3 Promising European Penny Stocks With At Least €5M Market Cap

As the pan-European STOXX Europe 600 Index inches closer to record highs, optimism around earnings and economic prospects is creating a favorable backdrop for investors. In this context, penny stocks—often representing smaller or newer companies—remain an intriguing segment of the market. While historically associated with speculative trading, these stocks can offer unique opportunities when backed by robust financials and growth potential.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.488 | €1.55B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.69 | €83.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €222.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.00 | €63.63M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.37 | €386.24M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.28 | €315.14M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0726 | €7.81M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.80 | €26.79M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 293 stocks from our European Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Ecosuntek (BIT:ECK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ecosuntek S.p.A. operates in the photovoltaic electricity generation sector both in Italy and internationally, with a market capitalization of €40.44 million.

Operations: The company's revenue is primarily derived from Ricavireseller/Energy and Gas Trading, which accounts for €1.03 billion, with additional income from Power Generation at €5.14 million.

Market Cap: €40.44M

Ecosuntek S.p.A., with a market cap of €40.44 million, operates in the photovoltaic sector and has shown significant growth, with earnings rising 23.9% over the past year, outpacing the industry. The company's short-term assets (€189.5M) surpass long-term liabilities (€49.4M), although they fall short of covering short-term liabilities (€196.6M). Its debt is well covered by operating cash flow (55.2%), and it holds more cash than total debt, indicating financial stability despite interest payments not being fully covered by EBIT (2.9x). Recent reports show revenue growth to €604.49 million for H1 2025 from €312.02 million a year prior, though net income slightly decreased to €1.09 million from €1.38 million.

- Take a closer look at Ecosuntek's potential here in our financial health report.

- Gain insights into Ecosuntek's outlook and expected performance with our report on the company's earnings estimates.

Ekobox (WSE:EBX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ekobox S.A. is an engineering company based in Poland with a market cap of PLN45.45 million.

Operations: Ekobox S.A. has not reported any revenue segments.

Market Cap: PLN45.45M

Ekobox S.A., with a market cap of PLN45.45 million, demonstrates financial stability despite its classification as a penny stock. The company reported Q3 2025 revenue of PLN16.36 million, an increase from the previous year, and net income rose to PLN0.47 million. Its short-term assets (PLN30.3M) comfortably cover both short- and long-term liabilities, while debt is well-managed with a reduced debt-to-equity ratio from 41.6% to 18.3% over five years and operating cash flow covering debt by 179.9%. However, share price volatility remains high compared to most Polish stocks, reflecting potential investment risk.

- Jump into the full analysis health report here for a deeper understanding of Ekobox.

- Understand Ekobox's track record by examining our performance history report.

M Food (WSE:MFD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: M Food S.A. specializes in providing honey and bee products both in Poland and internationally, with a market capitalization of PLN21.75 million.

Operations: The company's revenue is primarily generated from its wholesale groceries segment, amounting to PLN125.20 million.

Market Cap: PLN21.75M

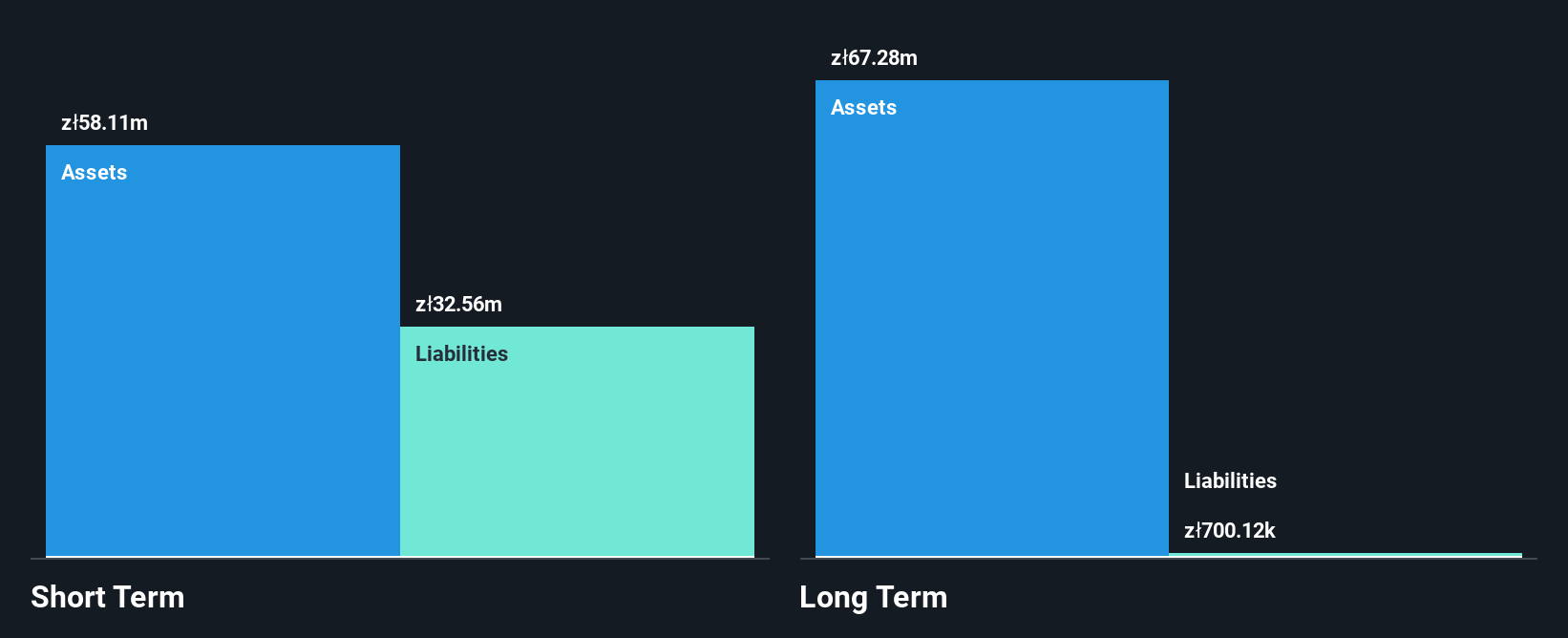

M Food S.A., with a market cap of PLN21.75 million, has shown significant improvement in its financial performance, becoming profitable this year. The company reported Q3 2025 revenue of PLN21.05 million and net income of PLN1.68 million, reversing last year's losses. Its short-term assets (PLN58.1M) exceed both short- and long-term liabilities, indicating solid liquidity management. Debt is satisfactorily managed with a net debt to equity ratio of 24.2%, though interest coverage is less than ideal at 2.7x EBIT. Despite high-quality earnings and reduced debt levels over five years, share price volatility remains elevated at 26%.

- Get an in-depth perspective on M Food's performance by reading our balance sheet health report here.

- Assess M Food's previous results with our detailed historical performance reports.

Where To Now?

- Unlock our comprehensive list of 293 European Penny Stocks by clicking here.

- Interested In Other Possibilities? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal