US Undiscovered Gems to Watch in December 2025

As 2025 comes to a close, the U.S. stock market has experienced a roller-coaster of activity with major indices like the Dow Jones and S&P 500 achieving notable gains despite recent declines. In this dynamic environment, identifying undiscovered gems within the small-cap sector can offer investors unique opportunities, particularly as these companies often thrive on innovation and niche market strategies that may not yet be reflected in their valuations.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Senstar Technologies | NA | -15.82% | 43.55% | ★★★★★★ |

| Security Federal | 20.04% | 5.77% | 1.59% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| FineMark Holdings | 114.54% | 2.38% | -28.53% | ★★★★★★ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| NameSilo Technologies | 12.63% | 14.48% | 3.12% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

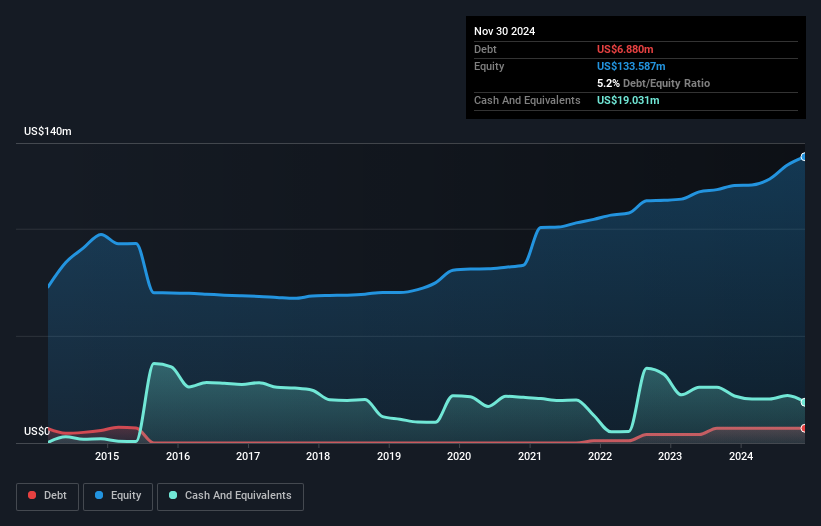

Pure Cycle (PCYO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Pure Cycle Corporation provides water and wastewater services in the United States and has a market capitalization of approximately $265 million.

Operations: Pure Cycle generates revenue primarily from land development and water and wastewater resource development, with respective contributions of $15.26 million and $10.33 million. The single-family rental segment adds a smaller amount of $0.50 million to the overall revenue mix.

Pure Cycle, a water utility player, has seen a notable earnings growth of 12.9% over the past year, surpassing the industry's 12.5%. Despite this positive trend, its earnings have decreased by 1.6% annually over the last five years. The company is trading significantly below its estimated fair value by about 70%, suggesting potential undervaluation in the market. Recently reported net income rose to US$13.11 million from US$11.61 million last year, with basic earnings per share improving to US$0.54 from US$0.48 previously, indicating solid financial health and operational efficiency amidst fluctuating sales figures and strategic share repurchases totaling US$0.99 million since November 2022.

- Unlock comprehensive insights into our analysis of Pure Cycle stock in this health report.

Evaluate Pure Cycle's historical performance by accessing our past performance report.

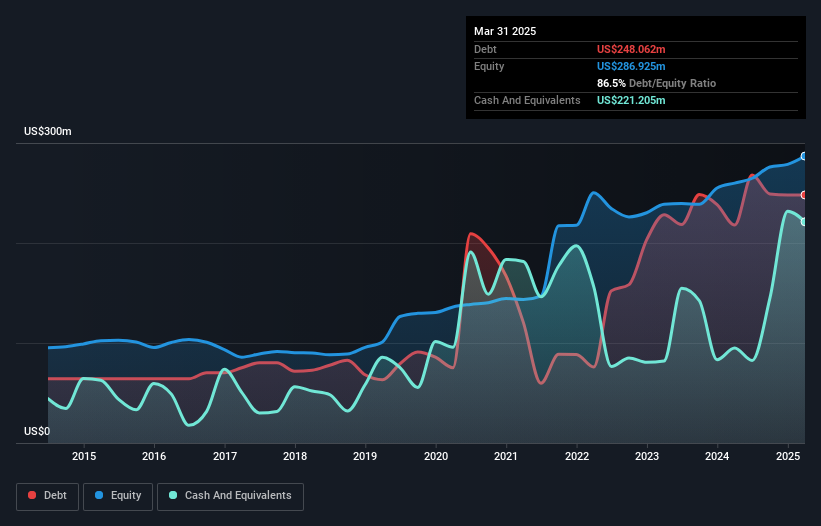

Colony Bankcorp (CBAN)

Simply Wall St Value Rating: ★★★★★★

Overview: Colony Bankcorp, Inc. is the bank holding company for Colony Bank, offering a range of banking products and services to retail and commercial customers in the United States, with a market capitalization of approximately $312.95 million.

Operations: Colony Bankcorp generates revenue primarily through its Banking Division, contributing $104.64 million, followed by the Small Business Specialty Lending Division at $10.74 million, and the Mortgage Banking Division at $7.17 million.

Colony Bankcorp, with total assets of US$3.2 billion and equity of US$302.3 million, stands out for its robust financial health. It holds deposits totaling US$2.6 billion against loans of US$2 billion, backed by a sufficient allowance for bad loans at 0.7% of total loans, ensuring stability in its lending activities. The bank's earnings growth rate over the past year was an impressive 26%, surpassing the industry average of 18%. With a net interest margin at 2.7%, Colony is trading slightly below fair value estimates, indicating potential upside for investors seeking value opportunities in smaller financial institutions.

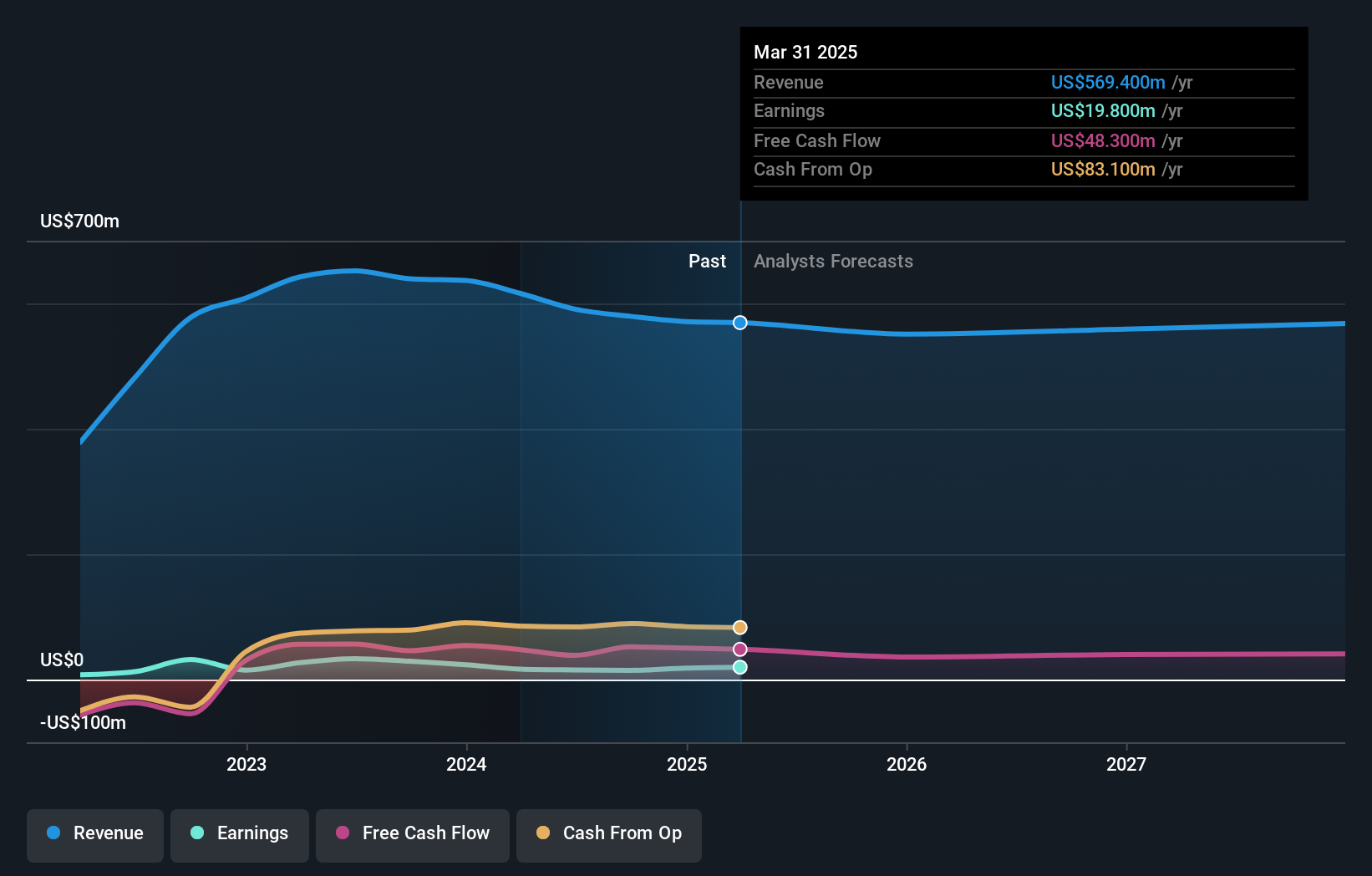

Ranger Energy Services (RNGR)

Simply Wall St Value Rating: ★★★★★★

Overview: Ranger Energy Services, Inc. offers onshore high specification well service rigs and wireline services to exploration and production companies in the United States, with a market cap of $304.97 million.

Operations: Ranger Energy Services generates revenue primarily from its High Specification Rigs segment, contributing $341.70 million, followed by Wireline Services at $79.10 million and Processing Solutions and Ancillary Services at $127 million.

Ranger Energy Services, a nimble player in the energy sector, showcases financial resilience with no debt and positive free cash flow. Over the past year, its earnings growth of 1.4% outpaced the industry's -20.4%, hinting at strong operational efficiency. The company recently repurchased 906,925 shares for $11.08 million and declared a quarterly dividend of $0.06 per share as part of its capital return strategy. Despite reporting Q3 revenue of $128.9 million compared to last year's $153 million, it trades at 79.5% below estimated fair value, suggesting potential upside for investors eyeing undervalued opportunities in this space.

Taking Advantage

- Click through to start exploring the rest of the 293 US Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal