High Growth Tech Stocks Including Hangzhou DPtech TechnologiesLtd For Potential Portfolio Enhancement

As global markets continue to navigate a landscape marked by record highs in major U.S. indices and mixed economic signals, small-cap stocks, such as those in the Russell 2000 Index, have shown modest growth amidst these dynamics. In this environment, identifying high-growth tech stocks like Hangzhou DPtech Technologies Ltd can be pivotal for investors looking to enhance their portfolios by leveraging innovation-driven sectors that may thrive despite broader market fluctuations.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 34.73% | 40.54% | ★★★★★★ |

| Zhongji Innolight | 35.08% | 35.94% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.94% | 32.84% | ★★★★★★ |

| Shengyi Electronics | 24.67% | 33.32% | ★★★★★★ |

| Gold Circuit Electronics | 29.41% | 37.22% | ★★★★★★ |

| eWeLLLtd | 21.55% | 22.80% | ★★★★★★ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| CD Projekt | 37.82% | 51.75% | ★★★★★★ |

| Co-Tech Development | 35.68% | 75.80% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Hangzhou DPtech TechnologiesLtd (SZSE:300768)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou DPtech Technologies Co., Ltd., along with its subsidiary, operates in the network security sector across China, Hong Kong, and internationally, with a market cap of CN¥11.86 billion.

Operations: DPtech Technologies, with its subsidiary, focuses on network security businesses in China, Hong Kong, and globally.

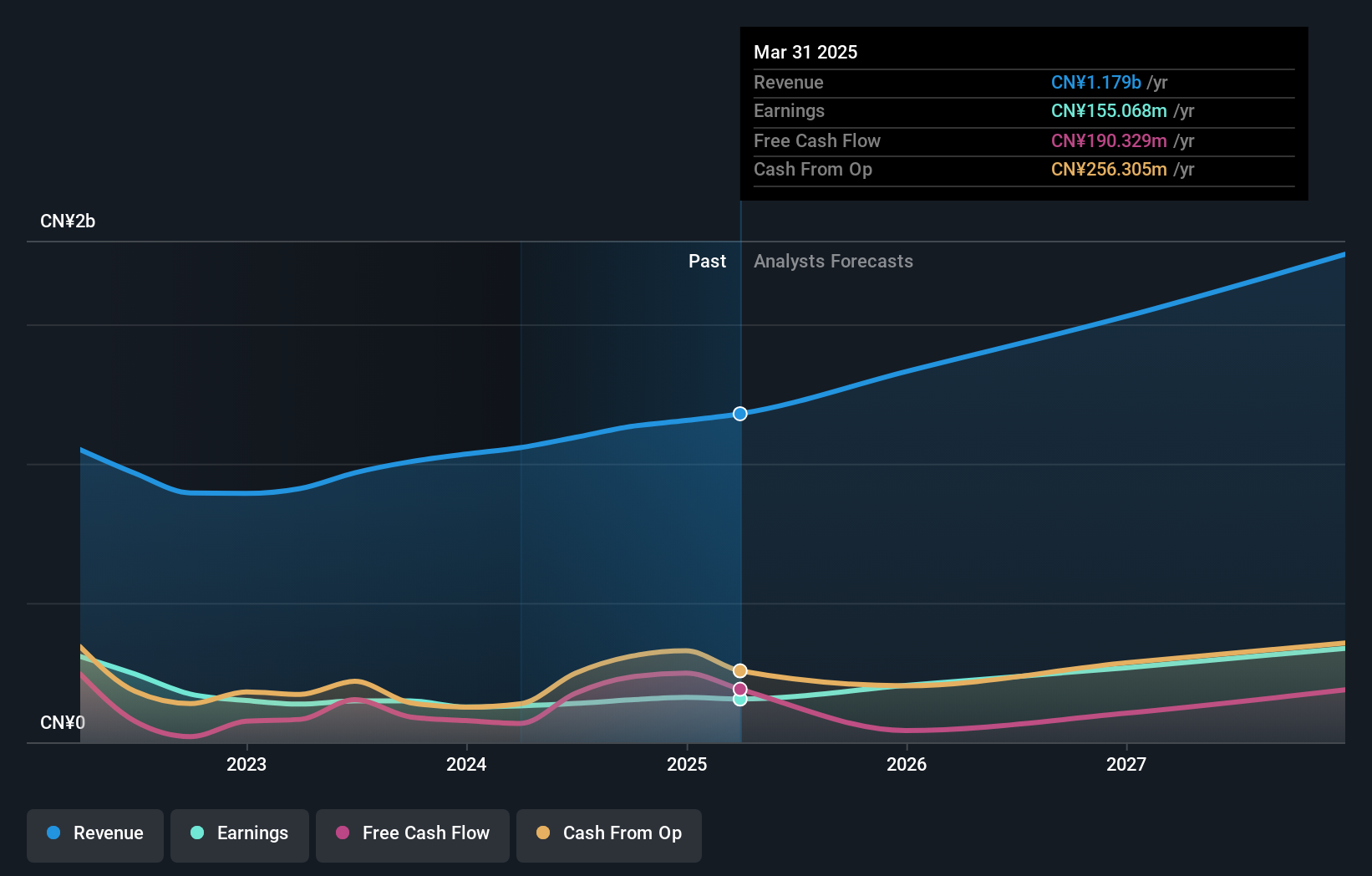

Hangzhou DPtech TechnologiesLtd has demonstrated robust financial performance with a notable increase in sales to CNY 870.72 million, up from CNY 819.3 million the previous year, reflecting a consistent revenue growth of 15.8% annually. This growth is complemented by an earnings surge projected at 30.3% per year, outpacing the broader Chinese market's expansion rate of 27.6%. The company's commitment to innovation is evident from its R&D investments which are crucial for maintaining its competitive edge in the rapidly evolving tech landscape. Moreover, DPtech’s recent earnings report underscores high-quality earnings and a positive free cash flow status, positioning it well for sustained operational success and making it a noteworthy entity in the tech sector despite fierce industry competition and faster-than-industry average growth rates.

- Click here to discover the nuances of Hangzhou DPtech TechnologiesLtd with our detailed analytical health report.

Learn about Hangzhou DPtech TechnologiesLtd's historical performance.

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. specializes in the planning, development, and selling of cloud-based solutions in Japan with a market capitalization of ¥223.16 billion.

Operations: Sansan, Inc. generates revenue primarily from its Sansan/Bill One Business, which accounts for ¥40.07 billion, while the Eight Business contributes ¥5.50 billion. The company's focus on cloud-based solutions underpins its business model in Japan's technology sector.

Sansan, a player in the contact management sector, is leveraging its niche to enhance business connectivity. With an annual revenue growth of 16.1% and earnings acceleration at 37.4%, it outstrips many within the tech sphere. Particularly notable is its investment in R&D, which has grown consistently, underpinning future innovations and service expansions. This focus on development not only sharpens competitive edges but also aligns with evolving digital transformation trends across global industries. As businesses increasingly rely on robust data networks and solutions like those Sansan offers, its strategic positioning could well dictate stronger market presence moving forward.

- Get an in-depth perspective on Sansan's performance by reading our health report here.

Review our historical performance report to gain insights into Sansan's's past performance.

CD Projekt (WSE:CDR)

Simply Wall St Growth Rating: ★★★★★★

Overview: CD Projekt S.A., along with its subsidiaries, focuses on developing, publishing, and digitally distributing video games for PCs and consoles in Poland, with a market capitalization of PLN24.13 billion.

Operations: The company generates revenue primarily through its CD PROJEKT RED segment, contributing PLN934.38 million, and GOG.Com, which adds PLN205.61 million. The business involves developing and distributing video games for PCs and consoles in Poland, with a focus on digital platforms.

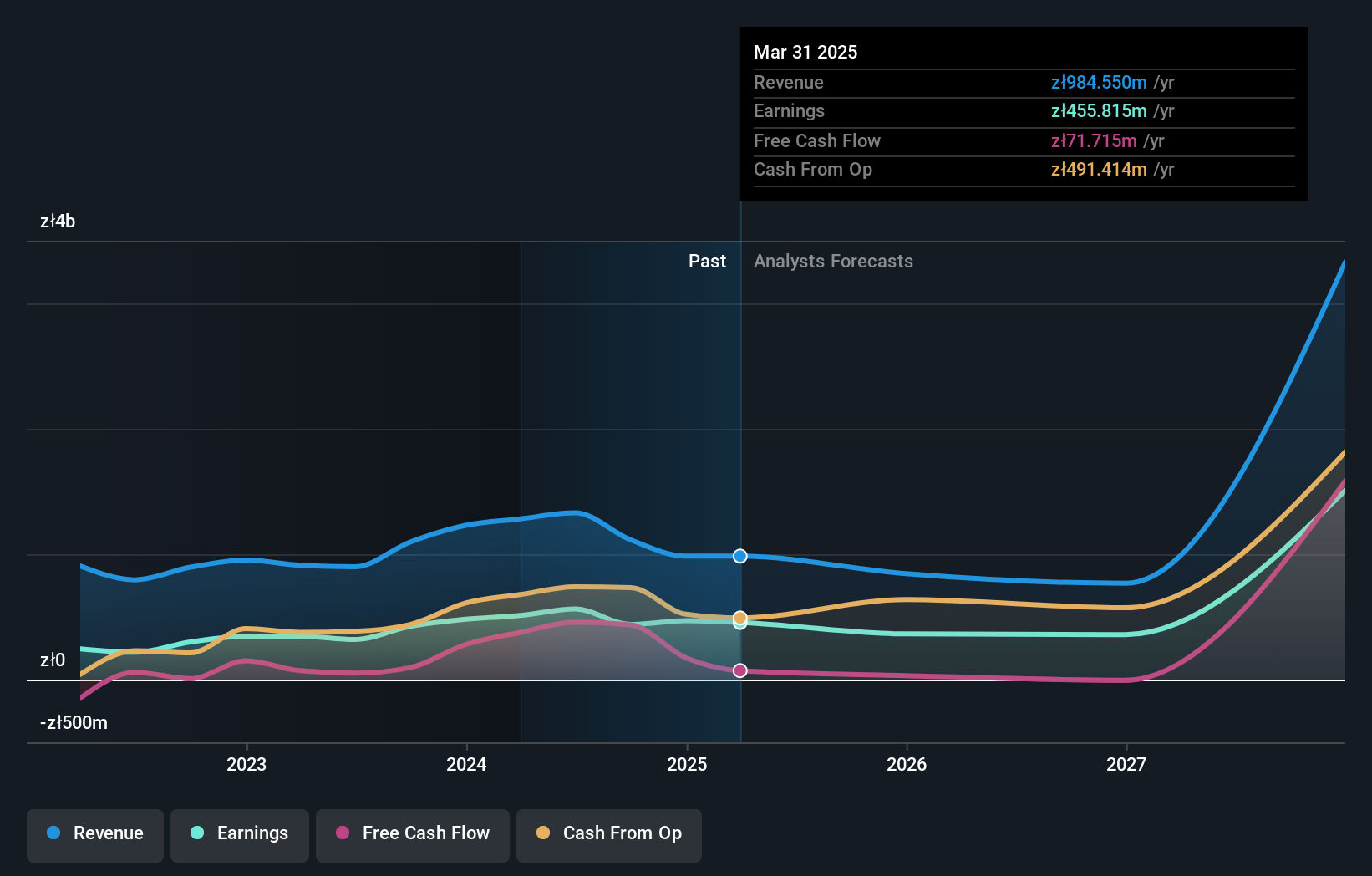

CD Projekt, a luminary in the gaming sector, is making significant strides with its financial and strategic maneuvers. The company's revenue has surged by 37.8% annually, outpacing the Polish market's growth of 4.6%. This robust expansion is complemented by an impressive earnings growth rate of 51.8% per year, dwarfing the local market average of 16.7%. A recent collaboration with VITURE to launch a limited-edition XR product underscores CD Projekt’s innovative edge and ability to blend art with cutting-edge technology, potentially opening new revenue streams and enhancing its brand prestige globally. This strategic move not only capitalizes on the trend towards immersive gaming experiences but also positions CD Projekt at the forefront of technological integration in entertainment, promising exciting future prospects for growth and innovation.

- Navigate through the intricacies of CD Projekt with our comprehensive health report here.

Explore historical data to track CD Projekt's performance over time in our Past section.

Summing It All Up

- Click here to access our complete index of 241 Global High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal