European Equities Trading Below Estimated Intrinsic Values December 2025

In a holiday-shortened week, the pan-European STOXX Europe 600 Index ended slightly higher, nearing record levels amid optimism about future earnings and economic prospects. As investors navigate this environment, identifying stocks trading below their estimated intrinsic values can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.078 | €6.05 | 49.1% |

| Sanoma Oyj (HLSE:SANOMA) | €9.47 | €18.46 | 48.7% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.50 | NOK66.01 | 49.2% |

| Kamux Oyj (HLSE:KAMUX) | €2.22 | €4.41 | 49.7% |

| Hemnet Group (OM:HEM) | SEK171.80 | SEK337.32 | 49.1% |

| Gentili Mosconi (BIT:GM) | €3.30 | €6.54 | 49.5% |

| Elekta (OM:EKTA B) | SEK57.05 | SEK113.78 | 49.9% |

| Dynavox Group (OM:DYVOX) | SEK102.70 | SEK203.06 | 49.4% |

| Doxee (BIT:DOX) | €3.81 | €7.44 | 48.8% |

| Allcore (BIT:CORE) | €1.36 | €2.66 | 48.9% |

Here we highlight a subset of our preferred stocks from the screener.

Recordati Industria Chimica e Farmaceutica (BIT:REC)

Overview: Recordati Industria Chimica e Farmaceutica S.p.A. is a pharmaceutical company that researches, develops, produces, and sells medications across various international markets including Italy, the United States, and several European countries with a market cap of approximately €9.92 billion.

Operations: Recordati generates revenue from its Specialty & Primary Care segment, which accounts for €1.54 billion, and its Pharmaceutical Sector for Rare Diseases segment, contributing €1.01 billion.

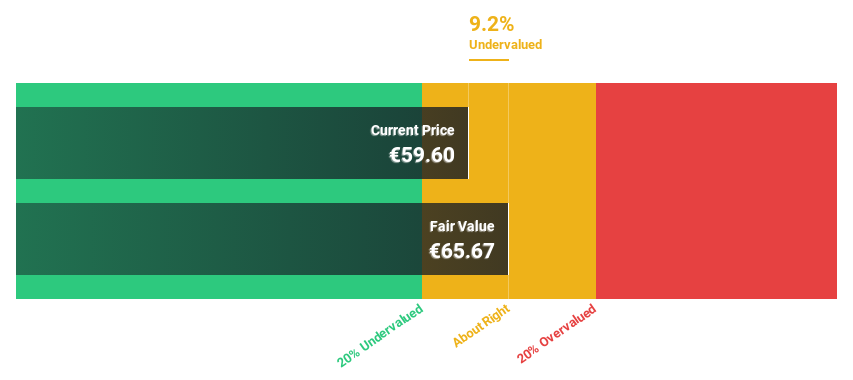

Estimated Discount To Fair Value: 29.6%

Recordati Industria Chimica e Farmaceutica is trading significantly below its estimated fair value of €68.92, with a current price of €48.5, suggesting potential undervaluation based on cash flows. Despite high debt levels and a dividend not fully covered by free cash flows, the company's revenue growth is expected to outpace the Italian market at 7.1% annually. Recent earnings showed stable sales growth, though net income slightly declined year-over-year.

- Our growth report here indicates Recordati Industria Chimica e Farmaceutica may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Recordati Industria Chimica e Farmaceutica's balance sheet health report.

Archicom (WSE:ARH)

Overview: Archicom S.A. operates in the real estate sector in Poland, with a market capitalization of PLN2.61 billion.

Operations: The company's revenue segments include Supporting Companies at PLN251.56 million, Housing Activities in Wroclaw at PLN419.86 million, Warszawa at PLN122.42 million, Lodz at PLN102.58 million, Cracow at PLN2.33 million, and Poznan at PLN10.24 million.

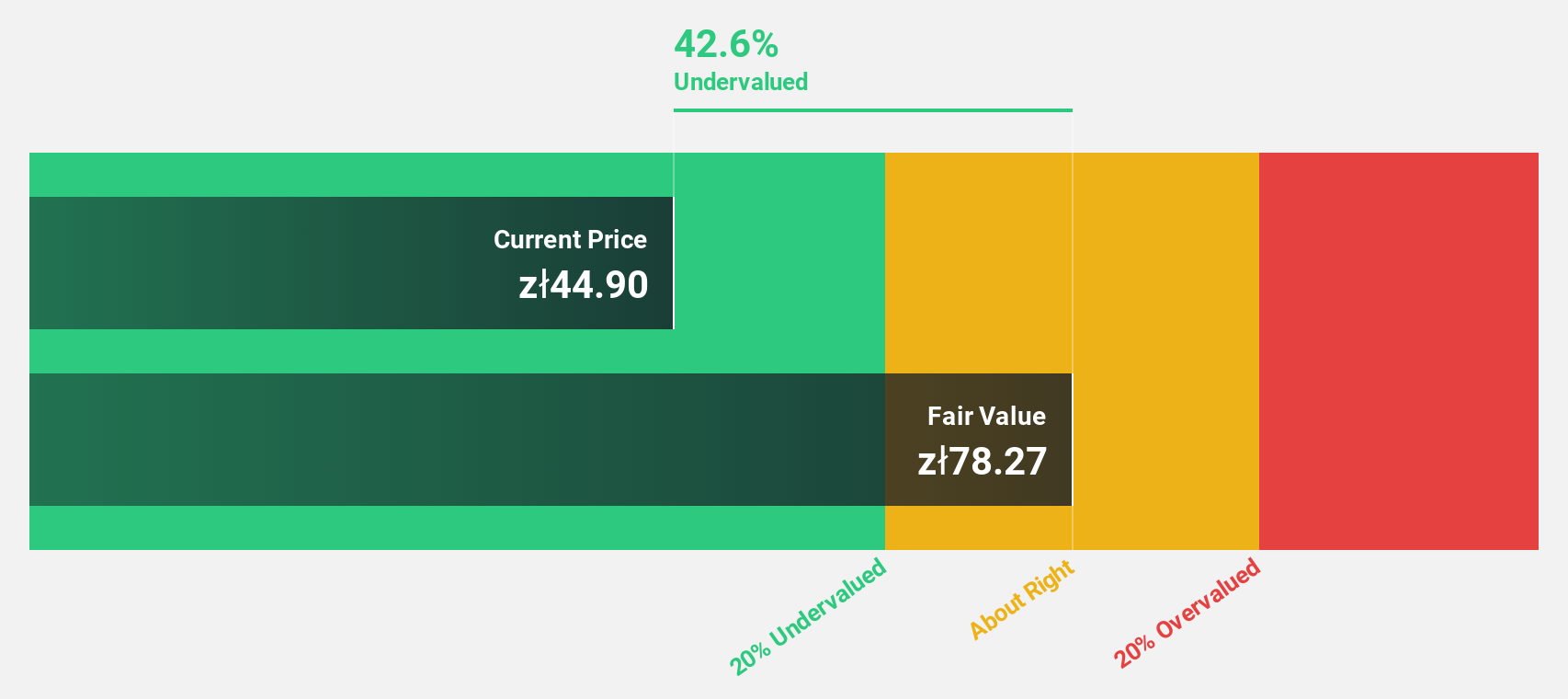

Estimated Discount To Fair Value: 36.9%

Archicom is trading at PLN44.6, significantly below its estimated fair value of PLN70.65, highlighting potential undervaluation based on cash flows. Despite a recent drop in net income to PLN4.84 million from PLN77.56 million year-over-year, earnings and revenue are forecast to grow substantially above the Polish market rates over the next three years. However, profit margins have decreased, and debt coverage by operating cash flow remains weak, raising concerns about financial stability despite high growth expectations.

- Insights from our recent growth report point to a promising forecast for Archicom's business outlook.

- Navigate through the intricacies of Archicom with our comprehensive financial health report here.

AmRest Holdings (WSE:EAT)

Overview: AmRest Holdings SE operates and manages a diverse portfolio of quick service, fast casual, coffee, and casual dining restaurants across Central and Eastern Europe, Western Europe, China, and other international markets with a market cap of PLN2.89 billion.

Operations: The company generates its revenue primarily from its restaurant operations, totaling €2.59 billion.

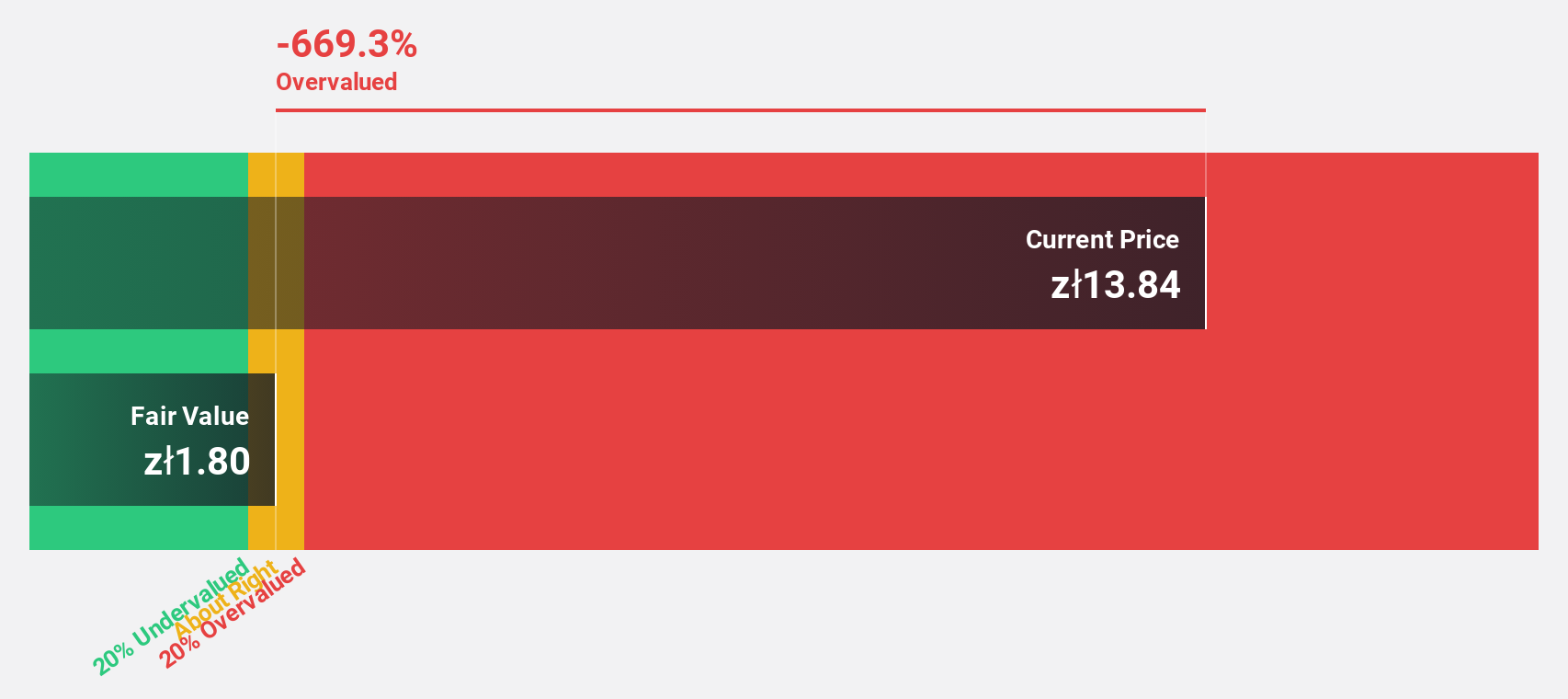

Estimated Discount To Fair Value: 10.1%

AmRest Holdings is trading at PLN13.46, slightly below its estimated fair value of PLN14.97, suggesting potential undervaluation based on cash flows. The company turned profitable this year with net income of €13 million for the nine months ending September 2025, up from a loss last year. Earnings are expected to grow significantly over the next three years, outpacing the Polish market despite low forecasted return on equity and interest payments not well covered by earnings.

- Our earnings growth report unveils the potential for significant increases in AmRest Holdings' future results.

- Get an in-depth perspective on AmRest Holdings' balance sheet by reading our health report here.

Seize The Opportunity

- Click here to access our complete index of 190 Undervalued European Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal