Asian Stocks Estimated To Be Trading Below Their Intrinsic Value In December 2025

As global markets navigate a period of optimism fueled by artificial intelligence advancements and favorable economic data, Asian stock markets have also shown resilience, with key indices in China and Japan experiencing notable gains. In this environment, identifying stocks that are potentially trading below their intrinsic value can be an appealing strategy for investors looking to capitalize on market inefficiencies and unlock potential growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Visional (TSE:4194) | ¥10010.00 | ¥19887.98 | 49.7% |

| Takara Bio (TSE:4974) | ¥795.00 | ¥1580.06 | 49.7% |

| Nan Juen International (TPEX:6584) | NT$347.00 | NT$686.60 | 49.5% |

| Kuraray (TSE:3405) | ¥1587.00 | ¥3163.27 | 49.8% |

| JINS HOLDINGS (TSE:3046) | ¥5530.00 | ¥11032.70 | 49.9% |

| Innovent Biologics (SEHK:1801) | HK$76.25 | HK$150.79 | 49.4% |

| Forth Corporation (SET:FORTH) | THB5.75 | THB11.21 | 48.7% |

| Daiichi Sankyo Company (TSE:4568) | ¥3348.00 | ¥6544.37 | 48.8% |

| CURVES HOLDINGS (TSE:7085) | ¥801.00 | ¥1581.79 | 49.4% |

| Aidma Holdings (TSE:7373) | ¥3160.00 | ¥6305.80 | 49.9% |

Let's dive into some prime choices out of the screener.

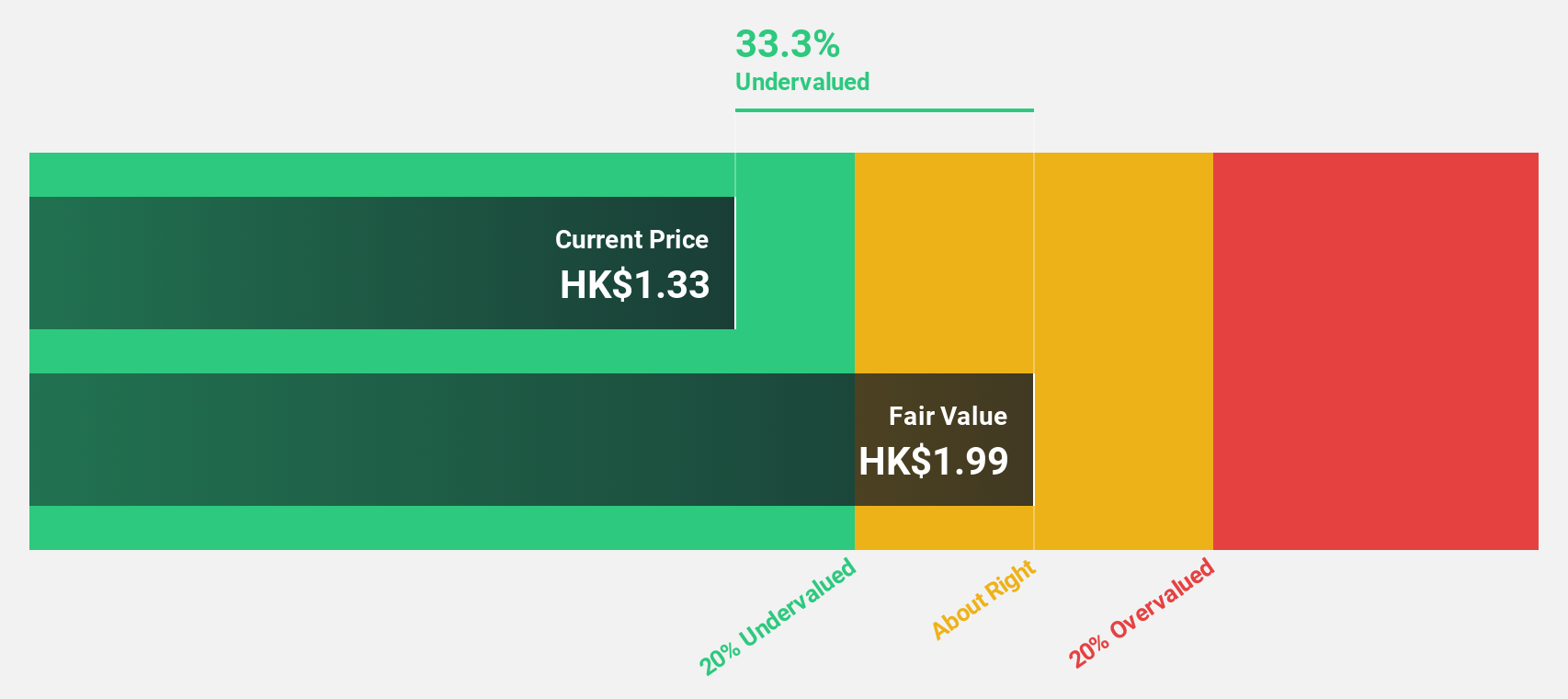

MicroPort CardioFlow Medtech (SEHK:2160)

Overview: MicroPort CardioFlow Medtech Corporation is a medical device company focused on developing and commercializing transcatheter and surgical solutions for structural heart diseases both in China and internationally, with a market cap of HK$2.92 billion.

Operations: The company generates revenue from its Surgical & Medical Devices segment, amounting to CN¥367.53 million.

Estimated Discount To Fair Value: 39%

MicroPort CardioFlow Medtech is trading at HK$1.21, significantly below its estimated fair value of HK$1.98, suggesting it may be undervalued based on cash flows. Despite recent board changes and strategic committee formations aimed at enhancing commercialization strategies, the company shows potential with forecasted earnings growth of 107.89% annually over the next three years, outpacing both revenue growth expectations and the broader Hong Kong market's performance.

- Our comprehensive growth report raises the possibility that MicroPort CardioFlow Medtech is poised for substantial financial growth.

- Navigate through the intricacies of MicroPort CardioFlow Medtech with our comprehensive financial health report here.

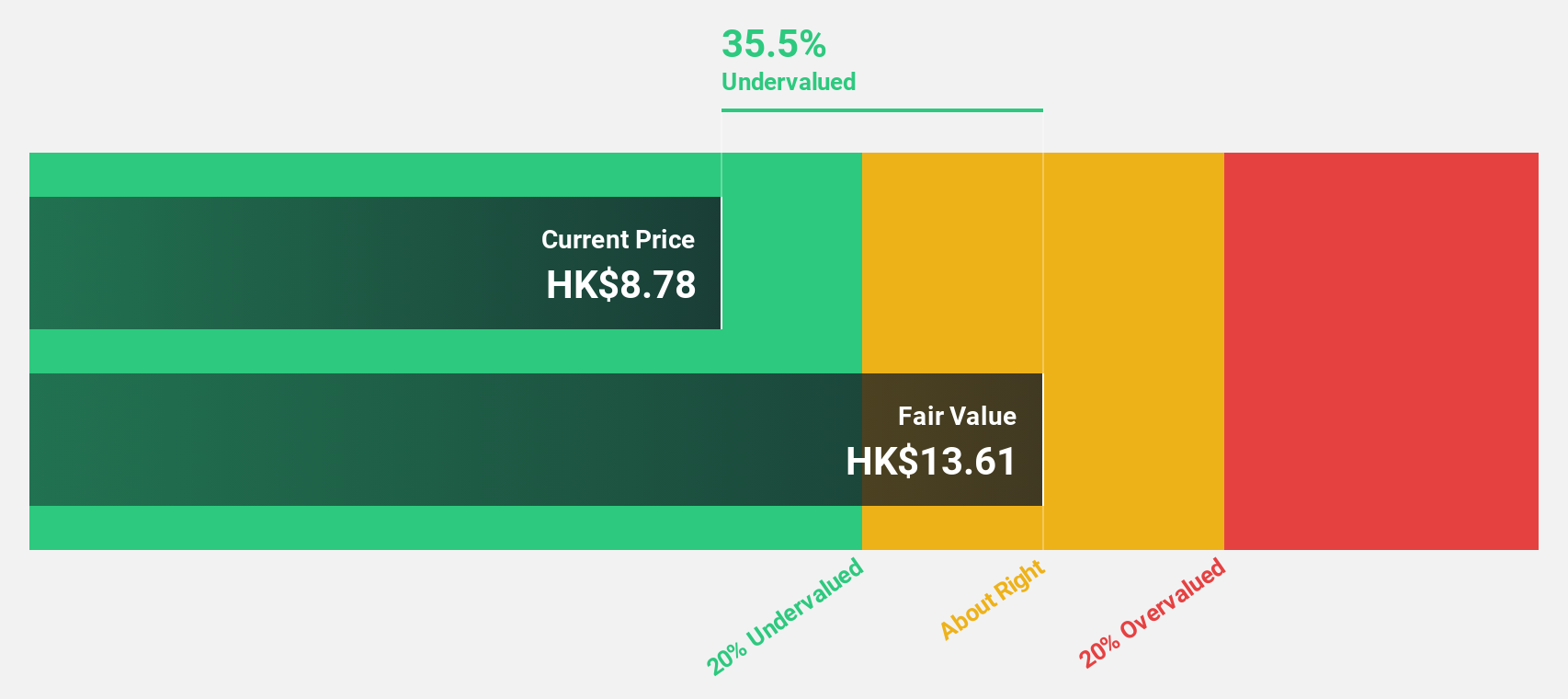

Dongfeng Motor Group (SEHK:489)

Overview: Dongfeng Motor Group Company Limited is involved in the research, development, manufacture, and sale of commercial and passenger vehicles, engines, and auto parts in China with a market cap of approximately HK$72.79 billion.

Operations: Dongfeng Motor Group generates revenue primarily from the sale of commercial and passenger vehicles, as well as engines and auto parts, within the People's Republic of China.

Estimated Discount To Fair Value: 42%

Dongfeng Motor Group is trading at HK$8.82, below its estimated fair value of HK$15.22, indicating potential undervaluation based on cash flows. Despite a net loss in recent earnings, the company shows promise with expected profitability within three years and revenue growth forecasted to outpace the Hong Kong market. Recent executive changes and increased new energy vehicle production highlight strategic shifts that could enhance future performance amidst current undervaluation concerns.

- The growth report we've compiled suggests that Dongfeng Motor Group's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Dongfeng Motor Group's balance sheet health report.

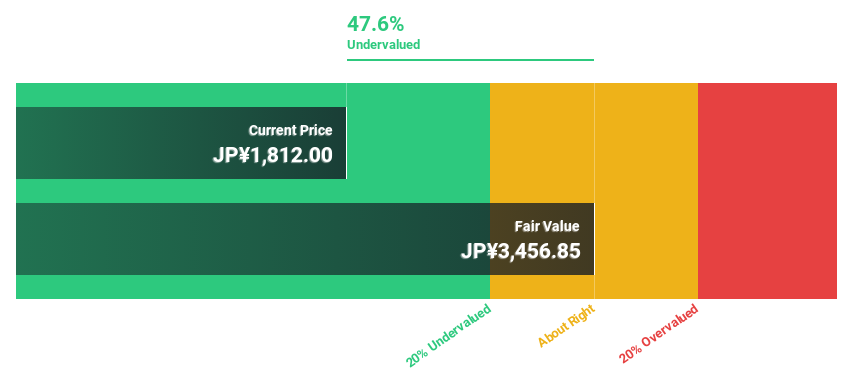

Renesas Electronics (TSE:6723)

Overview: Renesas Electronics Corporation is a global company that focuses on researching, developing, designing, manufacturing, selling, and servicing semiconductors across various regions including Japan, China, the rest of Asia, Europe, and North America with a market cap of approximately ¥3.88 trillion.

Operations: The company's revenue is primarily derived from two segments: Automotive, contributing ¥625.17 billion, and Industrial/Infrastructure/IoT, which accounts for ¥626.54 billion.

Estimated Discount To Fair Value: 13.8%

Renesas Electronics, trading at ¥2140, is undervalued based on cash flows with a fair value estimate of ¥2481.83. Despite high share price volatility and low forecasted return on equity, its revenue growth surpasses the JP market average. Recent product innovations in automotive and IoT sectors, coupled with strategic leadership changes and potential divestiture of its timing unit valued up to $2 billion, may influence future profitability as it aims for market expansion.

- Our earnings growth report unveils the potential for significant increases in Renesas Electronics' future results.

- Unlock comprehensive insights into our analysis of Renesas Electronics stock in this financial health report.

Key Takeaways

- Explore the 256 names from our Undervalued Asian Stocks Based On Cash Flows screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal