European Penny Stocks To Consider In December 2025

The European market has been buoyed by positive sentiment, with the pan-European STOXX Europe 600 Index closing just shy of a record high amid optimism about future earnings and economic conditions. As investors navigate these promising yet cautious times, penny stocks—though an older term—continue to represent intriguing opportunities for growth. By focusing on smaller or newer companies with strong financials and solid fundamentals, investors can identify potential hidden gems that offer both stability and potential upside in the ever-evolving market landscape.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.488 | €1.55B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.69 | €83.29M | ✅ 4 ⚠️ 1 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €222.71M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.00 | €63.63M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.37 | €386.24M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.28 | €315.14M | ✅ 3 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0726 | €7.81M | ✅ 2 ⚠️ 3 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.80 | €26.79M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 293 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Angler Gaming (DB:0QM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Angler Gaming plc invests in companies providing online gaming services in Malta and has a market cap of €222.71 million.

Operations: The company's revenue segment includes Casinos & Resorts, generating €32.27 million.

Market Cap: €222.71M

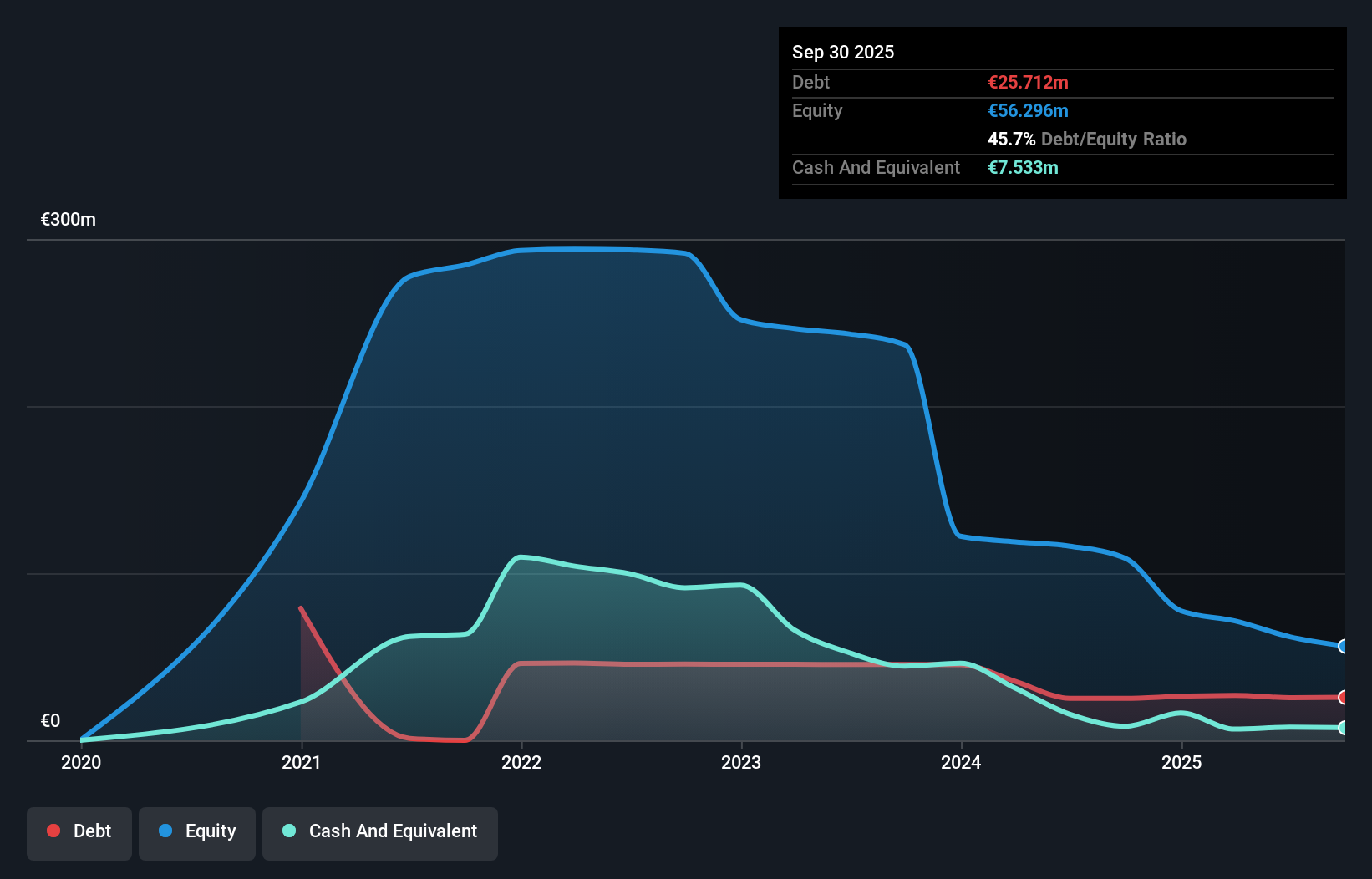

Angler Gaming, with a market cap of €222.71 million, has demonstrated some financial resilience despite a volatile share price and declining sales. The company reported Q3 2025 net income of €1.22 million, up from €0.73 million the previous year, indicating improved net profit margins from 6.1% to 8.1%. Although earnings have grown by 5.2% over the past year, they remain below its five-year average decline of -44.1%. Angler Gaming is debt-free with high return on equity at 23.8%, but its dividend yield of 4.29% is not well covered by free cash flows, suggesting potential sustainability issues.

- Unlock comprehensive insights into our analysis of Angler Gaming stock in this financial health report.

- Gain insights into Angler Gaming's outlook and expected performance with our report on the company's earnings estimates.

Honkarakenne Oyj (HLSE:HONBS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Honkarakenne Oyj designs, manufactures, and sells log and solid-wood house packages in Finland with a market cap of €16.96 million.

Operations: The company's revenue is primarily derived from its Home Builders segment, which focuses on residential and commercial projects, generating €38.91 million.

Market Cap: €16.96M

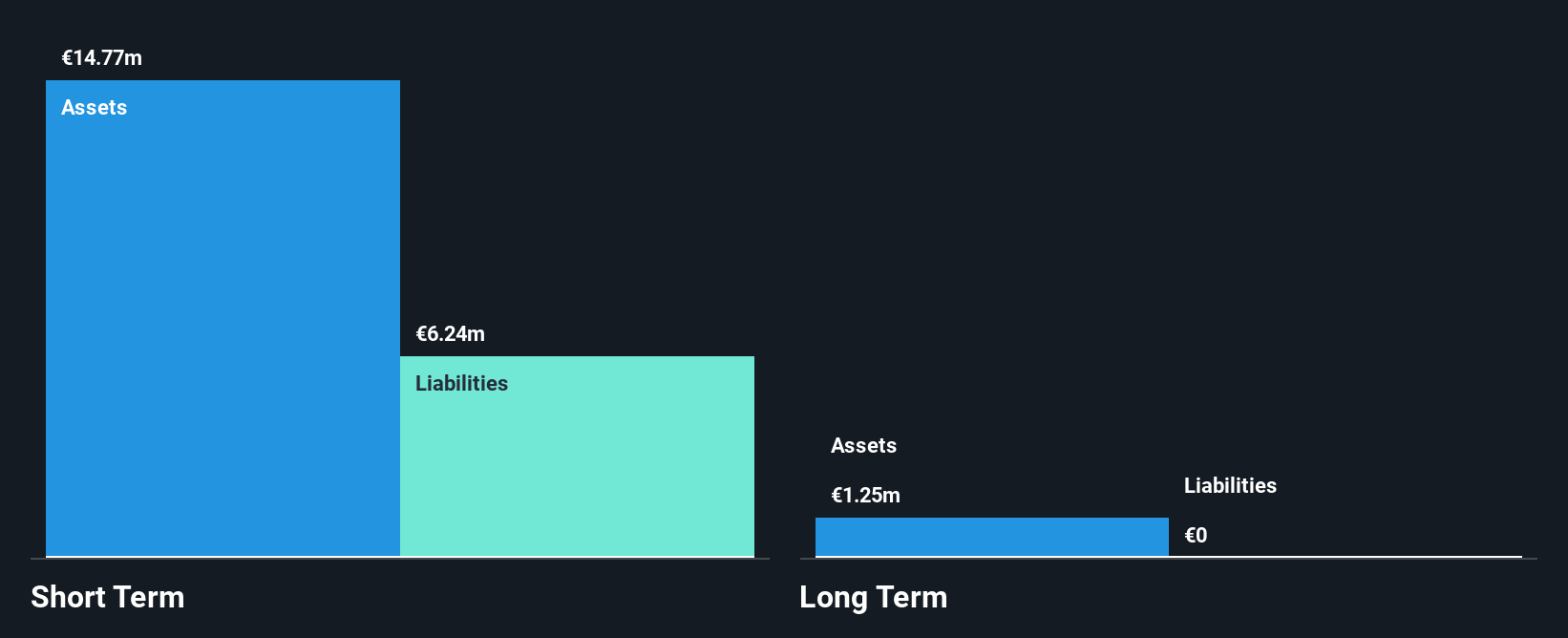

Honkarakenne Oyj, with a market cap of €16.96 million, is navigating the penny stock landscape with strategic alliances and innovative projects. Despite its unprofitability and negative operating cash flow, the company maintains more cash than debt and has reduced its debt-to-equity ratio over five years. Its recent partnerships in Europe and Central Asia focus on sustainable construction using CLT log technology for floating homes and resorts, highlighting potential growth avenues despite current financial challenges. Trading at a significant discount to estimated fair value, Honkarakenne's experienced management team continues to explore scalable solutions in niche markets.

- Click here and access our complete financial health analysis report to understand the dynamics of Honkarakenne Oyj.

- Assess Honkarakenne Oyj's future earnings estimates with our detailed growth reports.

Cherry (XTRA:C3RY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Cherry SE, along with its subsidiaries, is engaged in the manufacturing and sale of computer input devices in Germany, with a market capitalization of €14.61 million.

Operations: The company's revenue is primarily derived from Gaming & Office Peripherals (€66.47 million), Digital Health & Solutions (€24.37 million), and Components (€10.00 million).

Market Cap: €14.61M

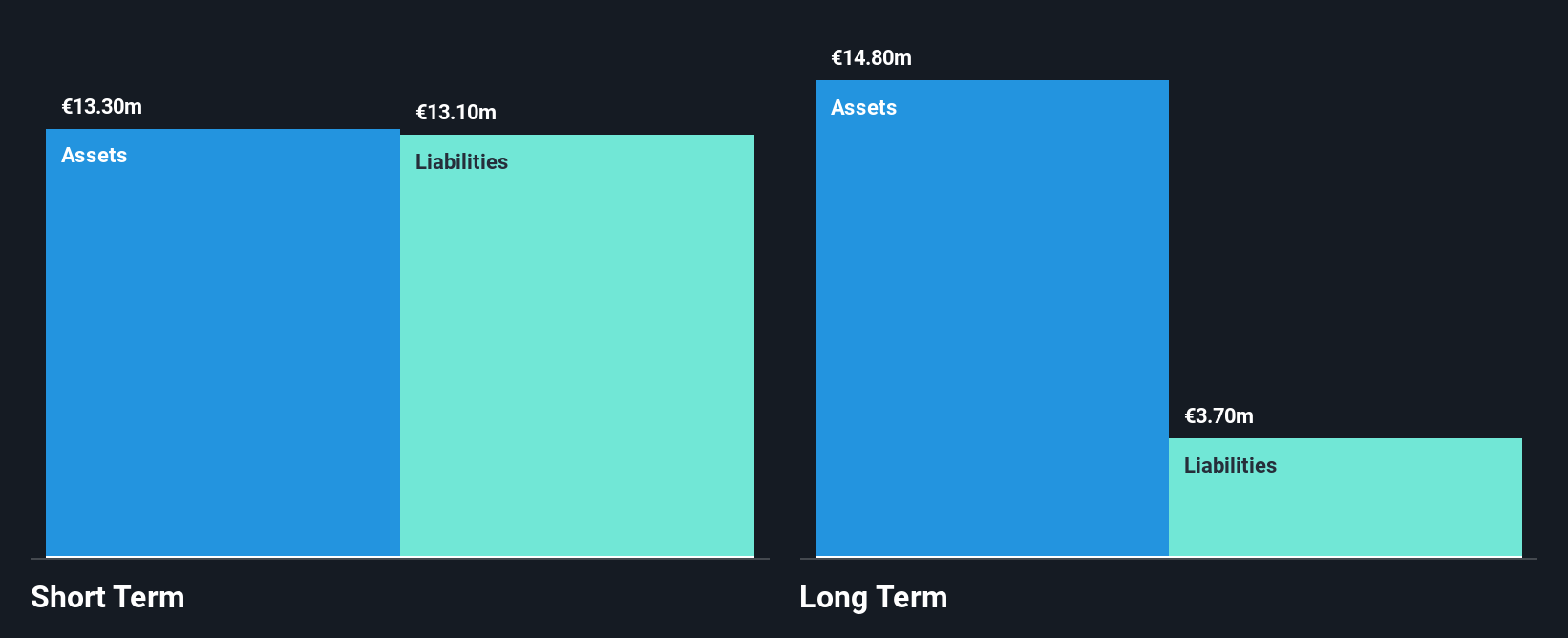

Cherry SE, with a market cap of €14.61 million, faces challenges typical of penny stocks, including high volatility and unprofitability. The company's revenue primarily comes from Gaming & Office Peripherals (€66.47 million), but it reported increased losses over the past five years. Despite this, Cherry's management and board are experienced, with no significant shareholder dilution recently. However, its cash runway is less than a year due to negative free cash flow. Recent events include an interim CEO appointment and auditor changes following unexpected revenue shortfalls in Q4 2025 due to delayed equipment rollouts initially planned for 2026.

- Take a closer look at Cherry's potential here in our financial health report.

- Learn about Cherry's future growth trajectory here.

Seize The Opportunity

- Reveal the 293 hidden gems among our European Penny Stocks screener with a single click here.

- Ready To Venture Into Other Investment Styles? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal