European Growth Stocks With High Insider Ownership For December 2025

As the European market edges closer to record highs, driven by positive sentiment around earnings and economic prospects for the coming year, investors are increasingly focusing on growth stocks with substantial insider ownership. In this context, companies where insiders hold significant stakes can be particularly appealing due to their potential alignment of interests with shareholders and commitment to long-term success.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Redelfi (BIT:RDF) | 12.4% | 39.1% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's dive into some prime choices out of the screener.

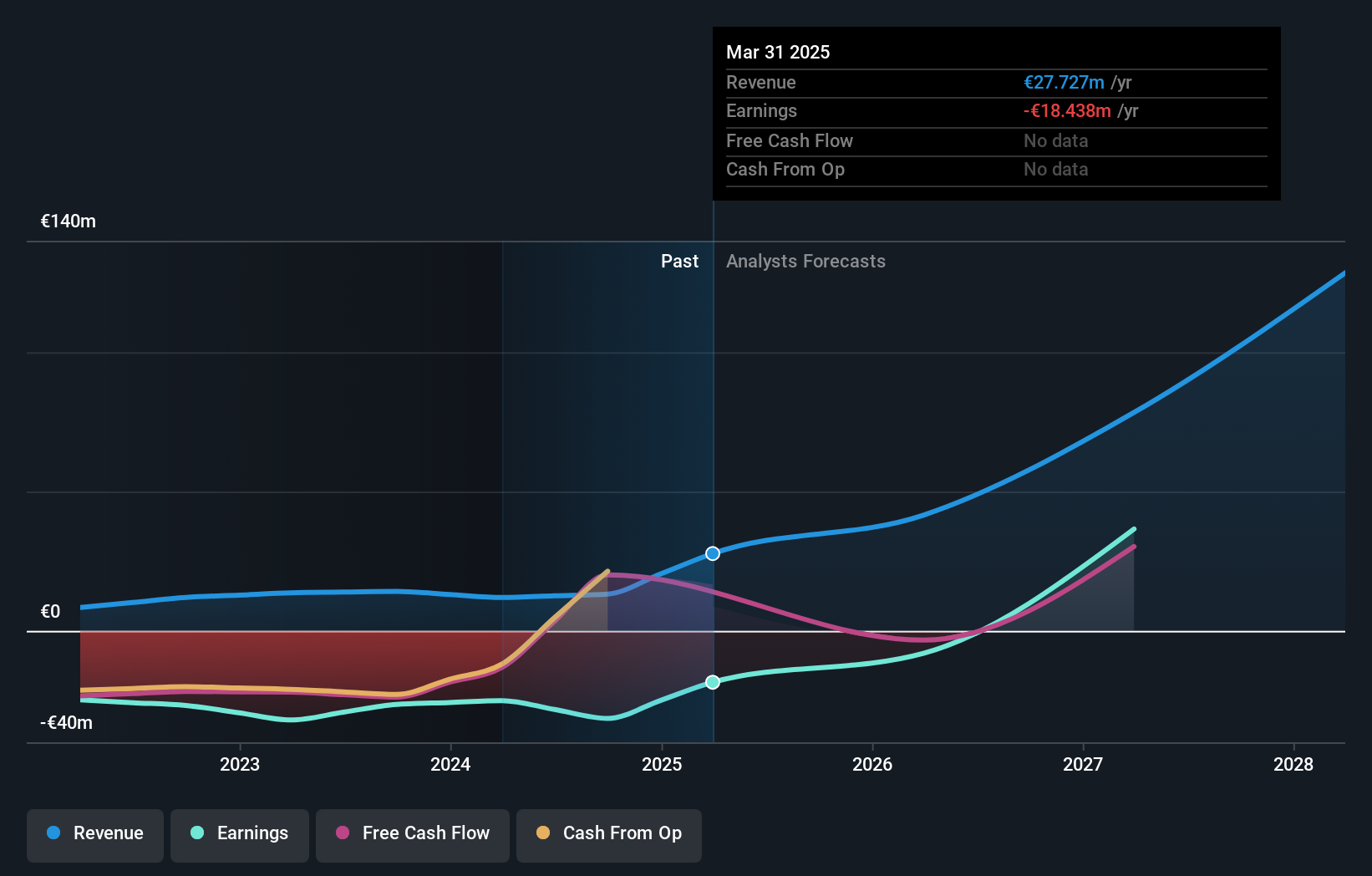

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a clinical-stage and commercial biopharmaceutical licensing company based in France that focuses on developing long-acting injectables across various therapeutic areas, with a market cap of €827.57 million.

Operations: The company's revenue segment involves conducting research and development on biodegradable polymer-based processes, generating €32.44 million.

Insider Ownership: 12.5%

Earnings Growth Forecast: 116.2% p.a.

MedinCell demonstrates strong growth potential with its revenue projected to increase by 36% annually, surpassing the French market's average. Despite a current net loss of €16.08 million for the half-year, its inclusion in the MSCI World Small Cap Index highlights investor confidence. The recent FDA approval of UZEDY® for bipolar I disorder treatment further solidifies its innovative edge, while strategic leadership under Dr. Grace Kim aims to drive U.S. capital growth and global expansion efforts effectively.

- Click here and access our complete growth analysis report to understand the dynamics of MedinCell.

- Our valuation report here indicates MedinCell may be overvalued.

Metall Zug (SWX:METN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Metall Zug AG operates through its subsidiaries in the medical devices, infection control, technology cluster and infrastructure sectors across Switzerland and internationally, with a market cap of CHF368.10 million.

Operations: The company's revenue is primarily derived from its medical devices segment, which accounts for CHF163.02 million, and investments & corporate activities contributing CHF33.45 million.

Insider Ownership: 35.4%

Earnings Growth Forecast: 107.7% p.a.

Metall Zug's growth potential is underscored by its strategic real estate projects, such as the Tech Cluster Zug, which promises stable cash flows through long-term leases. Despite a forecasted revenue growth of 4.8% per year, it outpaces the Swiss market average. The company secured a CHF 220 million loan to support these ventures. However, its expected low return on equity and unsustainable dividend coverage highlight potential challenges in achieving robust profitability.

- Delve into the full analysis future growth report here for a deeper understanding of Metall Zug.

- Insights from our recent valuation report point to the potential overvaluation of Metall Zug shares in the market.

Semperit Holding (WBAG:SEM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Semperit Aktiengesellschaft Holding is a global company that develops, produces, and sells rubber products for the medical and industrial sectors, with a market cap of €256.34 million.

Operations: The company generates revenue through its Semperit Engineered Applications segment, which accounts for €362.01 million, and its Semperit Industrial Applications segment, contributing €291.58 million.

Insider Ownership: 10.1%

Earnings Growth Forecast: 90.1% p.a.

Semperit Holding's growth prospects are highlighted by its forecasted revenue increase of 7.6% annually, surpassing the Austrian market average. Despite recent earnings improvements, challenges remain with a low return on equity forecast at 5.7% and dividends not well covered by earnings. Analysts expect the stock price to rise significantly, while insider ownership aligns management interests with shareholders'. The company aims to achieve profitability within three years, indicating positive future potential despite current hurdles.

- Unlock comprehensive insights into our analysis of Semperit Holding stock in this growth report.

- According our valuation report, there's an indication that Semperit Holding's share price might be on the cheaper side.

Seize The Opportunity

- Dive into all 210 of the Fast Growing European Companies With High Insider Ownership we have identified here.

- Searching for a Fresh Perspective? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal