3 TSX Stocks Estimated To Be Up To 49.5% Below Intrinsic Value

As the Canadian market navigates a landscape characterized by strategic sector recommendations and evolving global economic conditions, investors are urged to focus on diversification as a key strategy for success in 2026. In this context, identifying undervalued stocks becomes crucial, as these opportunities may offer substantial potential for growth when aligned with sectors poised for resilience and expansion.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Topicus.com (TSXV:TOI) | CA$126.25 | CA$224.56 | 43.8% |

| Neo Performance Materials (TSX:NEO) | CA$15.61 | CA$30.90 | 49.5% |

| Major Drilling Group International (TSX:MDI) | CA$13.00 | CA$22.08 | 41.1% |

| kneat.com (TSX:KSI) | CA$4.96 | CA$9.38 | 47.1% |

| Haivision Systems (TSX:HAI) | CA$5.25 | CA$8.63 | 39.2% |

| GURU Organic Energy (TSX:GURU) | CA$4.89 | CA$8.91 | 45.1% |

| EQB (TSX:EQB) | CA$103.49 | CA$184.85 | 44% |

| Endeavour Mining (TSX:EDV) | CA$70.16 | CA$122.97 | 42.9% |

| Dexterra Group (TSX:DXT) | CA$11.95 | CA$22.91 | 47.8% |

| Black Diamond Group (TSX:BDI) | CA$14.83 | CA$28.50 | 48% |

Here we highlight a subset of our preferred stocks from the screener.

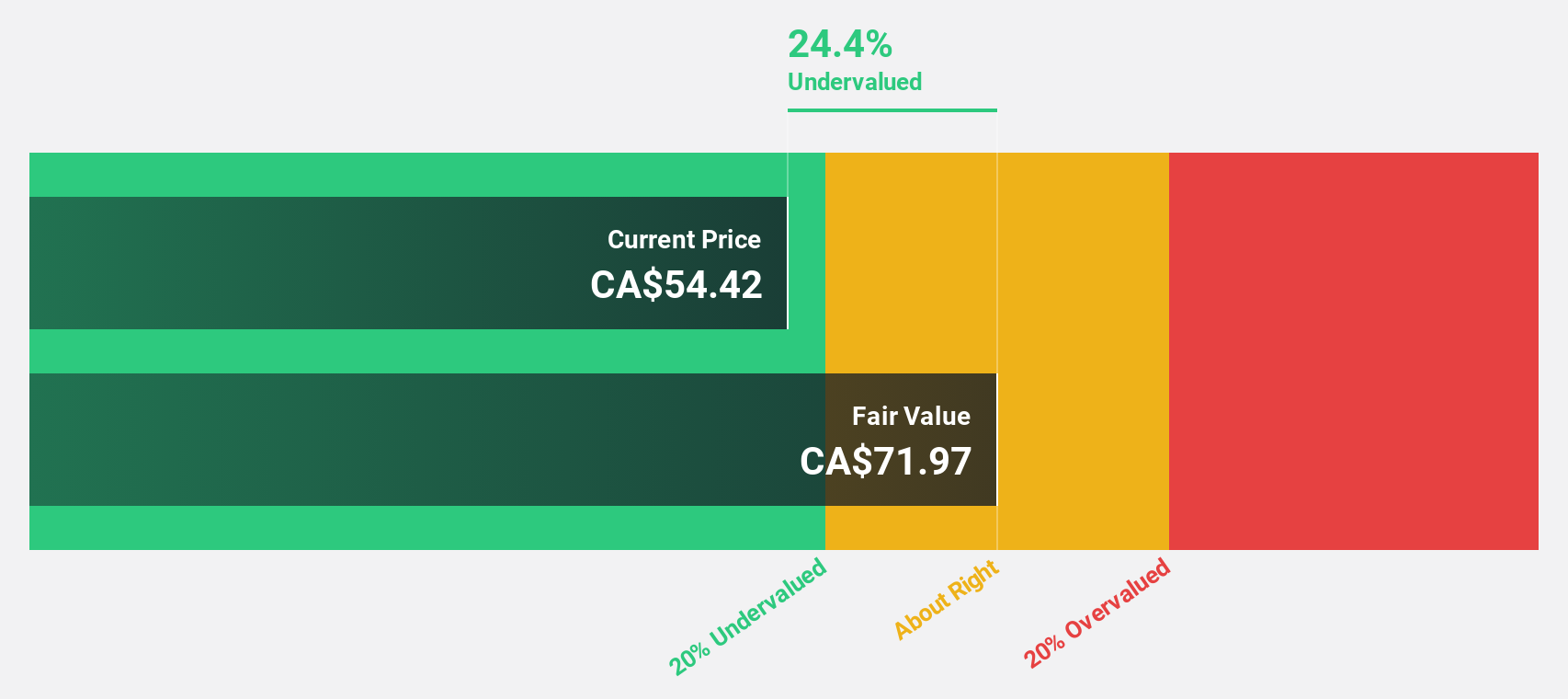

Badger Infrastructure Solutions (TSX:BDGI)

Overview: Badger Infrastructure Solutions Ltd. offers non-destructive excavating and related services across Canada and the United States, with a market cap of CA$2.52 billion.

Operations: The company generates revenue of $805.35 million from its non-destructive excavating and related services in Canada and the United States.

Estimated Discount To Fair Value: 17.4%

Badger Infrastructure Solutions is trading at CA$74.78, below its estimated fair value of CA$90.51, indicating potential undervaluation based on cash flows. Despite high debt levels, the company's earnings are projected to grow significantly by 24.4% annually over the next three years, outpacing the Canadian market's growth rate of 12%. Recent earnings reports showed increased sales and net income for Q3 2025 compared to last year, highlighting robust financial performance.

- Our earnings growth report unveils the potential for significant increases in Badger Infrastructure Solutions' future results.

- Get an in-depth perspective on Badger Infrastructure Solutions' balance sheet by reading our health report here.

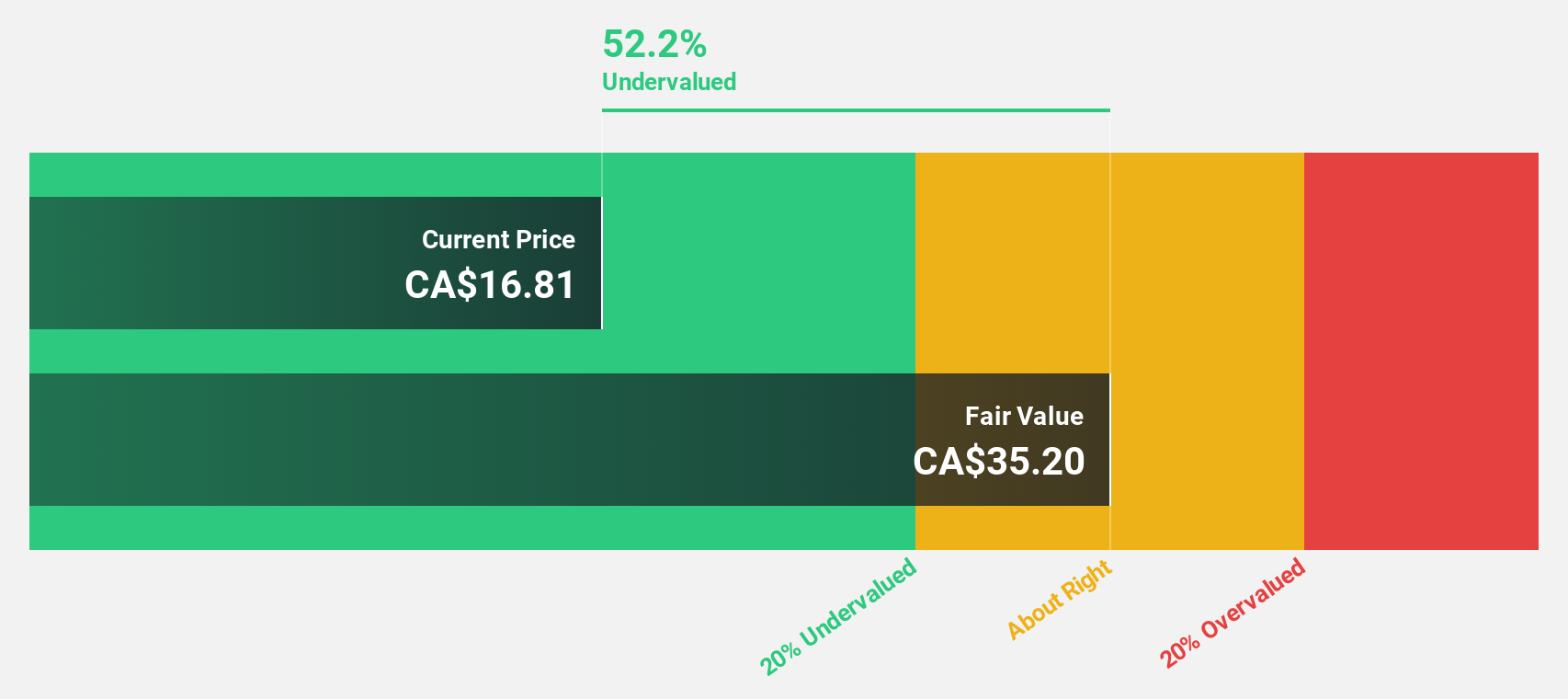

Montage Gold (TSX:MAU)

Overview: Montage Gold Corp. is involved in the acquisition, exploration, and development of mineral properties in Africa with a market cap of CA$3.51 billion.

Operations: The company's revenue segments are not specified in the provided text.

Estimated Discount To Fair Value: 10.8%

Montage Gold, trading at CA$9.65, is below its fair value estimate of CA$10.82, suggesting it may be undervalued based on cash flows. The company recently expanded its Kone project in Cote d'Ivoire with new exploration permits and high-grade discoveries, enhancing future production potential. While currently unprofitable with a net loss of US$4.55 million for Q3 2025, revenue is expected to grow rapidly at 65.7% annually over the next three years, outpacing the Canadian market significantly.

- The analysis detailed in our Montage Gold growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Montage Gold.

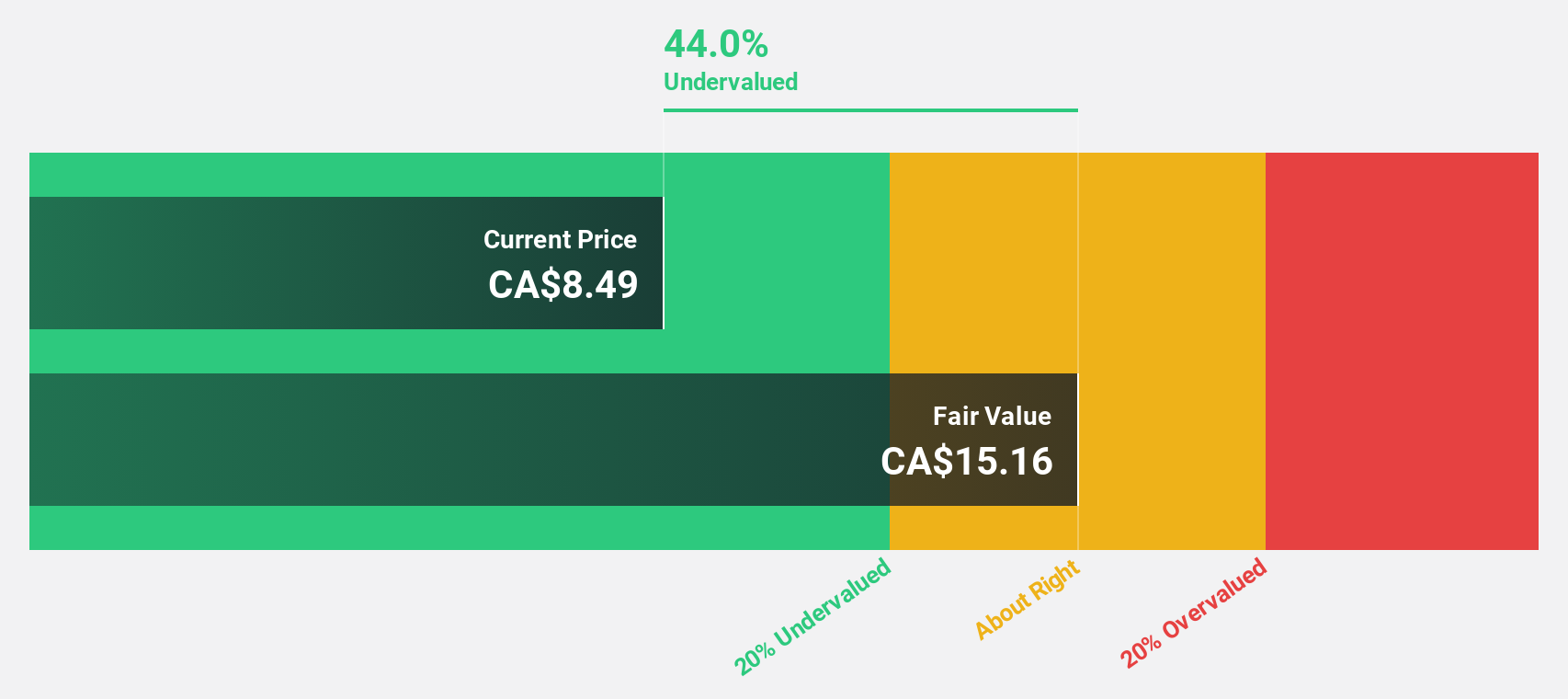

Neo Performance Materials (TSX:NEO)

Overview: Neo Performance Materials Inc. manufactures and sells rare earth, magnetic powders, magnets, and rare metal-based functional materials across various global markets including China, Japan, Thailand, South Korea, North America, and Europe with a market cap of CA$656.43 million.

Operations: The company's revenue segments consist of Magnequench at $193.10 million, Rare Metals at $156.42 million, and Chemicals & Oxides at $149.38 million.

Estimated Discount To Fair Value: 49.5%

Neo Performance Materials, trading at CA$15.61, is significantly undervalued with a fair value estimate of CA$30.9. Recent earnings show improved performance with Q3 2025 net income of US$1.36 million compared to a loss last year, reflecting positive cash flow dynamics despite revenue growth forecasted at 5.4% annually, slower than the desired rate for rapid expansion. Analysts expect profitability within three years, though the dividend yield of 2.49% lacks coverage from earnings or free cash flows.

- Our comprehensive growth report raises the possibility that Neo Performance Materials is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Neo Performance Materials stock in this financial health report.

Seize The Opportunity

- Reveal the 28 hidden gems among our Undervalued TSX Stocks Based On Cash Flows screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal