Insider Action On Undervalued Small Caps Across Regions For December 2025

As the United States market navigates a holiday-shortened week, major stock indexes have closed lower, with technology shares leading the declines and precious metals retreating from record highs. Despite this downturn, small-cap stocks remain a focal point for investors seeking opportunities amid broader market fluctuations. In such an environment, identifying promising small-cap companies often involves looking at factors like financial health and growth potential that align with current economic indicators and investor sentiment.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Merchants Bancorp | 7.7x | 2.6x | 49.28% | ★★★★★★ |

| Peoples Bancorp | 10.6x | 1.9x | 44.15% | ★★★★★☆ |

| Angel Oak Mortgage REIT | 12.3x | 6.2x | 44.12% | ★★★★★☆ |

| Shore Bancshares | 10.5x | 2.8x | 40.71% | ★★★★☆☆ |

| Metropolitan Bank Holding | 12.5x | 3.1x | 30.90% | ★★★★☆☆ |

| Farmland Partners | 6.3x | 7.8x | -86.42% | ★★★★☆☆ |

| Citizens & Northern | 13.5x | 3.3x | 31.32% | ★★★☆☆☆ |

| Stock Yards Bancorp | 14.5x | 5.2x | 35.45% | ★★★☆☆☆ |

| Omega Flex | 18.3x | 2.9x | 1.44% | ★★★☆☆☆ |

| Vestis | NA | 0.3x | -10.33% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Innospec (IOSP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Innospec is a global specialty chemicals company with operations in fuel specialties, oilfield services, and performance chemicals, boasting a market capitalization of approximately $2.64 billion.

Operations: Fuel Specialties, Oilfield Services, and Performance Chemicals are key revenue segments. The company has seen fluctuations in its net income margin with a peak of 12.62% in Q1 2016 and recent declines to negative margins by Q3 2025. Operating expenses consistently impact profitability, with significant contributions from general and administrative costs.

PE: -1622.1x

Innospec, a smaller player in the U.S. market, has recently completed a share buyback of 246,528 shares for US$22.2 million, indicating insider confidence in its valuation. Despite a dip in net income to US$12.9 million for Q3 2025 from US$33.4 million the previous year, earnings are projected to grow significantly at nearly 60% annually. The company declared an increased semi-annual dividend of $0.87 per share for H2 2025 and relies entirely on external borrowing for funding, which carries higher risk compared to customer deposits.

- Click here to discover the nuances of Innospec with our detailed analytical valuation report.

Understand Innospec's track record by examining our Past report.

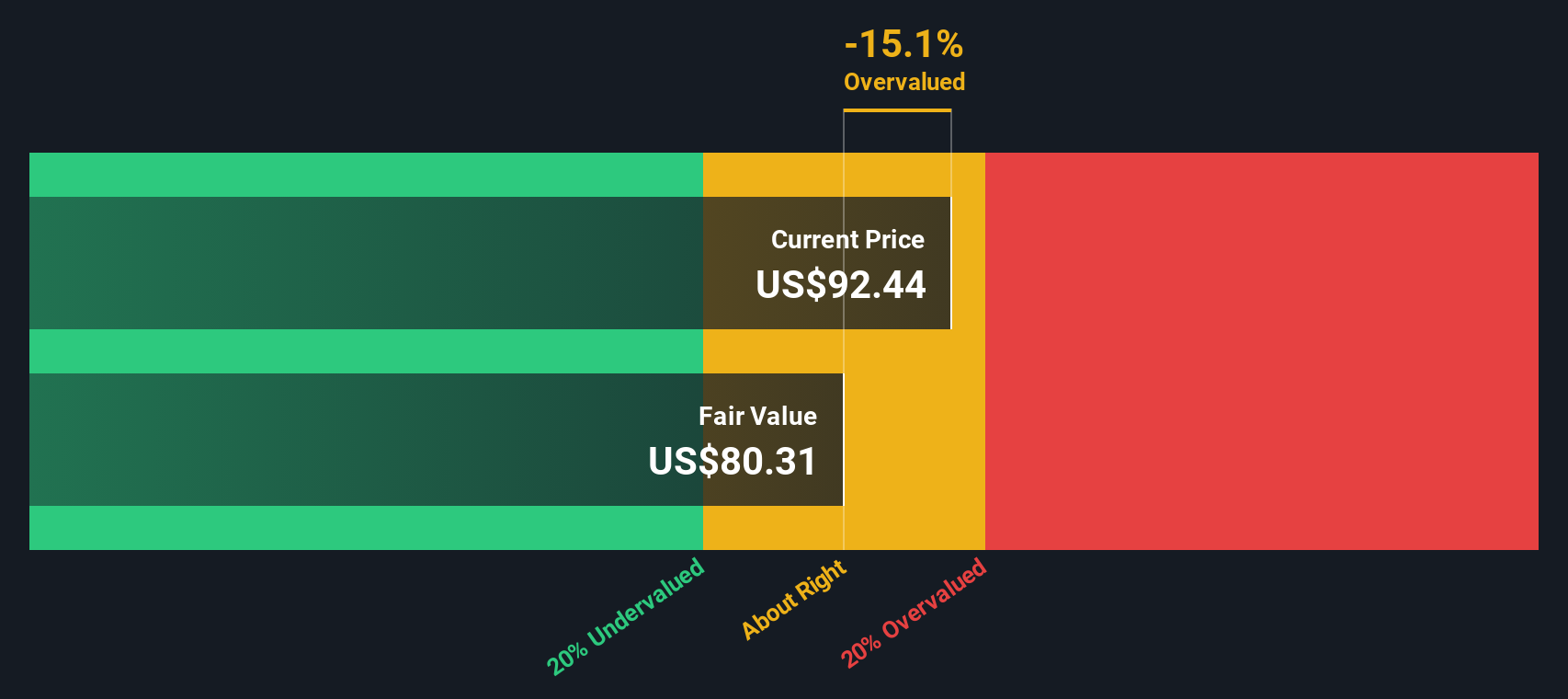

J&J Snack Foods (JJSF)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: J&J Snack Foods is a company specializing in the manufacturing and distribution of niche snack foods and beverages, with a market cap of approximately $3.91 billion.

Operations: J&J Snack Foods generates revenue primarily from its Food Service, Frozen Beverages, and Retail Supermarket segments. The company's cost of goods sold (COGS) significantly impacts its gross profit margin, which has shown a variation over time with a recent figure of 29.45%. Operating expenses are largely driven by sales and marketing efforts. Over the years, J&J Snack Foods has experienced fluctuations in net income margins due to changes in non-operating expenses and other financial factors.

PE: 26.7x

J&J Snack Foods, a smaller player in the U.S. market, has seen insider confidence with recent share purchases, signaling potential trust in its future. Despite a dip in Q4 2025 earnings to US$11.38 million from US$29.64 million the previous year, annual sales showed resilience at US$1.58 billion. With an anticipated 12% yearly growth and stable dividends of $0.80 per share declared for January 2026, J&J's prospects remain promising amidst adjustments to company bylaws enhancing shareholder engagement timelines.

Wolverine World Wide (WWW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Wolverine World Wide is a global footwear and apparel company with operations in various segments including work, active, and other categories, and it has a market cap of $1.30 billion.

Operations: The Active Group is the largest revenue contributor, generating $1.37 billion, followed by the Work Group with $439.3 million. The company experienced fluctuations in gross profit margin, reaching a high of 46.58% and a low of 37.96%. Operating expenses include significant allocations to general and administrative costs and sales & marketing expenses, which have varied over time but generally represent substantial portions of total operating costs.

PE: 16.8x

Wolverine World Wide, a smaller player in the U.S. market, showcases potential with insider confidence as Independent Director DeMonty Price acquired 35,000 shares for US$535,500 in November 2025. Despite challenges like higher-risk funding and debt not fully covered by operating cash flow, Wolverine anticipates a revenue increase of up to 6.4% for fiscal year 2025. Recent leadership changes and innovative product collaborations aim to drive growth across its diverse brand portfolio.

- Dive into the specifics of Wolverine World Wide here with our thorough valuation report.

Assess Wolverine World Wide's past performance with our detailed historical performance reports.

Where To Now?

- Investigate our full lineup of 85 Undervalued US Small Caps With Insider Buying right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal