Top ASX Dividend Stocks To Consider In December 2025

As the Australian stock market winds down for the year, experiencing a slight dip amid profit-taking and holiday preparations, investors are keenly observing the performance of precious metals and commodities. In this climate, dividend stocks remain an attractive option for those seeking steady income streams; they offer potential stability in a fluctuating market environment.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Treasury Wine Estates (ASX:TWE) | 7.63% | ★★★★★☆ |

| Super Retail Group (ASX:SUL) | 5.99% | ★★★★★☆ |

| Sugar Terminals (NSX:SUG) | 7.94% | ★★★★★☆ |

| Steadfast Group (ASX:SDF) | 3.69% | ★★★★★☆ |

| MFF Capital Investments (ASX:MFF) | 3.59% | ★★★★★☆ |

| Kina Securities (ASX:KSL) | 7.28% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 4.12% | ★★★★★☆ |

| EQT Holdings (ASX:EQT) | 4.70% | ★★★★★☆ |

| Dicker Data (ASX:DDR) | 4.28% | ★★★★☆☆ |

| Accent Group (ASX:AX1) | 7.41% | ★★★★★☆ |

Click here to see the full list of 30 stocks from our Top ASX Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

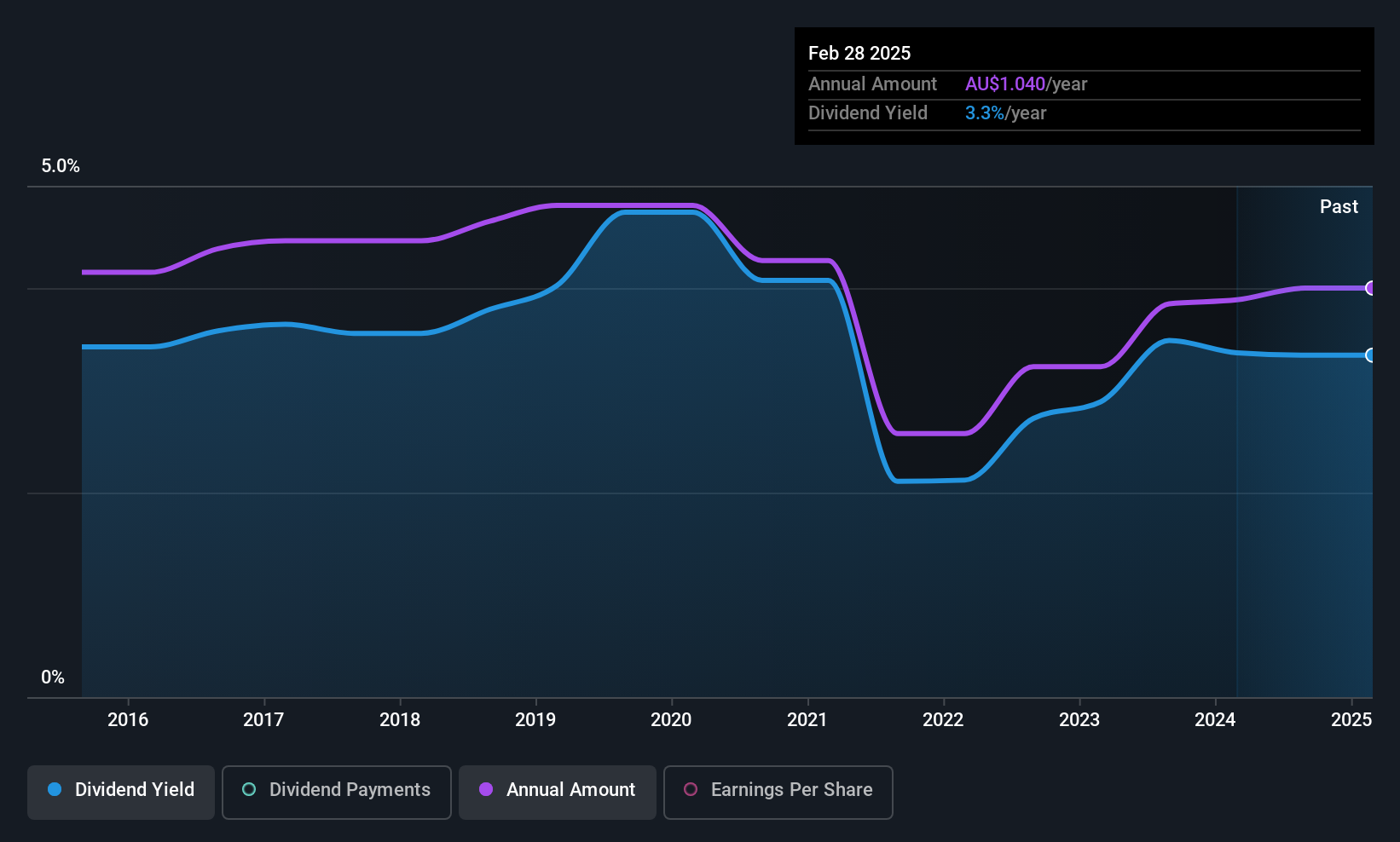

Carlton Investments (ASX:CIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Carlton Investments Limited is a publicly owned asset management holding company with a market cap of A$912.22 million.

Operations: Carlton Investments Limited generates revenue primarily through the acquisition and long-term holding of shares and units, amounting to A$41.60 million.

Dividend Yield: 3.3%

Carlton Investments' dividend payments have shown volatility over the past decade, with periods of significant annual drops. Despite this, dividends have generally increased over the last ten years. The current dividend yield of 3.27% is below the top quartile in Australia but remains sustainable with a payout ratio of 77% and cash payout ratio of 75.7%, indicating coverage by both earnings and cash flows.

- Take a closer look at Carlton Investments' potential here in our dividend report.

- The analysis detailed in our Carlton Investments valuation report hints at an inflated share price compared to its estimated value.

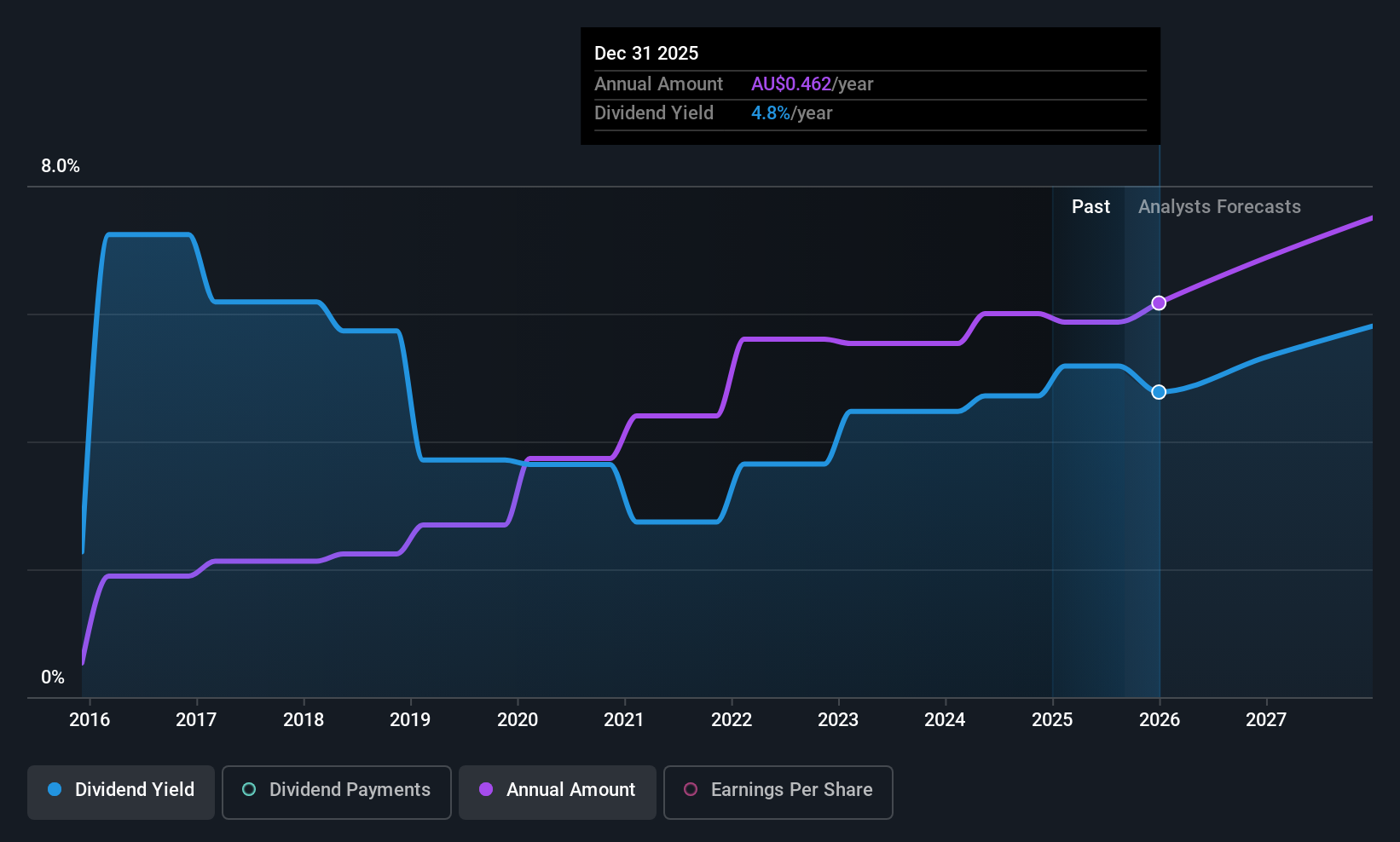

Dicker Data (ASX:DDR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dicker Data Limited is a wholesale distributor of computer hardware, software, and related products serving corporate and commercial markets in Australia and New Zealand, with a market cap of A$1.86 billion.

Operations: Dicker Data Limited generates revenue from the wholesale distribution of computer peripherals, amounting to A$2.44 billion.

Dividend Yield: 4.3%

Dicker Data's dividend yield of 4.28% is below the top quartile in Australia and is not well covered by earnings, with a high payout ratio of 96.2%. However, dividends have been stable and growing over the past decade, supported by cash flows at an 83.3% cash payout ratio. The company trades at a favorable price-to-earnings ratio compared to industry peers but carries a significant debt load. Recent board changes include appointing Marcus Derwin as an independent Non-Executive Director.

- Click here to discover the nuances of Dicker Data with our detailed analytical dividend report.

- Our valuation report here indicates Dicker Data may be undervalued.

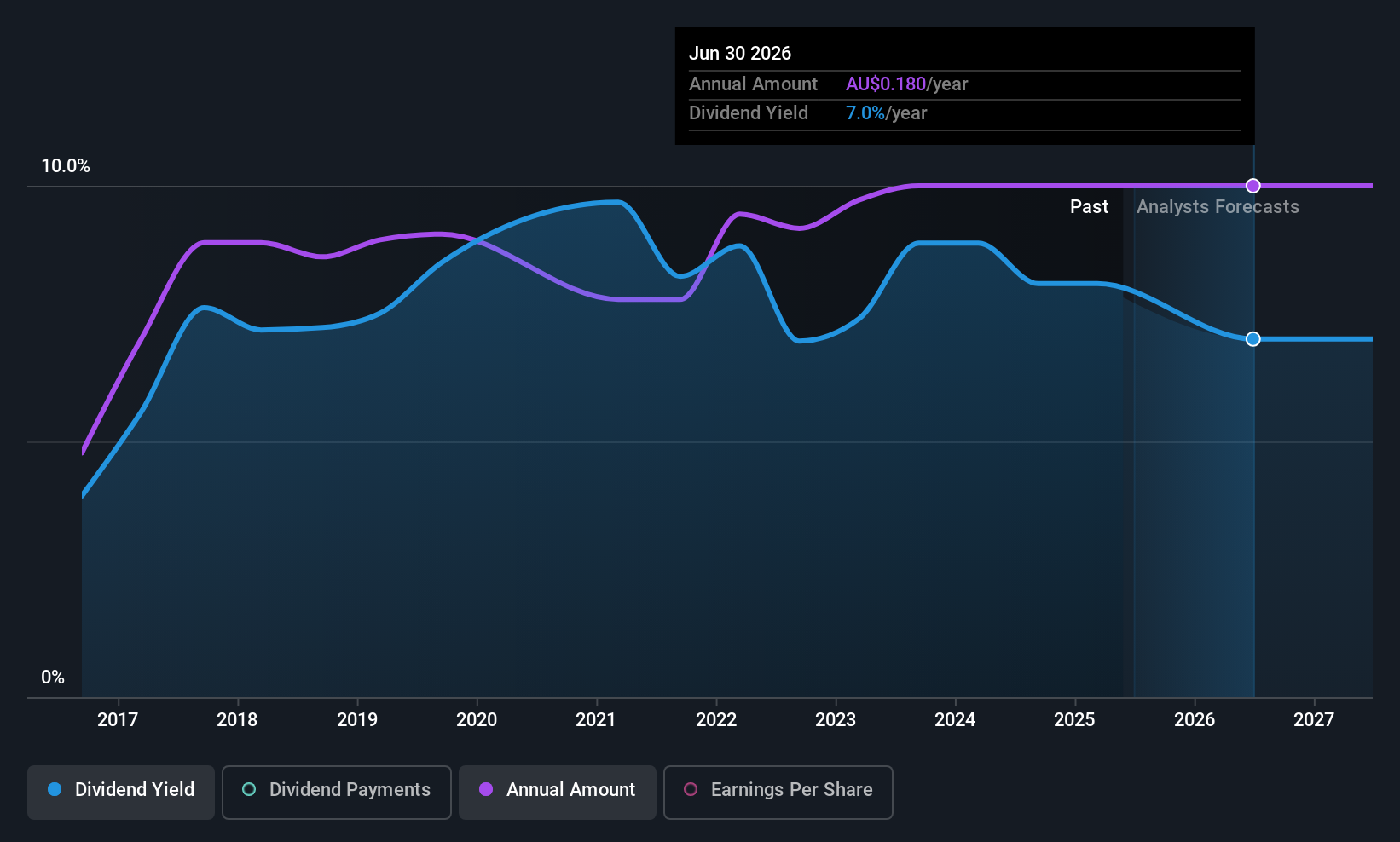

IVE Group (ASX:IGL)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IVE Group Limited, along with its subsidiaries, operates in the marketing sector in Australia and has a market capitalization of A$462.61 million.

Operations: IVE Group Limited generates revenue primarily from its advertising segment, amounting to A$959.25 million.

Dividend Yield: 6%

IVE Group's dividend yield of 5.98% places it in the top 25% of Australian payers, with payments covered by earnings and cash flows at payout ratios of 59.6% and 34.9%, respectively. However, dividends have been volatile over nine years, lacking stability despite recent growth in earnings by A$69 million last year. The stock is trading at a significant discount to its estimated fair value but carries a high debt level that may concern investors seeking reliability.

- Delve into the full analysis dividend report here for a deeper understanding of IVE Group.

- Our valuation report unveils the possibility IVE Group's shares may be trading at a discount.

Make It Happen

- Get an in-depth perspective on all 30 Top ASX Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal