CITIC Construction Investment: Hong Kong's residential market has stopped falling and rebounded, establishing structural improvements in the commercial market

The Zhitong Finance App learned that CITIC Construction Investment Securities released a research report saying that residential transactions in Hong Kong will begin to increase in March 2025, and a second-hand private home transaction is expected to exceed 60,000 in 2025, reaching the second highest level after 2021 in nearly 13 years; housing prices in Hong Kong bottomed out in March-May, and second-hand housing prices are expected to increase 4.5% throughout 2025.

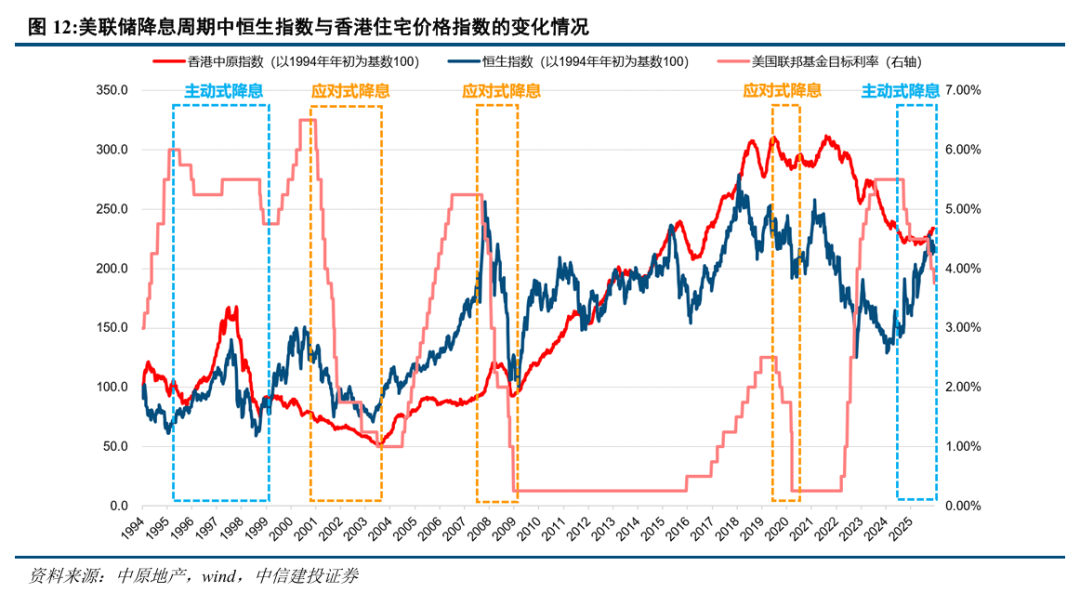

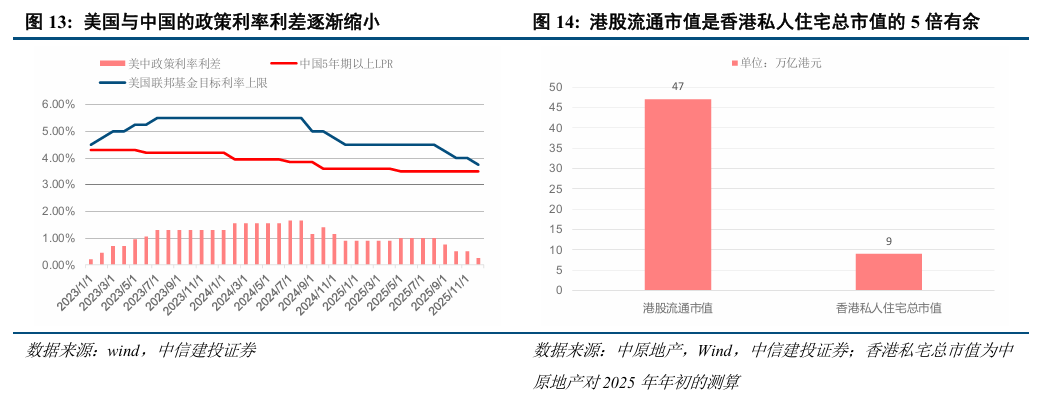

CITIC Construction Investment Securities believes that the increase in demand for asset allocation in the context of the Federal Reserve's interest rate cuts is the main reason for the current round of residential volume and price declines. CITIC Construction Investment expects private housing sales in Hong Kong to increase 7.9% to 65,000 units and the price of second-hand housing to increase by 4.0% in 2026, which is beneficial to developers with rich land reserves in Hong Kong. The Hong Kong commercial market, on the other hand, is showing an overall situation of pressure and structural improvement. The strengthening of domestic business layout in Hong Kong has boosted the popularity of office transactions, and the transformation of office buildings into student apartments has also become a new way of dealing with vacant office buildings; the retail property rental situation in the core area has improved.

CITIC Construction Investment's main views are as follows:

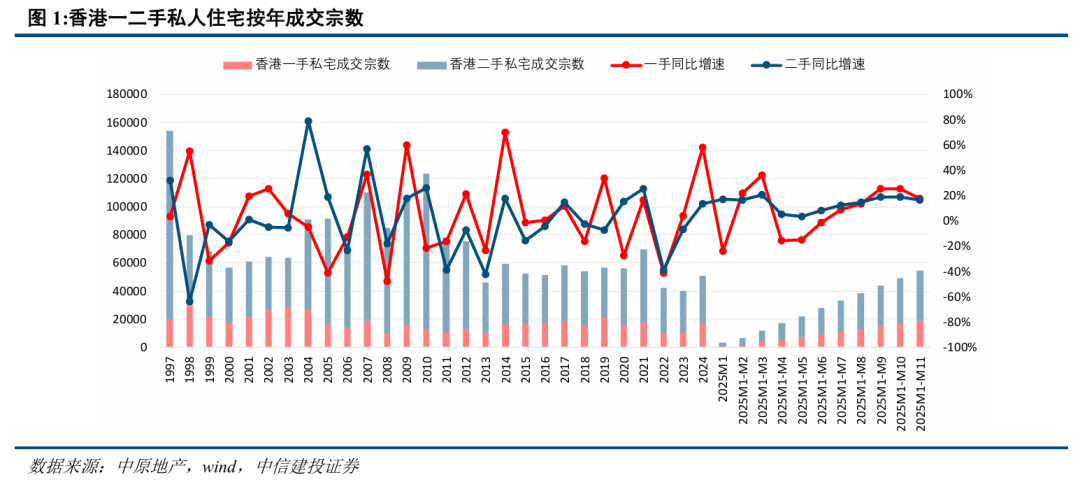

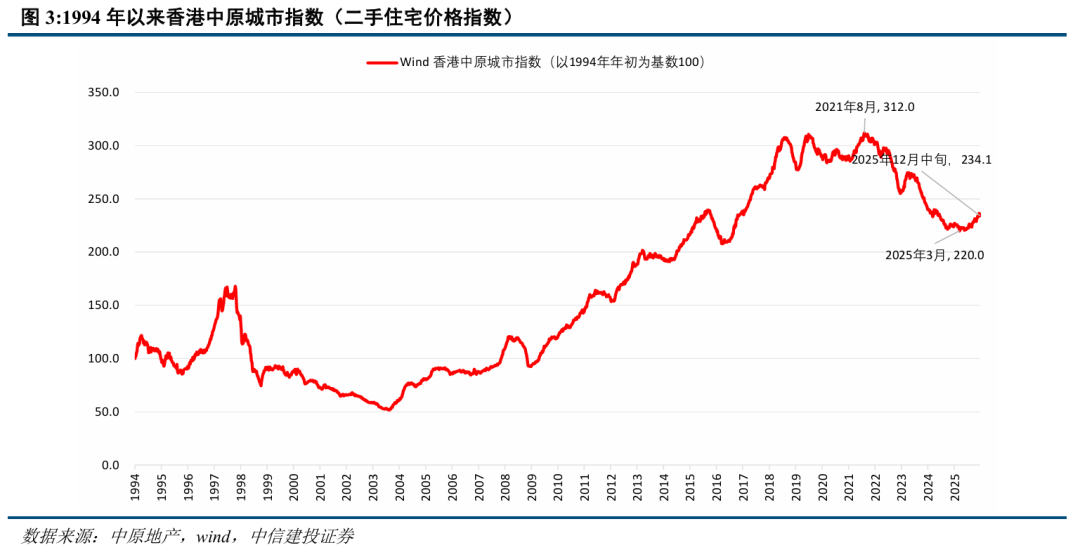

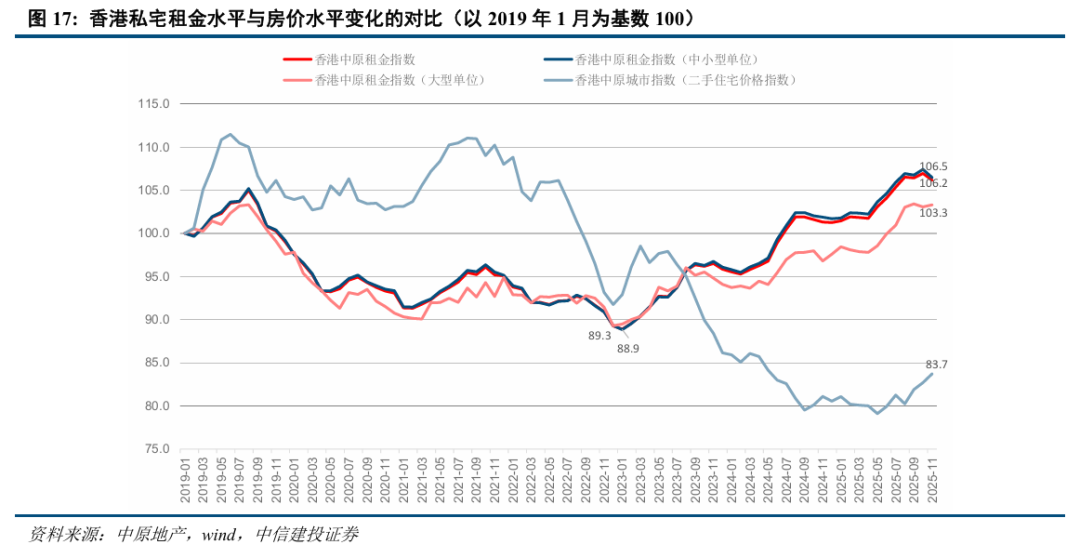

The volume and price of residential transactions in Hong Kong continues to rise, and investment demand in the transaction structure has recently increased. The total number of second-hand private housing transactions in Hong Kong in the first 11 months of 2025 was 54,669, an increase of 17.0% over the previous year. It is expected to exceed 60,000 in 2025, reaching the second highest level after 2021 in the past 13 years. Second-hand housing prices in Hong Kong were confirmed at the bottom from March to May 2025. Housing prices have rebounded 6.2% since the low at the end of May. Housing prices in mid-December increased 4.3% from the end of 2024, and are expected to increase 4.5% for the whole of 2025. Since the volume of residential transactions began in March 2025, the share of high-volume housing transactions of HK$5 million or more rebounded for the first time since 2022; at the same time, the price increase of small and medium-sized residential units in Hong Kong was greater than that of large units since the beginning of the year, reflecting an increase in investment demand in the housing market.

Increased demand for asset allocation in the context of the Federal Reserve's interest rate cuts is the main reason for this round of housing price recovery. There are three main reasons for the increase in capital allocation requirements for Hong Kong housing assets: calming the impact of the HKD/USD on the downturn in the RMB exchange rate, the return of capital in the context of the decline in US dollar credit, and the strong wealth effect brought about by the rise in Hong Kong stocks. Furthermore, multiple benefits, such as active talent introduction policies, housing demand brought about by the increase in the number of international students, the increase in residential rent-to-sales ratios, the Hong Kong government's restrained new supply, the complete withdrawal of spurities' enthusiasm, and a stable basic market for local Hong Kong residents, also provided support for this round of rising housing volume and prices. We expect the trend of residential volume and price growth in Hong Kong to continue. The total volume of private housing transactions in Hong Kong is expected to increase by 7.9% to 65,000 units in 2026, and the price of second-hand housing will increase by 4.0%, which is beneficial to developers with rich land reserves in Hong Kong.

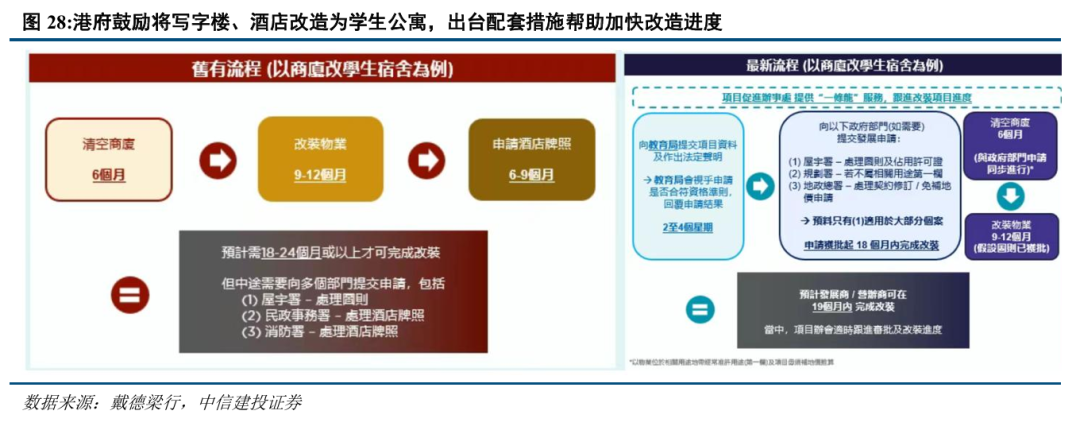

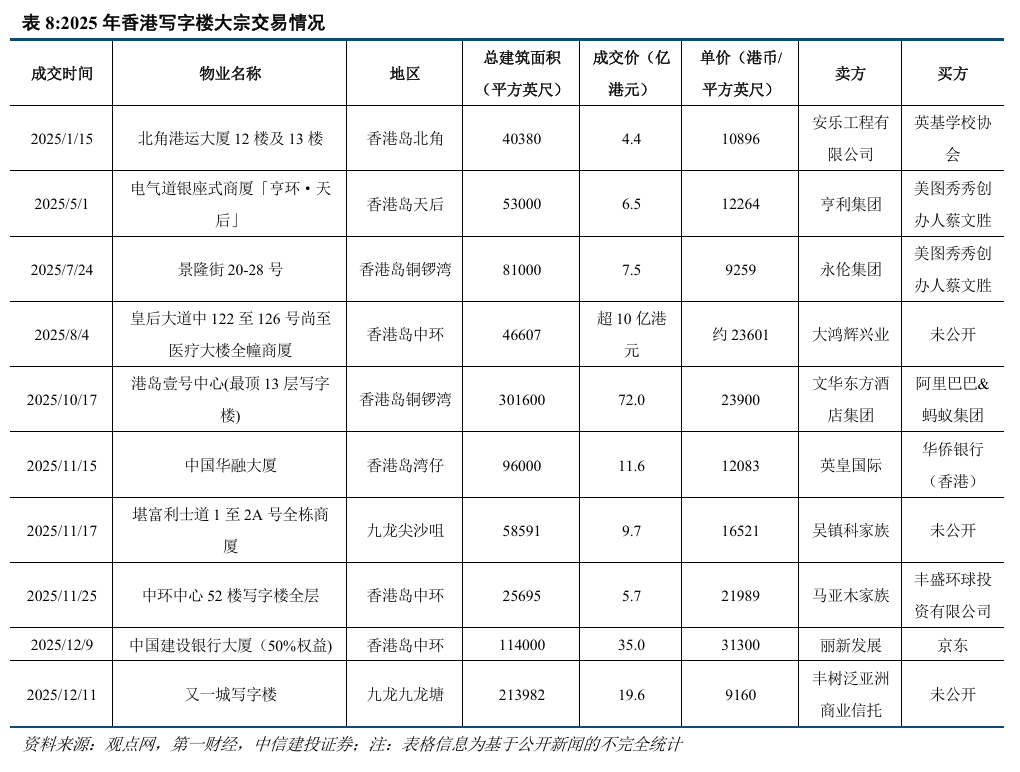

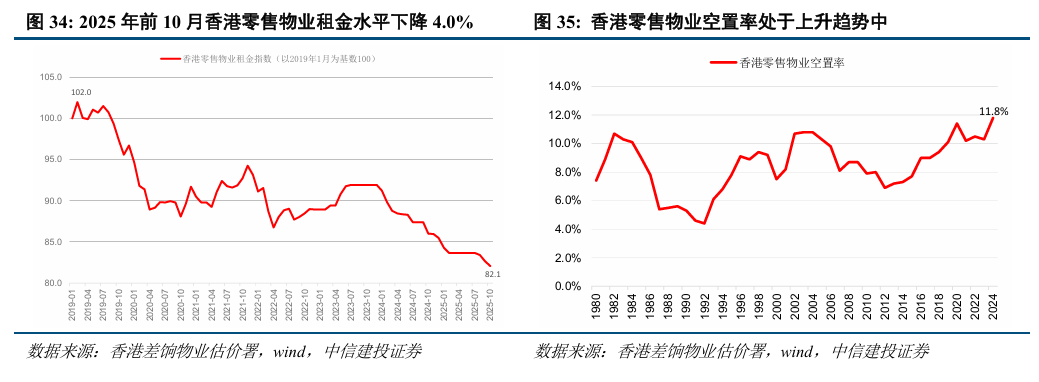

The overall commercial market in Hong Kong is under pressure. There are structural improvements. Mainland buyers are boosting the popularity of the office building market, and retail property leasing in core regions is improving. Office rents in Hong Kong are still on a downward trend. The vacancy rate remains high at around 17%, and the pressure on rent and occupancy rates will continue in the context of high new supply in the coming year. Converting to student housing has become a new way for Hong Kong office buildings to cope with high vacancy rates. At the same time, domestic companies are strengthening their business layout in Hong Kong, boosting the popularity of office transactions in 2025. The overall rent and occupancy rate of retail properties in Hong Kong is under pressure against the backdrop of the recent increase in the number of Hong Kong people and the increase in the share of online shopping. Driven by the increase in inbound visitors and the year-on-year increase in retail sales value, the retail property rental situation in the core area of Hong Kong is improving structurally.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal