Walsh Cattle Opportunities - Pure Hedge Division

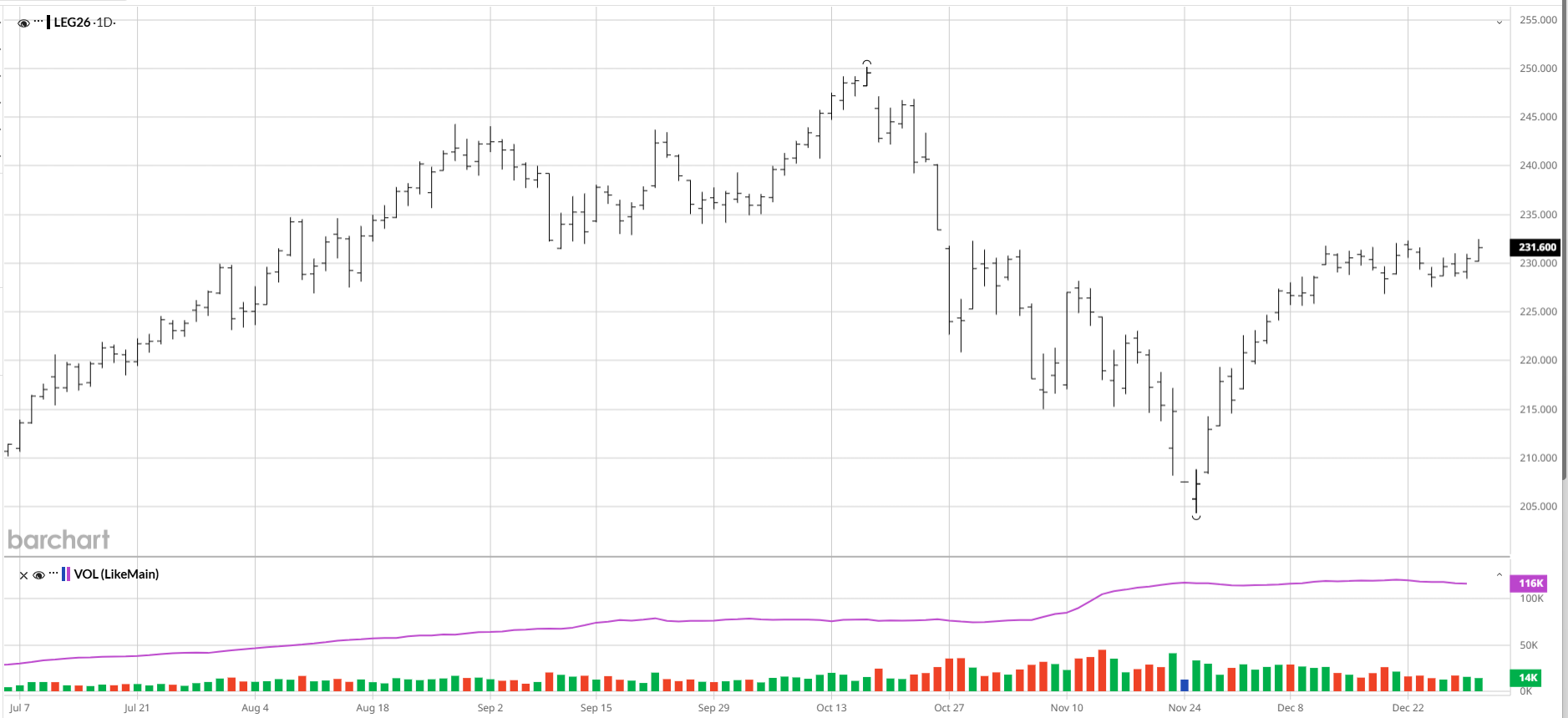

Live cattle and feeder cattle prices closed higher yesterday and continued higher today. There was a new screwworm detection reported yesterday afternoon in the Mexican state of Tamaulipas. The case was reported in a 6-day-old calf located about 197 miles from the US border. This newest case of screwworm is the first in Tamaulipas and the northernmost active case. Previously, the market’s reaction to new screwworm cases has been bullish, and that was true again today, with February live cattle +1.150 to 231.625 and April feeder cattle +0.750 to 344.175. The front-month feeders were +0.725 to 345.300.

If you would like to open an account or receive more information on the commodity markets, please use the link below:

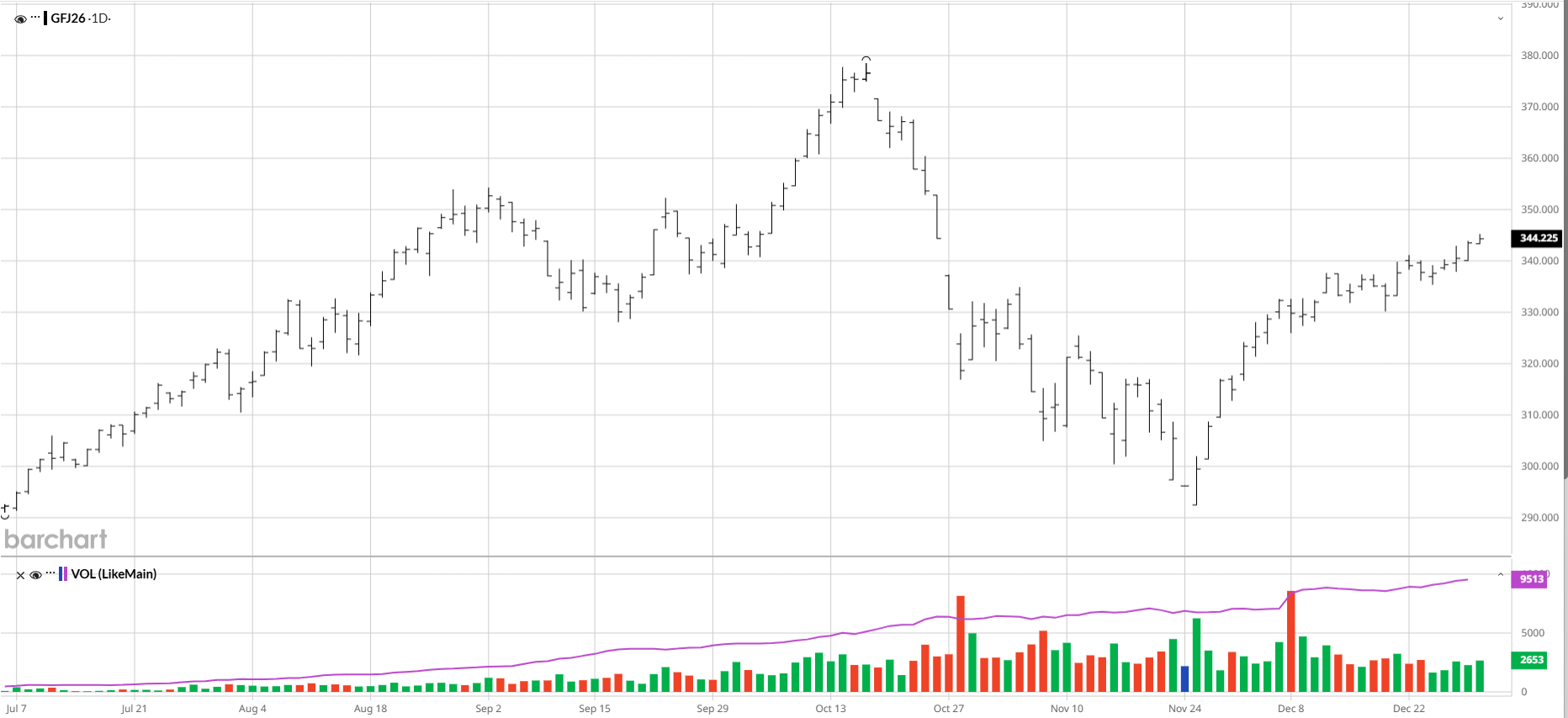

The December Cattle on Feed report further emphasized the tight cattle supply, with placements in feedlots falling 11% lower than November 2024. Cattle and calves on feed for slaughter were also down 2% from a year ago. Boxed beef cutout has been falling over the last week. Choice was down 20 cents to $348.00, and Select was down 77 cents to $342.39 this morning. Last Monday, Choice was $362.87, while Select was $350.69. Front-month feeders are trading at a $3 discount to the CME feeder index, which was 348.44 as of yesterday.

If you would like to open an account or receive more information on the commodity markets, please use the link below:

Yesterday, feeder cattle filled the gap in the chart from late October. April feeders are looking strong technically, trading above the 14, 21, 50, and 100-day moving averages. The daily chart shows a similar tighter consolidation pattern, as seen back in September, before feeders made an all-time high in mid-October.

.

February live cattle are showing similar technical strength trading above the 14, 21, and 50-day moving average but just beneath the 100-day. Both live cattle and feeders have strong support and may see new money enter these markets in the new year.

If you believe cattle prices could be getting ready for the next leg higher consider the following strategies:

.

APRIL ’26 FEEDER CATTLE

BUY 1 APRIL’26 390 CALL 2.25

SELL 1 APRIL’26 300 PUT 3.35

BUY 1 APRIL’26 265 PUT 1.10

PRICE: ZERO

COST: $0.00/TRADE PACKAGE, PLUS FEE AND COMMISSIONS.

APRIL’26 FEEDER CATTLE OPTIONS EXPIRE 4/30/26 (120 Days)

MAXIMUM LOSS: LIMITED

.

BUY 1 APRIL’26 235 CALL 6.42 ½

SELL 1 APRIL’26 240 CALL 4.45

SELL 1 APRIL’26 225 PUT 4.95

BUY 1 APRIL’26 220 PUT 3.55

PRICE: 0.57 1/2

COST: $230.00/TRADE PACKAGE, PLUS FEES AND COMMISSIONS.

APRIL’26 LIVE CATTLE OPTIONS EXPIRE 4/2/26 (92 Days)

MAXIMUM LOSS: LIMITED

.

FEBRUARY ’26 LIVE CATTLE

BUY 1 February’26 233 call 4.15

Sell 1 February’26 240 call 1.50

Sell 1 February’26 225 put 2.92 1/2

Buy 1 February’26 220 put 1.30

Price: 1.02 ½

Cost: $410.00/Trade Package, Plus Fees and Commissions.

February’26 Live Cattle Options Expire 2/6/26 (37 Days)

MAXIMUM LOSS: LIMITED

.

APRIL ’26 LEAN HOGS

BUY 1 APRIL’26 92 CALL 3.025

SELL 1 APRIL’26 96 CALL 1.475

SELL 1 APRIL’26 86 PUT 2.175

BUY 1 APRIL’26 80 PUT 0.775

PRICE: 0.15

COST: $60.00/TRADE PACKAGE, PLUS FEES AND COMMISSIONS.

APRIL’26 LEAN HOG OPTIONS EXPIRE 4/15/26 (105 DAYS)

MAXIMUM LOSS: LIMITED

The cattle markets are moving higher, and I feel the hogs could be next with the African Swine Fever still a problem in Europe.

If you’re ready to start trading, click the link below to open an account with Walsh Trading, Inc.

Hans Schmit

Broker, Walsh Trading

312-765-7311

hschmit@walshtrading.com

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal