Cui Dongshu: China's share of the world's cars rebounded to 40% in November

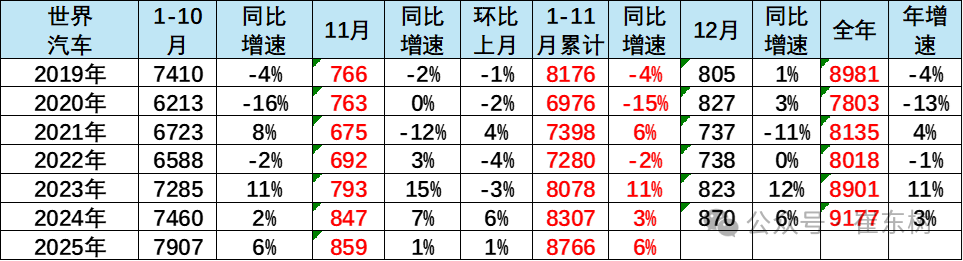

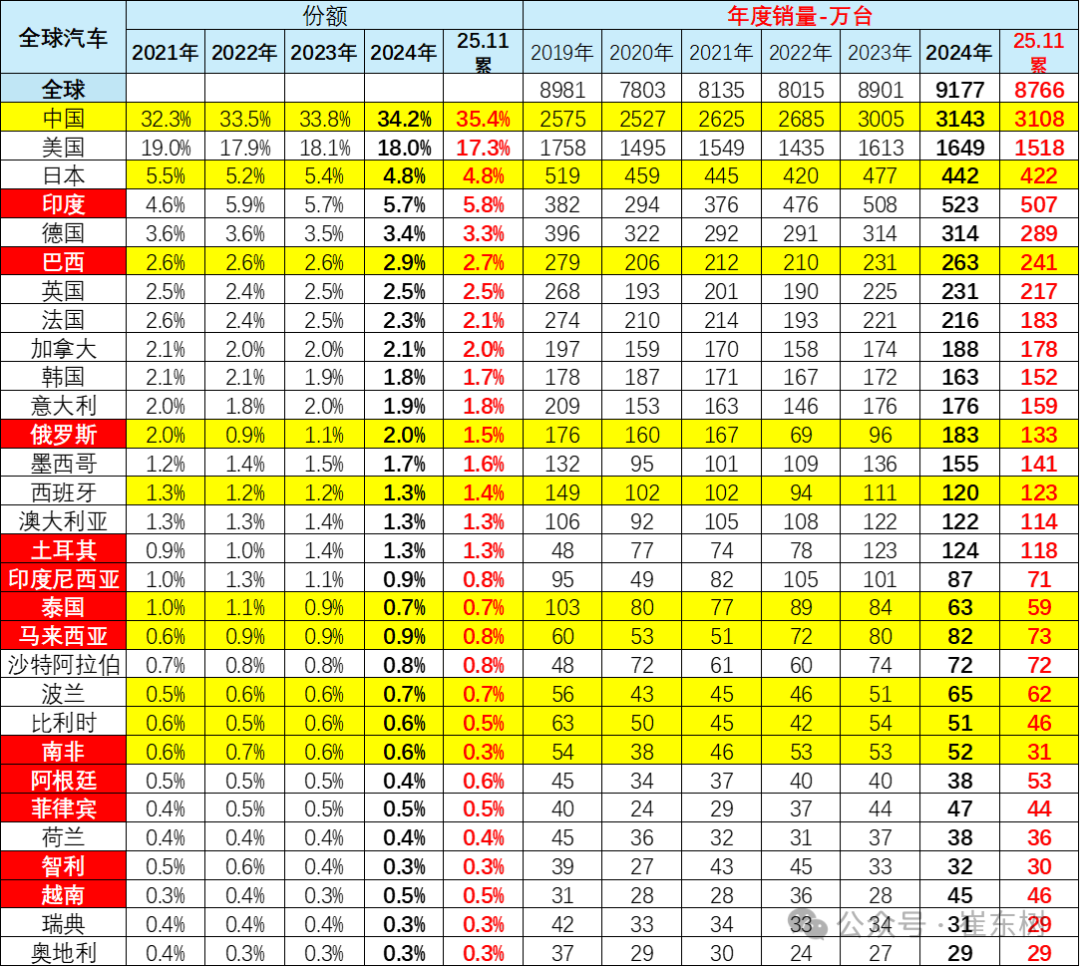

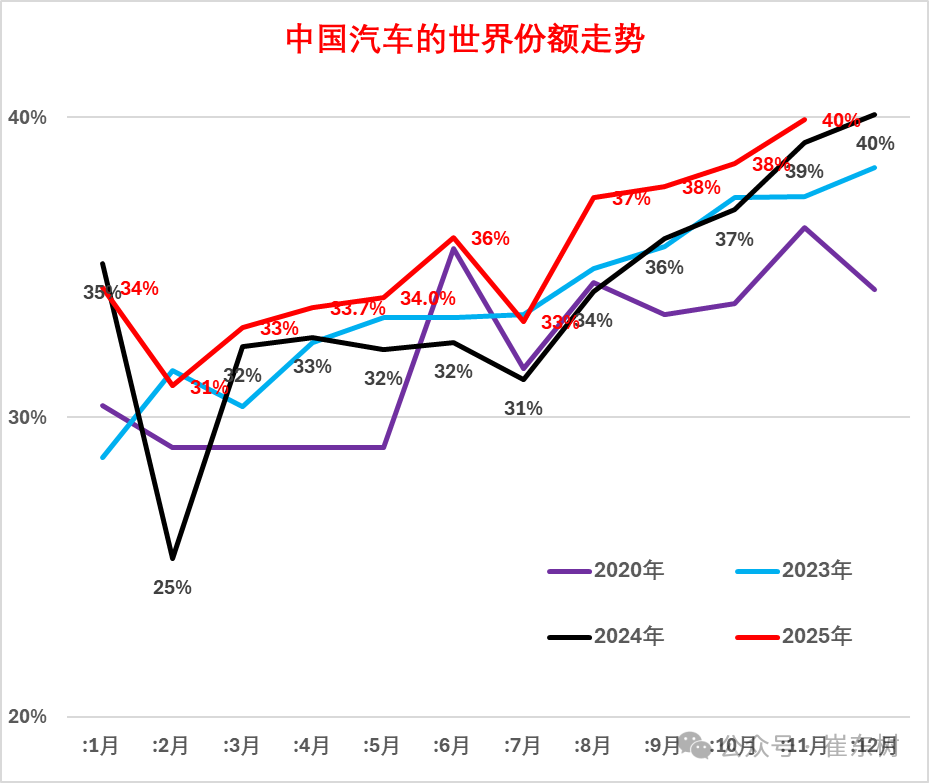

The Zhitong Finance App learned that on December 30, Cui Dongshu, Secretary General of the Passenger Transport Association, published an article stating that in November 2025, world car sales reached 8.59 million units, up 1% year on year and 1% month on month. With the relative slowdown in the Chinese and US car markets, sales growth in the world car market slowed in November 2025. Sales volume from January to November 2025 was 87.66 million units, up 6% year over year. The world share of Chinese automobiles continues to rise. In November, China's share in the world rose back to a good level of 40%, an increase of 1 percentage point over last year. The Chinese auto market reached 34.2% in 2024, and the Chinese auto market reached 35.4% of the world from January to November 2025, an increase of 1.2 percentage points over the same period.

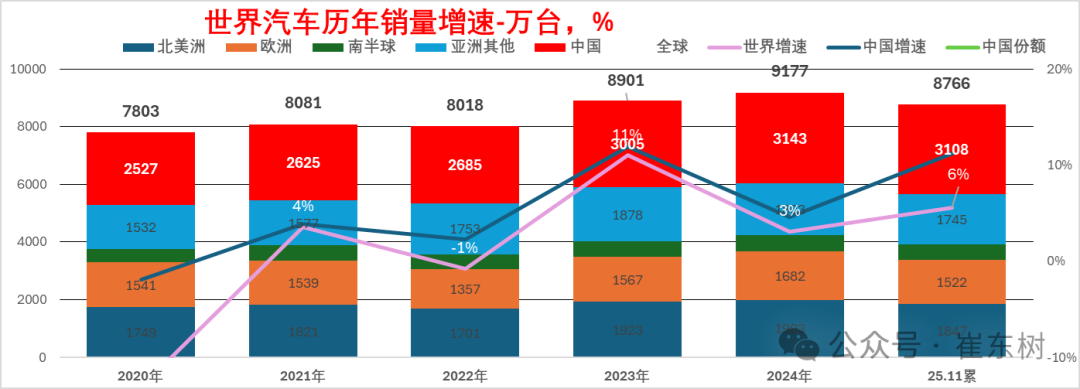

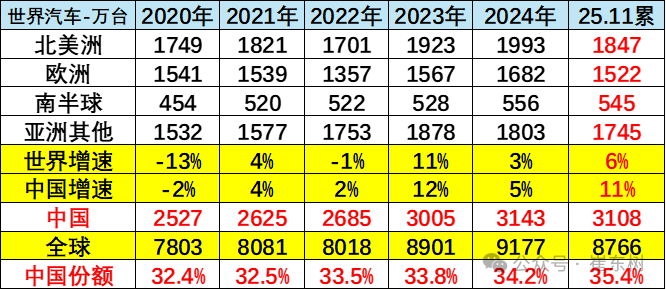

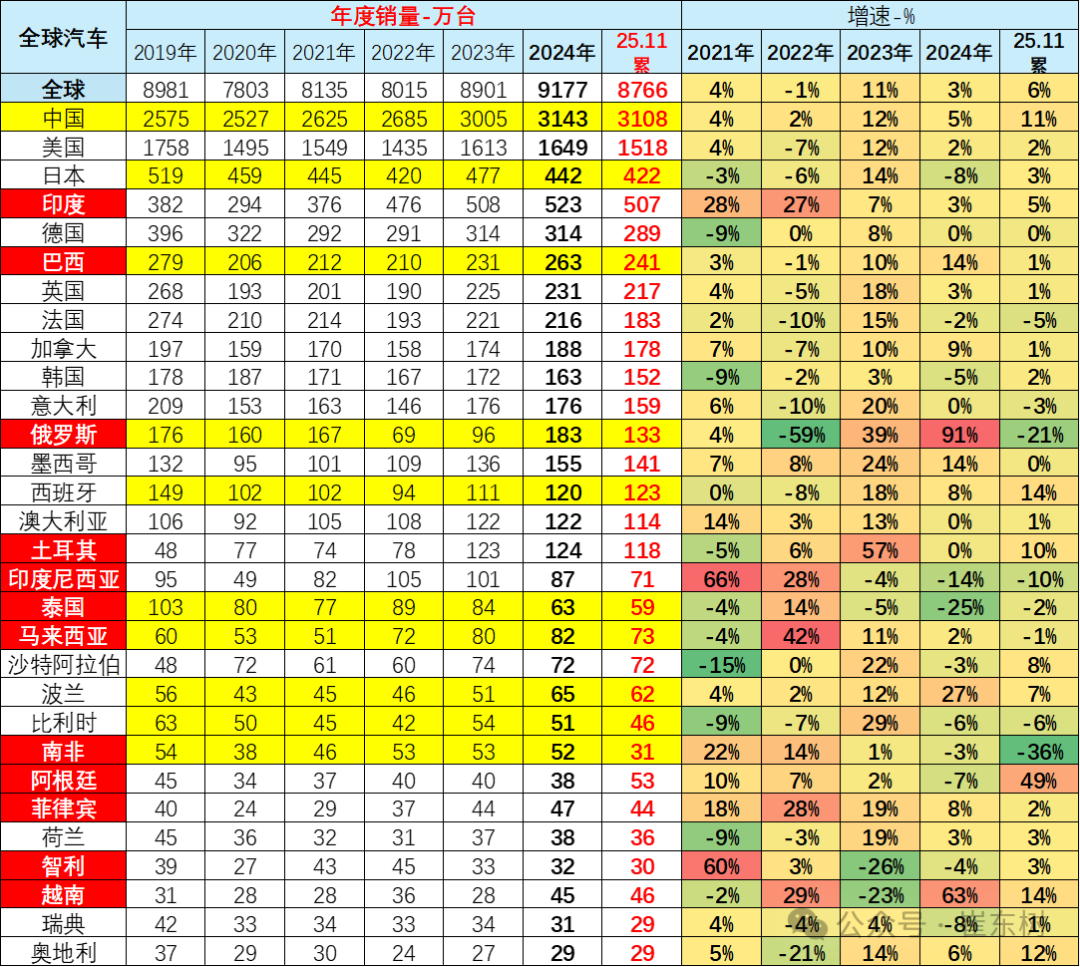

Global automobile sales increased 6% from January to November 2025, with sales of 31.08 million units in China increasing 11%, sales of 15.18 million units in the US increasing 2%, sales of 5.07 million units in India increasing 5%, sales of 4.22 million units in Japan increasing 3%, and sales of 2.89 million units in Germany, the same as the previous year. Currently, I think the Chinese market is the most dynamic and growing rapidly. The Russian market has experienced a severe decline, while Mexico's growth rate has slowed, while markets such as Argentina in South America have performed well.

Among the top 10 car companies in the world, the shares of the 3 Chinese car companies rose strongly this year. BYD reached 6th place in the world, Geely 8th place, and Chery 10th place. The development of electrification has also led to the gradual decline of some international car companies. Apart from the unusually strong temporary strength of the US market and favorable factors in the Indian market such as Suzuki, the share of other international brands has declined significantly across the board.

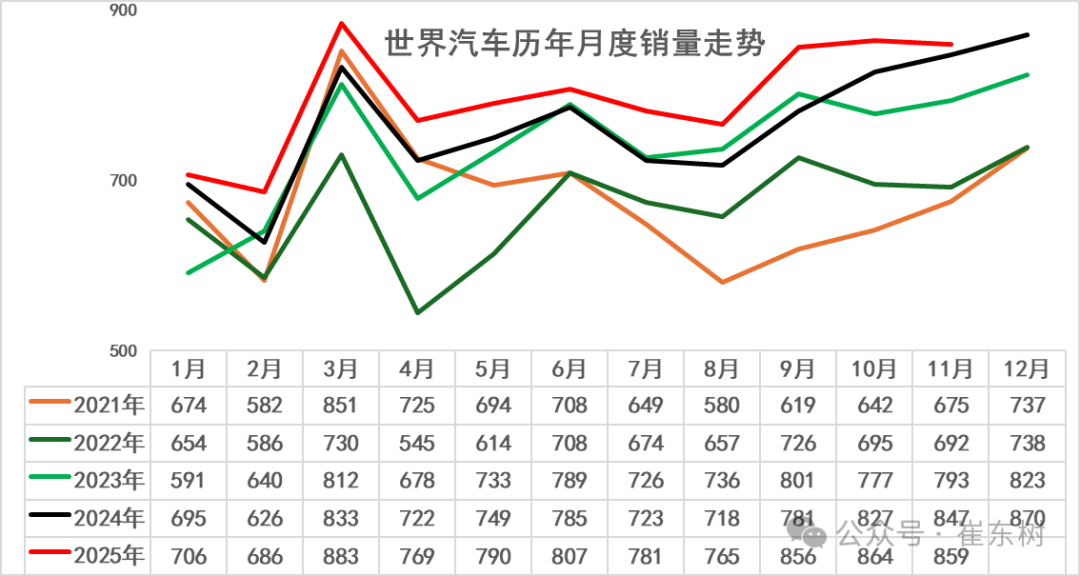

World car sales trend for the current month

The world car market was relatively stable from January to November 2025. Due to the Chinese Spring Festival in January and low sales in the Chinese New Year car market, the world growth in January was low. The world car market trend was strong in February-November. Chinese car companies contributed large increases in February-September. The Chinese car market was sluggish in October-November, and the growth of the world car market also slowed.

World car sales reached 8.59 million units in November 2025, up 1% year on year and 1% month on month. With the relative slowdown in the Chinese and US car markets, sales growth in the world car market slowed in November 2025. Sales volume from January to November 2025 was 87.66 million units, up 6% year over year.

After a continuous decline in 2018-2020, car sales in the world's major countries in 2021 were 81.35 million units, up 4% year on year, and the recovery performance after the pandemic was good. However, in 2022, there were only 80.18 million units, a year-on-year decrease of 1%, which is only slightly higher than sales in 2020. World car sales reached 89.01 million units in 2023, an increase of 11% over the previous year. The revised total annual sales volume in 2024 is 91.77 million units, surpassing 2019 and returning to a reasonable level. According to current levels, automobile sales in 2025 are expected to be around 96 million units.

World car sales trends over the years

World car sales in the table above are mainly sales in 70 countries. These 70 core countries had around 90 million units in 2019, which can also basically track monthly sales. World data has been slow in recent months due to frequent wars.

There are 100 other countries that can only track annual sales. In recent years, the total sales volume is about 3 million units. Compared with 70 major countries with 80 million units, these smaller countries have a total volume of about 3%, which has little impact.

Judging from the world sales volume represented by major countries, the downward cycle began after 2018 and bottomed out in 2020; the recovery began in 2021; the 6% increase in world sales from January to November 2025 performed well. Among them, the Chinese auto market contributed greatly to 11% growth. The overall performance of the Chinese auto market has surpassed expectations this year and continues to lead world growth.

China maintains leading position in sales volume in 2025

The Chinese automobile market has an enormous influence on the world automobile market. In 2016-2018, Chinese automobiles accounted for about 30% of the world; in 2019, it fell to 29%, but it still has an absolute advantage; in 2020-2021, China's share rebounded to 32%; in 2022, China's share rose to 33.5%; in 2023, China's share remained at 33.8%; in 2024, China reached 34.2% of the world's automobile share; from January to November 2025, China reached 35.4% of the world's automobile share. The low level of Chinese car companies at the beginning of the year is a normal reflection of the Spring Festival factor. As policy stimulus effects became apparent, China's auto market continued to strengthen in March, and share growth in autumn and winter was even more prominent.

Developing countries' markets have strengthened significantly

Judging from the sales volume of countries around the world, the current relatively good performance is in developed European and American markets. It is an objective reality that you can only buy a car if you have money, and the cost of a vehicle is lower. The Russian market is gradually recovering in 2023-2024, bringing high sales volume and high profits to Chinese autonomous car companies. In 2025, the Russian market declined significantly, and its share fell to 1.5%.

The overall trend of China's auto market is good, and its share continues to rise. Since 2020, China's share in the world has continued to rise, reaching 33.8% by 2023, reaching 34.2% in 2024, and reaching 35.4% of the world from January to November 2025, an increase of 1.2 percentage points over the same period.

Market trends in countries around the world

Global automobile sales increased 6% from January to November 2025, with sales of 31.08 million units in China increasing 11%, sales of 15.18 million units in the US increasing 2%, sales of 5.07 million units in India increasing 5%, sales of 4.22 million units in Japan increasing 3%, and sales of 2.89 million units in Germany, the same as the previous year. Currently, I think the Chinese market is the most dynamic and growing rapidly. The Russian market has experienced a severe decline, while Mexico's growth rate has slowed, while markets such as Argentina in South America have performed well.

Trends in China's global market share

In 2025, the world market was further divided, and China's share gradually rebounded. At the beginning of 2025, with the gradual launch of two new subsidy policies, China's automobile sales rebounded, reaching 34% in January. However, due to the February Spring Festival factors and temporary high markets in the US and Japan, China's share of the world was only 31% in February. With the promotion of trade-in subsidies, the world share of Chinese cars continues to rise. In November, China's world share climbed back to a good level of 40%, an increase of 1 percentage point over last year.

In 2025, China's auto market gradually returned to normal, and exports gradually recovered, so China's sales share continued to strengthen. The Chinese market picked up further from March to November 2025, and the sales share of the Chinese car market continued to surpass the historical high of the world share in that month.

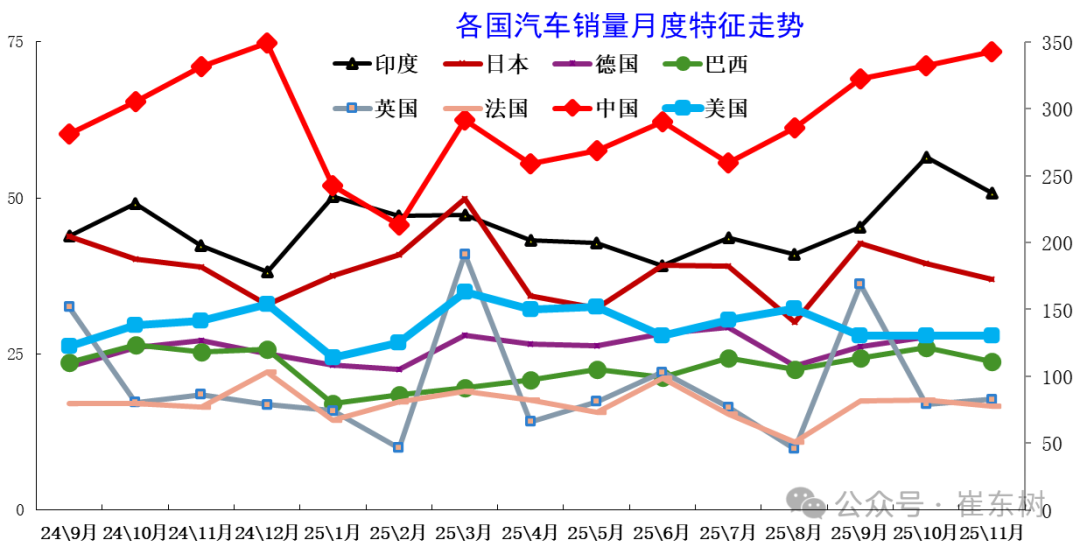

Characteristics of monthly automobile sales trends in various countries

Judging from the monthly sales growth trend in countries around the world, the trend between months is basically balanced. However, due to many influences such as seasonal factors and yearly factors, there is still a big contrast between the trends of various countries.

Since the Chinese car market is still popular for private cars, it shows a situation where the trend is relatively strong at the beginning and end of the year, and the trend is relatively weak in the middle of the year, while the US car market is relatively weak at the beginning of the year and relatively stable in the middle of the year. The trend of the US car market in October-November this year was weak, while the Indian car market was strong.

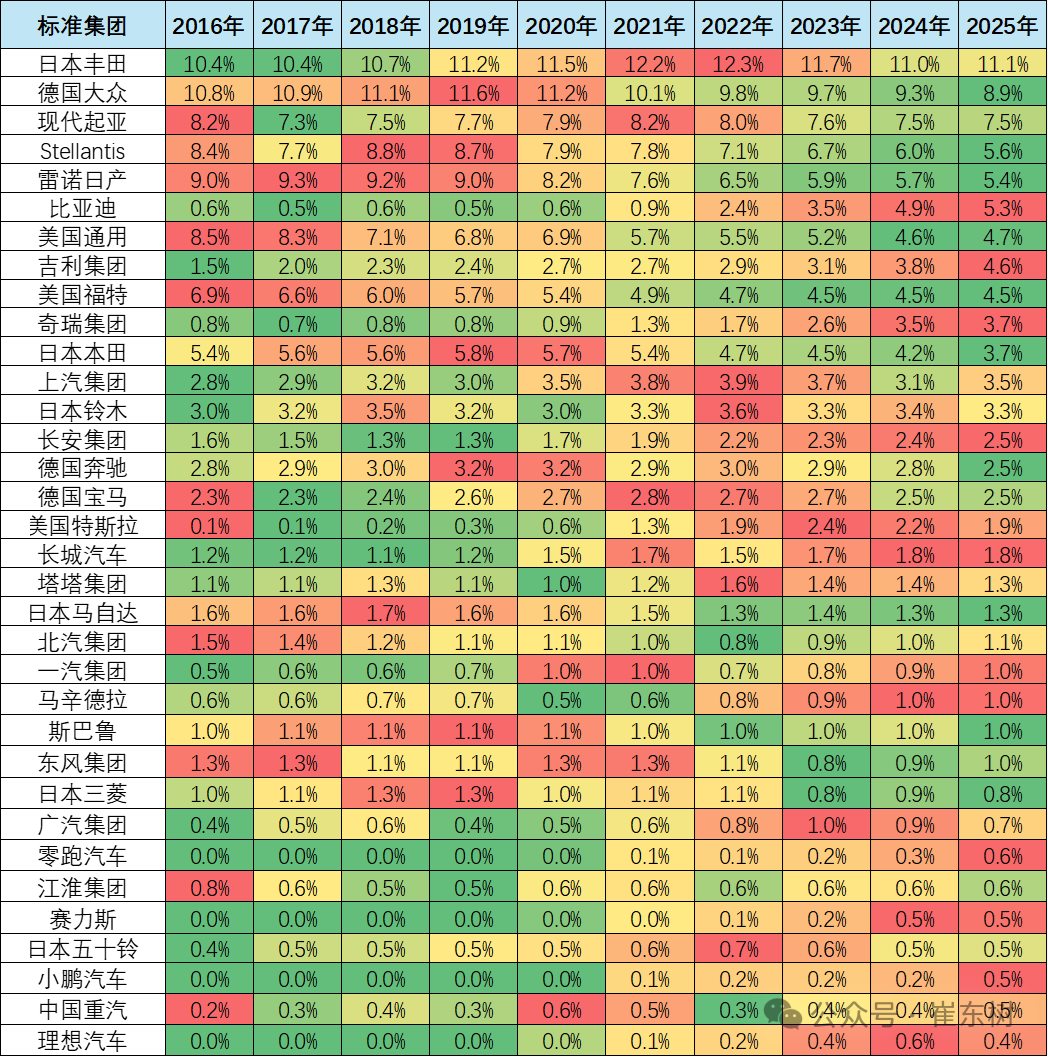

World share performance of international groups

This chart shows the global sales share trends of major automobile groups. Judging from the Group's overall performance at present, the share of leading international car companies has declined markedly, and Chinese car companies have generally performed well. As China, Russia, and India's position in the international car market has improved, and Asian car companies such as Geely, BYD, Chery, Changan, and Suzuki have performed well in the market, so the production and sales trend of Asian car companies is relatively good. European car companies generally performed poorly.

Among the top 10 car companies in the world, the shares of the 3 Chinese car companies rose strongly this year. BYD reached 6th place in the world, Geely 8th place, and Chery 10th place.

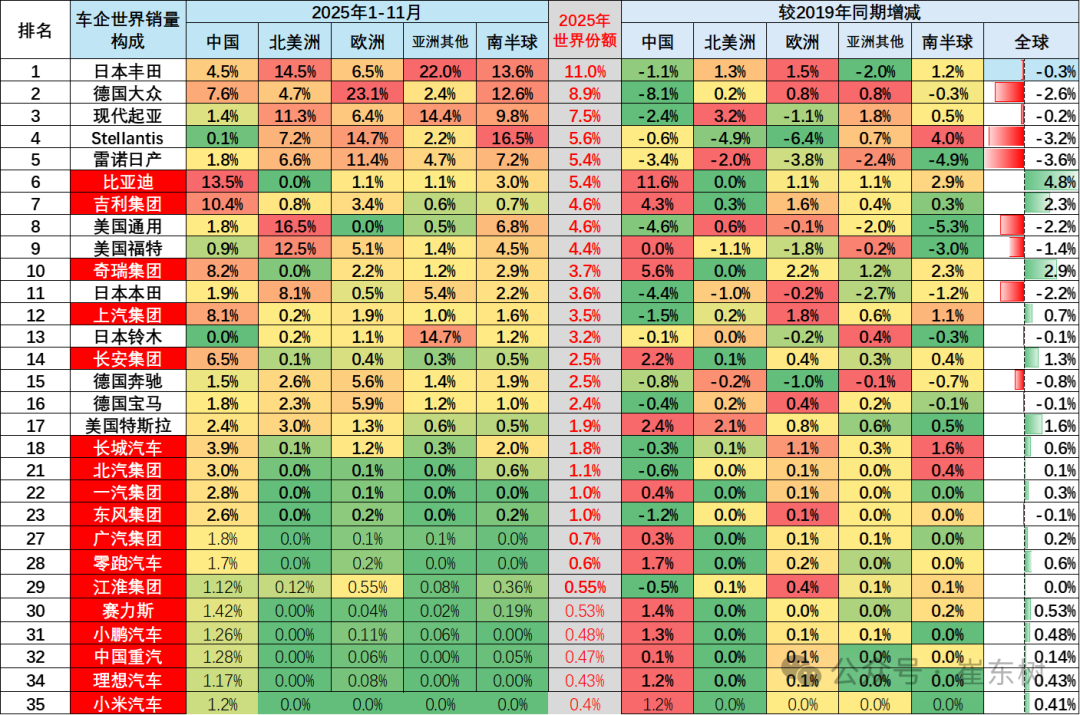

Regional share performance of international groups

Rising east and falling west, China's own brands are increasing their global share across the board. BYD, Geely, Chery, SAIC, Changan, etc. performed well independently.

In addition to favorable factors in the Indian market such as Suzuki and Tata, the share of other international brands declined significantly across the board in 2025.

Asian car companies are strong. From January to November 2025, the Toyota Group performed relatively well, down 0.3 percentage points from 2019, and maintained a global share of around 11% in 2025. This is also due to Toyota's overall strong performance in the European and North American markets. The trend of Hyundai Motors in Korea is relatively stable, reaching 7.5% from January to November 2025, down 0.2 percentage points from 2019. Korea Hyundai Group has performed well in other markets in North America and Asia, but the trend continues to be weak in China due to poor product strength. Suzuki's market performance is strong, mainly in markets such as India and Japan. The Honda Group also had poor performance this year, down 2.2% from 2019, and the performance of the Chinese market was weak.

From January to November 2025, European car companies were generally weak. In particular, Renault Nissan's share fell 3.6% from 2019, and Stellantis Volkswagen's performance was relatively weak. The share fell 3.2% compared to 2019, and the pressure on the Chinese market was high. The VW Group has generally improved significantly in other markets around the world, and the southern hemisphere market has clearly rebounded.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal