Some Zhongchao Inc. (NASDAQ:ZCMD) Shareholders Look For Exit As Shares Take 32% Pounding

To the annoyance of some shareholders, Zhongchao Inc. (NASDAQ:ZCMD) shares are down a considerable 32% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 72% loss during that time.

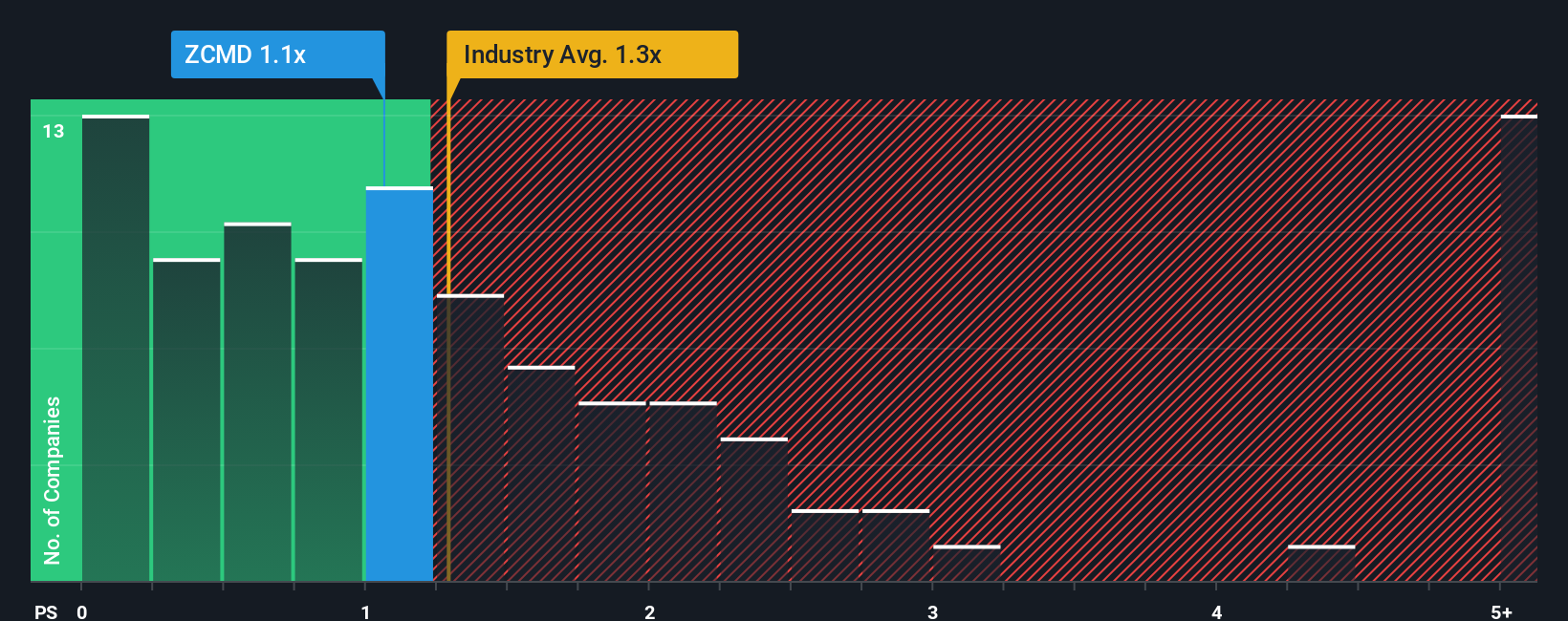

In spite of the heavy fall in price, you could still be forgiven for feeling indifferent about Zhongchao's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Consumer Services industry in the United States is also close to 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Zhongchao

What Does Zhongchao's Recent Performance Look Like?

For instance, Zhongchao's receding revenue in recent times would have to be some food for thought. Perhaps investors believe the recent revenue performance is enough to keep in line with the industry, which is keeping the P/S from dropping off. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Zhongchao will help you shine a light on its historical performance.How Is Zhongchao's Revenue Growth Trending?

In order to justify its P/S ratio, Zhongchao would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 12% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 8.7% shows it's an unpleasant look.

In light of this, it's somewhat alarming that Zhongchao's P/S sits in line with the majority of other companies. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh on the share price eventually.

The Final Word

Following Zhongchao's share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Zhongchao revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Zhongchao (1 is potentially serious!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal