3 Growth Companies With Insider Ownership Up To 17%

As the U.S. markets experience a slight downturn with major indexes closing lower for the third consecutive session, investors are increasingly focusing on companies that demonstrate resilience and potential for growth. In these uncertain times, firms with high insider ownership can be particularly appealing, as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 74% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.5% | 42.5% |

| Cloudflare (NET) | 10.2% | 43.5% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 135.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

We'll examine a selection from our screener results.

Astera Labs (ALAB)

Simply Wall St Growth Rating: ★★★★★★

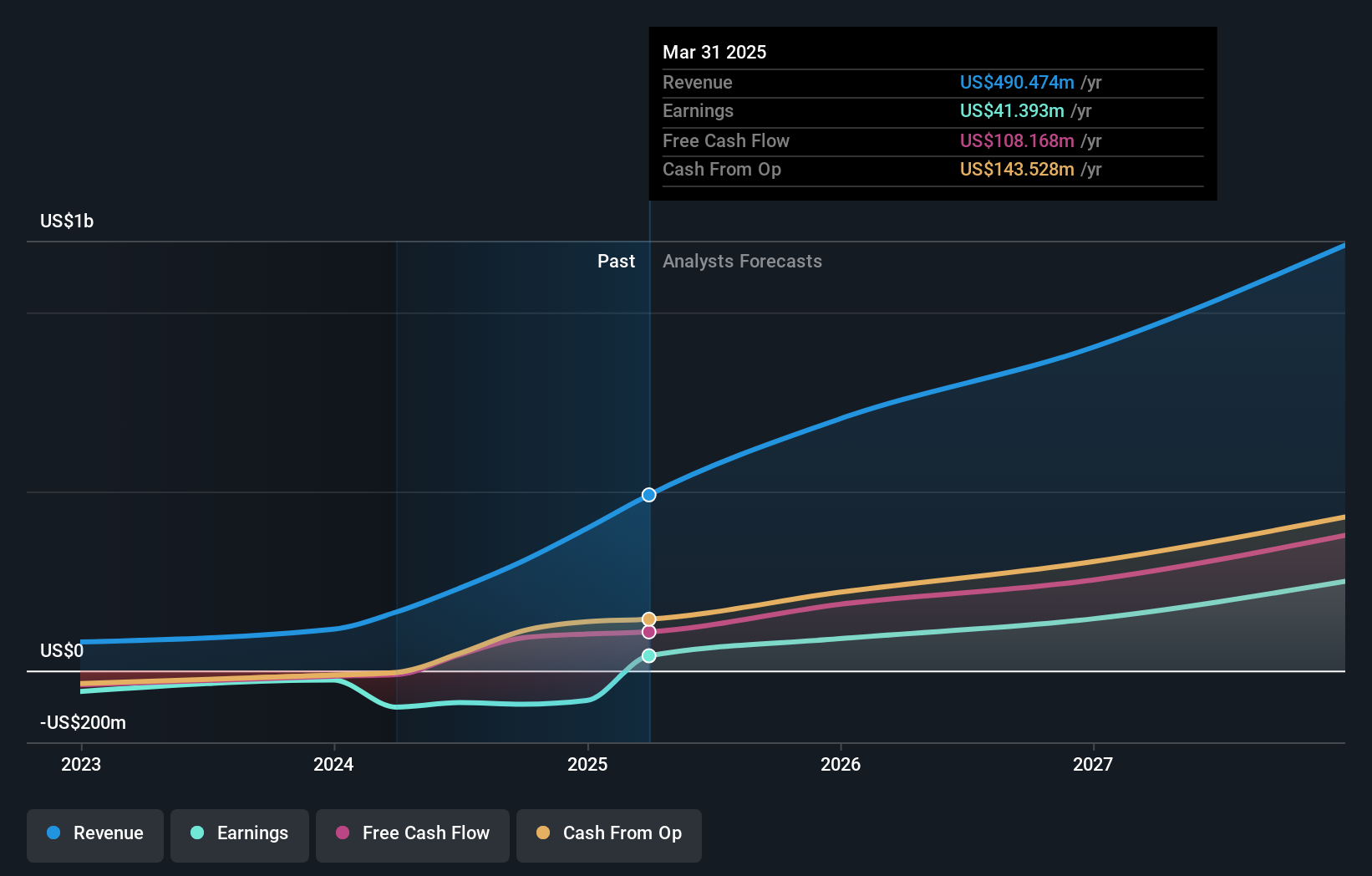

Overview: Astera Labs, Inc. designs, manufactures, and sells semiconductor-based connectivity solutions for cloud and AI infrastructure with a market cap of $28.86 billion.

Operations: The company's revenue segment is primarily derived from its semiconductor-based connectivity solutions, totaling $723.04 million.

Insider Ownership: 10.5%

Astera Labs is experiencing significant growth, with its revenue projected to increase by 23.9% annually, outpacing the broader US market. Recent product announcements highlight its focus on AI infrastructure and custom connectivity solutions, crucial for hyperscalers. The company reported strong financial performance with US$230.58 million in third-quarter sales and a turnaround to profitability this year. Despite high share price volatility, insider activity shows more buying than selling recently, indicating confidence in future prospects.

- Unlock comprehensive insights into our analysis of Astera Labs stock in this growth report.

- In light of our recent valuation report, it seems possible that Astera Labs is trading beyond its estimated value.

Arista Networks (ANET)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Arista Networks, Inc. develops, markets, and sells data-driven networking solutions for various environments globally and has a market cap of approximately $168.93 billion.

Operations: Arista Networks generates revenue of approximately $8.45 billion from its computer networks segment, providing data-driven networking solutions across AI, data center, campus, and routing environments globally.

Insider Ownership: 17.2%

Arista Networks is positioned for growth with revenue forecasted to increase by 17.3% annually, surpassing the US market average. Recent collaborations, such as with Fortinet on AI data center solutions, underscore its strategic focus on AI and networking innovations. Despite recent insider selling and no substantial buying in the past three months, Arista's strong earnings growth of 34.4% annually over five years reflects robust financial health and operational success in expanding its product offerings.

- Take a closer look at Arista Networks' potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Arista Networks shares in the market.

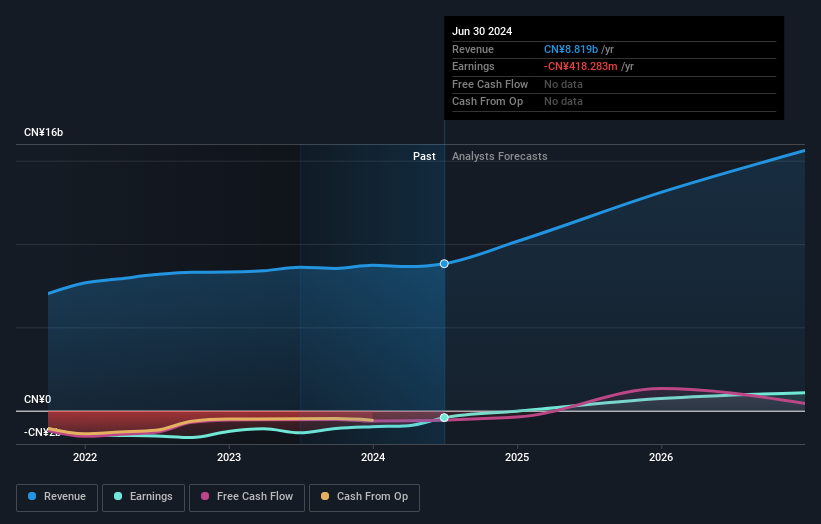

ZKH Group (ZKH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ZKH Group Limited operates a trading and service platform for maintenance, repair, and operating (MRO) products in China, with a market cap of approximately $605.69 million.

Operations: The company's revenue primarily comes from its Business-To-Business Trading and Services of Industrial Products segment, generating approximately CN¥8.80 billion.

Insider Ownership: 17.8%

ZKH Group's revenue is forecast to grow at 11.9% annually, outpacing the US market average. The company reported a narrowing net loss for Q3 2025, signaling potential improvement in financial health. Trading significantly below its estimated fair value, ZKH is expected to become profitable within three years with earnings growth projected at over 100% annually. Despite no recent insider trading activity, it remains a good relative value compared to peers and industry standards.

- Click here to discover the nuances of ZKH Group with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, ZKH Group's share price might be too pessimistic.

Key Takeaways

- Embark on your investment journey to our 209 Fast Growing US Companies With High Insider Ownership selection here.

- Interested In Other Possibilities? This technology could replace computers: discover the 29 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal