Wonik Corporation (KOSDAQ:032940) Surges 47% Yet Its Low P/S Is No Reason For Excitement

Wonik Corporation (KOSDAQ:032940) shareholders have had their patience rewarded with a 47% share price jump in the last month. The last month tops off a massive increase of 213% in the last year.

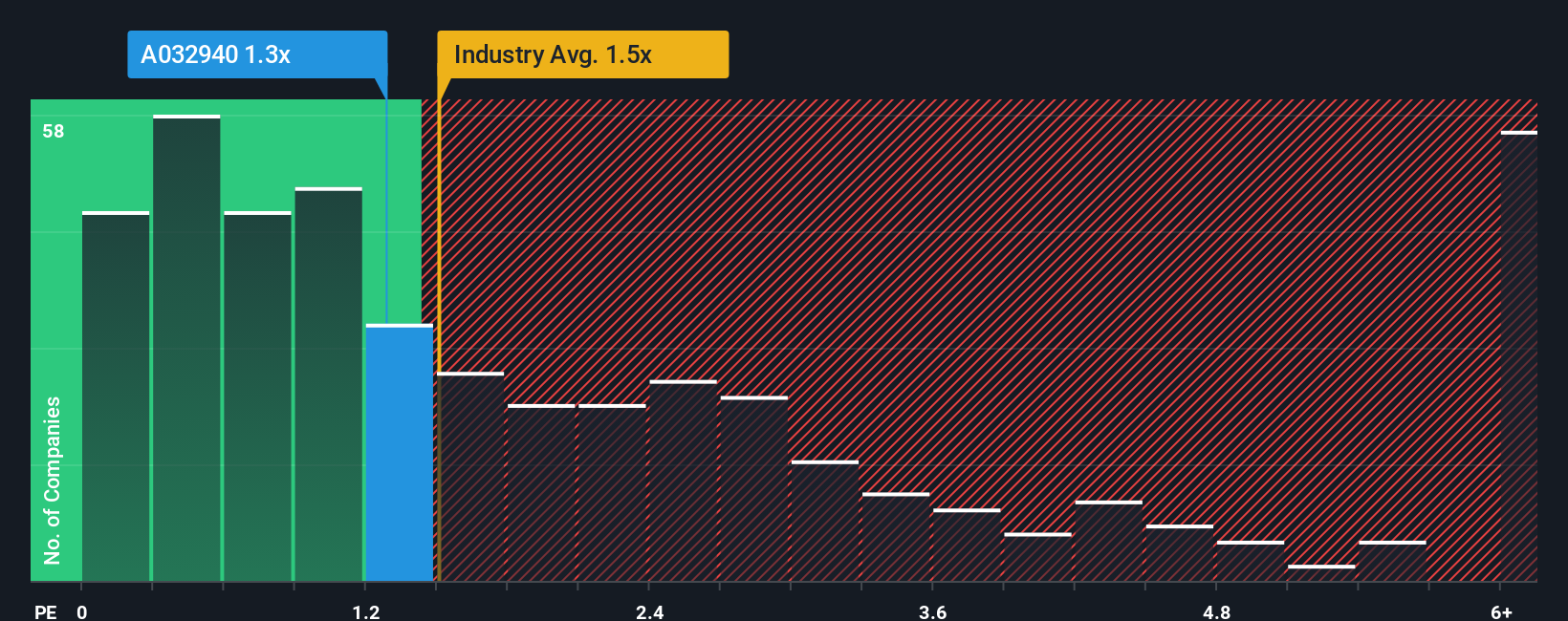

In spite of the firm bounce in price, considering around half the companies operating in Korea's Healthcare industry have price-to-sales ratios (or "P/S") above 1.9x, you may still consider Wonik as an solid investment opportunity with its 1.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Wonik

How Has Wonik Performed Recently?

The revenue growth achieved at Wonik over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. Those who are bullish on Wonik will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Wonik will help you shine a light on its historical performance.How Is Wonik's Revenue Growth Trending?

In order to justify its P/S ratio, Wonik would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a decent 8.0% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 45% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 16% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this information, we can see why Wonik is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Final Word

The latest share price surge wasn't enough to lift Wonik's P/S close to the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Wonik confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Wonik (at least 2 which are a bit concerning), and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal