The magical end of 2025: gold soars 65%, the dollar falls, Trump's return stirs up the world

The Zhitong Finance App learned that although most investors have already predicted that the market pattern will definitely be different in 2025 as Trump returns to the center of power in the world's largest economy, few people can anticipate the turbulence of this market and the final results.

The global stock market recovered strongly from the sharp decline triggered by the “Liberation Day” tariff policy in April. The full year of 2025 rose 21%, achieving double-digit growth for the sixth time in the past seven years. However, looking at other asset classes, surprises abound.

Gold, recognized as a safe haven in the troubled world, ushered in the best year since the 1979 oil crisis, with an annual increase of nearly 65%; on the other hand, the US dollar index fell by nearly 10%, and crude oil prices fell by about 18%, while the riskiest junk bonds in the bond market surged.

Since NVDA.US (NVDA.US), a leading artificial intelligence (AI) company, became the first company in the world with a market capitalization exceeding 5 trillion US dollars in October, the aura of America's “Big Seven” seems to have faded, and Bitcoin's market value has suddenly evaporated by one-third.

Bill Campbell, fund manager at Dual Tier Capital, described 2025 as a “year of change and surprise.” He pointed out that large fluctuations in various types of assets are “closely intertwined” with the three major disruptive issues of trade wars, geopolitics, and debt issues.

Campbell said, “If anyone had told me in advance that Trump would re-enter the White House and pursue aggressive trade policies at the current pace, I would never have anticipated that valuations would be as strong or high as today.”

Affected by Trump's policies, European military companies' stock prices soared 56% throughout the year. Earlier, there were signs that the Trump administration would reduce military protection for Europe, forcing the European region and other NATO member states to speed up arms expansion.

This trend also boosted European bank stocks to record their best annual performance since 1997; the Korean Composite Index rose by 75%, and the return on Venezuelan defaulted bonds was even closer to 100%; silver and platinum rose even more impressive, surging 145% and 125%, respectively.

The Fed cut interest rates three times during the year, Trump's public criticism of the Federal Reserve, and debt concerns sweeping the world all had an impact on the bond market.

The “big and beautiful” spending plan introduced by the Trump administration pushed the US 30-year Treasury yield to break 5.1% in May, the highest level since 2007. Although the current yield has fallen back to 4.8%, the bankers' “term premium” — that is, the widening spread between long-term interest rates and short-term interest rates — is once again triggering market panic.

The yield on Japan's 30-year treasury bonds also climbed to a record high. Paradoxically, global bond market volatility is at a four-year low, while emerging market bonds denominated in local currency ushered in their best year since 2009.

Companies borrow heavily to lay out AI, making AI an important factor affecting the debt market. Goldman Sachs estimates that large AI “hyperscale enterprises” will invest nearly 400 billion US dollars in 2025, and this figure is expected to increase to 530 billion US dollars in 2026.

It's not just gold that shines

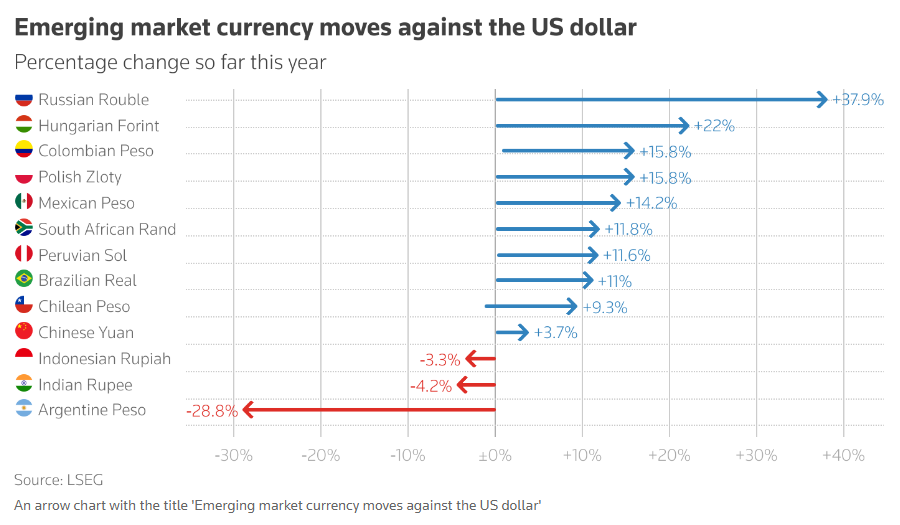

The weakening dollar drove the euro to rise by nearly 14% in 2025, and the Swiss franc by 14.5%; although the yen experienced a sharp drop in December, the exchange rate remained flat throughout the year.

Trump and Russian President Vladimir Putin resumed interaction, driving the Russian ruble exchange rate to soar 40%. However, the ruble was still subject to severe sanctions, and the title of the best currency of the year was eventually taken by Ghanaian cedi — the gold-producing country's currency rose by 41% throughout the year.

The Polish zloty, the Czech koruna, and the Hungarian forint rose between 15% and 21%; in May, the exchange rate of the Taiwan dollar surged 8% against the US dollar in just two days; the Mexican peso and Brazilian real ignored the trade war and both achieved double-digit gains.

Jonny Goulden, head of fixed income strategy research for emerging markets at J.P. Morgan Chase, said: “We don't think this is a short-term phenomenon. The emerging market currency bear market has continued for 14 years, and has since bottomed out and reversed.”

The performance of the Argentine market was also impressive. In September, Argentina's President Javier Millet lost in local elections, and the country's market suffered a severe setback; however, a few weeks later, the Trump administration promised 20 billion US dollars in aid to help Millet win the national midterm elections, and the Argentine market immediately skyrocketed.

The cryptocurrency sector is also in turmoil. Trump launched his own meme coin and pardoned Binance founder Changpeng Zhao as president. The price of Bitcoin once surpassed 125,000 US dollars in October, reaching a record high, then plummeted below 88,000 US dollars, with a cumulative decline of more than 6% for the whole year.

New year, new worries

The 2026 market is bound to be an uneventful start.

Trump is already actively building momentum for November's midterm elections and is expected to nominate a new chairman of the Federal Reserve soon — an appointment critical to the independence of the Federal Reserve.

Israel plans to hold parliamentary elections before the end of October, and the fragile cease-fire situation in the Gaza Strip will continue to be the focus of the market; the end of the Russian-Ukrainian conflict remains difficult; Hungarian Prime Minister Orban will face the most severe election test since taking office in April; and Colombia and Brazil will also hold key general elections in May and October, respectively.

Furthermore, there are still many unknown variables in the AI field.

Matt King, founder of Satori Insights, pointed out that judging from the valuation level, the market is entering 2026 in an “extraordinary” state; while political leaders such as Trump are “looking everywhere for excuses” to try to make concessions to voters through economic stimulus or tax cuts.

Matt King said, “The effects of monetary easing are being pushed to the limit, and this risk persists.”

“From the rise in term premiums in the bond market, to the sudden collapse of Bitcoin, to the continued rise of gold, the margins of the market are actually already rift.”

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal