Exploring High Growth Tech Stocks In The US For December 2025

As the United States market enters a holiday-shortened week, major stock indexes have closed lower, with technology shares leading declines amid broader concerns about capital expenditures in the tech sector. In this environment, identifying high-growth tech stocks requires a keen understanding of market dynamics and an ability to navigate economic indicators that may impact small-cap companies.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Marker Therapeutics | 75.24% | 59.07% | ★★★★★★ |

| Sanmina | 31.01% | 33.24% | ★★★★★☆ |

| Palantir Technologies | 28.00% | 32.57% | ★★★★★★ |

| Kiniksa Pharmaceuticals International | 17.51% | 33.44% | ★★★★★☆ |

| Workday | 11.13% | 32.18% | ★★★★★☆ |

| RenovoRx | 71.45% | 71.45% | ★★★★★☆ |

| Zscaler | 15.85% | 45.93% | ★★★★★☆ |

| Circle Internet Group | 23.08% | 84.58% | ★★★★★☆ |

| Procore Technologies | 11.70% | 116.48% | ★★★★★☆ |

| Duos Technologies Group | 53.36% | 152.11% | ★★★★★☆ |

Click here to see the full list of 72 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

MongoDB (MDB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MongoDB, Inc. offers a general-purpose database platform globally and has a market capitalization of $34.44 billion.

Operations: The company's primary revenue stream is from its data processing segment, which generated $2.32 billion. The focus on providing a general-purpose database platform supports its global operations.

Amidst a dynamic tech landscape, MongoDB has demonstrated robust financial agility and strategic foresight. With a notable 15.7% annual revenue growth outpacing the US market's 10.7%, the company is on a clear upward trajectory. Recent share buybacks, including 513,620 shares for $151.01 million, underscore confidence in its financial health and future prospects. Additionally, MongoDB's commitment to innovation is evident from its R&D spending trends which are crucial for sustaining long-term growth in the competitive tech sector. This focus on research not only fuels product enhancement but also positions MongoDB well within the high-stakes AI and cloud domains where it continues to expand its footprint.

Intapp (INTA)

Simply Wall St Growth Rating: ★★★★☆☆

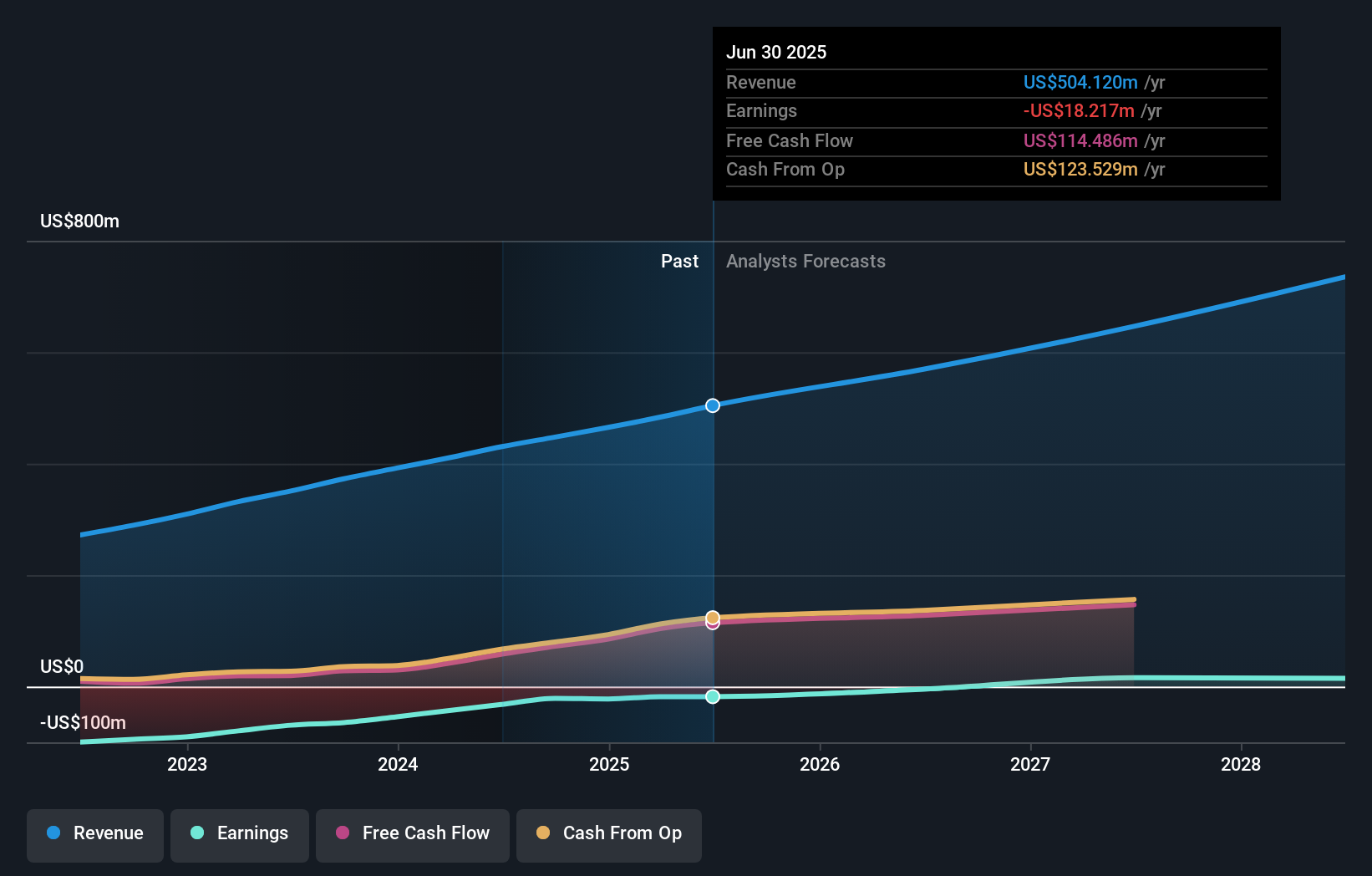

Overview: Intapp, Inc., through its subsidiary Integration Appliance, Inc., delivers AI-powered solutions across the United States, the United Kingdom, and internationally with a market cap of approximately $3.89 billion.

Operations: Integration Appliance, Inc., a subsidiary of Intapp, generates revenue primarily through its software and programming segment, which accounts for $524.34 million.

Intapp, navigating the competitive tech landscape, has shown resilience and adaptability. Despite reporting a net loss of $14.35 million in Q1 2026, an increase from the previous year's $4.52 million, the company is poised for recovery with projected annual revenue growth of 12%, slightly above the US market average of 10.7%. This forecast aligns with its strategic initiatives like Intapp Collaboration which integrates seamlessly with Microsoft 365 to enhance client engagement and operational efficiency for firms like Ostberg Sinclair & Co. Moreover, Intapp's recent repurchase of over a million shares for approximately $50 million signals strong confidence in its future trajectory and commitment to shareholder value amidst ongoing innovations and market expansions.

- Delve into the full analysis health report here for a deeper understanding of Intapp.

Review our historical performance report to gain insights into Intapp's's past performance.

Krystal Biotech (KRYS)

Simply Wall St Growth Rating: ★★★★★☆

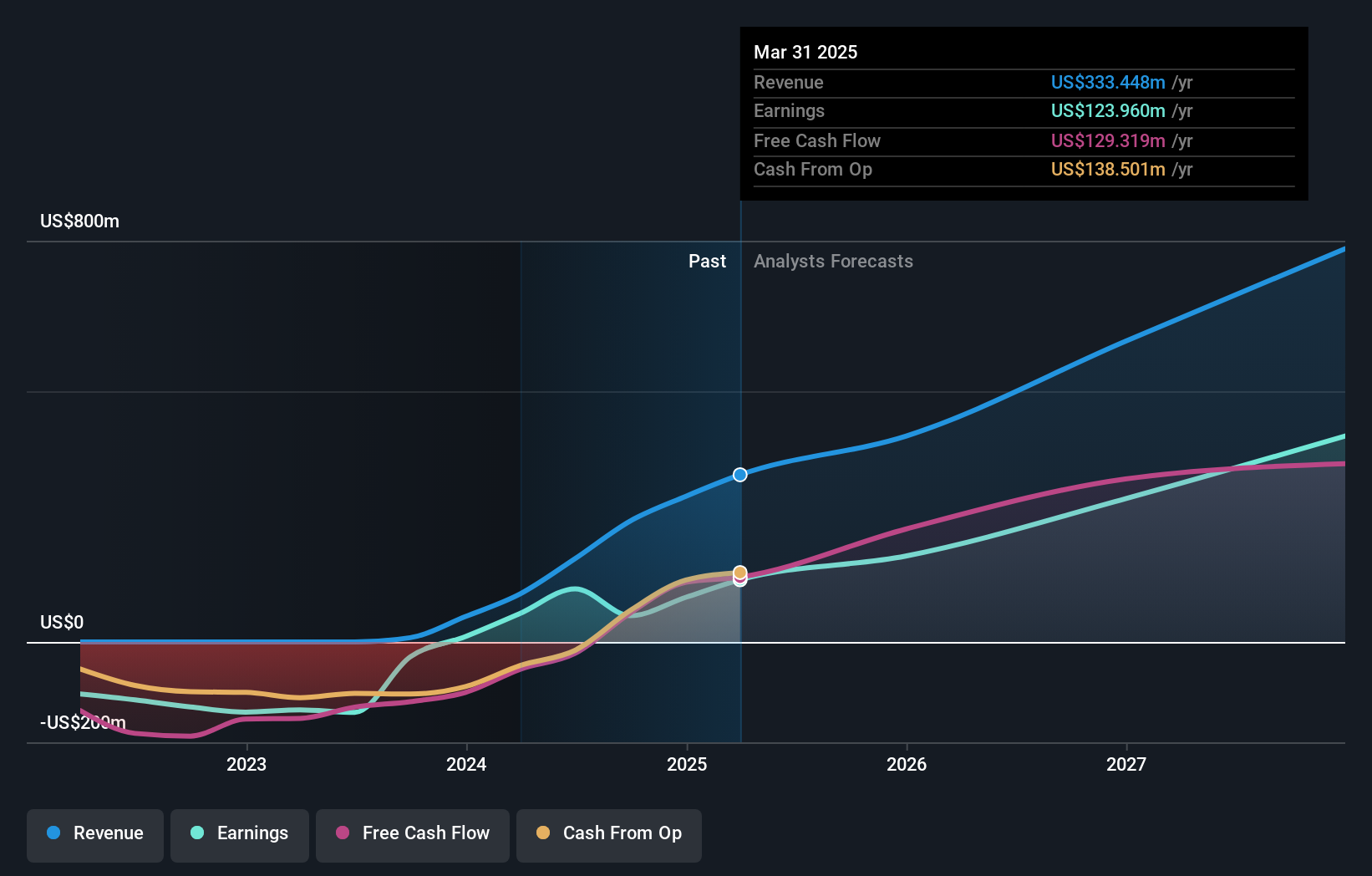

Overview: Krystal Biotech, Inc. is a commercial-stage biotechnology company focused on discovering, developing, manufacturing, and commercializing genetic medicines for diseases with high unmet medical needs in the United States, with a market cap of $7.36 billion.

Operations: Krystal Biotech generates revenue by commercializing genetic medicines aimed at treating diseases with significant unmet medical needs, reporting $373.16 million in this segment. The company operates within the biotechnology sector, focusing on innovation and development to address critical health challenges in the U.S.

Krystal Biotech's recent achievements underscore its strategic positioning in the high-growth biotech sector, marked by a robust increase in net income to $79.37 million for Q3 2025 from $27.18 million the previous year, reflecting an impressive annual growth. The company's forward-looking initiatives are evident from its FDA-granted platform technology designation for KB801, enhancing its pipeline potential in ophthalmology. This aligns with a significant 279.8% earnings surge over the past year and an expected revenue growth of 26.1% per annum, surpassing the US market forecast of 10.7%. These milestones not only highlight Krystal's innovative edge but also signal strong future prospects amid industry advancements.

- Take a closer look at Krystal Biotech's potential here in our health report.

Gain insights into Krystal Biotech's past trends and performance with our Past report.

Summing It All Up

- Explore the 72 names from our US High Growth Tech and AI Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal