European Growth Companies With High Insider Ownership Expecting Up To 120% Earnings Growth

As the pan-European STOXX Europe 600 Index hovers near record highs, buoyed by positive sentiment about future earnings and economic prospects, investors are increasingly focused on identifying growth opportunities within this optimistic landscape. In the current market environment, companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business in its potential for substantial earnings growth.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| Redelfi (BIT:RDF) | 12.4% | 39.1% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations in the Nordic countries and Baltic regions, with a market cap of NOK17.49 billion.

Operations: Atea ASA generates revenue from several regional segments, including NOK9.27 billion from Norway, NOK13.73 billion from Sweden, NOK8.56 billion from Denmark, NOK3.48 billion from Finland, and NOK1.90 billion from the Baltics.

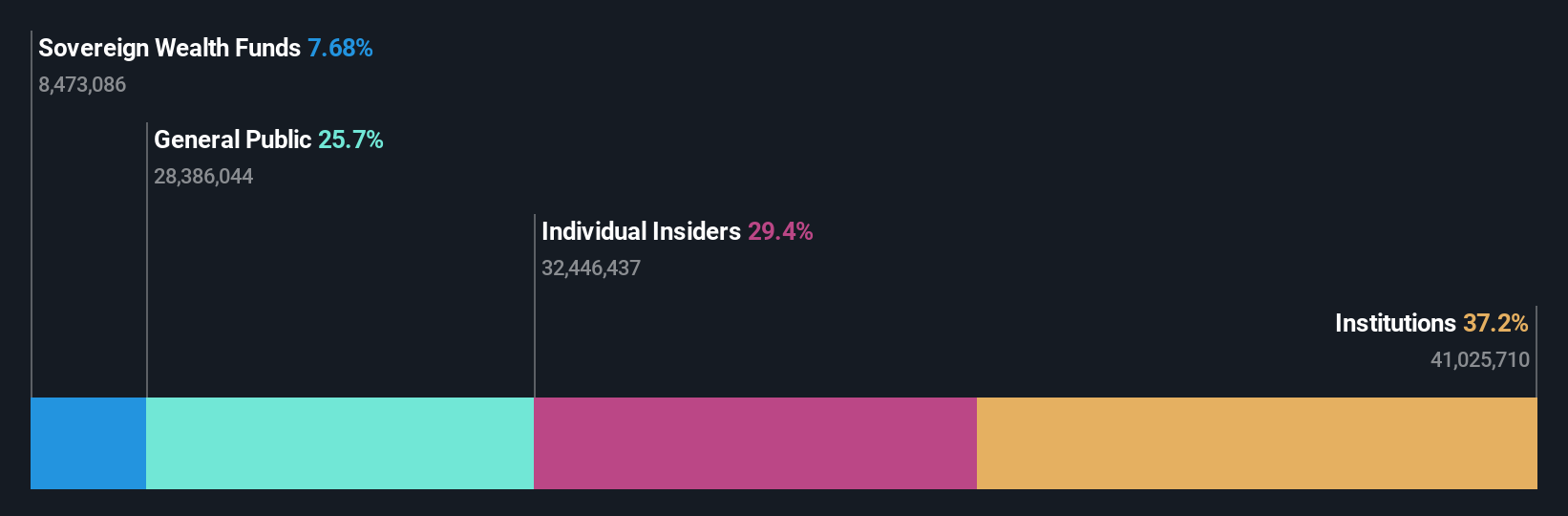

Insider Ownership: 29.1%

Earnings Growth Forecast: 18.5% p.a.

Atea's recent major contracts, including a NOK 500 million annual agreement with Tradebroker and a €130 million NATO contract, highlight its growth trajectory. The company anticipates reaching the top end of its revenue guidance for 2025, between NOK 57 billion and NOK 60 billion. Despite trading below fair value estimates, Atea's earnings are projected to grow faster than the Norwegian market at 18.5% annually. However, its dividend coverage is weak and insider trading activity is minimal.

- Unlock comprehensive insights into our analysis of Atea stock in this growth report.

- The analysis detailed in our Atea valuation report hints at an deflated share price compared to its estimated value.

Rusta (OM:RUSTA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rusta AB (publ) operates as a retailer offering home decoration, consumables, seasonal products, leisure items, and DIY goods across Sweden, Norway, Finland, and Germany with a market cap of SEK13.25 billion.

Operations: Rusta's revenue is primarily derived from its operations in Sweden (SEK7.16 billion), Norway (SEK2.59 billion), and other markets including Finland and Germany (SEK2.41 billion).

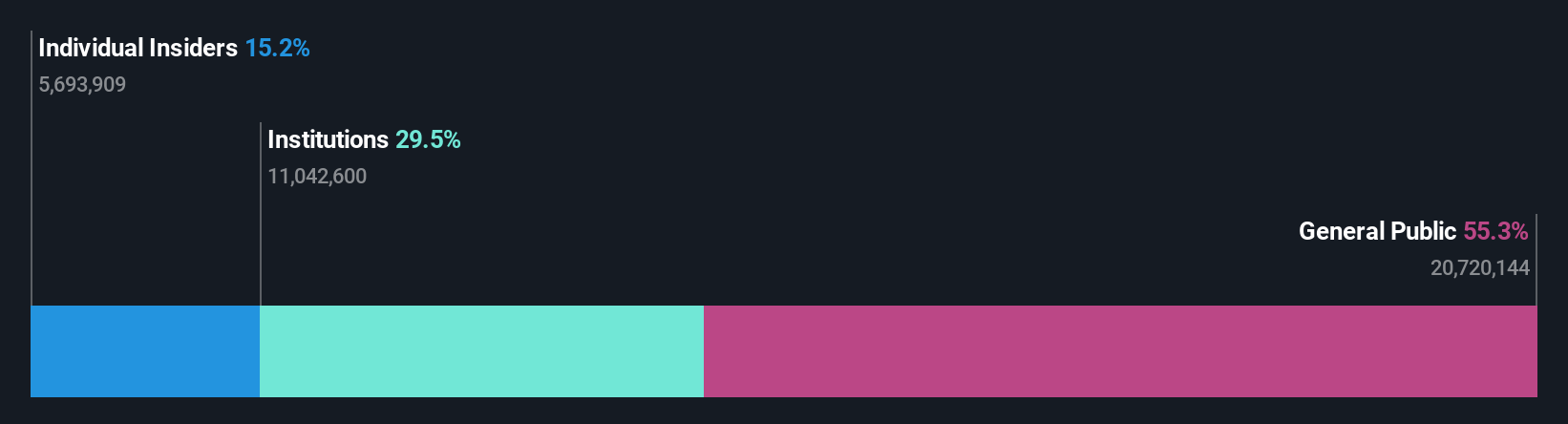

Insider Ownership: 13.5%

Earnings Growth Forecast: 21% p.a.

Rusta's recent earnings report shows a positive trend, with second-quarter sales rising to SEK 2.95 billion and net income nearly doubling from the previous year. The company is trading at a significant discount to its estimated fair value and has seen substantial insider buying recently, indicating confidence in its growth prospects. With earnings expected to grow over 21% annually, Rusta's revenue growth forecast of 8.6% outpaces the Swedish market average of 3.9%.

- Click here to discover the nuances of Rusta with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Rusta's share price might be too optimistic.

Smart Eye (OM:SEYE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Smart Eye AB (publ) develops AI technology solutions to understand, support, and predict human behavior across various regions globally, with a market cap of SEK2.92 billion.

Operations: Smart Eye's revenue is primarily derived from its Behavioral Research segment, which generated SEK252.90 million, and its Automotive Solutions segment, contributing SEK128.65 million.

Insider Ownership: 15%

Earnings Growth Forecast: 120.2% p.a.

Smart Eye's recent developments highlight its growth potential, supported by high insider ownership. The company secured a significant contract to supply Driver Monitoring Systems for two new truck models, with an estimated revenue of SEK 15 million. Smart Eye's collaboration with Sony Semiconductor Solutions enhances its product offerings, aligning with safety regulations and personalization trends. Despite reporting a net loss in Q3 2025, sales increased to SEK 99.14 million from the previous year. Revenue is forecasted to grow significantly faster than the Swedish market average at 47.4% annually, although profitability remains a future goal within three years.

- Click here and access our complete growth analysis report to understand the dynamics of Smart Eye.

- Upon reviewing our latest valuation report, Smart Eye's share price might be too pessimistic.

Key Takeaways

- Get an in-depth perspective on all 210 Fast Growing European Companies With High Insider Ownership by using our screener here.

- Searching for a Fresh Perspective? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal