Exploring 3 High Growth Tech Stocks In The US Market

As the U.S. market experiences a slight downturn with major indexes closing lower for the third consecutive session, investors are closely watching economic indicators and Federal Reserve actions that could influence future trends. In this environment, identifying high-growth tech stocks becomes crucial, as these companies often demonstrate resilience and potential for expansion despite broader market fluctuations.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Marker Therapeutics | 62.86% | 62.39% | ★★★★★★ |

| Palantir Technologies | 26.25% | 30.13% | ★★★★★★ |

| Workday | 11.13% | 32.18% | ★★★★★☆ |

| Kiniksa Pharmaceuticals International | 15.16% | 31.60% | ★★★★★☆ |

| RenovoRx | 59.12% | 64.21% | ★★★★★☆ |

| Zscaler | 15.85% | 45.93% | ★★★★★☆ |

| Cellebrite DI | 15.29% | 20.24% | ★★★★★☆ |

| Circle Internet Group | 23.08% | 84.58% | ★★★★★☆ |

| Procore Technologies | 11.70% | 116.48% | ★★★★★☆ |

| Duos Technologies Group | 53.76% | 155.11% | ★★★★★☆ |

Click here to see the full list of 71 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Arista Networks (ANET)

Simply Wall St Growth Rating: ★★★★☆☆

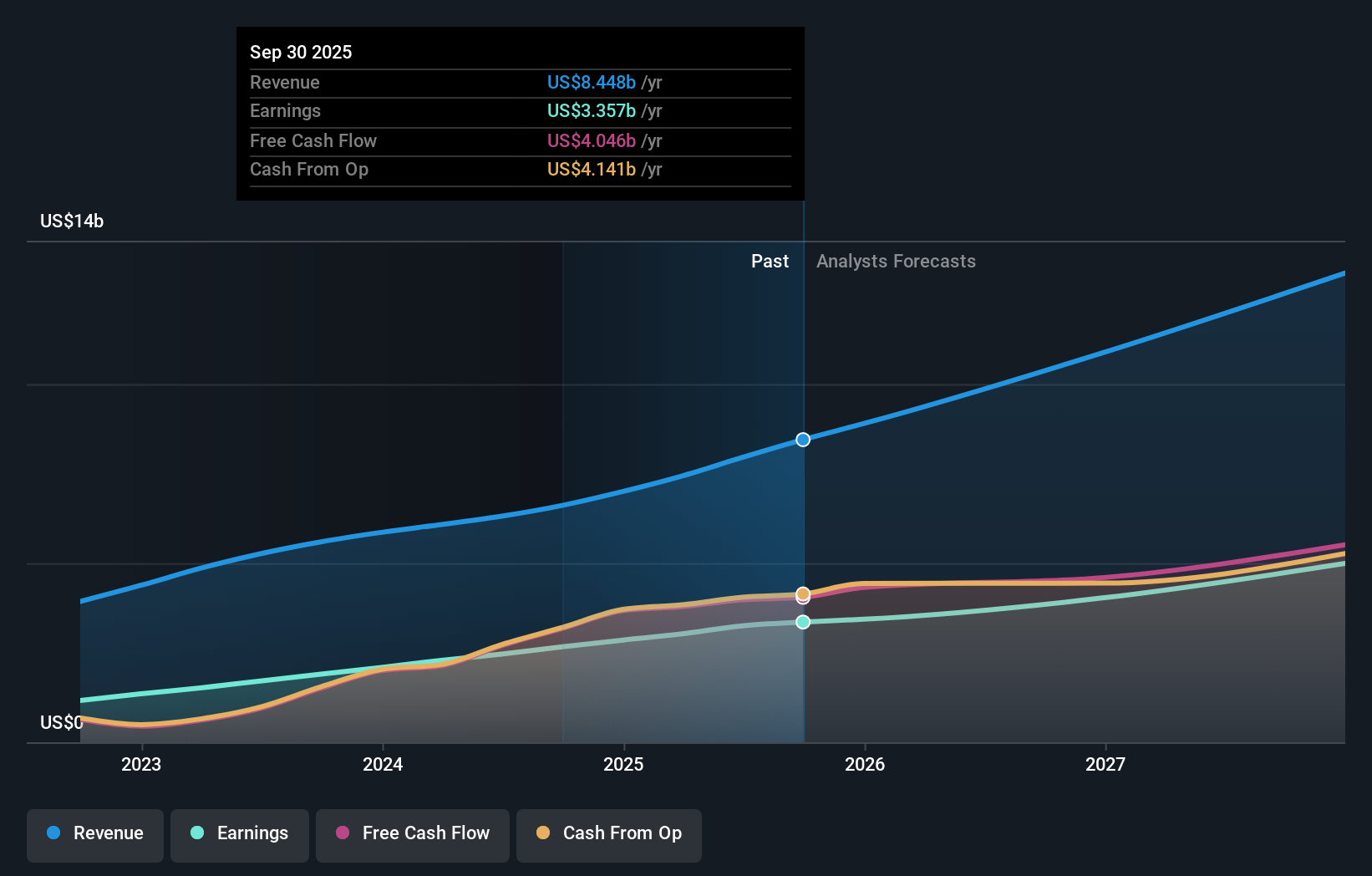

Overview: Arista Networks, Inc. specializes in creating and selling data-driven networking solutions for various environments globally, with a market cap of approximately $168.93 billion.

Operations: The company generates revenue primarily from its computer networks segment, which accounted for $8.45 billion. The focus is on delivering networking solutions across diverse environments including AI and data centers in multiple regions worldwide.

Arista Networks has demonstrated robust financial performance with a notable 17.3% annual revenue growth and an earnings increase of 16.2% per year, reflecting its strong market position in high-growth tech sectors like AI data centers and cognitive campus networks. The company's strategic collaborations, such as the recent partnership with Fortinet to deploy a Secure AI Data Center solution at Monolithic Power Systems, underscore its commitment to innovation and operational excellence in multivendor architecture environments. This approach not only enhances Arista's service offerings but also solidifies its role in advancing next-generation AI infrastructure solutions, ensuring long-term growth and industry leadership.

HubSpot (HUBS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: HubSpot, Inc. offers a cloud-based customer relationship management platform for businesses across the Americas, Europe, and the Asia Pacific with a market capitalization of approximately $20.92 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $2.99 billion.

HubSpot's trajectory in the tech sector is underscored by a robust 14.3% annual revenue growth and an anticipated leap into profitability within three years, with earnings expected to surge by 48.34% annually. Recent strategic board appointments, like that of AI leader Clara Shih, signal a deeper foray into AI-driven solutions for marketing and customer relationship management, aligning with industry shifts towards more integrated and intelligent platforms. This move not only diversifies HubSpot’s expertise but also enhances its offerings to better meet evolving business needs, positioning it favorably in a competitive landscape where innovation leads market dynamics.

- Get an in-depth perspective on HubSpot's performance by reading our health report here.

Evaluate HubSpot's historical performance by accessing our past performance report.

Exzeo Group (XZO)

Simply Wall St Growth Rating: ★★★★☆☆

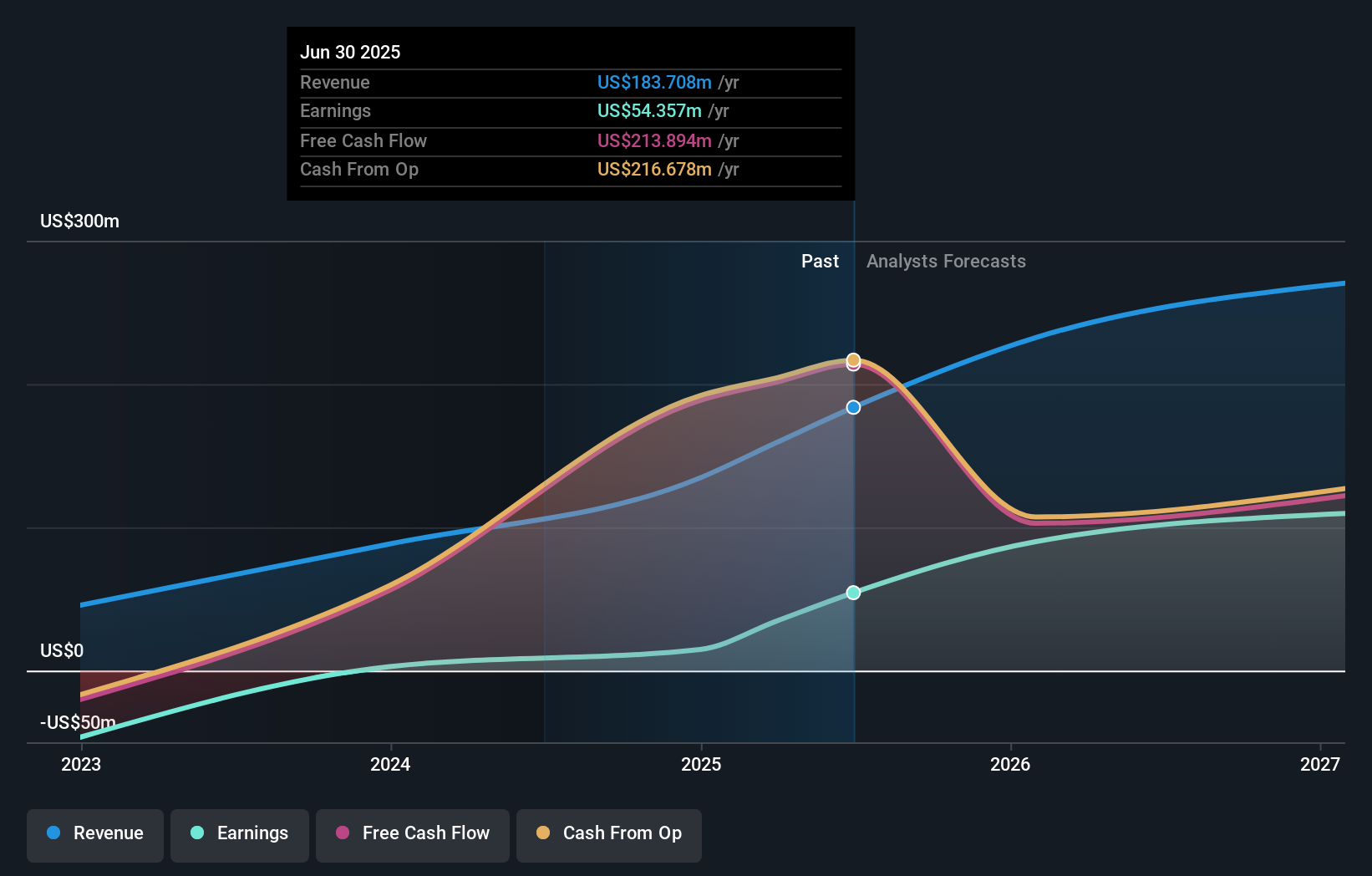

Overview: Exzeo Group, Inc. offers comprehensive insurance technology and operational solutions to carriers and agents, with a market cap of $2.12 billion.

Operations: Exzeo Group, Inc. generates revenue primarily through its insurance technology and operations solutions for the property and casualty sector, amounting to $210.67 million.

Exzeo Group's recent strategic maneuvers, including a substantial IPO and subsequent Shelf Registration, underscore its robust financial trajectory with a remarkable 490.6% earnings growth over the past year, significantly outpacing the software industry's average. This performance is bolstered by an aggressive R&D commitment, integral to its innovation strategy, which aligns well with its projected annual earnings growth of 20.3%. These developments not only reflect Exzeo’s adaptability in a competitive tech landscape but also hint at sustained future growth through strategic market expansions and product innovations.

- Navigate through the intricacies of Exzeo Group with our comprehensive health report here.

Examine Exzeo Group's past performance report to understand how it has performed in the past.

Make It Happen

- Dive into all 71 of the US High Growth Tech and AI Stocks we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal