UK Growth Companies With High Insider Ownership December 2025

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic uncertainties. In such a climate, growth companies with high insider ownership can be appealing as they often reflect confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| Quantum Base Holdings (AIM:QUBE) | 33.9% | 93.2% |

| Plexus Holdings (AIM:POS) | 11.5% | 140% |

| Manolete Partners (AIM:MANO) | 34.9% | 38.1% |

| Kainos Group (LSE:KNOS) | 20.6% | 23% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Hochschild Mining (LSE:HOC) | 38.4% | 40.8% |

| Energean (LSE:ENOG) | 19% | 21.1% |

| Afentra (AIM:AET) | 37.7% | 38.2% |

| ActiveOps (AIM:AOM) | 21.9% | 102.9% |

Here we highlight a subset of our preferred stocks from the screener.

Mortgage Advice Bureau (Holdings) (AIM:MAB1)

Simply Wall St Growth Rating: ★★★★☆☆

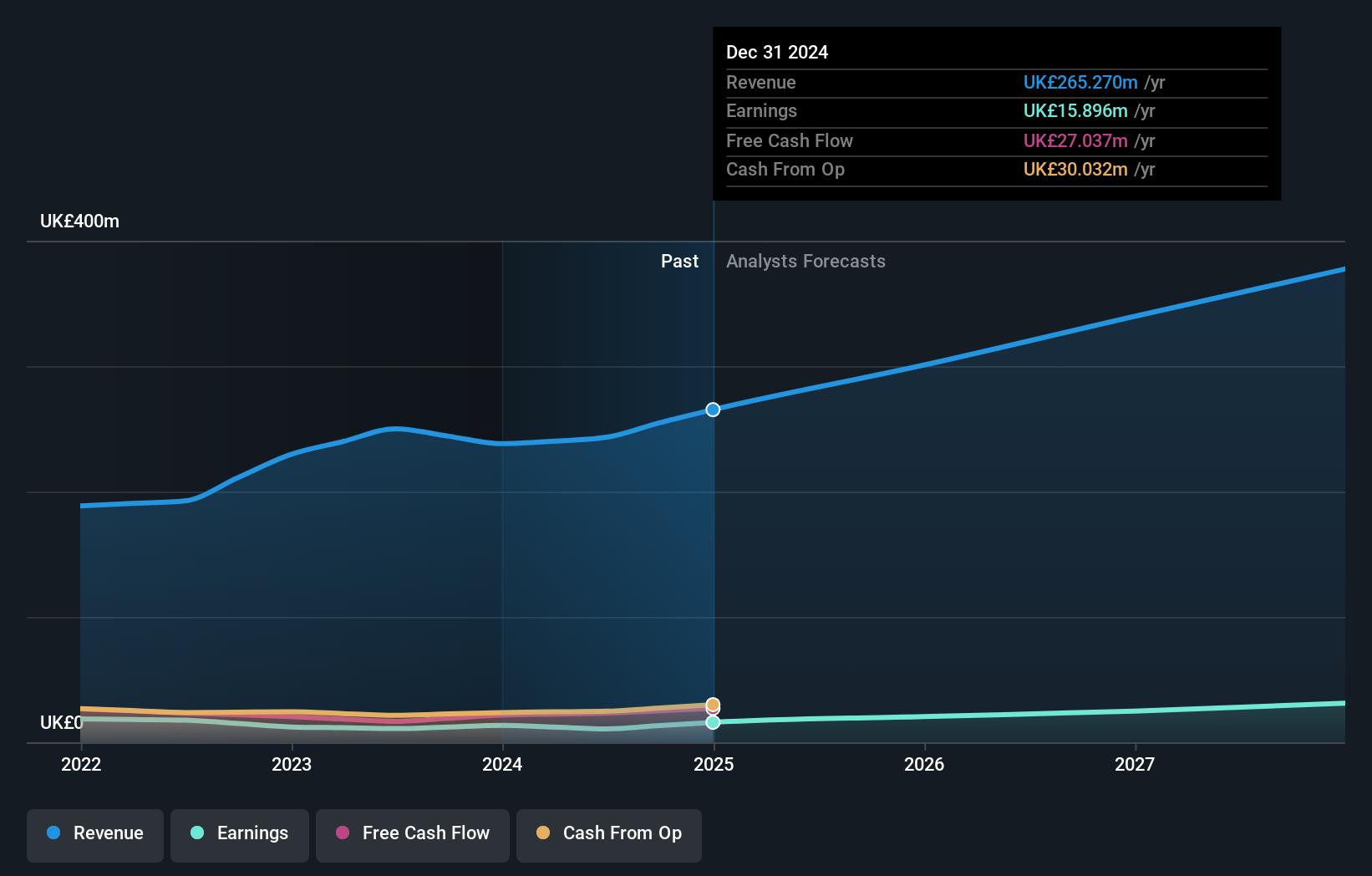

Overview: Mortgage Advice Bureau (Holdings) plc, along with its subsidiaries, offers mortgage advice services in the United Kingdom and has a market capitalization of approximately £389.91 million.

Operations: The company generates revenue primarily through its provision of financial services, amounting to £289.64 million.

Insider Ownership: 18.2%

Earnings Growth Forecast: 19.1% p.a.

Mortgage Advice Bureau (Holdings) has shown strong growth with earnings increasing by 77.1% over the past year and forecasted to grow at 19.1% annually, outpacing the UK market. Revenue is projected to rise by 11% per year, faster than the market's 4.4%. Insider buying has occurred recently, though not in substantial volumes. The appointment of Yaiza Luengo as COO may bolster strategic initiatives given her extensive experience in financial services transformation and technology-enabled change.

- Take a closer look at Mortgage Advice Bureau (Holdings)'s potential here in our earnings growth report.

- Our expertly prepared valuation report Mortgage Advice Bureau (Holdings) implies its share price may be too high.

SRT Marine Systems (AIM:SRT)

Simply Wall St Growth Rating: ★★★★★★

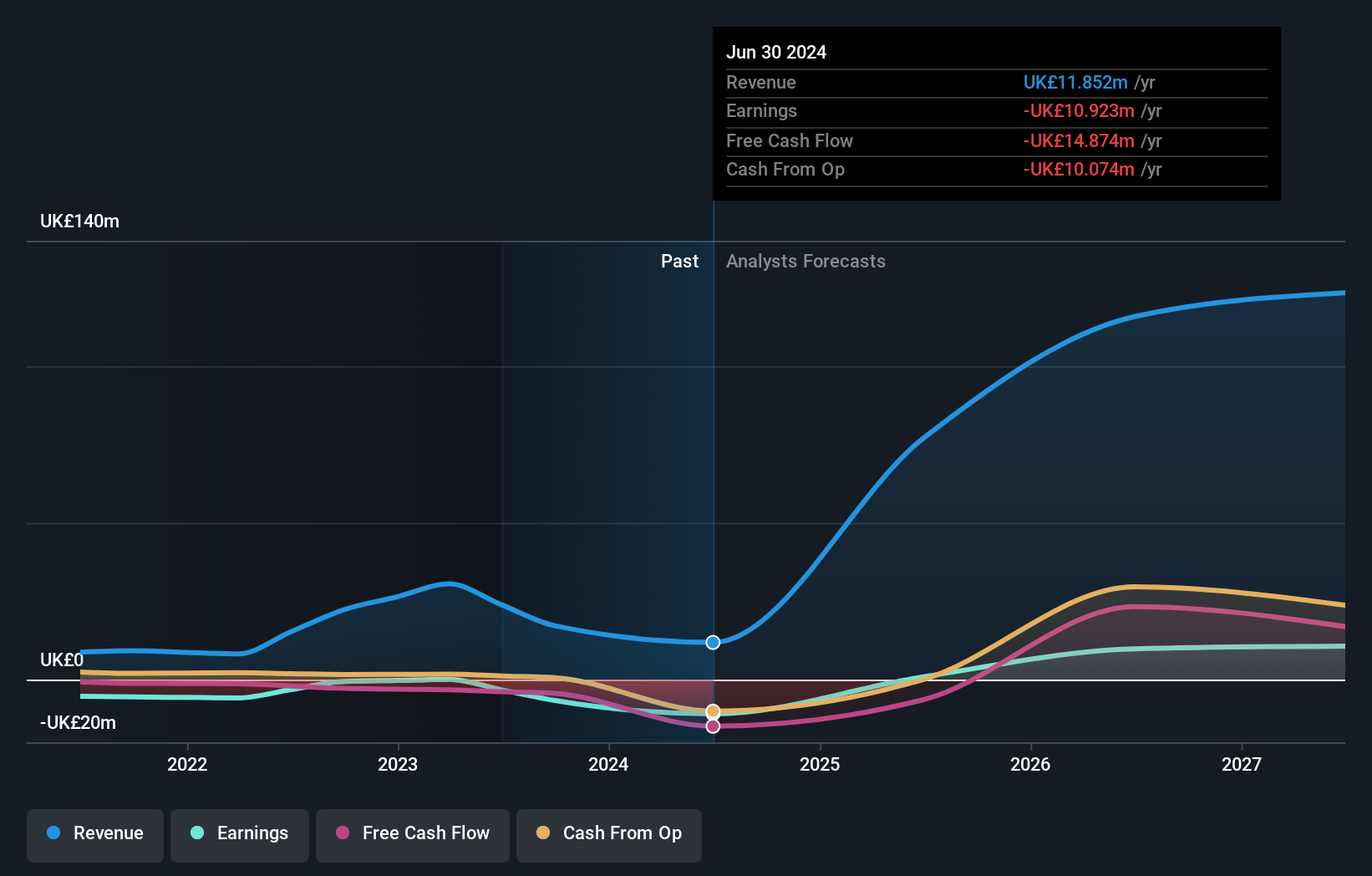

Overview: SRT Marine Systems plc, along with its subsidiaries, develops and supplies AIS-based maritime domain awareness technologies, products, and systems, with a market cap of £188.64 million.

Operations: The company's revenue is primarily generated from its Marine Technology Business, which accounted for £78.02 million.

Insider Ownership: 16.3%

Earnings Growth Forecast: 57.8% p.a.

SRT Marine Systems, with high insider ownership, recently reported annual sales of £78.02 million and a net income of £2.03 million. The company has become profitable this year and is forecasted to grow earnings by 57.8% annually over the next three years, significantly outpacing the UK market's growth rate. Revenue is expected to increase by 21.5% per year, also exceeding market averages, although debt coverage by operating cash flow remains a concern.

- Navigate through the intricacies of SRT Marine Systems with our comprehensive analyst estimates report here.

- Our valuation report here indicates SRT Marine Systems may be overvalued.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★☆☆

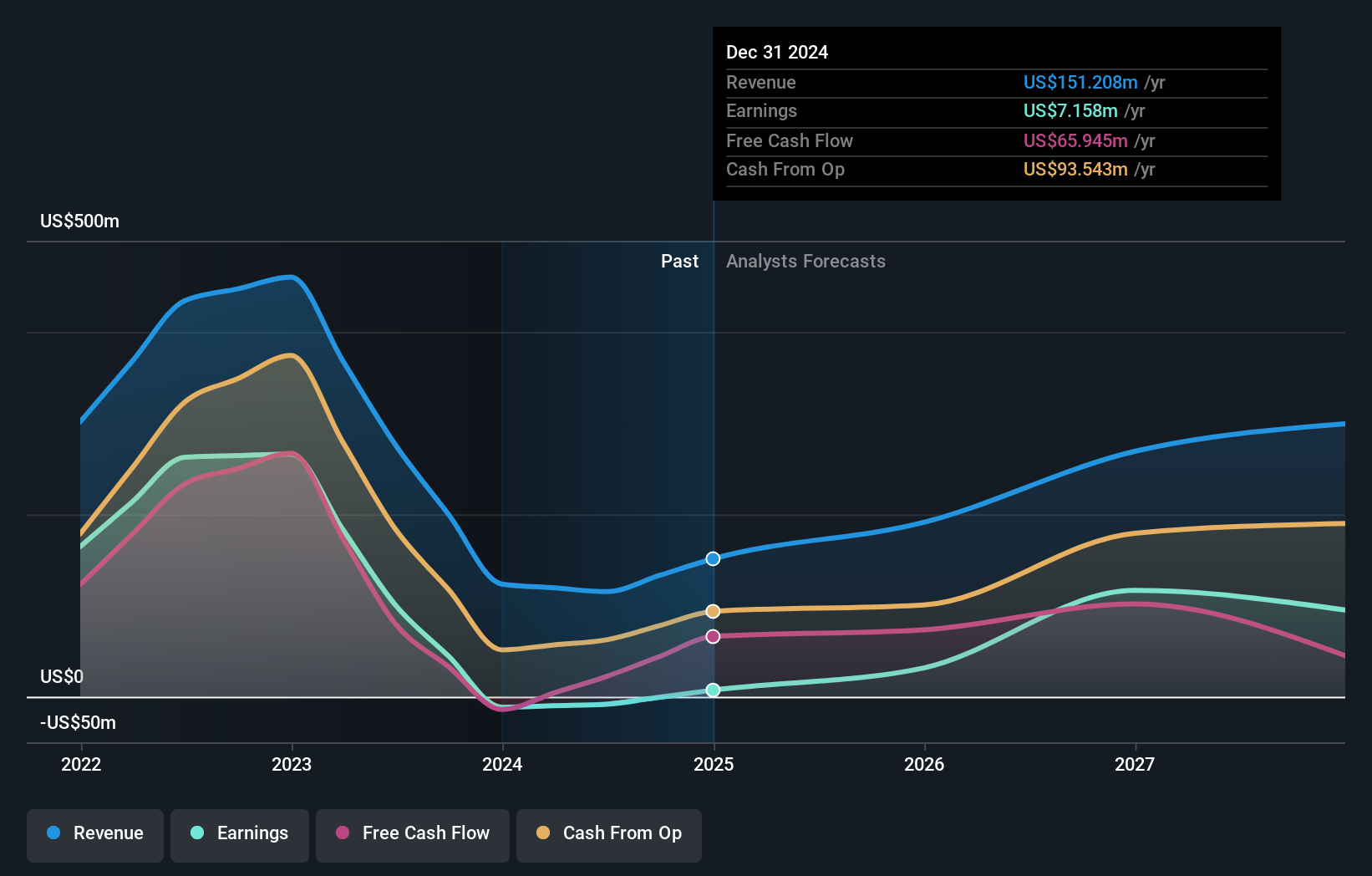

Overview: Gulf Keystone Petroleum Limited is involved in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of £376.11 million.

Operations: The company's revenue is derived from its operations in the exploration and production of oil and gas, amounting to $163.17 million.

Insider Ownership: 12.2%

Earnings Growth Forecast: 87.7% p.a.

Gulf Keystone Petroleum, with significant insider ownership, is expected to achieve profitability within three years, surpassing average market growth. While earnings are forecasted to grow 87.75% annually, revenue growth of 18.8% per year outpaces the UK market's 4.4% but remains below the 20% threshold for high growth. The dividend yield of 9.85% is not well covered by earnings and Return on Equity is projected at a modest 14.7%, indicating potential challenges in delivering shareholder value long-term.

- Unlock comprehensive insights into our analysis of Gulf Keystone Petroleum stock in this growth report.

- Upon reviewing our latest valuation report, Gulf Keystone Petroleum's share price might be too optimistic.

Taking Advantage

- Reveal the 52 hidden gems among our Fast Growing UK Companies With High Insider Ownership screener with a single click here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal