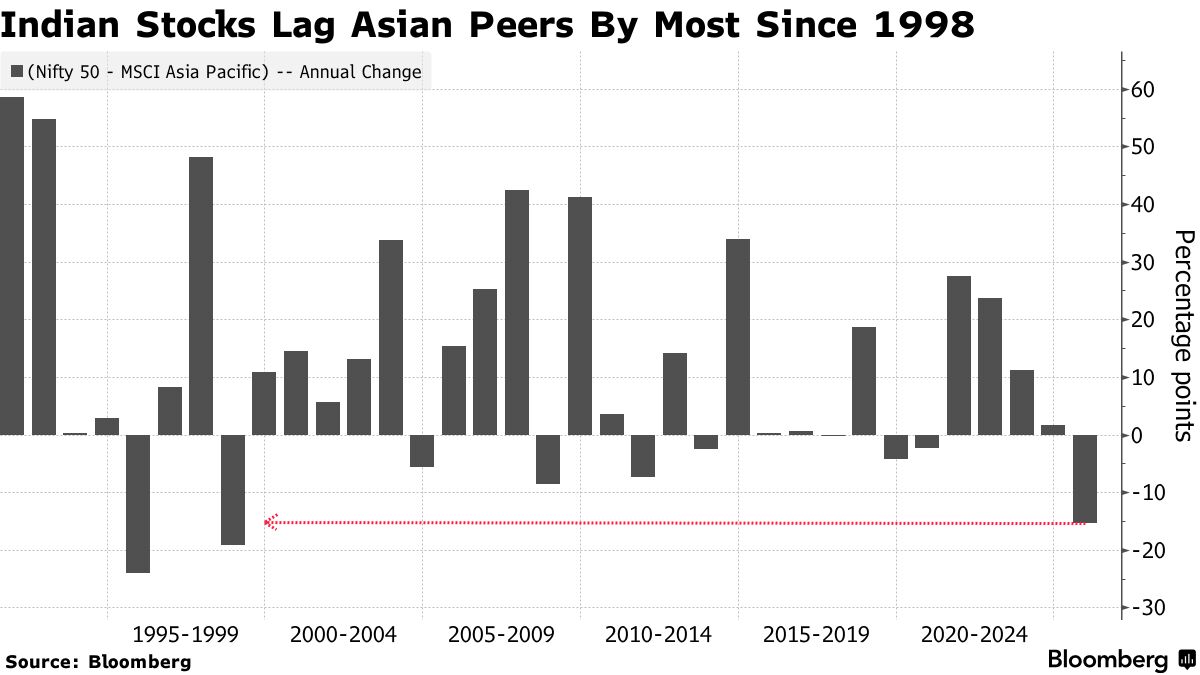

Foreign capital outflows compounded the depreciation of the rupee, and India's stock market outperformed its Asian peers, and the margin is expected to hit the highest level in 30 years

The Zhitong Finance App learned that under the double pressure of foreign capital outflows and the depreciation of the rupee, the Indian stock market is ending the year with the worst performance compared to its Asian peers in nearly 30 years. As global fund managers cut their risk exposure to India, the rebound in the country's stock market that began in September has subsided. Foreign funds withdrew $1.7 billion in December, bringing the full year's capital outflow to a record $17.9 billion. Overvalued valuations, slowing profit growth, and lack of credible AI-related stocks dampened market sentiment, causing the Indian stock market to lose favor with overseas investors this year. Meanwhile, the depreciation of the rupee intensified selling pressure and eroded the returns of overseas investors. The lack of progress in the trade deal between India and the US — the US imposes the highest tariff rate in Asia on India — has caused the rupee to continuously fall below record lows in recent months.

Pranav Haridasan, CEO of Axis Securities, said 2025 will not be an easy year for India's capital market. But he added that the challenging year 2025 may lay the foundation for a more stable year in the future, where the average is likely to return.

On the positive side, the Indian stock market will continue to rise for the 10th year in a row, and the NSE Nifty 50 index has risen more than 10% since this year. Strong demand from local institutions — which invested around $81 billion in the stock market in 2025 — provided key support for India's stock market to return this year.

The strategists of Nomura Holdings and Citigroup Corp. expect that as long as corporate profits continue to improve and policies and measures aimed at supporting domestic demand are effective, the Indian stock market will rise further in 2026 and may outperform other emerging market peers.

Despite this, the near term outlook for Indian assets remains uncertain. According to the data, local stocks in India rarely started the new year with a strong momentum, and the NSE Nifty 50 index fell by an average of 1.1% in January.

Furthermore, after a record year in 2025, the booming initial public offering (IPO) market will continue to direct liquidity to newly listed companies in 2026, and Kotak Mahindra Capital and Goldman Sachs Group both forecast that India's IPO funding amount will exceed $25 billion next year.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal