The M&A evolution of Yiteng Pharmaceutical and the “two-way movement” of Jiahe Biotech (06998)

On December 30, Yiteng Pharmaceutical Group Co., Ltd. (“Yiteng Pharmaceuticals”) completed a share exchange merger and listing with Jiahe Biopharmaceuticals (Cayman) Holdings Co., Ltd. (“Jiahe Biotech”) through a reverse acquisition. The conclusion of this reverse acquisition marks the formal establishment of Yiteng Jiahe Pharmaceutical Group Co., Ltd. (“Yiteng Jiahe”) and has entered a new stage in strategic integration and development.

In China's biomedical industry, where competition is currently fierce and the narrative is converging, the path leading to Biopharma seems to have been predetermined. One is the BeiGe Shenzhou style of “fighting high”, which uses a global perspective and heavy investment in independent research and development to completely break apart the international market in core fields such as hematoma, and win global competition with “best-in-class” data. The other is Cinda Biotech's “double balance,” which focuses on promoting efficient R&D and deepening local commercialization capabilities, constructs a stable product matrix in various fields such as oncology, metabolism, and self-prevention, and hits the global market with cutting-edge pipelines such as PD-1/IL-2 dual antibodies. Both paths, without exception, follow the classical linear logic of advancing from the “R&D side” to the “commercial side.” However, this path is full of uncertainty, and countless companies are in the middle of R&D or commercialization.

In contrast, Yiteng Pharmaceutical chose the reverse path of “start first, break later”. Starting from a solid “back end” of commercialization, reverse integrating the “front end” of production and R&D, and finally building a complete industrial closed loop of self-hematopoiesis and collaborative innovation. This is not only 18A's first successful reverse takeover, but also an important verification of the diversified growth path of Chinese pharmaceutical companies.

Yiteng Pharmaceutical's Biopharma Leap Forward

Established in 2001, Yiteng Pharmaceutical is a Chinese comprehensive biopharmaceutical company that has built up R&D, production and commercialization full value chain capabilities, focusing on treatment fields such as oncology, self-immunity, cardiovascular, respiratory and anti-infection. Its development process can be described as a microcosm of the transformation of China's pharmaceutical industry — every key transformation closely echoes profound changes in domestic policy and market environment.

Yiteng Pharmaceutical started as a CSO. As of June 30, 2025, the company had about 1,000 sales representatives, covering 31 provinces across the country, with about 17,000 hospitals, 19,000 pharmacies and 188 commercial companies, laying a solid market foundation.

Around 2015, with the implementation of the “two-vote system” policy, the traditional CSO model faced challenges; at the same time, multinational pharmaceutical companies began to adjust their strategies in China and divest non-core mature products. Yiteng Pharmaceutical reviewed the current situation and initiated a strategic transformation, moving from simple agency sales to a two-wheel drive with the acquisition of mature products and authorized introduction (license-in) of innovative drugs, beginning the transition to specialty pharma (Specialty Pharma).

2019 is a critical year in Yiteng Pharmaceutical's transformation journey. In the context of the full implementation of the national generic drug collection policy and the acceleration of the industry's transformation to innovation, the company completed two landmark acquisitions: the acquisition of the stable and trustworthy antibiotic brand from Eli Lilly and the rights of Shikelau in the Chinese market and the Suzhou production base; and the acquisition of the respiratory drug Yiruiping from GSK. These two acquisitions have enabled Yiteng Pharmaceutical to completely complete the transformation of its status from a “channel agent” to a “product owner and producer”, have self-controlled “cash cow” products and production bases, and officially upgrade to a real pharmaceutical company (Pharma).

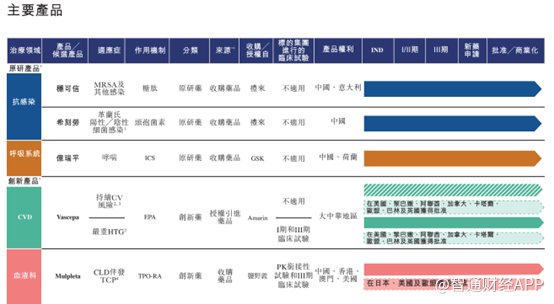

At present, Yiteng Pharmaceutical has established a balanced product portfolio. Its three core commercial products are: Wenkexin (vancomycin for injection), Chicelao (cefaclor capsules), and eirapine (fluticasone propionate suspension for atomized inhalation). At the same time, the company also has three innovative products: WeisiPei (ethyl eicosapentaenoate), Wenkeda (rutripopab tablets), and Jingzhuda (enteistat tablets), which reserve growth momentum for future development.

Thanks to deep sales channels, Yiteng Pharmaceutical's performance has grown steadily. According to the prospectus, from 2022 to 2024, the company's revenue was 2,074 billion yuan (unit, same below), 2,304 billion yuan and 2,546 billion yuan respectively; the corresponding net profit after tax was approximately RMB 306 million, RMB 308 million and RMB 388 million, respectively.

In terms of financial soundness, Yiteng Pharmaceutical's cash flow performance is outstanding. As of June 30, 2025, the company's cash and cash equivalents reached $778 million, an increase of 54.1% over the same period last year. It is worth emphasizing that its cash flow mainly comes from the hematopoietic capacity of the main business — for the whole of 2024 alone, the net cash flow from operating activities reached 916 million yuan. Abundant cash reserves and strong operating cash flow have jointly laid a solid financial foundation for Yiteng Pharmaceutical's future business development and strategic layout.

Since the end of 2021, the pharmaceutical industry has experienced a cold capital winter. In 2024, the number of primary market financing cases in China's biomedical industry was 811, with a total financing amount of US$7.3 billion, down 38% and 33% respectively from 2023. The number of 18A listed Hong Kong stocks also declined from a peak of 20 in 2021 to 4 in 2024.

The cold winter of capital in the pharmaceutical industry is a cruel and necessary stress test. It is driving the industry to say goodbye to homogenized internal volumes and return to the roots of R&D and clinical value. Although the chill has not completely dissipated, the original purpose of the policy is to optimize the structure rather than destroy the industry, so the pharmaceutical industry is in a deep reshuffle. Naturally, it is very uncomfortable for most innovative pharmaceutical companies with tight cash flow. Conversely, for Pharma like Yiteng Pharmaceutical, which has strong commercial capabilities and sufficient cash flow, it is a good opportunity to achieve a closed commercial loop integrating research, production, and marketing through mergers and acquisitions, and become Biopharma.

At this time, Jiahe Biotech, which has strong R&D capabilities, weak commercialization capabilities, and tight cash, caught the eye of Yiteng Pharmaceutical.

Why Jiahe Biotech?

Jiahe Biotech, which first entered the capital market, can be said to be very impressive. It has laid out a variety of major biosimilar drug pipelines, with a market value of over HK$14 billion.

However, after capital enthusiasm waned, the market value of Jiahe Biotech shrunk by nearly 90% to the current HK$1.6 billion.

The sharp decline in market value was mainly due to the core product PD-1 monoclonal antibody (GB226) in the early days of marketing, but as pharmaceutical negotiations progressed, PD-1 prices plummeted, and the GB226 approval process was far more careful and lengthy than expected. In June 2023, GB226's marketing application was not approved, making it the first PD-1 drug to be rejected in China, which dealt a fatal blow to Jiahe Biotech.

In order to reverse the situation, starting in 2022, Jiahe Biotech has adjusted its R&D focus to developing lerosil hydrochloride tablets (GB491, CDK4/6i) and three novel antibody drugs GB261 (CD3/CD20), GB263T (EGFR/cMET/cMet), and GB268 (PD1/VEGF/CTLA-4) tri-antibodies for breast cancer.

The core product of Jiahe Biotech, GB491 (trade name: Ru Jianing), is a differentiated CDK4/6 inhibitor. After Jiahe Biotech signed a merger agreement with Yiteng Pharmaceutical, it was officially approved by the State Drug Administration for two new drug applications in May 2025, and successfully listed in the 2025 National Health Insurance Catalogue in December under the impetus of Yiteng Pharmaceutical, and has now entered the commercialization stage.

This is the second product to enter the commercialization stage after Jiahe Biotech's infliximab analogue (Jiayoujian) was approved for sale in 2022. CDK4/6 is a popular target for breast cancer treatment. Currently, a number of CDK4/6 inhibitors have been approved and marketed at home and abroad for first-line, second-line, and post-operative adjuvant treatment of unresectable locally advanced or metastatic HR-positive HER2-negative breast cancer. Pibacilli (Pfizer), rebosilil (Novartis), and abesilil (Eli Lilly) are the three CDK4/6 inhibitors with high sales volume among CDK4/6 inhibitors. In 2024, abesilil sales were US$5.307 billion (+37%), Basile $4.367 billion (-8%), Ripple Sealy $3,033 million (+46%).

Judging from the sales of the above pharmaceutical companies, the GB491 market potential is not small, and Jiahe Biotech's two indications are first-line and second-line therapies, respectively, which have greater potential than other domestic CDK4/6I products.

However, in the announcement, Jiahe Biotech unhesitatingly stated that commercialization of CDK4/6i requires strong commercialization capabilities to seize market opportunities. Previously, infliximab analogues (Jiayoujian) were not able to achieve ideal market volume after being marketed; moreover, many products are currently in the R&D stage, and strong and continuous cash flow is needed to support drug research and development work.

Let's take a look at another Jiahe Biotech product, GB261. According to the Zhitong Finance App, GB261 is a novel differentiated CD20/CD3 bispecific T-cell binder (TCE).

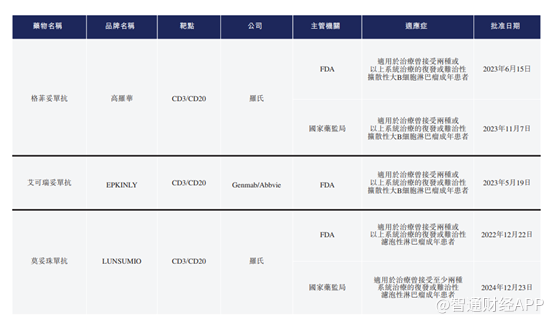

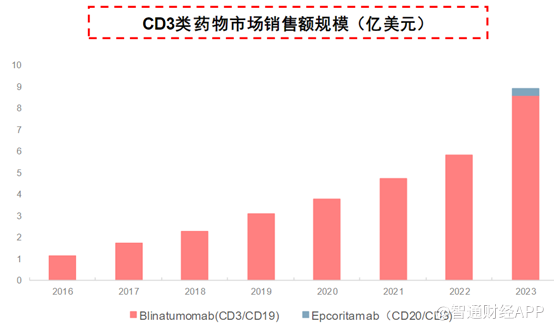

Currently, 3 CD3/CD20 dual antibodies have been approved for marketing worldwide, and 2 CD3/CD20 TCE have been approved in China.

According to public information, the sales volume of the CD3/CD19 dual-antibody drug blinatumomab in 2023 was 861 million US dollars, and the sales volume of the CD3/CD20 drug epcoritamab was 31 million US dollars, totaling about 1 billion US dollars.

In addition to GB261 from Jiahe Biotech, up to now, there are 5 CD3/CD20 TCEs in phase 1/2 or later clinical phase globally, while China also has 8 CD3/CD20 TCEs in phase 1/2 or later clinical phase. It is worth mentioning that the CD3/CD20 that has already been marketed are all jointly developed by international giants or pharmaceutical companies. Jiahe Biotech relies on self-research capabilities. Its GB261 is in phase 1/2, and the R&D progress is at the top.

Furthermore, the results of Ph1/2 multicenter studies on B-NHL (DLBCL and FL) in China and Australia showed that GB261 showed excellent safety and efficacy. Compared to other similar compounds, GB261 has been shown to significantly reduce cellular hormone release (CRS).

Excellent clinical results, combined with a good market competition pattern, attracted the attention of TRC 2004 and reached strategic cooperation. According to information, TCR 2004 is a company co-founded by Two River Foundation and Third Rock Ventures Foundation. Both of these funds are experienced company founders, and each focuses on optimizing disruptive treatment technology for patients. Two River has founded some of the most successful cell therapy companies in the industry, including Kite Pharma, the world's leading developer of the CD19 Car-T therapy YesCarta®. Third Rock Ventures is a leading healthcare venture capital fund that has raised $3.8 billion since inception, driving investments in more than 60 portfolio companies.

In addition to GB261, which is a major product, Jiahe Biotech's GB268 is also full of highlights.

According to the prospectus, GB268 is a highly innovative and differentiated three-specific antibody, specifically targeting the three important pathways PD-1, CTLA-4, and VEGF involved in cancer immunotherapy and tumor angiogenesis.

After fine tuning, GB268 has a novel molecular design that balances the activity of different groups of antibodies, which is more advantageous in terms of safety. The CTLA-4 group was deliberately designed to only partially block the interaction of CTLA-4 with its ligand CD80/CD86. Furthermore, CTLA-4 blocking is highly dependent on PD-1 expression. GB268 induces potent PD-1 internalization. In multiple in vivo experiments using PBMC humanized models (including A375 melanoma model, HT29 colorectal cancer model, and NCI-H460 NSCLC model), GB268 showed superior and coordinated anti-tumor efficacy compared with PD-1/VEGF bispecific antibodies (BsAb), PD-1/CTLA-4 bsAb, or triple combinations of pabolizumab, bevacizumab, and ipizumab.

Furthermore, an arthritis-induced model using hPD-1/hctLA-4 KI mice was used to evaluate potential immune-related toxicity. GB268 showed mild arthritis induction compared to the approved PD-1/CTLA-4 bsAb, and was about 20 times safer than ipimumab combined with odivol.

Currently, there are no approved PD-1/CTLA4/VEGF tri-specific antibodies in the world, and only two tri-specific PD-1/CTLA4/VEGF antibodies are in phase 1 clinical stage.

Although competition in the PD-1 field is fierce, dual antagonists using PD-1 in combination with other drugs have been very successful. Since Kangfang Biotech's PD-1/VEGF bispecific antibody ivoxide (AK112) BD ignited the market, domestic PD- (L) 1/VEGF dual antibodies have become the top assets contested by global pharmaceutical companies, and related transactions have continuously set new monetary records. Take the deal between Sansheng Pharmaceuticals and Pfizer as an example. The down payment of 1.25 billion US dollars not only set a Chinese record, but also reached the top level in the world, highlighting the extreme optimism of multinational giants about the market value of this targeted dual-antibody drug. At the same time, the $11.4 billion collaboration between Cinda Biotech and Takeda and BioNTech (introduction of Promex assets) and a subsequent agreement of more than 9 billion US dollars with Bristol-Myers Squibb (BMS) have created an unprecedentedly hot deal on the dual-track. These deals show that China's dual antibody research and development in the tumor immunization 2.0 era has entered the first tier of the world and has begun to dominate the global competitive landscape in this field.

As a scarce resource in the current market, PD-1/CTLA-4/VEGF tri-specific antibodies have considerable potential for future external BD. It is worth mentioning that Jiahe Biotech has a successful track record in external licensing (such as GB261 external licensing).

It is easy to see that Jiahe Biotech's R&D skills are quite solid, and it also has great potential in the research pipeline, but its shortcoming lies in commercialization. Yiteng Pharmaceutical, which is known for its commercialization capabilities, just made up for Jiahe Biotech's shortcomings, so the two hit it off.

Biopharma sets sail in reverse

In April 2025, Jiahe Biotech announced that it will issue approximately 1,778 billion cost shares to shareholders of Yiteng Pharmaceutical (based on the estimated maximum share exchange ratio of 3.32). The share value of Yiteng Pharmaceutical is about US$677 million, and the theoretical issue price per share is HK$2.96. After the transaction is completed, the actual controller of Yiteng Pharmaceutical will become the controlling shareholder of the merged company. This is also the first reverse takeover case of an innovative pharmaceutical company since the Hong Kong Stock Exchange promulgated Rule 18A. It is also the first and only reverse takeover case recently announced in the Hong Kong stock market.

The deal brought together well-known investment institutions including Gao Yu, Aobo, and Sequoia, and top professional teams such as Morgan Stanley and Kirkland & Ellis (KY).

For Yiteng Pharmaceutical, Jiahe Biotech is an “engine” and a “new blueprint.” Although the product line in the traditional advantage field of Yiteng Pharmaceutical is stable, the ceiling of growth is visible. The field of oncology and autoimmunity, which Jiahe Biotech focuses on, is the largest “main channel” and market growth point for global drug development. Through the merger, Yiteng Pharmaceutical obtained a highly competitive oncology pipeline portfolio, next-generation antibody technology platform, and strong self-development capabilities, and achieved strategic expansion in the field of treatment. What is particularly noteworthy is that Taizhou Yiteng Jingang, which is controlled by the controlling shareholder after the merger, owns the breast cancer product “Jingzhuda”, and there is potential co-drug collaboration space with Jiahe Biotech's GB491, which provides an imagination for creating a differentiated oncology product portfolio in the future.

For Jiahe Biotech, although the core product GB491 (CDK4/6 inhibitor) has been approved for marketing, the lack of strong commercial promotion in the fiercely competitive breast cancer market means huge opportunity costs. Yiteng Pharmaceutical's mature oncology drug sales network and more than 20 years of market experience can immediately provide a “highway” for the release of GB491. More importantly, Yiteng Pharmaceutical's stable cash flow can provide continuous “oxygen delivery” for the clinical development of Jiahe Biotech's follow-up pipeline and solve Biotech's biggest survival anxiety.

Compared with giants that have grown from the R&D side, such as Baekje and Cinda, the differentiated advantages and investment logic of Yitengjia after completing the merger are clearly distinguishable. Unlike growing Biopharma, which still requires continuous investment to achieve break-even, stable revenue from mature products such as Yitengjia and “stable and trustworthy” forms a “safety cushion” for the company's operations and supporting innovative research and development, making it more resilient in the midst of industry cycle fluctuations and cold capital winters.

Furthermore, GB491's sales volume pace under Yiteng Pharmaceutical's channel will be the first and most direct litmus test for the success or failure of this merger. Not only that, but there will also be a variety of research pipelines with room for imagination. This pattern of “short-term fulfillment, long-term expectations” provides a clearer anchor point for value evaluation.

Furthermore, Yiteng Pharmaceutical's deep commercialization genes mean that it has a sharp understanding of clinical unmet needs, doctors' prescription habits, and market competition patterns. This view of reversing R&D from the market is expected to guide the merged R&D system, lay out those “clinically necessary and commercially viable” differentiated pipelines more accurately, and avoid ineffective investment in “internal volume” targets.

It is easy to see that the merger of Yiteng Pharmaceuticals and Jiahe Biotech is a win-win situation, and the reason why many major capitalists are betting one after another has also seen this.

epilogue

The grand story of China's innovative drugs should not be written in just one way. BeiGene has proven China's high level of independent research and development and global competition; Cinda Biotech has verified China's depth of balanced development and deep localization; while Yiteng Pharmaceuticals is exploring a “Chinese-style pragmatic path” from the market to innovation.

It didn't start with a scientist's dream to change the world, but with the original intention of delivering good medicine to patients. Through three precise strategic mergers and acquisitions, it has reversed the complete value chain from commerce, production to R&D. This path may be less “sci-fi,” but it's solid, robust, and also points to Biopharma's ultimate form: a sustainable business model capable of self-hematopoiesis, continuous innovation, and ultimately benefiting a wider range of patients.

Yitengjia and Sailing will not only write a company's growth history, but also enrich and expand the ecological diversity of China's biomedical industry. In an arena where leaders compete, this “integrator” who has emerged from the hinterland of the market has unique reverse growth wisdom and is worthy of long-term attention.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal