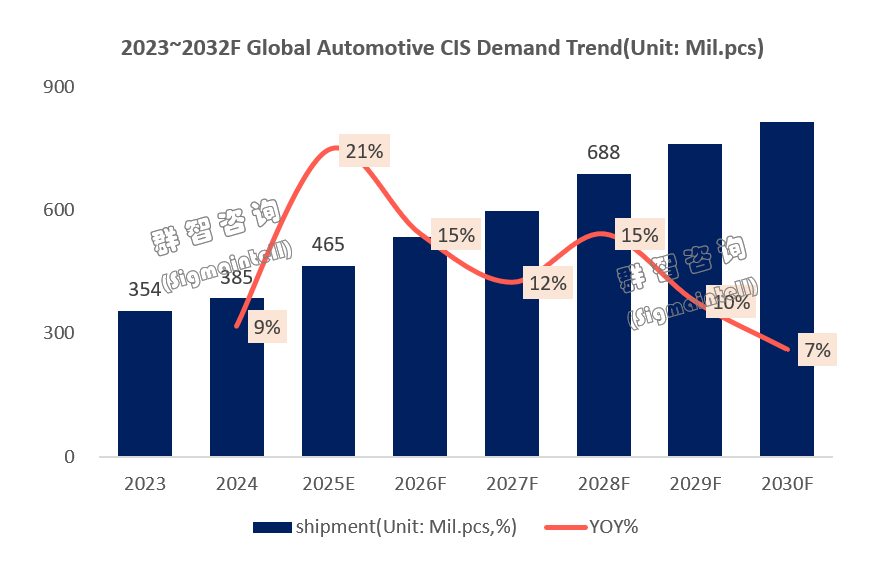

Qunzhi Consulting: Global demand for automotive CIS continues to rise in 2025, the overall demand is expected to exceed 460 million units, an increase of 21% year-on-year

The Zhitong Finance App learned that Qunzhi Consulting published an article stating that global demand for automotive CIS continues to rise. Overall demand is expected to exceed 460 million units in 2025, an increase of 21% over the previous year. It will continue to maintain a rapid growth model for the next 2 to 3 years. The main driving factors include the following two factors: ① the popularity of intelligent automobiles and the wave of industrial upgrading driven by the L2 to L3 crossing; ② the implementation of mandatory regulations for in-flight monitoring systems in major global automotive markets. With its multi-dimensional technical advantages, the integrated solution of in-vehicle CIS and SerDes has become an important direction to break through existing industry bottlenecks and will dominate the core pattern of the next stage of market competition.

As the global automotive industry accelerates into a deep zone of intelligent transformation, the market demand for in-vehicle image sensors (CIS) as the core visual component of intelligent driving perception systems is growing exponentially. Currently, the automotive CIS industry is in a double dividend period of policy drive and technology iteration, and the market pattern and technology routes are facing profound changes.

Global demand for in-vehicle CIS continues to rise, and the leap from L2 to L3 for intelligent assisted driving is driving a wave of industrial upgrading

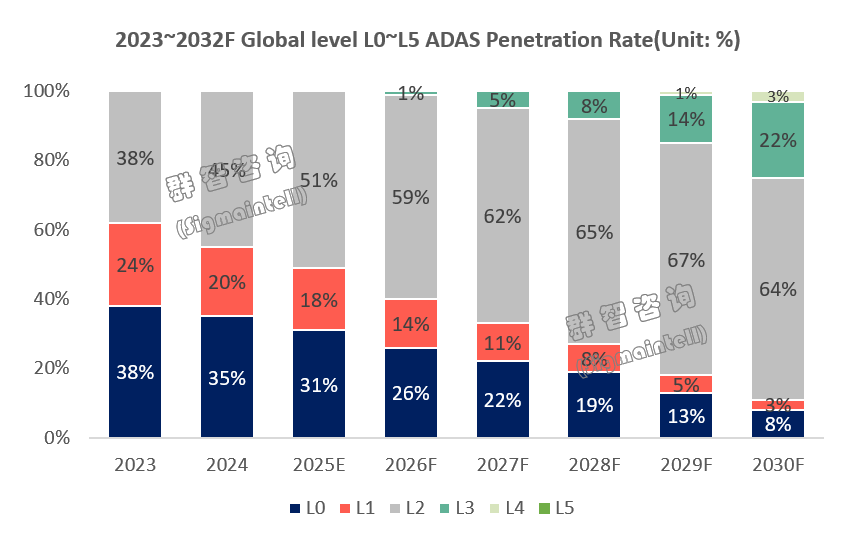

According to Sigmaintell (Sigmaintell)'s “Global In-depth Research Report on Vehicle Image Sensor Development Trends”, the continued surge in global demand for in-vehicle CIS is an inevitable result of the combination of the acceleration of the automotive intelligence process and increasingly strict safety regulations, and the growth momentum over the next 2-3 years will be highly concentrated on the two core variables of ADAS grade upgrades and the implementation of strong in-cabin monitoring standards. Judging from the ADAS level upgrade dimension, global intelligent driving is currently at a critical stage in the transition from L2 to L3. The penetration rate of L2 and above intelligent driving assistance systems has entered a rapid improvement channel. In 2025, the global passenger car L2 intelligent driver penetration rate has exceeded 51%. L3 intelligent driving has completed the local pilot layout, and the national road traffic law adapted to L3 is expected to be officially implemented in 2026, marking the beginning of the large-scale commercial phase of L3, which will directly drive the explosive growth in demand for in-vehicle CIS. Compared with the carrying capacity of 6-7 CISs on L2 class bikes, the L3 class system's requirements for sensing accuracy and range will increase to 12-14. Among them, the front view camera will need to be upgraded to 2-3 high-resolution products, and the configuration of side view, surround view, and in-cabin cameras will also be fully strengthened, forming a double impact on the number and specifications of the vehicle's CIS.

In addition, the implementation of mandatory regulations has provided definitive support for the growth in demand for in-vehicle CIS. Among them, the comprehensive standard configuration of in-cabin monitoring systems has become a core growth point. Major global automobile markets have gradually incorporated in-cabin monitoring into active safety evaluation systems. EU GSR II regulations first made it clear that from July 2024, new passenger car models will be required to be equipped with advanced driver distraction detection systems (ADDW), and all new cars will be required to install driver fatigue and attention detection systems (DDAW); domestic promotion of relevant standards has also begun, and the countdown for the full standard in-cabin monitoring system has entered the countdown. Increased demand for in-cabin monitoring is directly driving the volume of CIS for DMS (Driver Monitoring Systems) and OMS (Occupant Monitoring Systems). Such products are being upgraded from traditional VGA to 2M resolution to 5M hybrid or 8m high-resolution cameras, placing higher demands on performance indicators such as quantum efficiency and dynamic range, further enriching the market demand structure for in-vehicle CIS.

With its multi-dimensional technical advantages, the integrated solution of in-vehicle CIS and SerDes has become an important direction to break through existing industry bottlenecks and will dominate the core pattern of the next stage of market competition

According to #群智咨询 (Sigmaintell) “Global Optical Lens Industry Development Trend In-depth Research Report”, the integrated solution of automotive CIS and SerDes will become the core direction of the next stage of industry development, with its comprehensive advantages in cost control, performance improvement, and system adaptation. Judging from the technical advantages, the integrated solution has multiple core values:

① Significantly reduces system costs. Compared with the traditional “CIS+ external SerDes” discrete solution, incorporating SerDes functions directly into CIS films can reduce system costs by 10%-20%, reducing the procurement expenses of additional SerDes chips and the adaptation costs of bridging chips;

② Improve system reliability. The discrete solution has the pain points of many solder joints and a high risk of failure under vibration and impact. By simplifying the hardware architecture, the integrated solution greatly reduces the probability of failure in complex vehicle environments;

③ Optimize transmission performance. The integrated solution uses MIPI A-PHY or HSMT standards, long-range SerDes physical layer standards specially designed for vehicles, which can achieve high-speed, anti-interference, and long-distance data transmission, and perfectly match the big data transmission requirements of high-resolution automotive CIS;

④ Improve integration and space utilization, the integrated chip is smaller in size, more suitable for limited installation space in vehicle scenarios, and supports BGA or COB packaging, enhancing compatibility with vehicle electronic systems.

Judging from the current state of industry development, the integrated solutions of automotive CIS and Serdes have entered a critical stage of industrialization promotion, and the layout pace of leading manufacturers is directly leading the industry trend. Currently, the global automotive CIS market shows a concentrated pattern with Howell, Ansemi, and Sony. Leading manufacturers have all realized the strategic value of integrated solutions and have initiated technology research and product reserves. Among them, Sony has launched prototype solutions for related integrated products, and domestic manufacturers such as Stalway and Howell are also speeding up follow-up.

However, the development of the industry still faces multiple challenges: first, process adaptation problems. CIS needs to guarantee high quantum efficiency and low dark current, and SerDes relies on high-speed analog processes. The two have large differences in transistor characteristics and are more difficult to integrate across processes; second, IP resource limitations. Key IPs for high-speed SerDes (such as PLL, ADC/DAC, equalizer) have long been monopolized by TI, ADI and other manufacturers, and CIS manufacturers need to break through technical bottlenecks through self-development or high-price licensing; third, electromagnetic interference is concentrated due to single-chip cooling, and high speed SerDes The superposition of transmission and heat generation of CIS photodiodes may affect the image acquisition effect and needs to be solved through advanced packaging and thermal management technology. Despite many challenges, as the demand for high-resolution, high-reliability in-vehicle CIS for intelligent driving continues to rise, the industrialization process of integrated solutions will accelerate and become a key racetrack for manufacturers to build core competitiveness.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal