Global's Leading Dividend Stocks To Consider

As global markets continue to navigate a mix of economic growth and consumer confidence challenges, the U.S. indices have reached record highs, buoyed by favorable data and optimism around artificial intelligence. In this dynamic environment, dividend stocks can offer investors a steady income stream and potential resilience against market volatility, making them an appealing consideration for those seeking stability amidst fluctuating conditions.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.69% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.32% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.04% | ★★★★★★ |

| NCD (TSE:4783) | 3.95% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.72% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.73% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.37% | ★★★★★★ |

Click here to see the full list of 1280 stocks from our Top Global Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Keepers Holdings (PSE:KEEPR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Keepers Holdings, Inc. is an investment holding company involved in the distribution of liquor, wine, and specialty beverages in the Philippines with a market cap of ₱35.98 billion.

Operations: The Keepers Holdings, Inc. generates revenue of ₱20.21 billion from its distribution of spirits, wines, and specialty beverages in the Philippines.

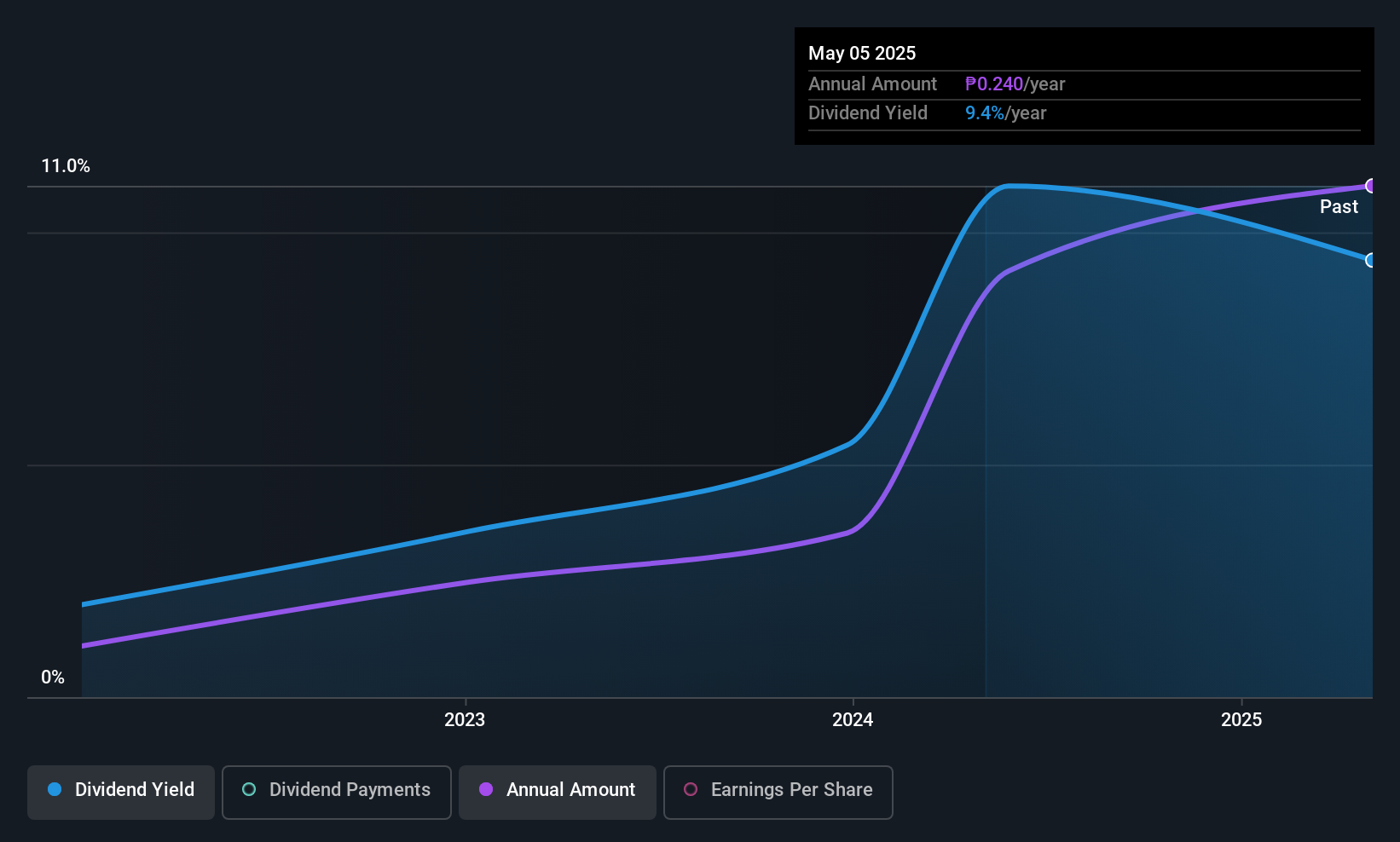

Dividend Yield: 9.7%

Keepers Holdings' dividends have been growing steadily, supported by a sustainable payout ratio of 45.8% and a cash payout ratio of 57.2%. Although the company has only paid dividends for four years, these payments have been reliable with minimal volatility. Recent earnings growth of 15.8% and strong financial results—PHP 13.39 billion in sales and PHP 2.50 billion net income—further underpin its dividend strategy, placing it among the top dividend payers in the Philippine market with a yield of 9.68%.

- Click to explore a detailed breakdown of our findings in Keepers Holdings' dividend report.

- Our valuation report unveils the possibility Keepers Holdings' shares may be trading at a discount.

Miyaji Engineering GroupInc (TSE:3431)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Miyaji Engineering Group Inc., with a market cap of ¥50.04 billion, operates through its subsidiaries in the construction and civil engineering sectors in Japan.

Operations: Miyaji Engineering Group Inc. generates its revenue from two main segments: MEC, contributing ¥44.26 billion, and MMB, adding ¥23.07 billion.

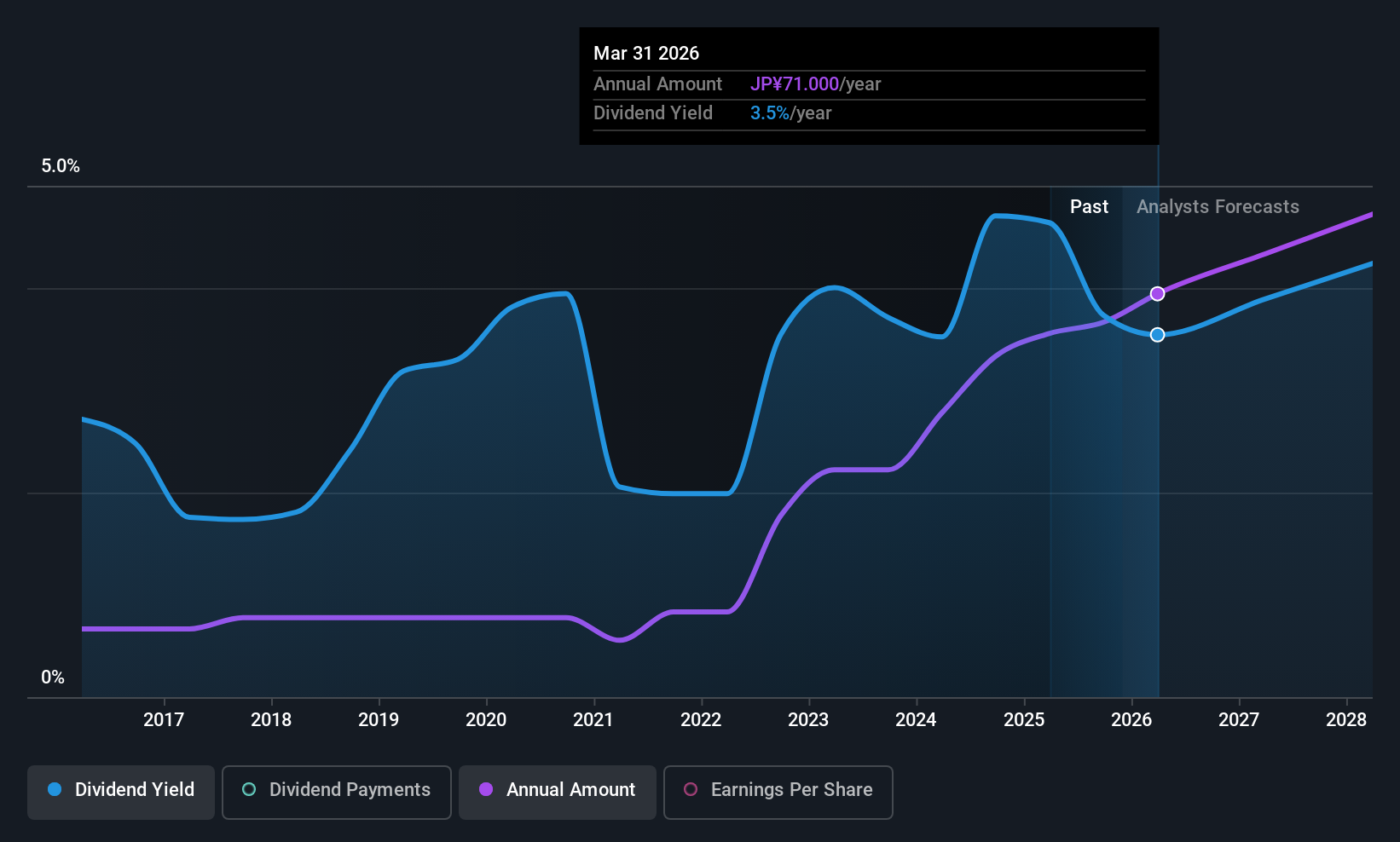

Dividend Yield: 5.2%

Miyaji Engineering Group's dividend yield of 5.17% ranks it in the top 25% of Japanese dividend payers, but its sustainability is questionable as dividends are not covered by free cash flows. Despite a reasonable payout ratio of 58.7%, past dividend payments have been volatile and unreliable, with significant annual drops over the last decade. Recent earnings guidance indicates improved profitability, which could support future payouts if sustained.

- Navigate through the intricacies of Miyaji Engineering GroupInc with our comprehensive dividend report here.

- Our valuation report unveils the possibility Miyaji Engineering GroupInc's shares may be trading at a premium.

FUJIKURA COMPOSITES (TSE:5121)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FUJIKURA COMPOSITES Inc. manufactures and sells industrial rubber components across Japan, the United States, China, and other international markets with a market cap of ¥39.19 billion.

Operations: FUJIKURA COMPOSITES Inc.'s revenue is primarily derived from Industrial Materials at ¥23.53 billion, followed by Sporting Goods at ¥13.85 billion, and Fabric Processed Products at ¥3.65 billion.

Dividend Yield: 3.2%

Fujikura Composites' dividends are well covered by earnings and cash flows, with a payout ratio of 32.4% and a cash payout ratio of 46.8%. However, its dividend yield of 3.23% is below the top tier in Japan, and past payments have been volatile. Recent initiatives include a share buyback program worth ¥2 billion to enhance shareholder value. The company also announced an increased dividend payment for the latest quarter, indicating potential growth in distributions.

- Click here and access our complete dividend analysis report to understand the dynamics of FUJIKURA COMPOSITES.

- According our valuation report, there's an indication that FUJIKURA COMPOSITES' share price might be on the cheaper side.

Key Takeaways

- Discover the full array of 1280 Top Global Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal