CHEM (SHSE:603360)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Dalian BIO-CHEM Company Limited researches, develops, produces, and sells industrial fungicides in China and internationally, with a market cap of CN¥22.58 billion.

Operations: Dalian BIO-CHEM focuses on the research, development, production, and sale of industrial fungicides both domestically and abroad.

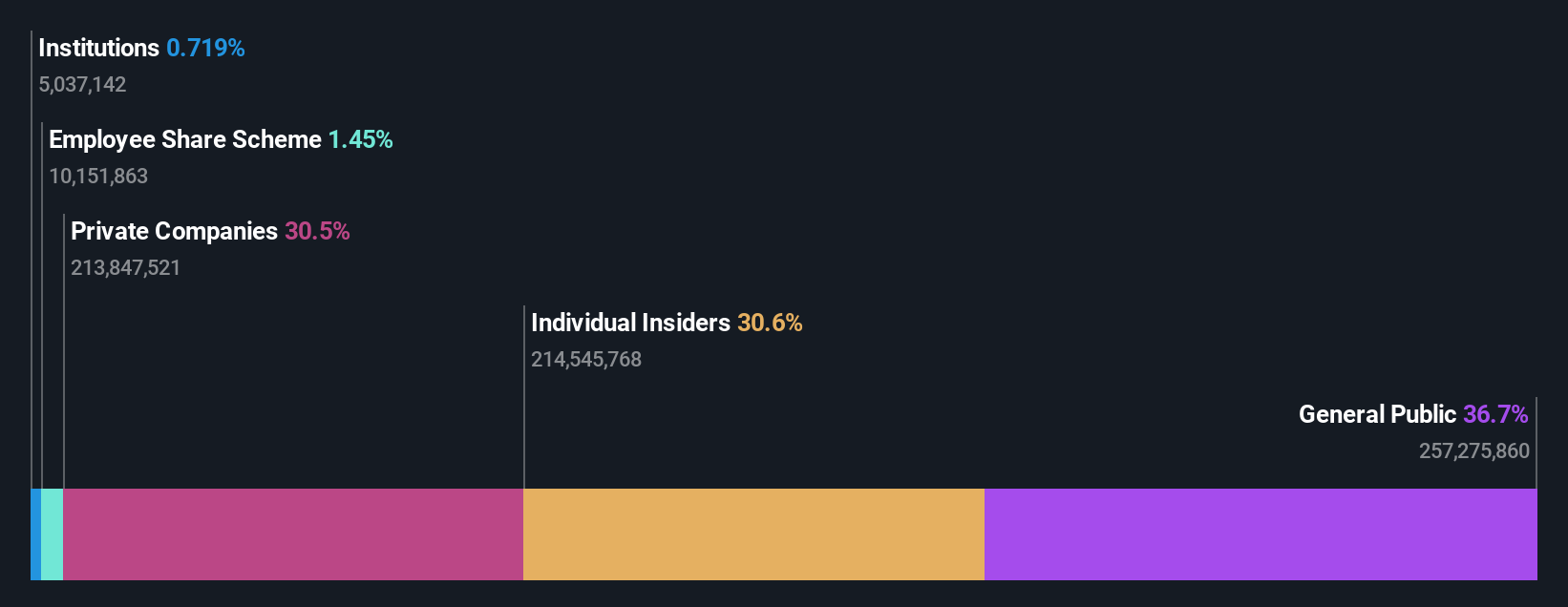

Insider Ownership: 30.6%

Earnings Growth Forecast: 28.5% p.a.

Dalian BIO-CHEM is experiencing significant growth, with earnings projected to rise 28.53% annually and revenue expected to grow 23.1% per year, surpassing the Chinese market average. Despite a volatile share price and declining profit margins from 27% to 14.7%, the company has completed a share buyback of CNY 111.56 million, indicating confidence in its future prospects. However, return on equity remains low at an estimated 18.1% over three years.

- Get an in-depth perspective on Dalian BIO-CHEM's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Dalian BIO-CHEM's share price might be too optimistic.

Phison Electronics (TPEX:8299)

Simply Wall St Growth Rating: ★★★★★☆

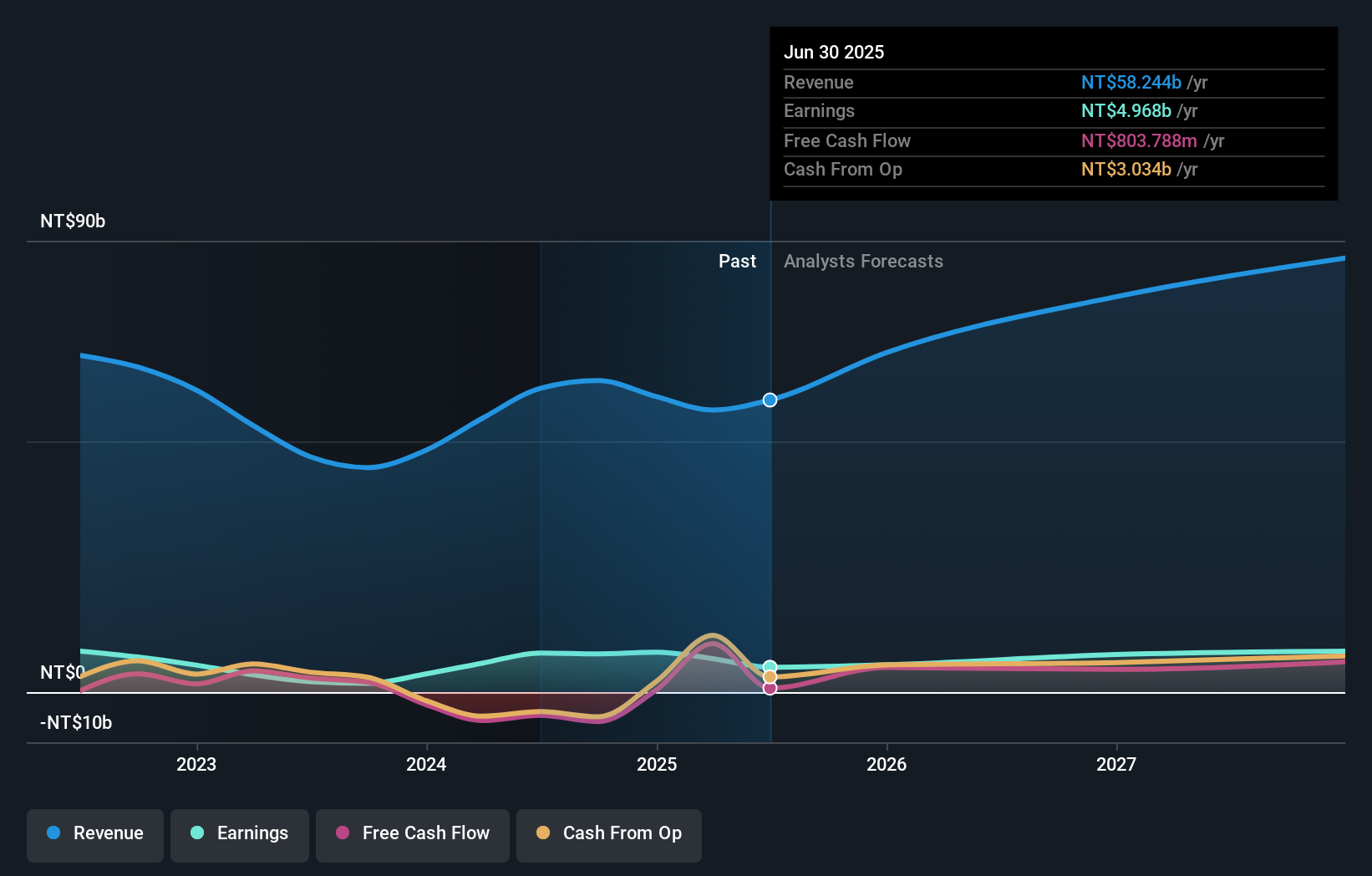

Overview: Phison Electronics Corp. designs, manufactures, and sells flash memory controllers and peripheral system applications globally, with a market cap of NT$301.75 billion.

Operations: The company generates revenue primarily from its Flash Memory Control Chip Design segment, amounting to NT$62.44 billion.

Insider Ownership: 10.8%

Earnings Growth Forecast: 26.5% p.a.

Phison Electronics is poised for substantial growth, with earnings projected to increase 26.49% annually, outpacing the Taiwanese market. Despite recent share price volatility and low forecasted return on equity of 19.4%, insider ownership remains strong without significant selling activity. Recent product innovations like the Pascari SSDs and aiDAPTIV+ technology enhance its position in AI-driven enterprise solutions, supporting robust revenue growth expectations of 22.2% per year beyond market averages.

- Unlock comprehensive insights into our analysis of Phison Electronics stock in this growth report.

- Our valuation report here indicates Phison Electronics may be overvalued.

Taking Advantage

- Unlock our comprehensive list of 628 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Searching for a Fresh Perspective? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal