Middle Eastern Penny Stocks Under US$70M Market Cap

As tensions between Saudi Arabia and the UAE over Yemen have led to a retreat in most Gulf markets, investors are closely watching the region's economic landscape. Penny stocks, though an older term, remain relevant for those interested in smaller or newer companies that might offer growth opportunities at lower price points. By focusing on financial strength and solid fundamentals, these stocks can present attractive options for investors seeking potential long-term value amidst current market conditions.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.29 | SAR1.32B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.75 | ₪197.21M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.03 | AED2.12B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.54 | SAR914M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.25 | AED384.62M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.54 | AED14.97B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.85 | AED503.03M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.577 | ₪202.29M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 81 stocks from our Middle Eastern Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Sharjah Insurance Company P.S.C (ADX:SICO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sharjah Insurance Company P.S.C. provides general, property, non-property, and life insurance products in the United Arab Emirates and internationally with a market cap of AED228 million.

Operations: The company's revenue segments include AED7.24 million from fire underwriting, AED0.72 million from marine underwriting, and AED1.60 million from other underwriting activities.

Market Cap: AED228M

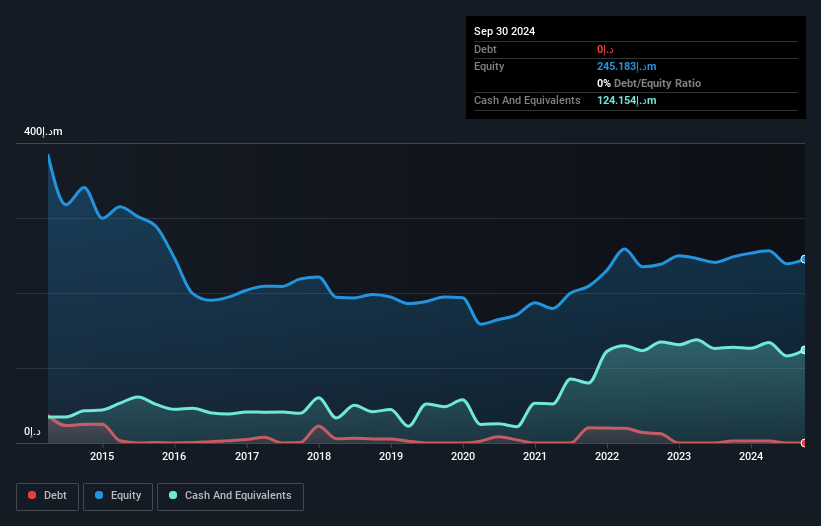

Sharjah Insurance Company P.S.C. has demonstrated remarkable earnings growth, with a 4002.5% increase over the past year, significantly outpacing its historical average and the broader insurance industry. The company's net profit margins have improved to 29.2%, reflecting enhanced profitability compared to last year's 2.6%. With a debt-free balance sheet and strong asset coverage of liabilities, SICO presents a financially stable profile in the penny stock segment. Recent earnings reports highlight substantial net income gains for Q3 and nine months ending September 2025, underscoring its potential for continued financial strength amidst market volatility.

- Navigate through the intricacies of Sharjah Insurance Company P.S.C with our comprehensive balance sheet health report here.

- Understand Sharjah Insurance Company P.S.C's track record by examining our performance history report.

Airtouch Solar (TASE:ARTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Airtouch Solar Ltd offers autonomous water-free robotic cleaning solutions for solar panels and has a market cap of ₪17.85 million.

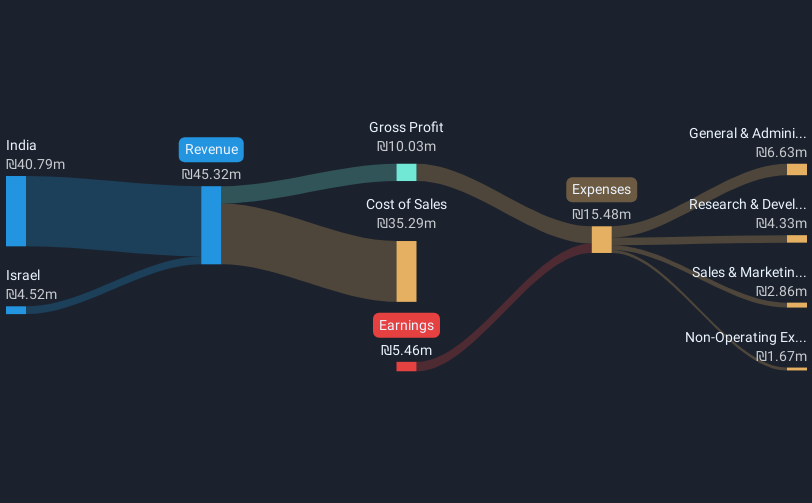

Operations: The company's revenue segment is Industrial Automation & Controls, generating ₪44.24 million.

Market Cap: ₪17.85M

Airtouch Solar Ltd, with a market cap of ₪17.85 million, operates in the Industrial Automation & Controls sector and generated revenues of ₪44.24 million. Despite being unprofitable, the company has reduced its losses by 1.6% annually over the past five years and maintains sufficient cash runway for over three years if free cash flow remains stable. Its management team is experienced with an average tenure of 2.8 years, while its board averages 4.6 years in tenure, indicating seasoned governance. The company's short-term assets comfortably cover both short- and long-term liabilities, reflecting a solid financial footing despite high share price volatility recently.

- Dive into the specifics of Airtouch Solar here with our thorough balance sheet health report.

- Evaluate Airtouch Solar's historical performance by accessing our past performance report.

Human Xtensions (TASE:HUMX-M)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Human Xtensions Ltd. is a medical robotics company that develops, manufactures, markets, and sells modular medical devices for minimally invasive surgical operations in Israel with a market cap of ₪3.88 million.

Operations: No specific revenue segments have been reported for this medical robotics company.

Market Cap: ₪3.88M

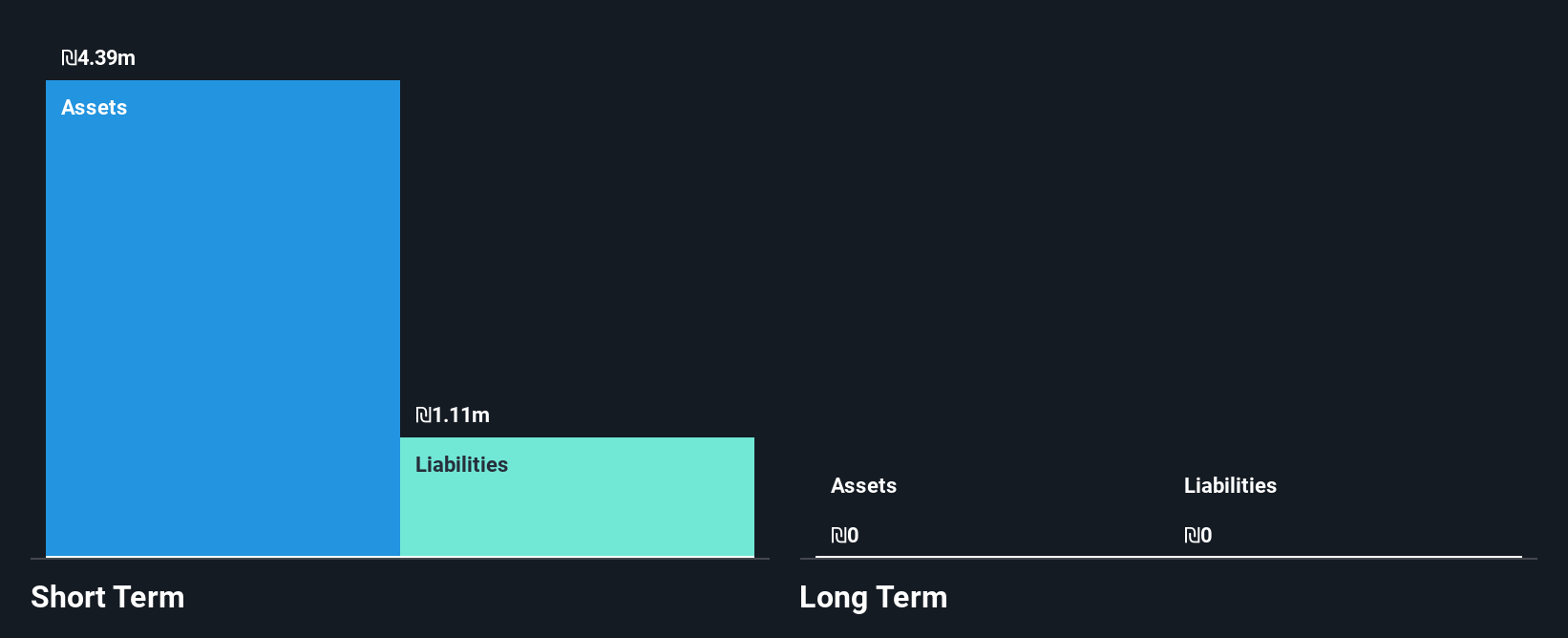

Human Xtensions, with a market cap of ₪3.88 million, is pre-revenue with reported revenue under US$1m (₪105K), indicating it may be in an early growth stage. The company is debt-free and has no long-term liabilities, but its cash runway is less than a year based on current free cash flow. Despite being unprofitable, it has reduced losses by 12.3% annually over the past five years and hasn't significantly diluted shareholders recently. A recent acquisition saw 5.35% of shares sold for ₪0.19 million at ₪0.133 per share, highlighting some investment interest despite financial challenges.

- Jump into the full analysis health report here for a deeper understanding of Human Xtensions.

- Learn about Human Xtensions' historical performance here.

Make It Happen

- Dive into all 81 of the Middle Eastern Penny Stocks we have identified here.

- Want To Explore Some Alternatives? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal