Asian Market Insights: Dida And Two Other Promising Penny Stocks

As global markets continue to navigate a landscape marked by economic fluctuations and technological optimism, Asian markets have shown resilience with key indices experiencing gains. Penny stocks, often overlooked but never obsolete, represent an intriguing segment of the market due to their potential for growth when supported by robust financials. In this article, we explore three promising penny stocks in Asia that stand out for their financial strength and potential long-term success.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.145 | SGD61.07M | ✅ 2 ⚠️ 4 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.44 | HK$890.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.60 | THB1.09B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.104 | SGD54.45M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.45 | SGD13.58B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.65 | HK$20.57B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.51 | HK$52.36B | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.84 | NZ$243.04M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 968 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Dida (SEHK:2559)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dida Inc. is a technology-driven platform offering carpooling marketplace and smart taxi services, with a market cap of HK$2.44 billion.

Operations: The company's revenue is primarily derived from its carpooling marketplace services at CN¥638.93 million, followed by advertising and other services at CN¥24.95 million, and smart taxi services contributing CN¥5.55 million.

Market Cap: HK$2.44B

Dida Inc., a technology-driven platform, faces challenges with declining earnings, having experienced an 87% drop over the past year and a 13.6% annual decline over five years. Despite trading at 23.1% below its estimated fair value, the company's profit margins have worsened to 28.5%. Dida is debt-free with strong short-term asset coverage for liabilities but is impacted by large one-off items affecting earnings quality. Recent executive resignations may affect strategic direction, although the management team remains seasoned with an average tenure of 5.3 years, ensuring some stability during this transitional phase.

- Click to explore a detailed breakdown of our findings in Dida's financial health report.

- Evaluate Dida's historical performance by accessing our past performance report.

Xinyi Solar Holdings (SEHK:968)

Simply Wall St Financial Health Rating: ★★★★★☆

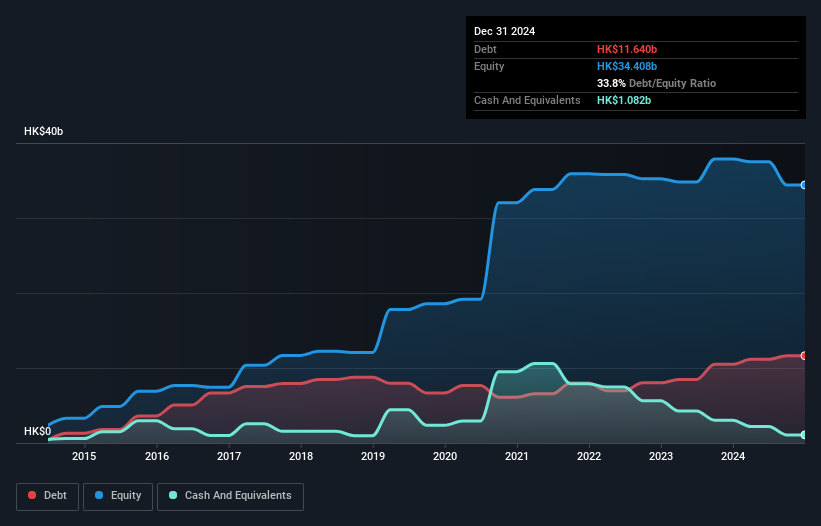

Overview: Xinyi Solar Holdings Limited is an investment holding company that produces, sells, and trades solar glass products across Mainland China, the rest of Asia, North America, Europe, and other international markets with a market cap of HK$27.62 billion.

Operations: The company generates revenue primarily from the sales of solar glass, amounting to CN¥18.07 billion, and its solar farm business, including EPC services, which contributes CN¥3.03 billion.

Market Cap: HK$27.62B

Xinyi Solar Holdings, despite being unprofitable with a negative return on equity of 1.2%, shows potential in its financial structure. The company's short-term assets of CN¥20 billion comfortably cover both short- and long-term liabilities, indicating strong liquidity. Its net debt to equity ratio at 28.3% is satisfactory, although operating cash flow covers only 12.6% of the debt, suggesting room for improvement in cash generation. While earnings are forecasted to grow significantly by 56.19% annually, past profit margins have deteriorated over five years at a rate of 15.5%, reflecting ongoing profitability challenges amidst stable stock volatility and seasoned board oversight.

- Navigate through the intricacies of Xinyi Solar Holdings with our comprehensive balance sheet health report here.

- Evaluate Xinyi Solar Holdings' prospects by accessing our earnings growth report.

Nam Cheong (SGX:1MZ)

Simply Wall St Financial Health Rating: ★★★★★☆

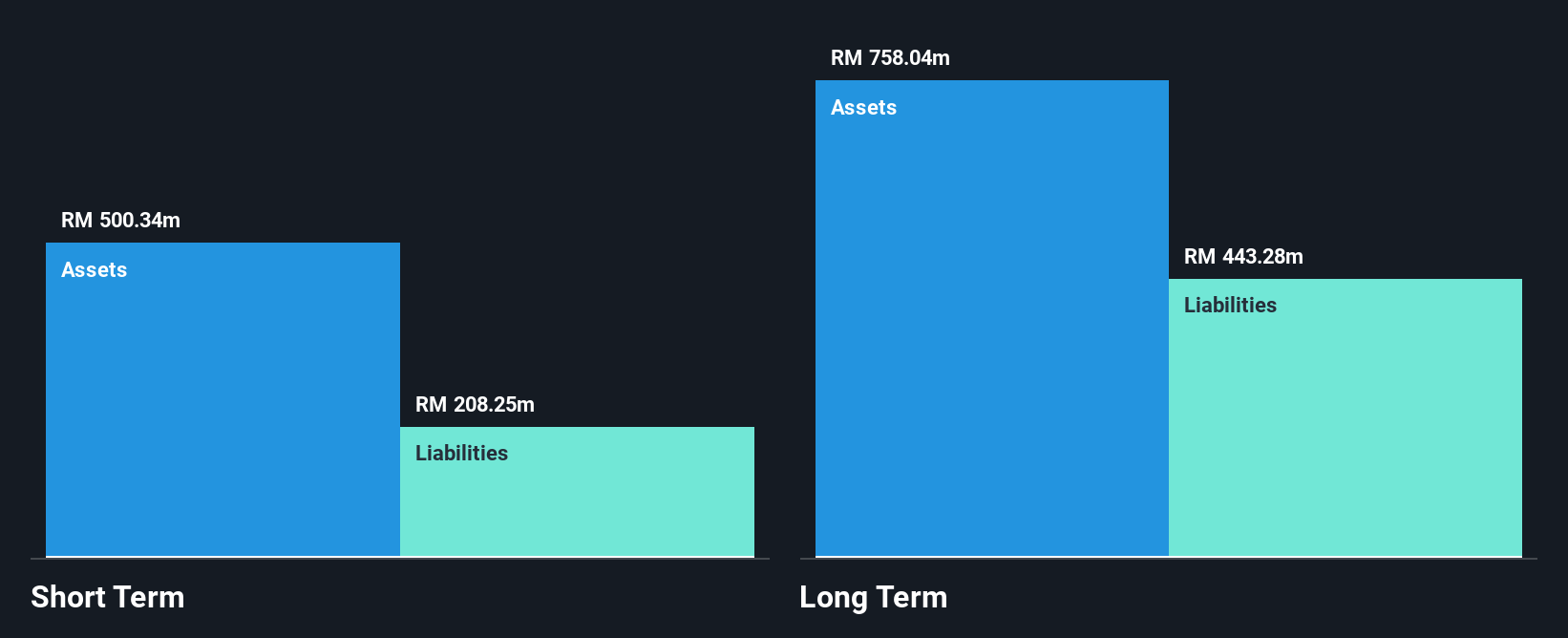

Overview: Nam Cheong Limited is an investment holding company engaged in shipbuilding and vessel chartering, with a market cap of SGD365.34 million.

Operations: The company generates revenue primarily from its chartering segment, which accounted for MYR621.33 million.

Market Cap: SGD365.34M

Nam Cheong Limited, with a market cap of S$365.34 million, has demonstrated financial resilience despite challenges. The company reported third-quarter sales of MYR170.79 million and a net income of MYR45.85 million, reflecting slight declines from the previous year. Its seasoned management team supports strong operational oversight, while interest payments are well covered by EBIT at 14.6x coverage. Although recent earnings growth was negative at -68.2%, the company maintains high return on equity at 35.3% and trades at an attractive price-to-earnings ratio of 4.8x compared to the SG market average, indicating potential value for investors seeking penny stocks in Asia.

- Get an in-depth perspective on Nam Cheong's performance by reading our balance sheet health report here.

- Explore Nam Cheong's analyst forecasts in our growth report.

Where To Now?

- Explore the 968 names from our Asian Penny Stocks screener here.

- Searching for a Fresh Perspective? The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal