Global's Best Undervalued Small Caps With Insider Action In December 2025

As the U.S. economy experiences its fastest growth in two years and major indices like the S&P 500 and Dow Jones Industrial Average reach record highs, small-cap stocks have shown a more tempered performance, with the Russell 2000 Index inching up by just 0.19% during a holiday-shortened week. Despite this modest gain, investors are keenly observing small-cap opportunities that may arise from favorable economic data and AI optimism, especially those with notable insider activity that could indicate potential value in an otherwise cautious market landscape.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| East West Banking | 3.1x | 0.7x | 19.51% | ★★★★☆☆ |

| Vita Life Sciences | 15.0x | 1.6x | 36.82% | ★★★★☆☆ |

| Chinasoft International | 20.8x | 0.6x | -1172.88% | ★★★★☆☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.63% | ★★★★☆☆ |

| BWP Trust | 11.0x | 14.4x | 11.19% | ★★★★☆☆ |

| Dicker Data | 22.1x | 0.8x | -45.35% | ★★★☆☆☆ |

| Amaero | NA | 65.0x | 31.02% | ★★★☆☆☆ |

| Ever Sunshine Services Group | 6.2x | 0.4x | -399.68% | ★★★☆☆☆ |

| PSC | 9.8x | 0.4x | 19.55% | ★★★☆☆☆ |

| Betr Entertainment | NA | 1.5x | 9.64% | ★★★☆☆☆ |

Here's a peek at a few of the choices from the screener.

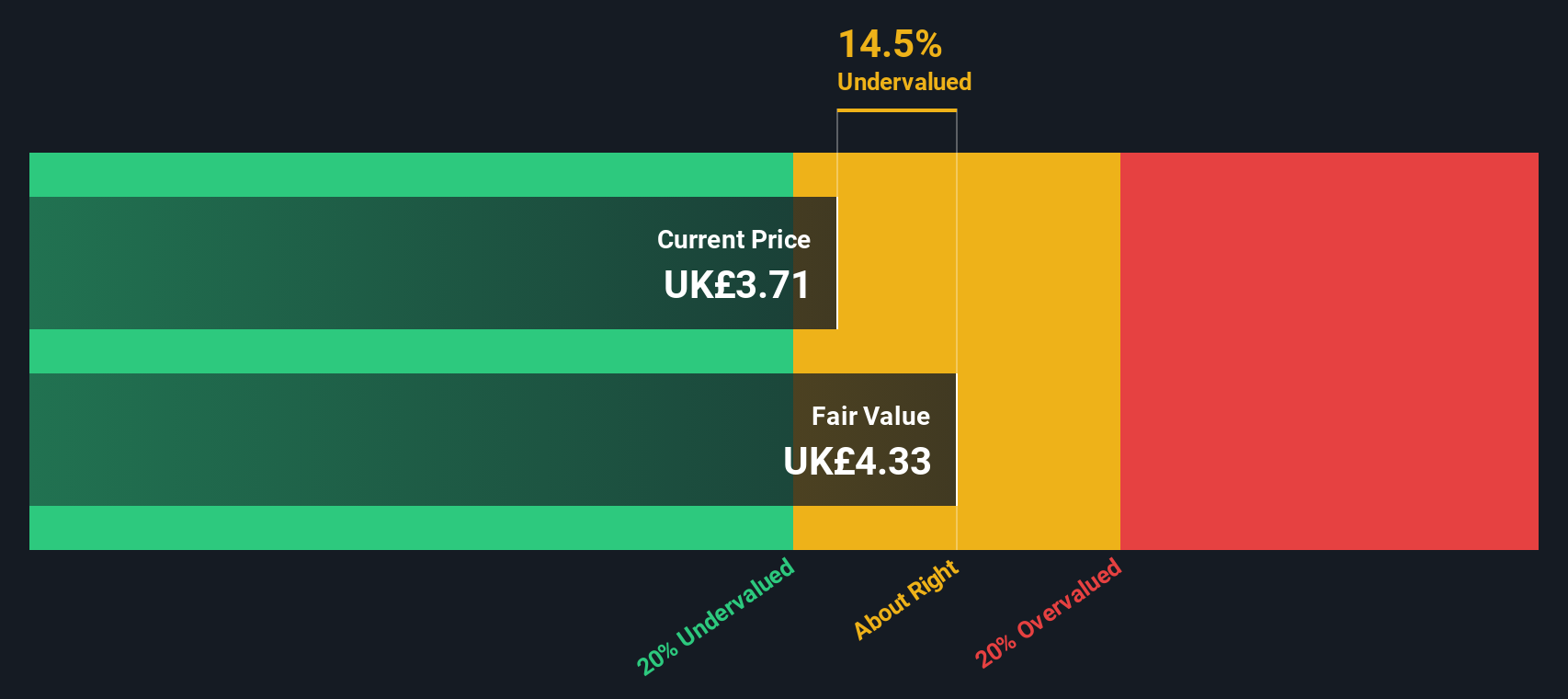

Hunting (LSE:HTG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hunting is an energy services provider that specializes in the manufacturing and distribution of products for the oil and gas industry, with a market cap of approximately £0.52 billion.

Operations: The company's revenue is primarily generated from North America, Asia Pacific, and Hunting Titan segments. Over recent periods, the gross profit margin has shown fluctuations, reaching 26.17% by mid-2025. Operating expenses are a significant cost component, with general and administrative expenses consistently being a major part of these costs.

PE: -21.7x

Hunting, a small cap stock, is making strides with its recent contract win in Brazil, marking a strategic entry into the South American market. This deal showcases their enhanced oil recovery technology's potential to boost reservoir performance and extend field life. Insider confidence is evident with share purchases over the past year. With earnings projected to grow 41% annually and $336 million liquidity for acquisitions, Hunting aims for expansion despite relying on external borrowing.

- Get an in-depth perspective on Hunting's performance by reading our valuation report here.

Gain insights into Hunting's historical performance by reviewing our past performance report.

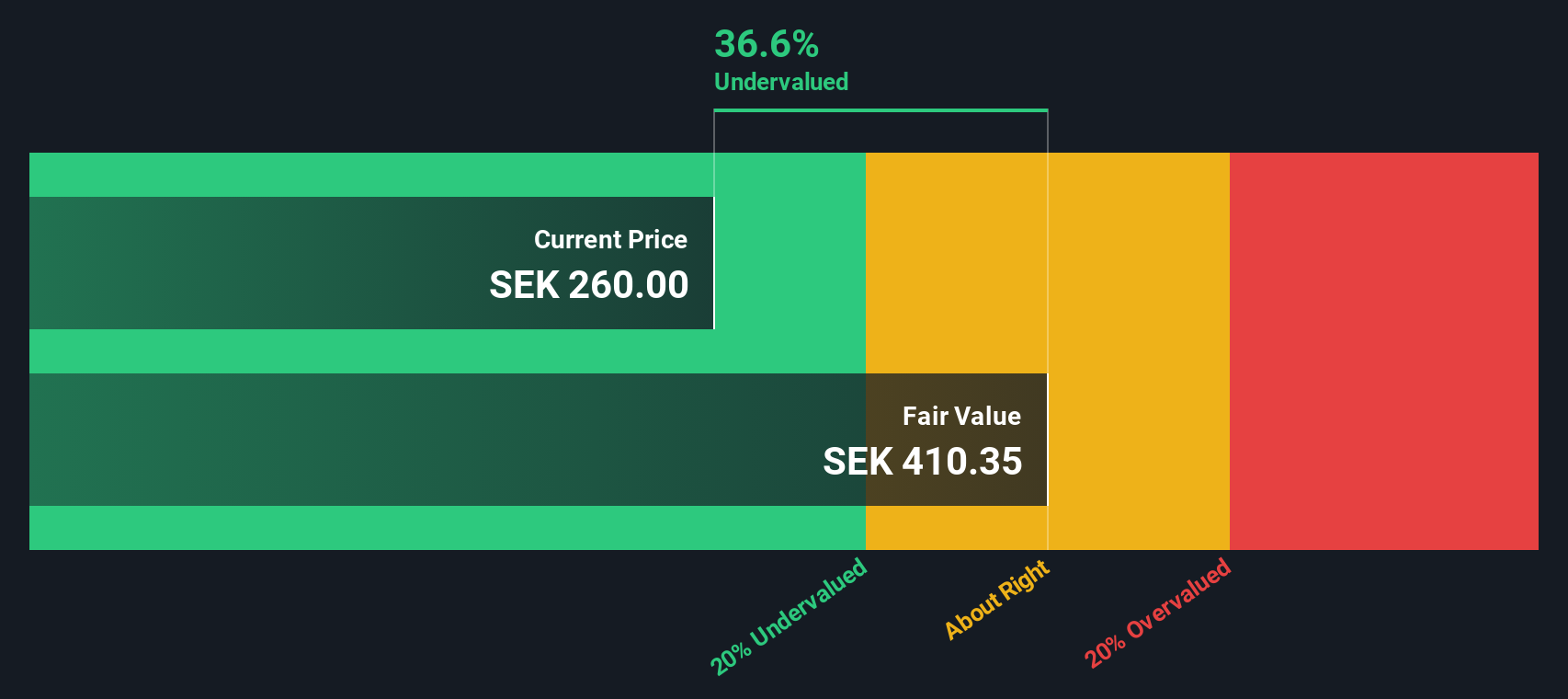

Invisio (OM:IVSO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Invisio specializes in advanced communication systems for defense and security sectors, with a market cap of approximately SEK 8.45 billion.

Operations: The company generates revenue primarily from the Aerospace & Defense sector, with recent figures showing a gross profit margin of 58.48%. Operating expenses are substantial, driven by significant allocations to sales and marketing as well as research and development. Net income margin has shown variability, recently recorded at 12.71%.

PE: 58.1x

Invisio, a small company in the communication solutions industry, has recently seen insider confidence with Lars Hansen purchasing 510,000 shares valued at SEK 214.2 million. Despite a challenging third quarter with sales dropping to SEK 291.3 million and a net loss of SEK 4.2 million, the company secured significant contracts including a SEK 190 million order from Europe and a framework agreement potentially worth up to SEK 365 million with the Netherlands Ministry of Defense. These developments highlight Invisio's potential for growth as demand for its advanced systems increases amidst projected earnings growth of over 45% annually.

- Dive into the specifics of Invisio here with our thorough valuation report.

Explore historical data to track Invisio's performance over time in our Past section.

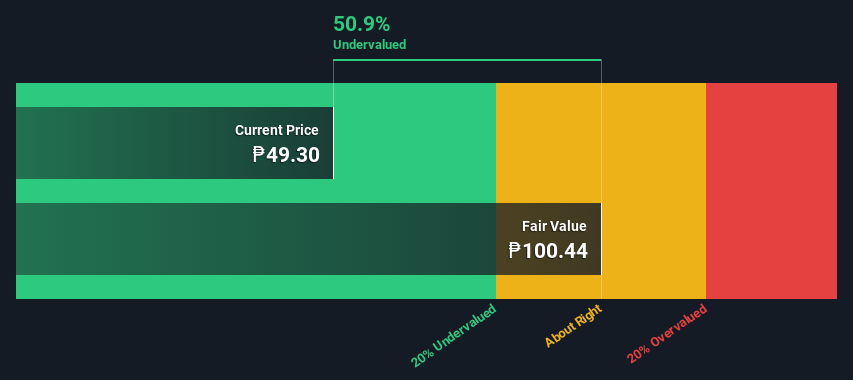

Philippine National Bank (PSE:PNB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Philippine National Bank is a major financial institution in the Philippines, primarily engaged in retail and corporate banking, treasury operations, and other financial services with a market capitalization of ₱60.24 billion.

Operations: The bank primarily generates revenue from retail banking, corporate banking, and treasury operations. Retail banking is the largest contributor with ₱35.10 billion in revenue, followed by corporate banking at ₱14.49 billion and treasury operations at ₱12.50 billion. The net income margin has shown variability over time, reaching as high as 38.94% in recent periods. Operating expenses are significant, with general and administrative expenses being a major component of these costs.

PE: 3.4x

Philippine National Bank, a smaller player in the financial sector, has shown signs of potential value with its recent performance. The bank's net income for Q3 2025 increased to PHP 5.96 billion from PHP 4.74 billion the previous year, indicating solid earnings growth. However, it grapples with a high bad loans ratio of 6.5% and a low allowance for bad loans at 82%. Insider confidence is evident as Executive VP & CFO Francis Albalate acquired shares worth approximately PHP 13.52 million over the past year, signaling belief in future prospects despite challenges like leadership changes and strategic adjustments within its branch banking group set to take effect early next year.

Next Steps

- Access the full spectrum of 142 Undervalued Global Small Caps With Insider Buying by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal