Discovering Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi And 2 Other Middle Eastern Penny Stocks

The Middle Eastern markets have been experiencing gains, buoyed by expectations of further Federal Reserve interest rate cuts, despite the tempered sentiment from subdued oil prices. In this context, understanding what makes a good stock is crucial. Penny stocks, though often seen as a relic of past market eras, continue to offer potential opportunities for growth at lower price points when they possess strong financial fundamentals. This article explores several promising penny stocks in the Middle East that may present compelling investment opportunities.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Thob Al Aseel (SASE:4012) | SAR3.34 | SAR1.32B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪2.509 | ₪179.93M | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.05 | AED2.14B | ✅ 3 ⚠️ 2 View Analysis > |

| Sharjah Insurance Company P.S.C (ADX:SICO) | AED1.52 | AED228M | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.50 | AED724.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Arabian Pipes (SASE:2200) | SAR4.66 | SAR932M | ✅ 3 ⚠️ 0 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.25 | AED386.93M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED3.66 | AED15.52B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.849 | AED517.02M | ✅ 2 ⚠️ 1 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.61 | ₪204.88M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 82 stocks from our Middle Eastern Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi produces and sells foam products both in Turkey and internationally, with a market cap of TRY871.75 million.

Operations: Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi generates revenue primarily from its Textile Operation, which accounts for TRY10.58 billion, and its Polyurethane Operations, contributing TRY28.24 million.

Market Cap: TRY871.75M

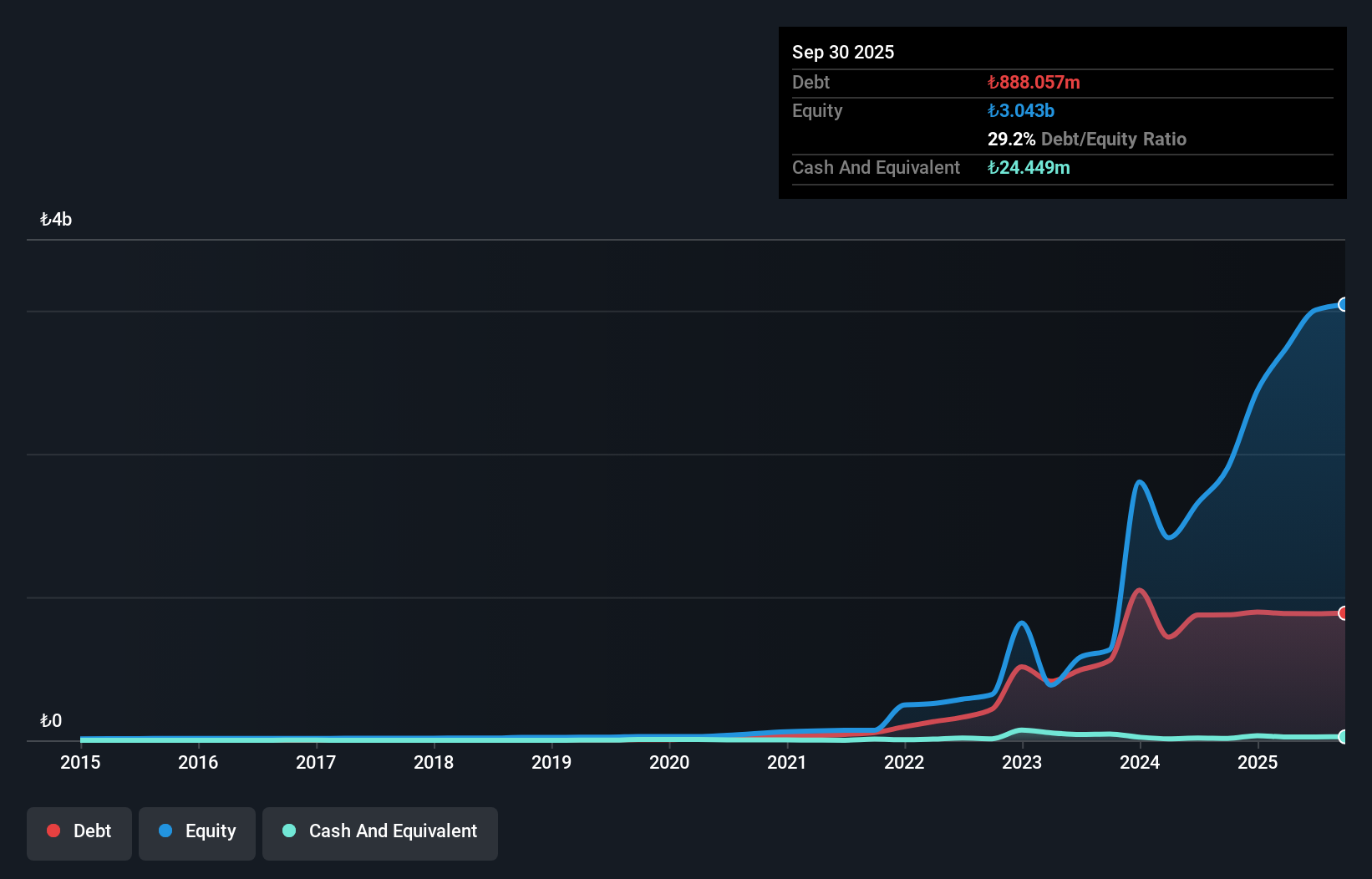

Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi, with a market cap of TRY871.75 million, shows strong financial indicators for a penny stock. Despite recent earnings volatility and a net loss in the third quarter of 2025, the company has demonstrated significant profit growth over the past year at 103.7%, surpassing its five-year average growth rate. Its debt management is commendable, with satisfactory net debt to equity and well-covered interest payments by EBIT. The company's short-term assets exceed both its short- and long-term liabilities, providing solid financial footing amidst fluctuating sales figures.

- Click here and access our complete financial health analysis report to understand the dynamics of Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi.

- Examine Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi's past performance report to understand how it has performed in prior years.

Seyitler Kimya Sanayi (IBSE:SEYKM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Seyitler Kimya Sanayi A.S. develops and sells medical adhesive tape products in Turkey, with a market cap of TRY980 million.

Operations: The company generates revenue primarily from its Disposable Medical Products segment, amounting to TRY175.71 million.

Market Cap: TRY980M

Seyitler Kimya Sanayi A.S., with a market cap of TRY980 million, presents a mixed picture for penny stock investors. Despite being unprofitable, the company has managed to maintain a positive free cash flow and has more cash than debt, ensuring a stable financial position. Its short-term assets significantly exceed both short- and long-term liabilities. However, earnings have declined by 53.9% annually over the past five years, and recent sales figures show a downturn from TRY95.07 million to TRY50.26 million year-over-year in Q3 2025, indicating challenges in revenue generation despite improved net income performance recently.

- Jump into the full analysis health report here for a deeper understanding of Seyitler Kimya Sanayi.

- Understand Seyitler Kimya Sanayi's track record by examining our performance history report.

Ratio Petroleum Energy - Limited Partnership (TASE:RTPT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ratio Petroleum Energy - Limited Partnership is involved in the exploration, development, and production of oil and gas, with a market cap of ₪55.76 million.

Operations: No revenue segments have been reported for this company.

Market Cap: ₪55.76M

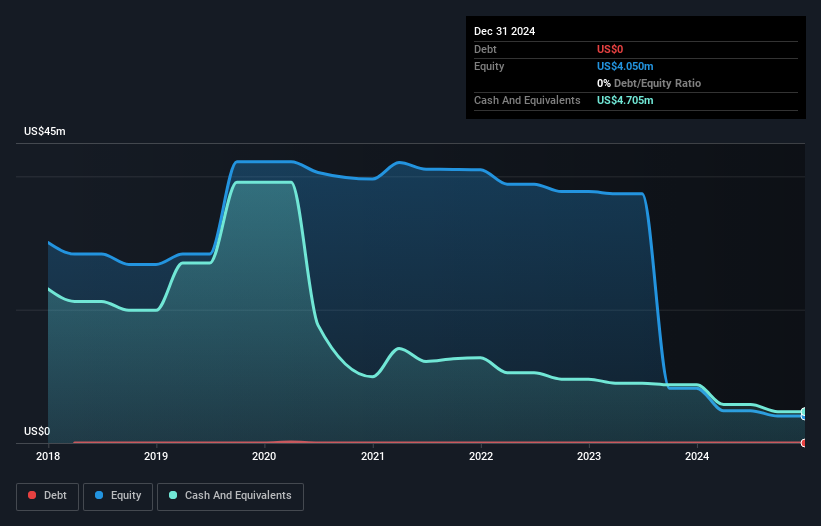

Ratio Petroleum Energy - Limited Partnership, with a market cap of ₪55.76 million, is a pre-revenue entity in the oil and gas sector. The company remains unprofitable, with increasing losses over the past five years at 7.2% annually. Despite this, it benefits from a seasoned board with an average tenure of 9.1 years and maintains financial stability through sufficient cash runway for over three years without debt concerns. Short-term assets ($4.9M) comfortably cover both short- ($1.4M) and long-term liabilities ($127K), while shareholders have not faced significant dilution recently despite negative return on equity (-35.11%).

- Click to explore a detailed breakdown of our findings in Ratio Petroleum Energy - Limited Partnership's financial health report.

- Evaluate Ratio Petroleum Energy - Limited Partnership's historical performance by accessing our past performance report.

Key Takeaways

- Click here to access our complete index of 82 Middle Eastern Penny Stocks.

- Searching for a Fresh Perspective? We've found 10 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal