Saudi Ceramic Company's (TADAWUL:2040) Popularity With Investors Is Under Threat From Overpricing

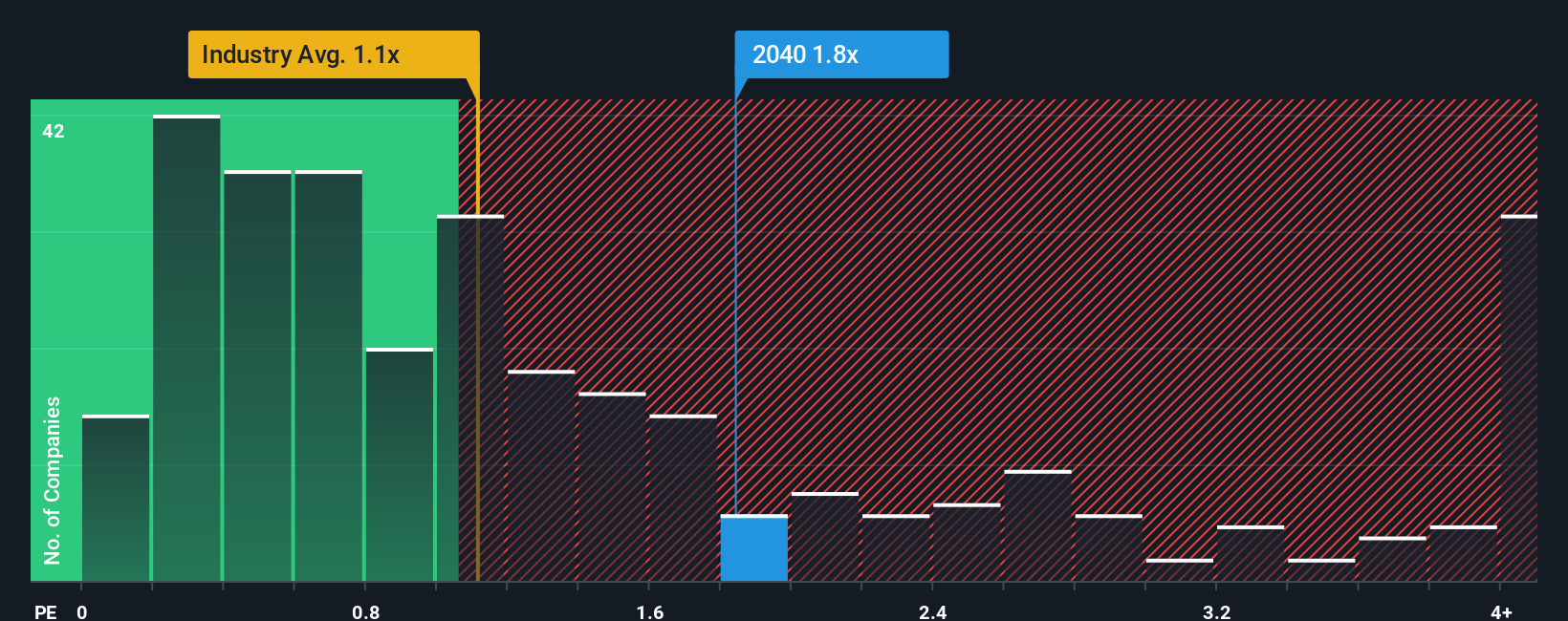

It's not a stretch to say that Saudi Ceramic Company's (TADAWUL:2040) price-to-sales (or "P/S") ratio of 1.8x right now seems quite "middle-of-the-road" for companies in the Building industry in Saudi Arabia, where the median P/S ratio is around 1.9x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Saudi Ceramic

How Saudi Ceramic Has Been Performing

Recent times haven't been great for Saudi Ceramic as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Saudi Ceramic will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Saudi Ceramic's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 4.8% gain to the company's revenues. Still, lamentably revenue has fallen 4.5% in aggregate from three years ago, which is disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 7.5% as estimated by the lone analyst watching the company. With the industry predicted to deliver 10% growth, the company is positioned for a weaker revenue result.

With this information, we find it interesting that Saudi Ceramic is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What Does Saudi Ceramic's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at the analysts forecasts of Saudi Ceramic's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Before you settle on your opinion, we've discovered 3 warning signs for Saudi Ceramic (1 is potentially serious!) that you should be aware of.

If these risks are making you reconsider your opinion on Saudi Ceramic, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal