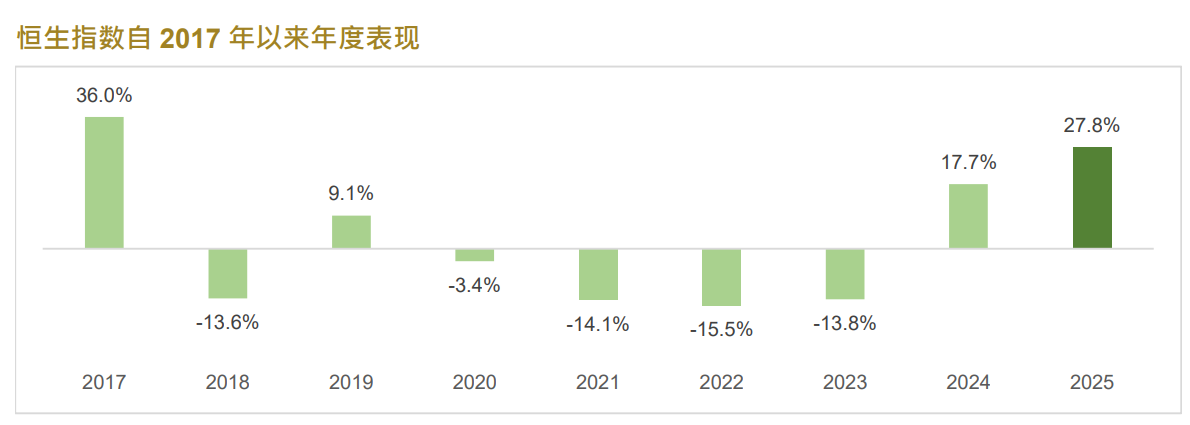

Hang Seng Index Company: The Hang Seng Index rose 27.8% in 2025 to be the best performance since 2017

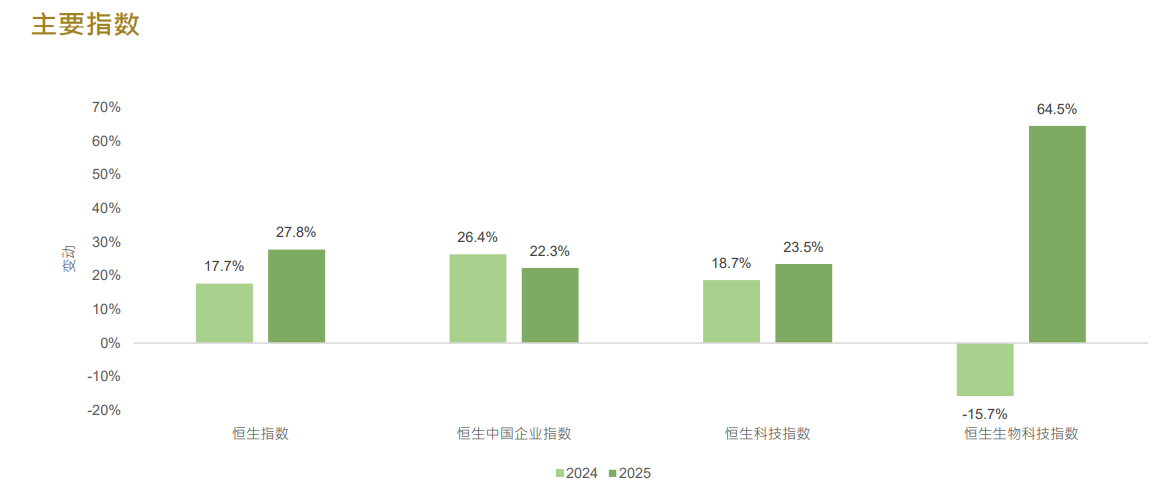

Zhitong Finance App learned that on December 31, Hang Seng Index published the “2025 End Market Summary Report”. In 2025, the Hong Kong stock market, represented by the Hang Seng Index (Hang Seng Index), rose 27.8%, the best performance since 2017. After recording a 17.7% increase in 2024, the Hang Seng Index continued to rise steadily for most of 2025, with the exception of a decline due to trade conflicts at the end of March. The rise in 2025 is comprised of several major factors, including record capital inflows from Hong Kong Stock Connect, expectations for the future development of artificial intelligence, and interest rate cuts. In 2025, the Hang Seng Index outperformed the other two flagship indices — the Hang Seng China Enterprise Index (China Index) and the Hang Seng Technology Index (HKI), which rose 22.3% and 23.5% respectively. Notably, futures tracking the Hang Seng Biotech Index were launched in November, and the index rose by 64.5% in 2025.

The Hang Seng Index added 6 additional constituent stocks in 2025, bringing the number of constituent stocks to 89, steadily reaching its target of 100 constituent stocks. The Hang Seng Index Volatility Index and Hang Seng Index both rose to high points during the year in early April, reaching 47.0 points and 52.6 points respectively, and then fell back to 19.0 and 20.8 points at the end of the year. Among the flagship index derivatives, the Hang Seng Index ESG Enhanced Index outperformed the Hang Seng Index, with an increase of 30.3% in 2025. According to Hang Seng Technology, the 15% Target Option Premium Weekly Prepaid Subscription Options Index recorded a slightly higher return than the K.I. Index, reaching 25.4%.

In 2025, the Hang Seng Composite Index (Hang Seng Composite Index) rose 31.0%. In the Hang Seng Composite Index, mid-cap stocks rose 31.6%, leading large stocks (+30.8%) and small caps (+28.8%). In the Hang Seng Composite Index industry index, the raw materials sector performed the best, rising 161.3%, while utilities were the worst performing sector, which recorded an increase of 5.7%.

In terms of thematic indices listed in Hong Kong, the Hang Seng Hong Kong Stock Connect Innovative Drugs Index and Hang Seng Healthcare Index performed best, with annual increases of 64.0% and 57.0% respectively.

In terms of mainland listed and cross-market thematic indices, the Hang Seng A-share Grid Equipment Index and the Hang Seng Hong Kong US Biotech Index increased by 72.3% and 53.9% respectively. • Among the high dividend indices, the Hang Seng High Yield 30 Index led the way, with an increase of 38.1% in 2025.

In terms of the ESG index, the Hang Seng Climate Change 1.5℃ Target Index performed well, with an annual increase of 31.2%.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal