ASX Growth Stocks With High Insider Ownership December 2025

As the Australian market approaches the end of 2025, it appears to be in a reflective mood with a slight dip as investors engage in profit-taking before the holiday break, despite Wall Street's indices nearing record highs. In this environment, growth companies with high insider ownership can present appealing opportunities due to their potential for alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.2% | 96.3% |

| Titomic (ASX:TTT) | 14.8% | 74.9% |

| Sea Forest (ASX:SEA) | 15.1% | 92.6% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IperionX (ASX:IPX) | 17.1% | 94.9% |

| Emerald Resources (ASX:EMR) | 18.4% | 43% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| BlinkLab (ASX:BB1) | 32.1% | 101.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

Let's uncover some gems from our specialized screener.

Clinuvel Pharmaceuticals (ASX:CUV)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Clinuvel Pharmaceuticals Limited is a biopharmaceutical company that develops and commercializes treatments for genetic, metabolic, systemic, and life-threatening disorders across Australia, Europe, the United States, Switzerland, and internationally with a market cap of A$625.50 million.

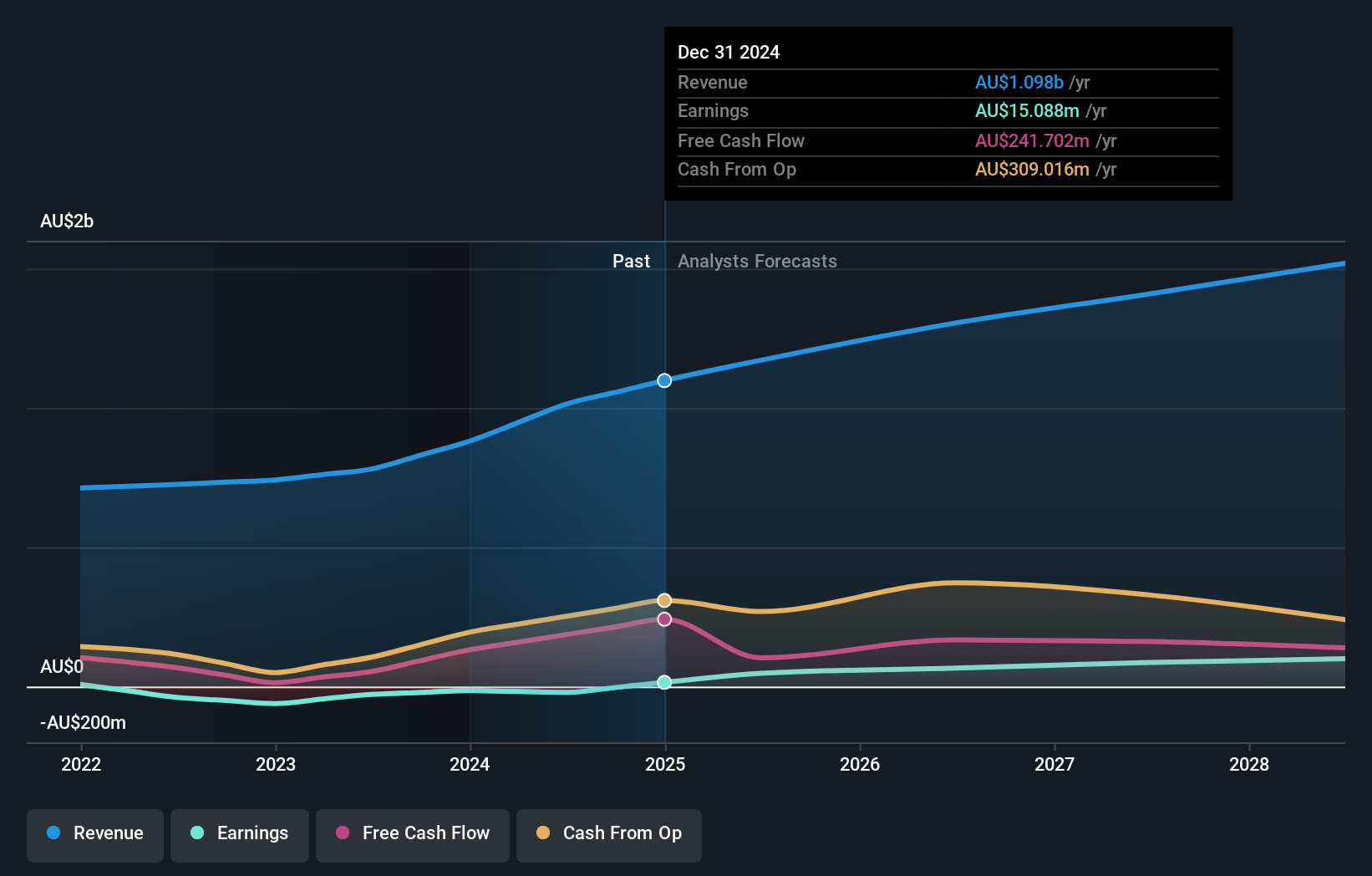

Operations: The company generates revenue of A$95.02 million from its biopharmaceutical sector, focusing on treatments for various disorders across multiple regions.

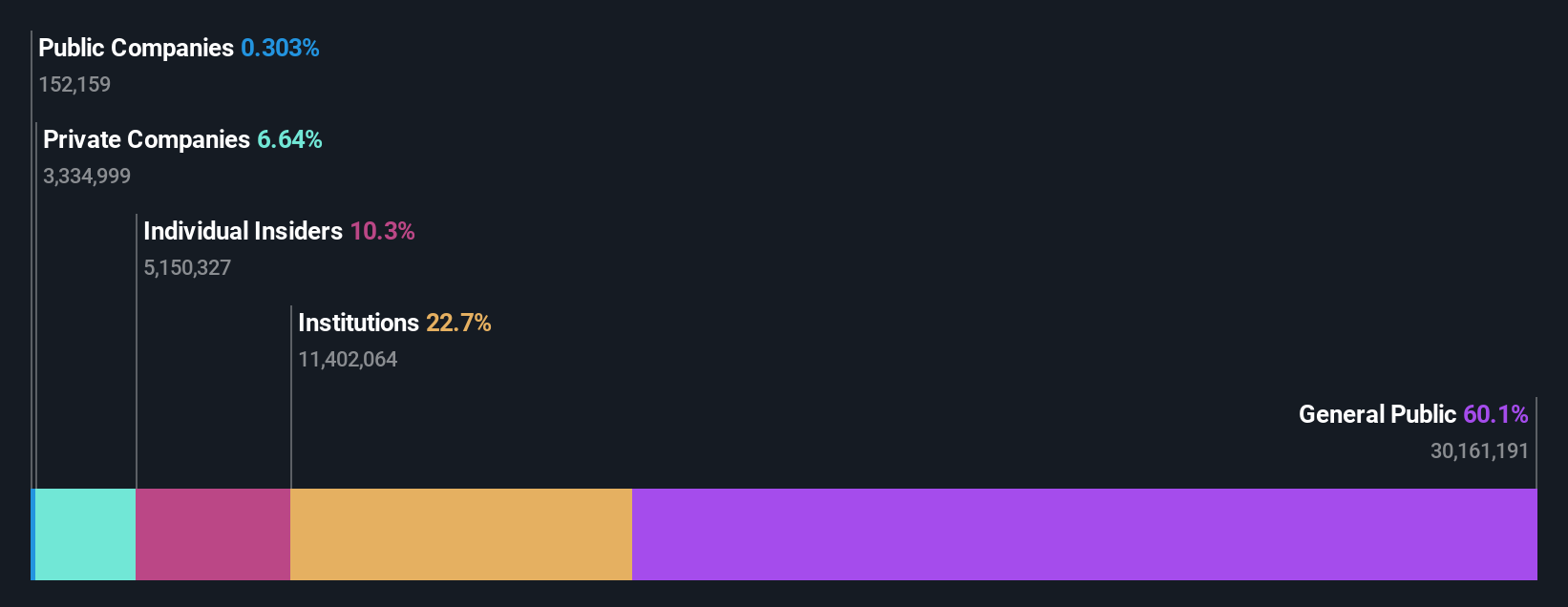

Insider Ownership: 10.3%

Clinuvel Pharmaceuticals is poised for robust growth, with earnings forecast to rise 23.9% annually, outpacing the Australian market. Despite a projected low Return on Equity of 18.8%, Clinuvel's revenue is expected to grow at 22% per year, surpassing market averages. The company trades significantly below its estimated fair value and maintains a disciplined approach to acquisitions, focusing on North American opportunities that align with its risk-adjusted return criteria while ensuring operational resilience and strategic capital deployment.

- Get an in-depth perspective on Clinuvel Pharmaceuticals' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Clinuvel Pharmaceuticals' share price might be on the cheaper side.

Regis Healthcare (ASX:REG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Regis Healthcare Limited provides residential aged care services in Australia and has a market cap of A$2.10 billion.

Operations: The company generates revenue of A$1.16 billion from its residential aged care, home care, and retirement living services in Australia.

Insider Ownership: 38.6%

Regis Healthcare is targeting strategic acquisitions to expand its portfolio and aims for 10,000 beds by 2028. The company is trading significantly below its estimated fair value and expects revenue growth of 8.2% annually, outpacing the Australian market. Although earnings are forecast to grow at a robust 18.6% annually, they remain below significant levels. Despite large one-off items affecting financial results, Regis's Return on Equity is projected to be very high in three years' time.

- Navigate through the intricacies of Regis Healthcare with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Regis Healthcare's share price might be too pessimistic.

Regal Partners (ASX:RPL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Regal Partners Limited is a privately owned hedge fund sponsor with a market capitalization of A$1.18 billion.

Operations: The company's revenue is primarily derived from the provision of investment management services, amounting to A$245.45 million.

Insider Ownership: 23.8%

Regal Partners is positioned for growth, with revenue expected to increase by 15.9% annually, surpassing the Australian market's average. The company's earnings are forecast to grow significantly at 31.51% per year, also exceeding market expectations. Despite trading at a substantial discount of 42.2% below its estimated fair value, profit margins have declined from last year’s levels. While its Return on Equity is projected to be low in three years, insider ownership remains high without recent substantial trading activity.

- Delve into the full analysis future growth report here for a deeper understanding of Regal Partners.

- In light of our recent valuation report, it seems possible that Regal Partners is trading behind its estimated value.

Where To Now?

- Unlock more gems! Our Fast Growing ASX Companies With High Insider Ownership screener has unearthed 108 more companies for you to explore.Click here to unveil our expertly curated list of 111 Fast Growing ASX Companies With High Insider Ownership.

- Want To Explore Some Alternatives? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal