The GEM IPO of Qingquan Co., Ltd. has been accepted. The global market share of MACM products is about 28%

The Zhitong Finance App learned that on December 29, Jiangsu Qingquan Chemical Co., Ltd. (abbreviation: Qingquan Co., Ltd.) Shenzhen Stock Exchange GEM IPO was accepted. Guoxin Securities is the sponsor and plans to raise 492.3 million yuan.

According to the prospectus, Qingquan Co., Ltd. is a national-level specialty “little giant” enterprise specializing in R&D, production and sales of specialty fine chemicals and special polymer materials. It focuses on the preparation of new polymer materials and monomers with high transparency, high weather resistance, high temperature resistance, etc., and the comprehensive utilization and development of furfural, a non-food bio-based material, and has built four major product systems covering new material monomers, green solvents, pharmaceutical and pesticide intermediates, and new special polymer materials, and is widely used in terminals in aerospace, wind power, automobiles, electronics and electronics, medical devices, chemicals, pharmaceuticals, Pesticides and other fields.

After testing by a third-party testing agency, the company's core products are the new material monomer MACM and the green solvent 2-MeTHF, focusing on promoting the polyimide OPI series and the new material monomer CHDM. The product performance has reached high standards in the industry and can target major competitors in the industry. The company's core products have high market competitiveness and industry position in the segment. According to estimates based on relevant reports issued by Yiou Consulting and the company's sales data, in 2024, the global market share of the company's MACM products was about 28%, and the global market share of the company's 2-METHF products was about 19%.

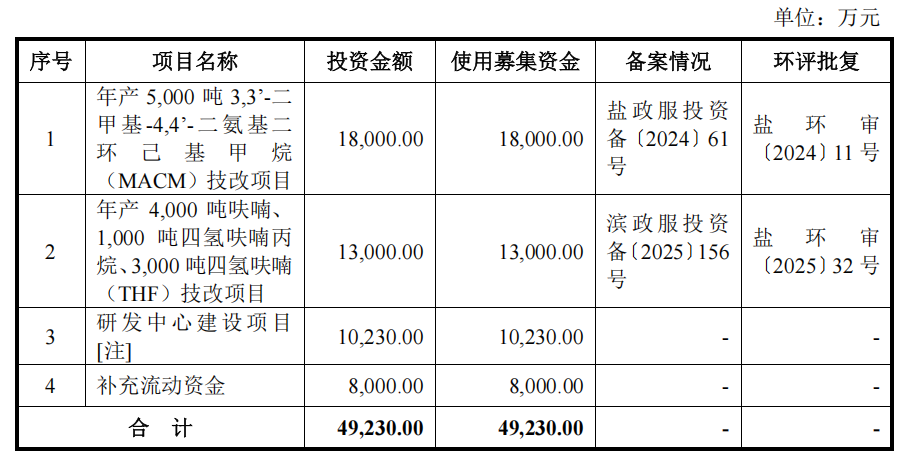

After deducting the issuance fee, the funds raised in this offering and listing will be invested in projects related to the company's main business. The details are as follows:

On the financial side, in 2022, 2023, 2024, and January-June 2025, the operating income of Qingquan Co., Ltd. was approximately 687 million yuan, 713 million yuan, 797 million yuan, and 396 million yuan respectively; for the same period, net profit was 52.8297 million yuan, 81.823,600 yuan, 986.632 million yuan, and 579.112 million yuan, respectively.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal