European Stocks Estimated To Be Trading At Up To 49.9% Below Intrinsic Value

As the pan-European STOXX Europe 600 Index closes just shy of a record high amid positive sentiment about future earnings and economic prospects, investors are keenly observing opportunities within the European market. In this environment, identifying stocks trading below their intrinsic value can be particularly appealing, as these may offer potential for growth when the broader economic recovery takes hold.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.078 | €6.05 | 49.1% |

| Sanoma Oyj (HLSE:SANOMA) | €9.47 | €18.46 | 48.7% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.50 | NOK66.01 | 49.2% |

| Kamux Oyj (HLSE:KAMUX) | €2.22 | €4.41 | 49.7% |

| Hemnet Group (OM:HEM) | SEK171.80 | SEK337.32 | 49.1% |

| Gentili Mosconi (BIT:GM) | €3.30 | €6.54 | 49.5% |

| Elekta (OM:EKTA B) | SEK57.05 | SEK113.78 | 49.9% |

| Dynavox Group (OM:DYVOX) | SEK102.70 | SEK203.06 | 49.4% |

| Doxee (BIT:DOX) | €3.81 | €7.44 | 48.8% |

| Allcore (BIT:CORE) | €1.36 | €2.66 | 48.9% |

We're going to check out a few of the best picks from our screener tool.

BFF Bank (BIT:BFF)

Overview: BFF Bank S.p.A. specializes in non-recourse factoring and credit management for public administration bodies and private hospitals across several European countries, with a market cap of €1.79 billion.

Operations: The company's revenue from Financial Services - Commercial amounts to €397.58 million.

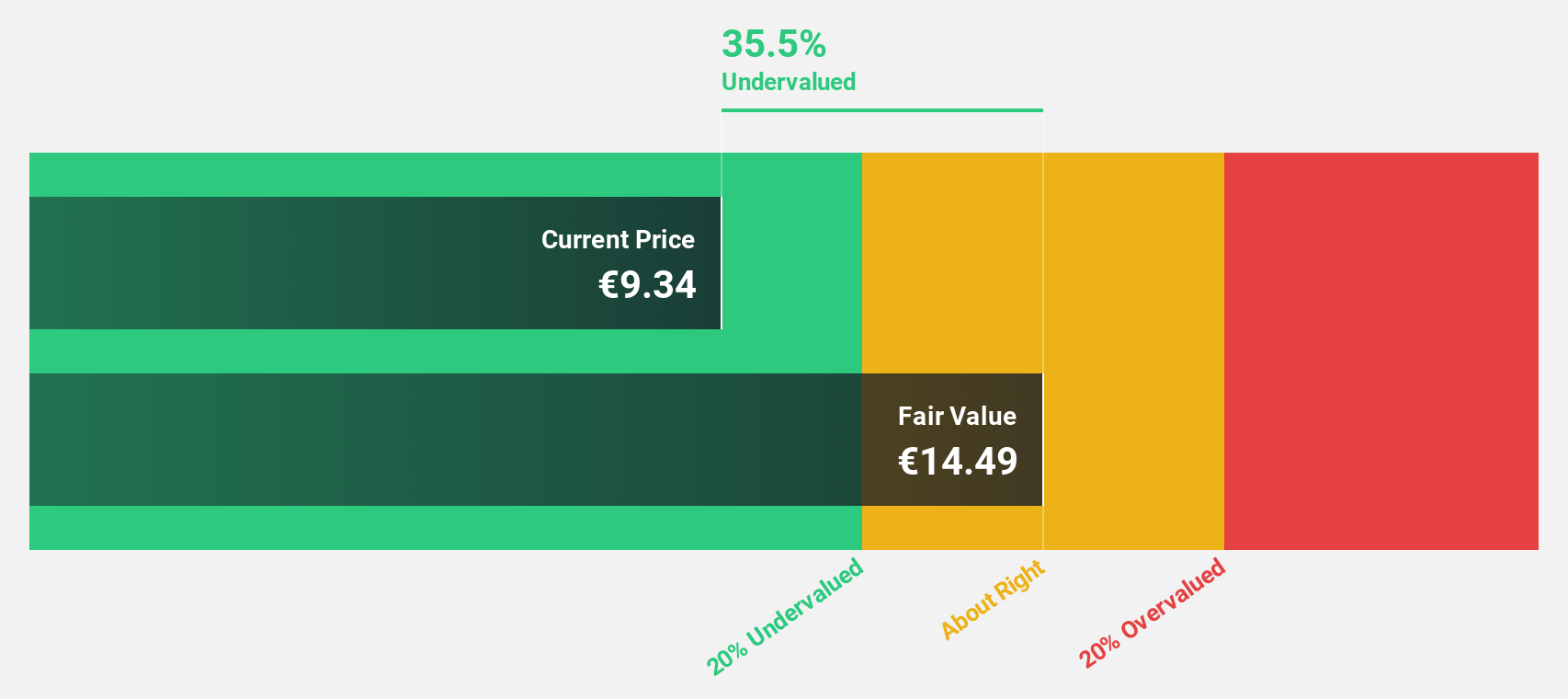

Estimated Discount To Fair Value: 25.2%

BFF Bank is trading at €9.49, below its estimated fair value of €12.69, indicating it may be undervalued based on cash flows. Despite a high debt level and unstable dividend history, BFF's earnings are forecast to grow 15.85% annually, outpacing the Italian market's 9.9%. Revenue growth is also expected to surpass the market average at 8.2% per year. Analysts predict a potential stock price increase of 24.9%.

- Our growth report here indicates BFF Bank may be poised for an improving outlook.

- Take a closer look at BFF Bank's balance sheet health here in our report.

Elekta (OM:EKTA B)

Overview: Elekta AB (publ) is a medical technology company specializing in clinical solutions for cancer and brain disorder treatments across various global regions, with a market cap of approximately SEK21.80 billion.

Operations: The company's revenue segments are comprised of SEK5.93 billion from the Asia Pacific, SEK4.83 billion from the Americas, and SEK6.81 billion from Europe, the Middle East, and Africa (EMEA).

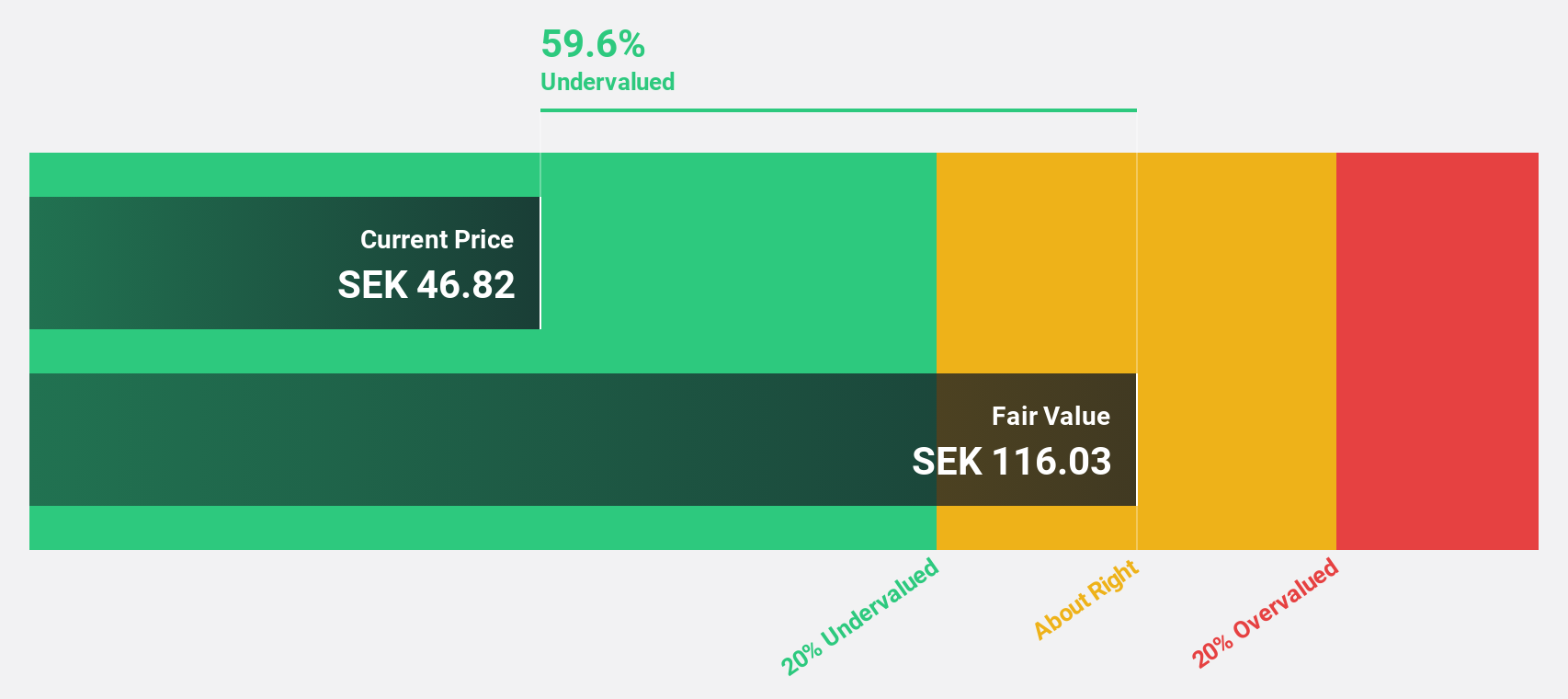

Estimated Discount To Fair Value: 49.9%

Elekta is trading at SEK 57.05, significantly below its estimated fair value of SEK 113.78, suggesting undervaluation based on cash flows. Despite a high debt level and reduced profit margins from last year, Elekta's earnings are forecast to grow substantially at 28.5% annually, outpacing the Swedish market's growth rate of 13.6%. However, revenue growth is slower at 5.6%, and dividend coverage remains weak amidst ongoing foreign exchange challenges impacting earnings negatively.

- Upon reviewing our latest growth report, Elekta's projected financial performance appears quite optimistic.

- Dive into the specifics of Elekta here with our thorough financial health report.

adidas (XTRA:ADS)

Overview: adidas AG, along with its subsidiaries, is involved in the design, development, production, and marketing of athletic and sports lifestyle products globally, with a market cap of approximately €30.01 billion.

Operations: adidas generates revenue from its diverse range of athletic and sports lifestyle products across Europe, Greater China, Japan, South Korea, Latin America, North America, and other international markets.

Estimated Discount To Fair Value: 39.4%

Adidas is trading at €168.25, well below its estimated fair value of €277.76, highlighting potential undervaluation based on cash flows. The company's earnings grew by a very large margin over the past year and are forecast to grow 21% annually, surpassing the German market's growth rate. Recent strategic activities include a €500 million fixed-income offering and increased earnings guidance for 2025, supporting robust future cash flow prospects despite slower revenue growth projections.

- Insights from our recent growth report point to a promising forecast for adidas' business outlook.

- Delve into the full analysis health report here for a deeper understanding of adidas.

Make It Happen

- Navigate through the entire inventory of 190 Undervalued European Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal