3 Growth Stocks With High Insider Confidence

As the United States stock market experiences a mixed start to the holiday-shortened week, with major indexes closing lower and precious metals retreating from record highs, investors are keenly observing companies that demonstrate resilience and strong insider confidence. In such fluctuating market conditions, growth stocks with high insider ownership can be particularly appealing as they often signal that those closest to the company have faith in its long-term potential.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 74% |

| SES AI (SES) | 12% | 68.9% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.4% | 52.7% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 135.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

| AppLovin (APP) | 27.3% | 27.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

LGI Homes (LGIH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LGI Homes, Inc. focuses on designing, constructing, and selling homes in the United States with a market cap of approximately $997.71 million.

Operations: The company generates revenue primarily through its homebuilding business, which accounted for $1.79 billion.

Insider Ownership: 12.4%

Earnings Growth Forecast: 27.2% p.a.

LGI Homes demonstrates potential as a growth company with high insider ownership, despite recent earnings declines. The company is expanding its footprint with new communities like Fulton Meadows and Orchard Park, offering upgraded homes that appeal to modern buyers. While profit margins have fallen from 8.8% to 5.9%, LGI's revenue and earnings are forecasted to grow faster than the US market at 19.8% and 27.2% annually, respectively, highlighting its growth trajectory amidst financial challenges such as debt coverage issues.

- Click to explore a detailed breakdown of our findings in LGI Homes' earnings growth report.

- Our expertly prepared valuation report LGI Homes implies its share price may be lower than expected.

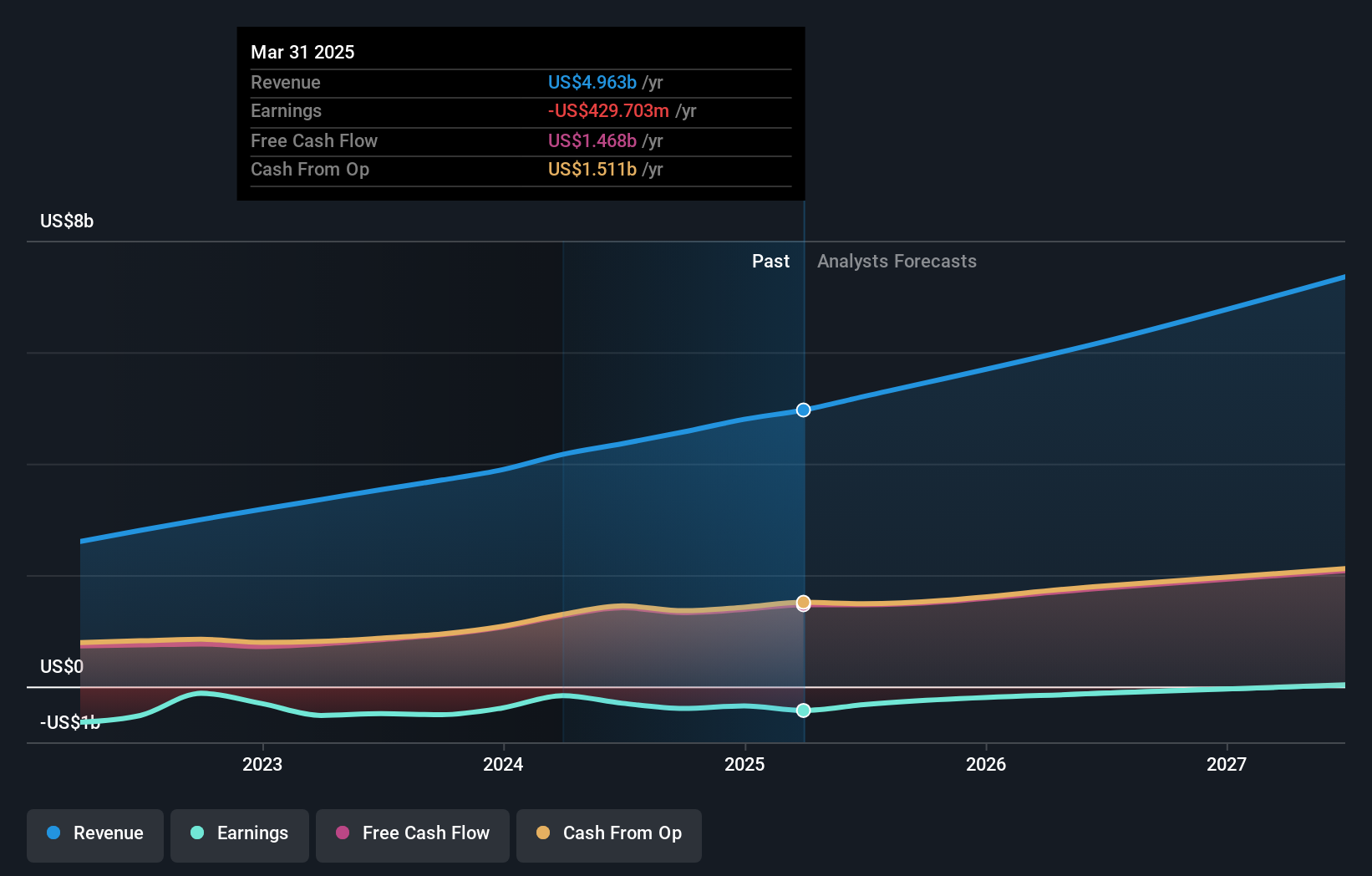

Atlassian (TEAM)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atlassian Corporation offers collaboration software designed to enhance productivity across organizations globally, with a market cap of approximately $43.15 billion.

Operations: The company's revenue is primarily derived from its Software & Programming segment, which generated approximately $5.46 billion.

Insider Ownership: 36.6%

Earnings Growth Forecast: 55.1% p.a.

Atlassian presents a compelling case for growth with significant insider ownership and strategic initiatives. Recent collaboration with AWS, listing cloud apps on AWS Marketplace, enhances its cloud transformation capabilities and expands market reach. Despite a net loss of US$51.87 million in Q1 2026, revenue rose to US$1.43 billion from US$1.19 billion year-on-year. Atlassian's forecasted revenue growth surpasses the broader market, while insider transactions show more buying than selling recently, indicating confidence in its future prospects.

- Dive into the specifics of Atlassian here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of Atlassian shares in the market.

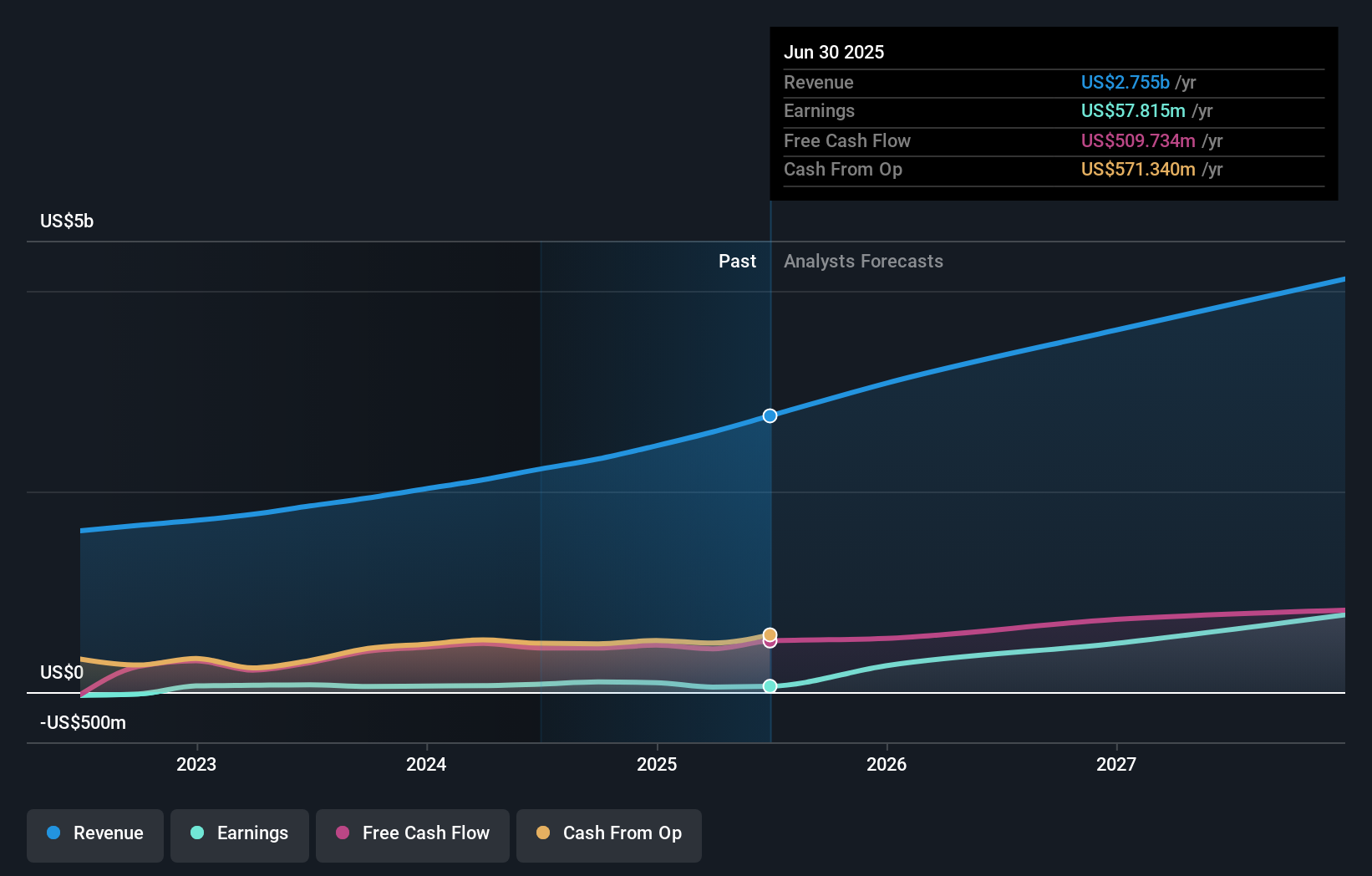

Ryan Specialty Holdings (RYAN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ryan Specialty Holdings, Inc. is a service provider offering specialty products and solutions for insurance brokers, agents, and carriers across several regions including the United States, Canada, Europe, India, and Singapore with a market cap of $13.67 billion.

Operations: The company's revenue segment is primarily derived from insurance brokers, amounting to $2.91 billion.

Insider Ownership: 15.5%

Earnings Growth Forecast: 48.2% p.a.

Ryan Specialty Holdings demonstrates strong growth potential with high insider ownership, supported by a forecasted earnings growth of 48.2% annually, outpacing the broader US market. Recent board changes follow Onex Corporation's complete exit from its investment, marking a shift in governance. Despite lower profit margins and debt challenges, revenue increased to US$754.58 million in Q3 2025 from US$604.69 million the previous year, indicating robust operational performance amidst strategic transitions and leadership appointments.

- Take a closer look at Ryan Specialty Holdings' potential here in our earnings growth report.

- Our valuation report unveils the possibility Ryan Specialty Holdings' shares may be trading at a premium.

Where To Now?

- Reveal the 208 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Want To Explore Some Alternatives? The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal