Top European Dividend Stocks To Consider In December 2025

As the pan-European STOXX Europe 600 Index edges closer to record highs amid positive sentiment about earnings and economic prospects, investors are increasingly looking toward dividend stocks as a potential source of stable returns. In this context, selecting dividend stocks with strong fundamentals and consistent payout histories can be an effective strategy for navigating the current market landscape.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.08% | ★★★★★★ |

| Holcim (SWX:HOLN) | 3.99% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.78% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.31% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.81% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.09% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 4.91% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.28% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.18% | ★★★★★★ |

| Afry (OM:AFRY) | 4.00% | ★★★★★☆ |

Click here to see the full list of 191 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Aeroporto Guglielmo Marconi di Bologna (BIT:ADB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aeroporto Guglielmo Marconi di Bologna S.p.A., along with its subsidiaries, is involved in the development, management, and maintenance of an airport both in Italy and internationally, with a market cap of €363.06 million.

Operations: The company's revenue segments include Aviation, generating €101.12 million, and Non-Aviation, contributing €77.57 million.

Dividend Yield: 4.7%

Aeroporto Guglielmo Marconi di Bologna (ADB) offers a dividend yield of 4.69%, placing it in the top 25% of Italian dividend payers, though its dividends have been volatile and unreliable over the past decade. The payout ratio is reasonable at 69%, yet dividends are not covered by free cash flows, raising sustainability concerns. Recent earnings showed modest growth with revenue reaching €131.33 million for nine months ended September 2025, but future earnings are expected to decline slightly.

- Unlock comprehensive insights into our analysis of Aeroporto Guglielmo Marconi di Bologna stock in this dividend report.

- In light of our recent valuation report, it seems possible that Aeroporto Guglielmo Marconi di Bologna is trading beyond its estimated value.

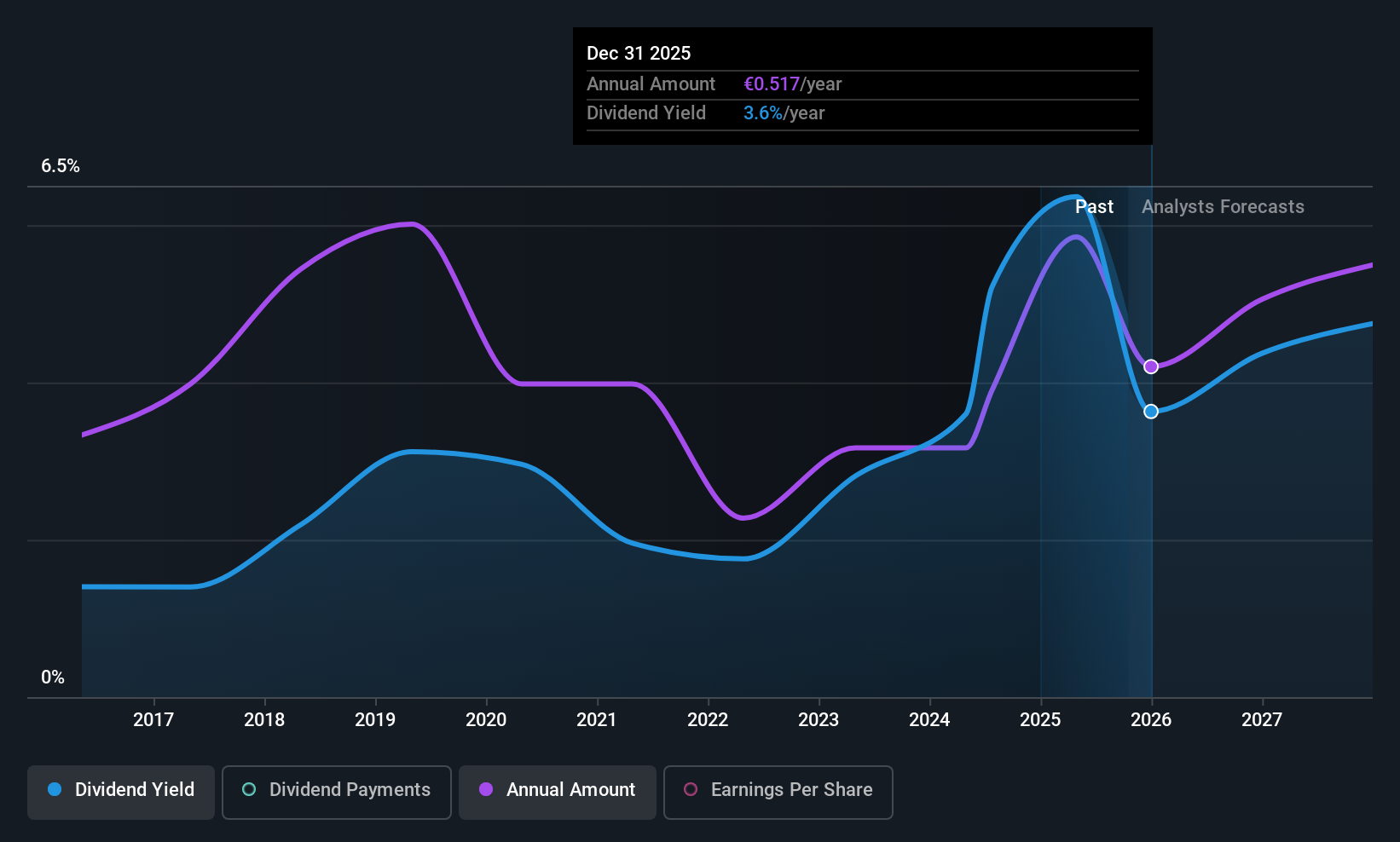

Arnoldo Mondadori Editore (BIT:MN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arnoldo Mondadori Editore S.p.A., with a market cap of €550.30 million, operates in the publishing sector, producing books and magazines across Italy, the rest of Europe, and the United States.

Operations: Arnoldo Mondadori Editore S.p.A. generates revenue through its segments, including Retail (€209.52 million), Average (€145.57 million), Books Trade (€397.04 million), Educational Books (€233.16 million), and Corporate and Shared Services (€47.97 million).

Dividend Yield: 6.6%

Arnoldo Mondadori Editore offers a dividend yield of 6.62%, ranking it among the top 25% of Italian payers. Despite only six years of payments, dividends have grown steadily and are covered by earnings (64.5%) and cash flows (68.6%), indicating sustainability. The stock trades at a significant discount to fair value, though high debt levels pose risks. Recent earnings showed slight declines with sales at €704.46 million and net income at €51.71 million for nine months ended September 2025.

- Take a closer look at Arnoldo Mondadori Editore's potential here in our dividend report.

- The analysis detailed in our Arnoldo Mondadori Editore valuation report hints at an deflated share price compared to its estimated value.

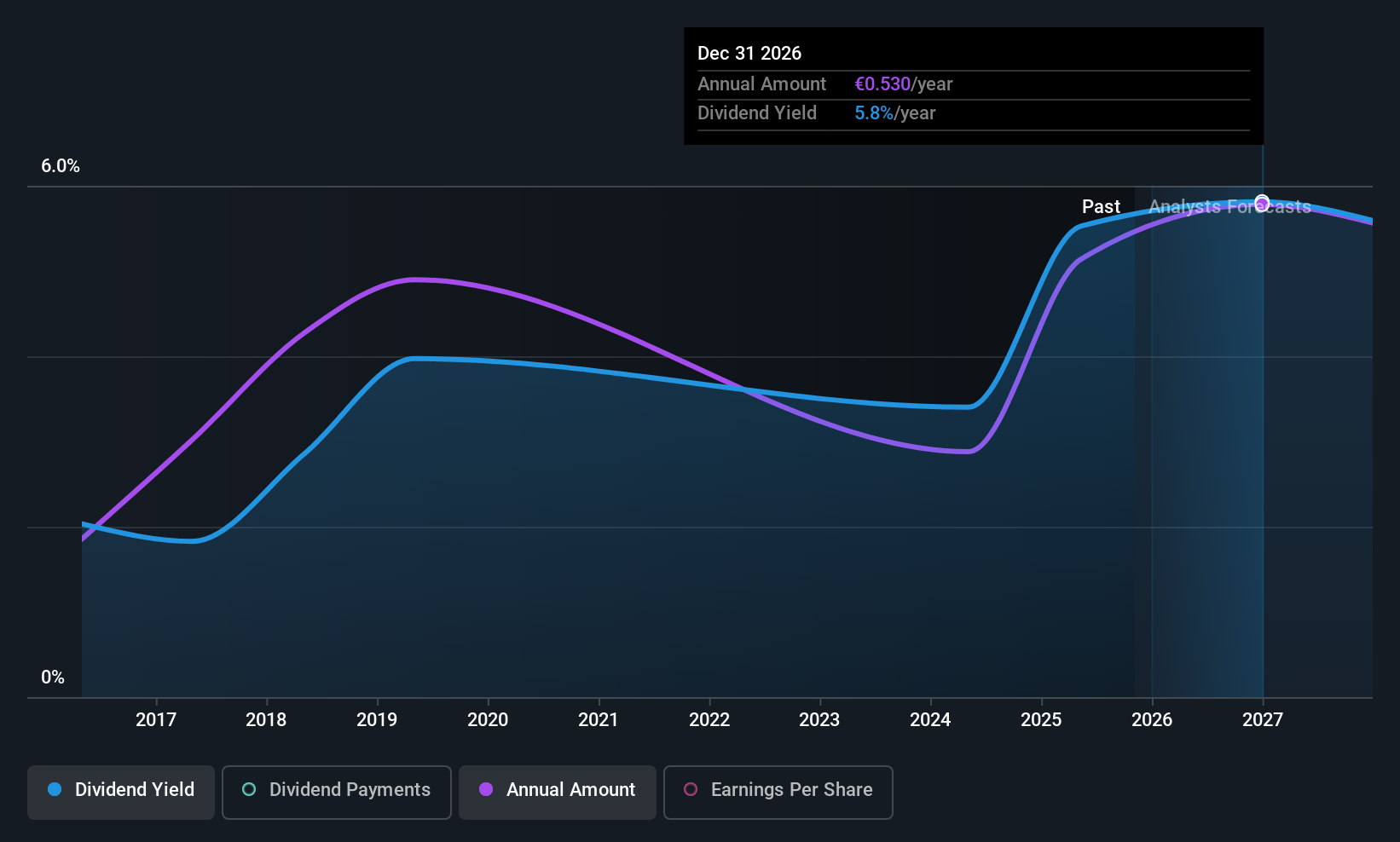

OPmobility (ENXTPA:OPM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OPmobility SE specializes in designing and producing intelligent exterior systems, customized complex modules, lighting systems, energy storage systems, and electrification solutions for mobility sectors globally, with a market cap of €2.28 billion.

Operations: OPmobility SE generates its revenue from three main segments: Exterior Systems (€4.70 billion), Modules (€3.15 billion), and Powertrain (€2.62 billion).

Dividend Yield: 4.5%

OPmobility's dividend yield of 4.51% trails the top French dividend payers, and its payouts have been volatile over the past decade. However, dividends are well covered by earnings (32.2%) and cash flows (50.2%), suggesting sustainability despite previous instability. The stock trades at a notable discount to fair value but carries high debt levels, which could be concerning for investors. Recent leadership changes with Félicie Burelle as CEO may influence future strategic direction amidst declining revenues in 2025.

- Click to explore a detailed breakdown of our findings in OPmobility's dividend report.

- Upon reviewing our latest valuation report, OPmobility's share price might be too optimistic.

Summing It All Up

- Embark on your investment journey to our 191 Top European Dividend Stocks selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal