Kenorland Minerals And 2 Other Promising Penny Stocks On The TSX

As the Canadian market navigates a complex landscape of sector-specific opportunities, investors are advised to focus on diversification, particularly within the energy, industrials, and materials sectors. In this context, penny stocks—often seen as relics of past market eras—continue to hold potential for growth and affordability when backed by strong financial health. This article explores several promising penny stocks on the TSX that combine balance sheet strength with long-term potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.17 | CA$54.35M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.75 | CA$21.97M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.25 | CA$247.83M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.18 | CA$115.41M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.415 | CA$3.47M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.345 | CA$50.24M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.29 | CA$858.23M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.20 | CA$23.19M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.28 | CA$166.37M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.96 | CA$186.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 388 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Kenorland Minerals (TSXV:KLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kenorland Minerals Ltd. focuses on acquiring and exploring mineral properties in North America, with a market cap of CA$207.54 million.

Operations: The company generates revenue through the exploration of mineral properties, amounting to CA$3.43 million.

Market Cap: CA$207.54M

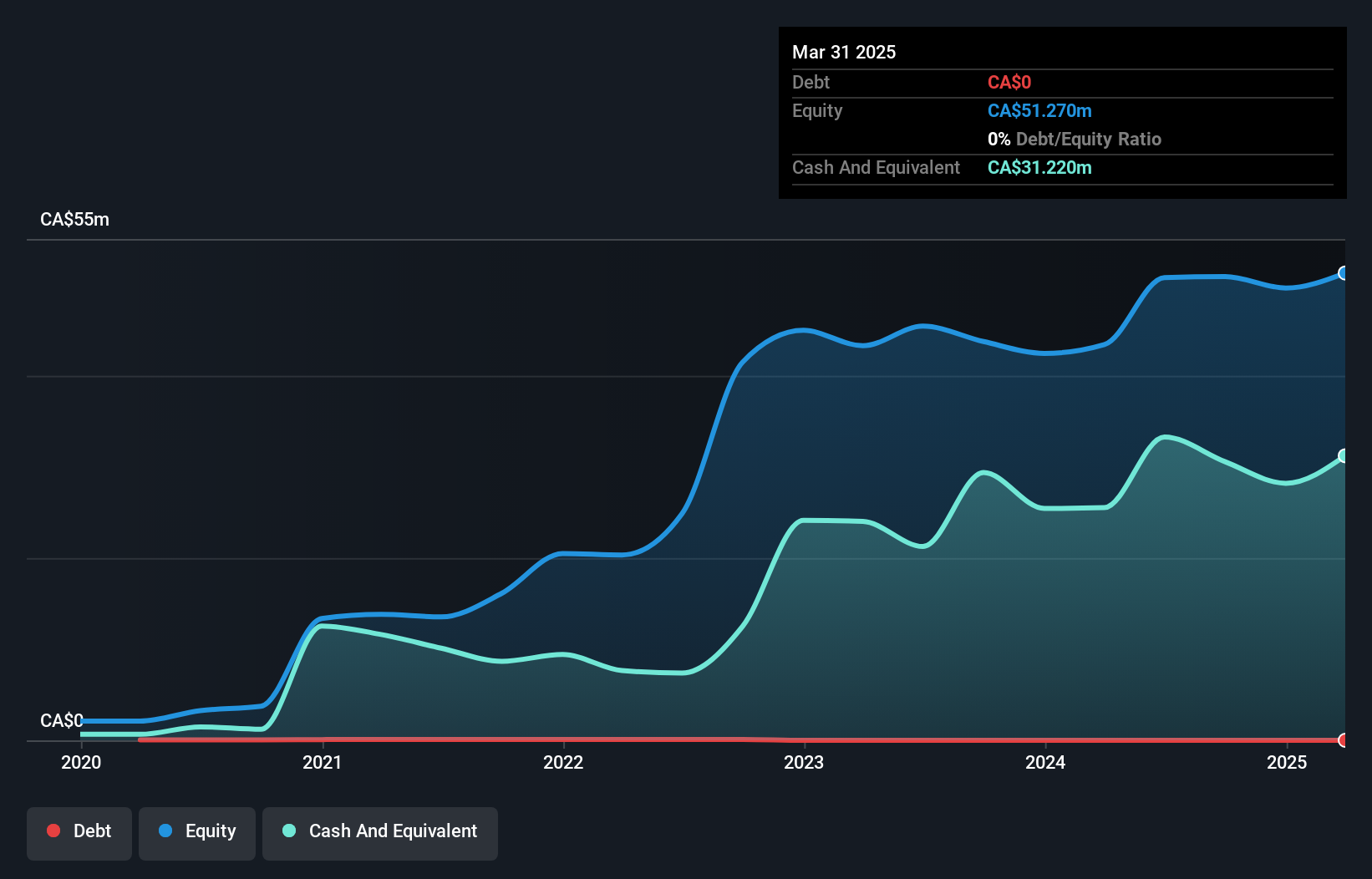

Kenorland Minerals Ltd., with a market cap of CA$207.54 million, remains pre-revenue despite generating CA$3.43 million in revenue from mineral exploration activities. The company is debt-free and benefits from an experienced management team with an average tenure of 3.9 years. Recent announcements highlight the maiden Inferred Mineral Resource at the Regnault gold deposit, part of the Frotet Project in Quebec, revealing 2.55 Moz of gold with significant expansion potential due to low discovery costs and extensive high-grade mineralization beyond current resource boundaries. Kenorland's strategic partnerships and exploration initiatives suggest potential for future growth within its projects across North America.

- Navigate through the intricacies of Kenorland Minerals with our comprehensive balance sheet health report here.

- Examine Kenorland Minerals' past performance report to understand how it has performed in prior years.

Lara Exploration (TSXV:LRA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Lara Exploration Ltd. engages in the acquisition, exploration, development, and evaluation of mineral properties in Brazil, Peru, and Chile with a market cap of CA$116.62 million.

Operations: Lara Exploration Ltd. has not reported any specific revenue segments.

Market Cap: CA$116.62M

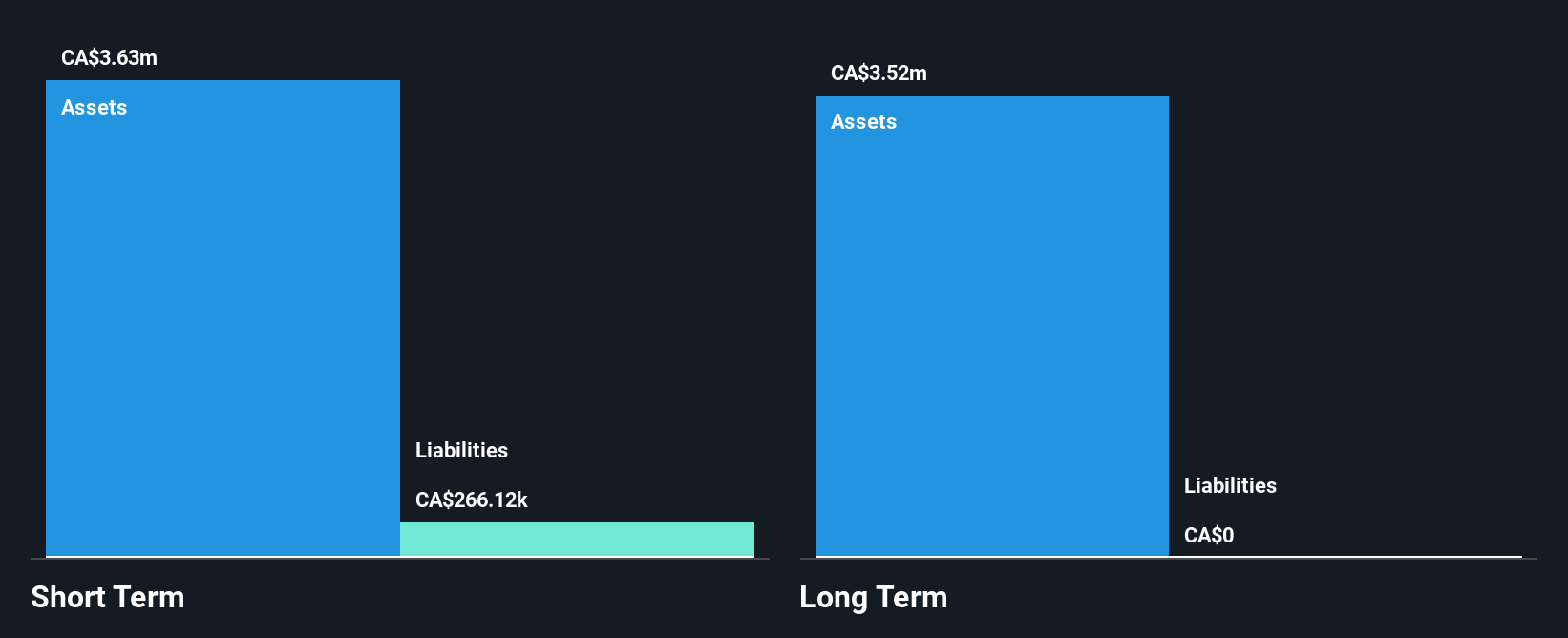

Lara Exploration Ltd., with a market cap of CA$116.62 million, remains pre-revenue and operates without debt, supported by an experienced management team. Recent developments include the Preliminary Economic Assessment (PEA) for its Planalto Copper-Gold Project in Brazil, projecting significant copper and gold production over an 18-year mine life. The PEA suggests promising economic indicators like a net present value of US$378 million but hinges on future metal prices and successful conversion of mineral resources to reserves. Despite current losses, Lara's strategic location within Brazil's well-supported mining district offers potential advantages in project development and operation efficiency.

- Jump into the full analysis health report here for a deeper understanding of Lara Exploration.

- Gain insights into Lara Exploration's historical outcomes by reviewing our past performance report.

Viva Gold (TSXV:VAU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Viva Gold Corp. is involved in the acquisition, exploration, and development of precious metal properties in the United States with a market cap of CA$27.65 million.

Operations: Viva Gold Corp. has not reported any revenue segments.

Market Cap: CA$27.65M

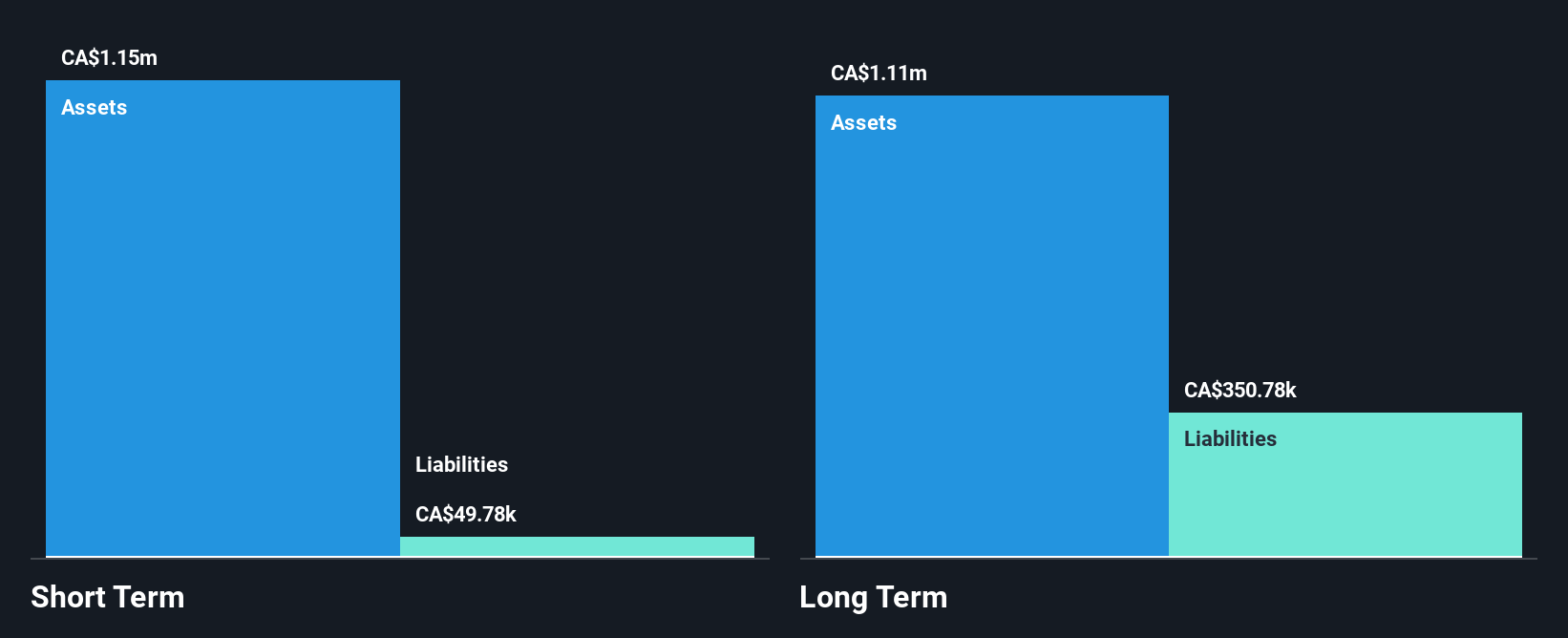

Viva Gold Corp., with a market cap of CA$27.65 million, is pre-revenue and operates debt-free, supported by an experienced management team with an average tenure of 8.1 years. Recent activities include a non-brokered private placement to raise up to CA$3 million, potentially enhancing its cash runway beyond the current five months based on free cash flow estimates. The company's board is seasoned, and short-term assets exceed both short- and long-term liabilities, indicating sound financial positioning despite unprofitability and negative return on equity due to lack of revenue-generating operations at this stage.

- Click to explore a detailed breakdown of our findings in Viva Gold's financial health report.

- Understand Viva Gold's track record by examining our performance history report.

Seize The Opportunity

- Navigate through the entire inventory of 388 TSX Penny Stocks here.

- Seeking Other Investments? Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal