Sentiment Still Eluding Safello Group AB (publ) (STO:SFL)

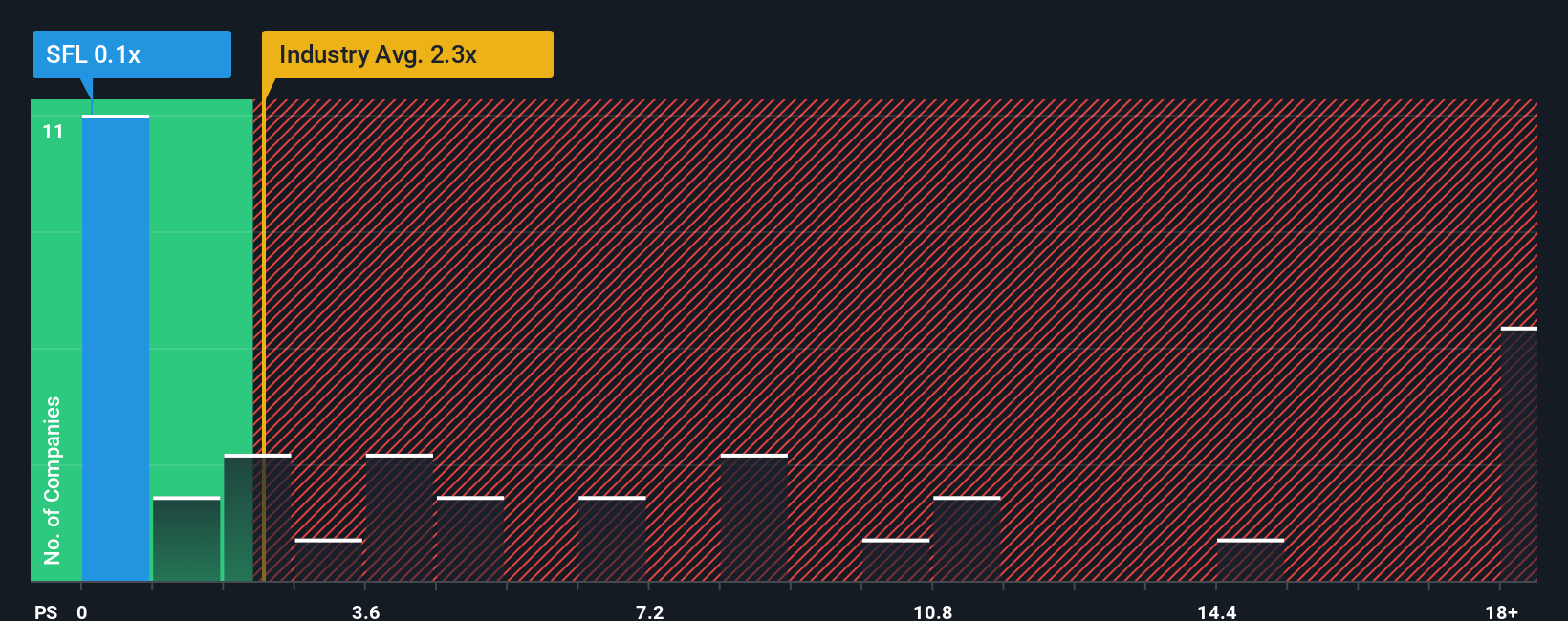

With a price-to-sales (or "P/S") ratio of 0.1x Safello Group AB (publ) (STO:SFL) may be sending very bullish signals at the moment, given that almost half of all the Capital Markets companies in Sweden have P/S ratios greater than 2.3x and even P/S higher than 11x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Safello Group

How Has Safello Group Performed Recently?

Revenue has risen at a steady rate over the last year for Safello Group, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Safello Group will help you shine a light on its historical performance.Is There Any Revenue Growth Forecasted For Safello Group?

In order to justify its P/S ratio, Safello Group would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a decent 5.4% gain to the company's revenues. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

It's interesting to note that the rest of the industry is similarly expected to grow by 2.5% over the next year, which is fairly even with the company's recent medium-term annualised growth rates.

With this information, we find it odd that Safello Group is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

What Does Safello Group's P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Safello Group revealed its three-year revenue trends looking similar to current industry expectations hasn't given the P/S the boost we expected, given that it's lower than the wider industry P/S, When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. While recent

And what about other risks? Every company has them, and we've spotted 2 warning signs for Safello Group (of which 1 is a bit concerning!) you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal