Further Upside For Leptos Calypso Hotels Public Limited (CSE:LCH) Shares Could Introduce Price Risks After 26% Bounce

The Leptos Calypso Hotels Public Limited (CSE:LCH) share price has done very well over the last month, posting an excellent gain of 26%. This latest share price bounce rounds out a remarkable 352% gain over the last twelve months.

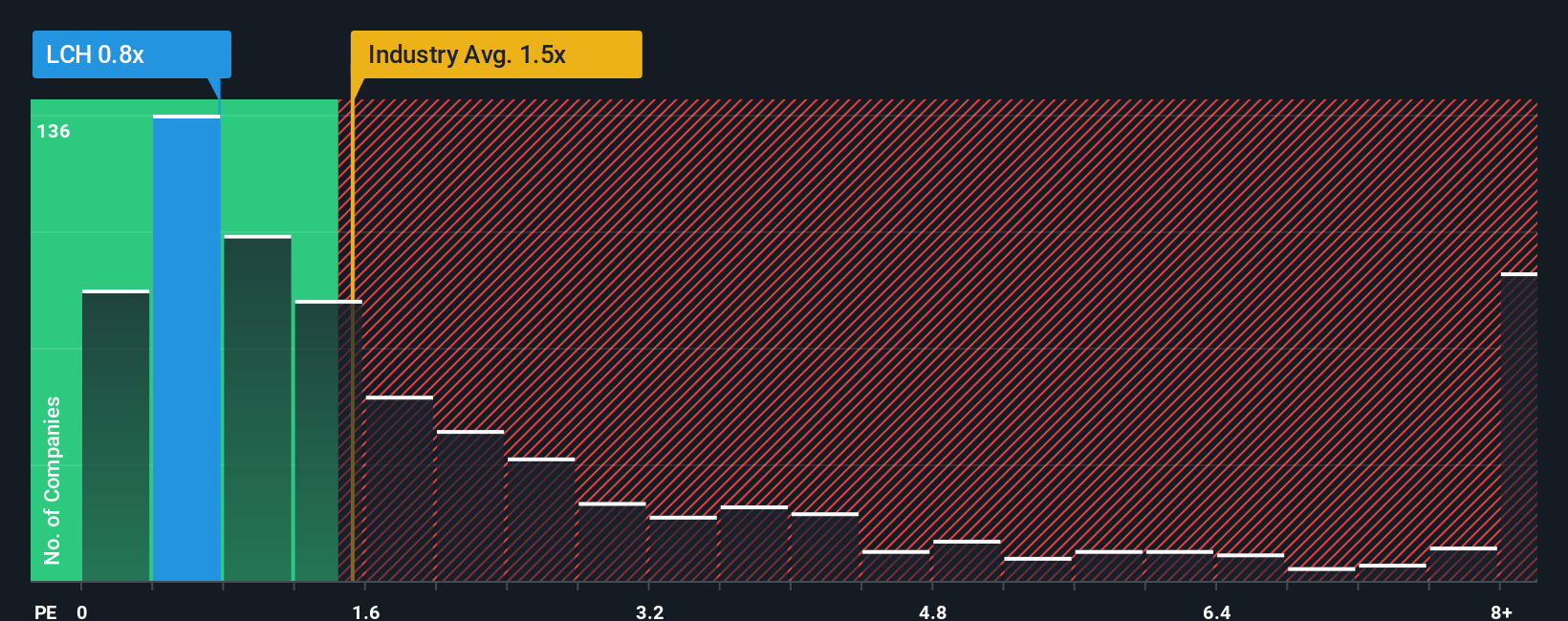

In spite of the firm bounce in price, there still wouldn't be many who think Leptos Calypso Hotels' price-to-sales (or "P/S") ratio of 0.8x is worth a mention when it essentially matches the median P/S in Cyprus' Hospitality industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Leptos Calypso Hotels

What Does Leptos Calypso Hotels' Recent Performance Look Like?

The revenue growth achieved at Leptos Calypso Hotels over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Leptos Calypso Hotels, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Leptos Calypso Hotels' Revenue Growth Trending?

In order to justify its P/S ratio, Leptos Calypso Hotels would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 26% gain to the company's top line. The latest three year period has also seen an excellent 112% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 25% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

In light of this, it's curious that Leptos Calypso Hotels' P/S sits in line with the majority of other companies. It may be that most investors are not convinced the company can maintain its recent growth rates.

The Key Takeaway

Its shares have lifted substantially and now Leptos Calypso Hotels' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Leptos Calypso Hotels currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. It'd be fair to assume that potential risks the company faces could be the contributing factor to the lower than expected P/S. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 3 warning signs for Leptos Calypso Hotels you should be aware of, and 2 of them are a bit unpleasant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal