ASOS And 2 Other UK Penny Stocks To Keep On Your Radar

The UK market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, impacting companies tied to its economic fortunes. Amid such global uncertainties, investors often look for stocks that offer potential growth and stability. Penny stocks, though an older term, still represent a valuable niche in the investment landscape by highlighting smaller or less-established companies with potential upside. In this article, we explore three UK penny stocks that may offer unique opportunities for those interested in tapping into smaller companies with promising prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.28 | £491.52M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.95 | £157.54M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.75 | £133.18M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.995 | £15.02M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.30 | £29.18M | ✅ 3 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.715 | $415.65M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.53 | £185.3M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.53 | £73.88M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.46 | £39.65M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.145 | £184.26M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 303 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

ASOS (LSE:ASC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ASOS Plc, along with its subsidiaries, is an online fashion retailer operating in the United Kingdom, the European Union, the United States, and internationally with a market cap of £328.66 million.

Operations: ASOS generates its revenue primarily through its online retail operations, amounting to £2.48 billion.

Market Cap: £328.66M

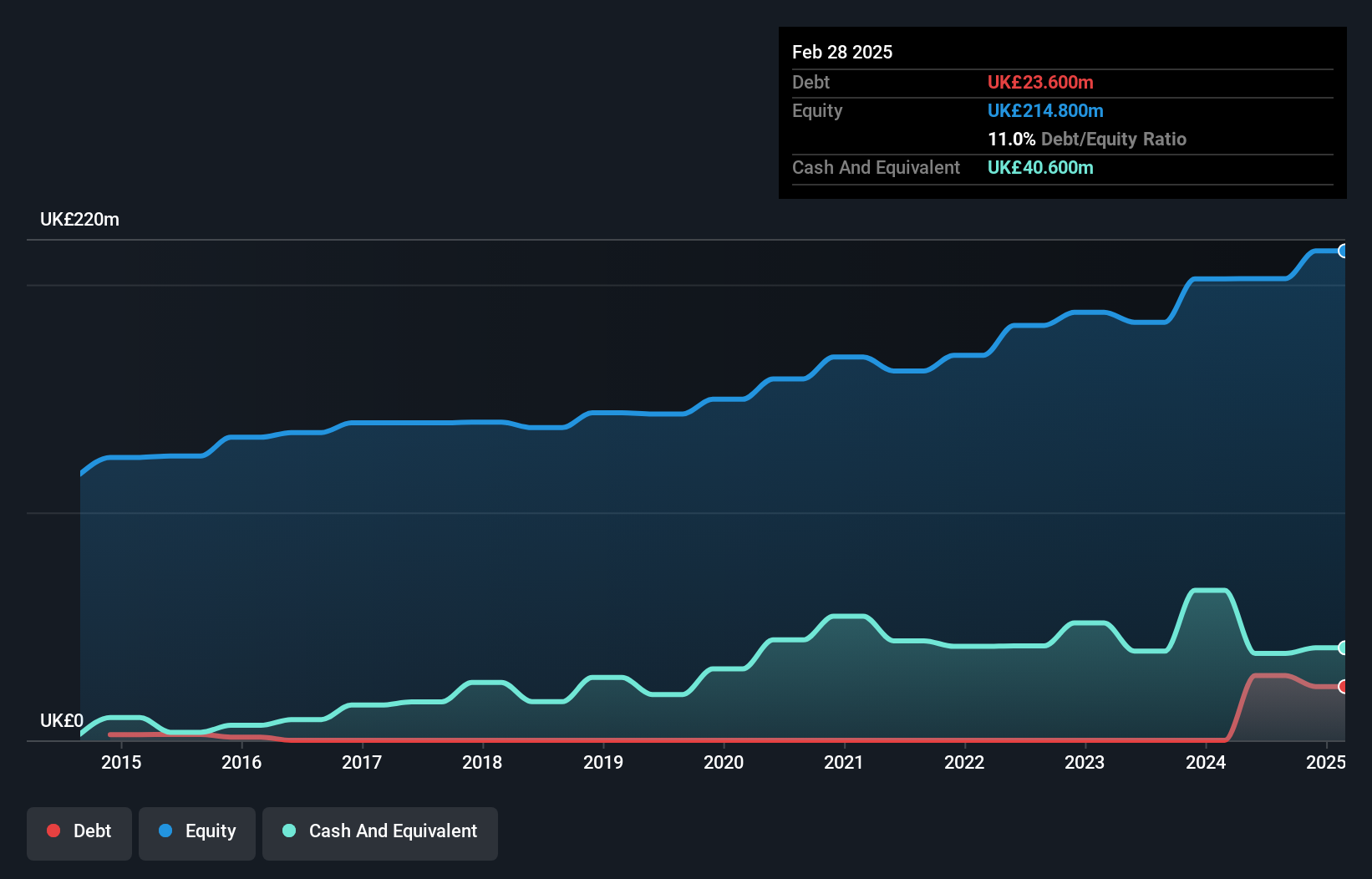

ASOS Plc, an online fashion retailer with a market cap of £328.66 million, is navigating significant challenges as it remains unprofitable with a negative return on equity. Despite this, the company has managed to maintain liquidity with short-term assets exceeding both short and long-term liabilities. Recent strategic moves include refinancing its loan facilities to improve financial flexibility and reduce interest costs, adding £87.5 million in liquidity headroom. The board's recent appointments aim to leverage extensive industry experience for improved governance. However, ASOS continues to face high volatility in share price and elevated debt levels amidst its ongoing turnaround efforts.

- Get an in-depth perspective on ASOS' performance by reading our balance sheet health report here.

- Understand ASOS' earnings outlook by examining our growth report.

Bloomsbury Publishing (LSE:BMY)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Bloomsbury Publishing Plc is a global publisher of academic, educational, and general fiction and non-fiction books for a diverse audience including children, general readers, teachers, students, researchers, libraries, and professionals with a market cap of £396.10 million.

Operations: The company's revenue is primarily derived from its Consumer segment, which generated £228.1 million, and its Academic & Professional segment, contributing £90.9 million.

Market Cap: £396.1M

Bloomsbury Publishing Plc, with a market cap of £396.10 million, demonstrates financial stability as its short-term assets surpass both short and long-term liabilities. Despite a decline in net profit margins from last year, the company maintains high-quality earnings and has not significantly diluted shareholders recently. Bloomsbury's strategic collaboration with Google Cloud aims to enhance digital innovation through AI-powered tools, potentially boosting book sales and operational efficiency. Although recent earnings showed decreased sales and net income compared to the previous year, Bloomsbury increased its interim dividend by 5%, reflecting confidence in future growth prospects amidst evolving industry dynamics.

- Take a closer look at Bloomsbury Publishing's potential here in our financial health report.

- Gain insights into Bloomsbury Publishing's outlook and expected performance with our report on the company's earnings estimates.

Funding Circle Holdings (LSE:FCH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Funding Circle Holdings plc operates online lending platforms in the United Kingdom and internationally, with a market cap of £395.44 million.

Operations: The company generates revenue through its United Kingdom operations, with £26.4 million from FlexiPay and £146.9 million from Term Loans.

Market Cap: £395.44M

Funding Circle Holdings, with a market cap of £395.44 million, has recently achieved profitability after several years of growth, although its return on equity remains low at 4.2%. The company benefits from strong liquidity as its short-term assets (£358.5M) exceed both short and long-term liabilities significantly. Despite having negative operating cash flow, Funding Circle's debt levels have improved over the last five years, reducing the debt to equity ratio from a very high level to 86%. Analysts forecast robust earnings growth of 60.82% annually, suggesting potential for future expansion despite current challenges in covering interest payments with EBIT.

- Click to explore a detailed breakdown of our findings in Funding Circle Holdings' financial health report.

- Explore Funding Circle Holdings' analyst forecasts in our growth report.

Next Steps

- Unlock more gems! Our UK Penny Stocks screener has unearthed 300 more companies for you to explore.Click here to unveil our expertly curated list of 303 UK Penny Stocks.

- Seeking Other Investments? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal