Asian Market Gems: Trigiant Group Leads 2 Other Penny Stocks

As global markets continue to navigate a landscape marked by optimism around artificial intelligence and fluctuating economic indicators, the Asian market remains a focal point for investors seeking diverse opportunities. Penny stocks, though often associated with speculative trading, can still offer compelling prospects when they are supported by solid financial foundations. This article will explore three such stocks in Asia that may present unique growth potential for those interested in uncovering lesser-known investment opportunities.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.145 | SGD61.07M | ✅ 2 ⚠️ 4 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.48 | HK$915.41M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.57 | HK$2.13B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.98 | THB894M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.44 | SGD13.54B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.66 | HK$20.61B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.97 | NZ$138.07M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.52 | HK$52.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.84 | NZ$240.51M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 968 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Trigiant Group (SEHK:1300)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Trigiant Group Limited is an investment holding company that manufactures and sells various cables and accessories for mobile communications and telecommunication equipment in the People's Republic of China, with a market cap of HK$654.16 million.

Operations: The company's revenue segments include Feeder Cable Series (CN¥1.08 billion), Flame-Retardant Flexible Cable Series (CN¥1.16 billion), Optical Fibre Cable Series and Related Products (CN¥294.18 million), and New-Type Electronic Components (CN¥128.62 million).

Market Cap: HK$654.16M

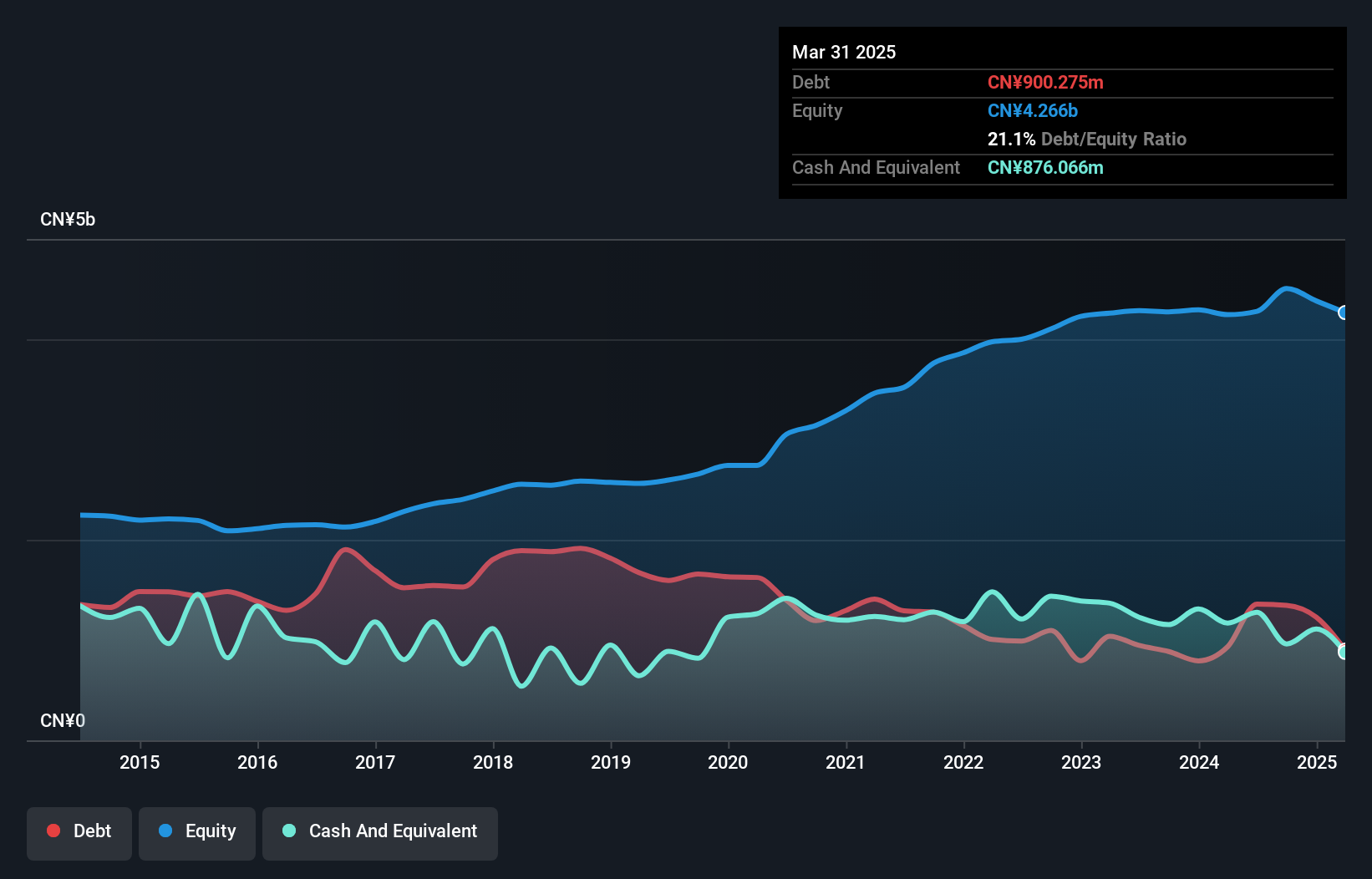

Trigiant Group, with a market cap of HK$654.16 million, presents a mixed picture for penny stock investors. The company has significant revenue streams from its cable and accessory products in China, including CN¥1.08 billion from Feeder Cable Series and CN¥1.16 billion from Flame-Retardant Flexible Cable Series. Despite stable weekly volatility and satisfactory debt levels with net debt to equity at 26.5%, Trigiant is currently unprofitable with negative return on equity (-0.67%) and inadequate interest coverage (0.3x EBIT). Its seasoned management team offers stability, though the board's inexperience may be a concern for governance oversight.

- Unlock comprehensive insights into our analysis of Trigiant Group stock in this financial health report.

- Evaluate Trigiant Group's historical performance by accessing our past performance report.

Xinjiang Xinxin Mining Industry (SEHK:3833)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xinjiang Xinxin Mining Industry Co., Ltd. operates in mining, ore processing, smelting, refining, and selling nickel, copper, and other nonferrous metals with a market capitalization of approximately HK$5.68 billion.

Operations: No specific revenue segments have been reported for this company.

Market Cap: HK$5.68B

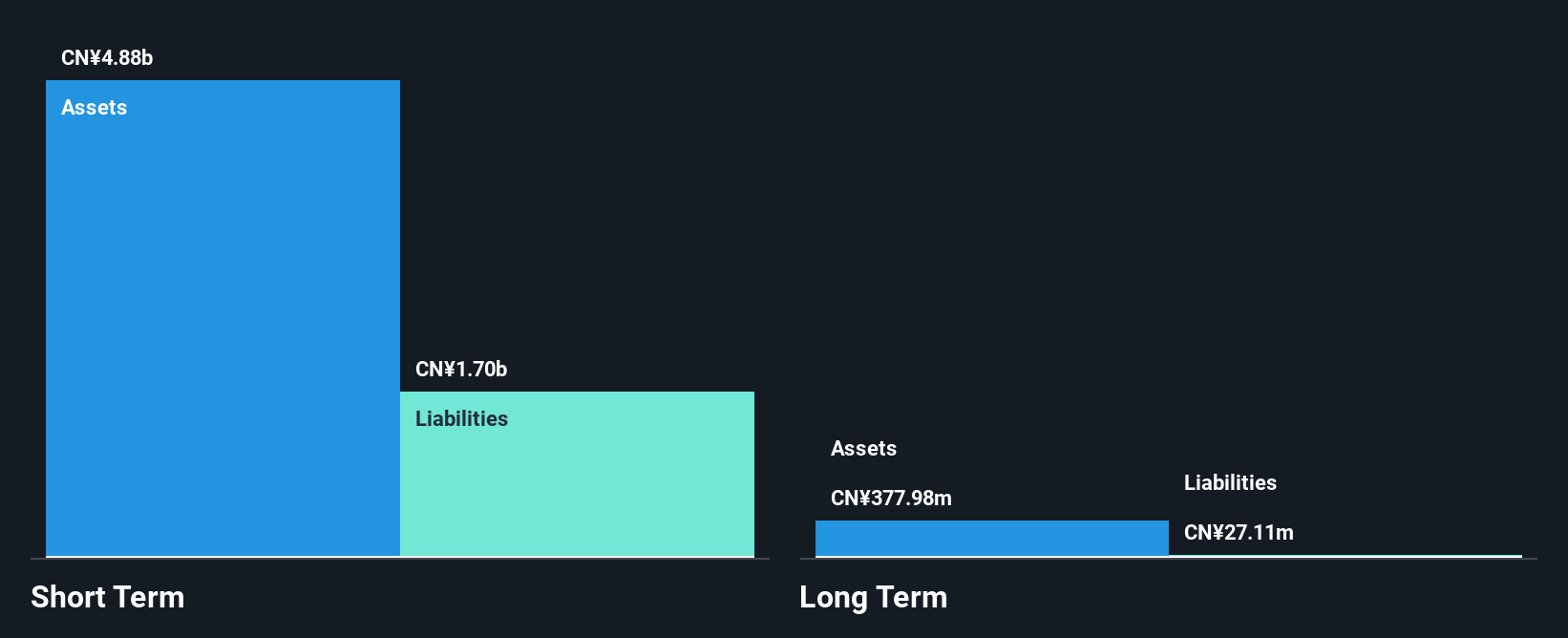

Xinjiang Xinxin Mining Industry, with a market cap of HK$5.68 billion, offers potential for penny stock investors despite certain challenges. The company has experienced improved debt management, reducing its debt to equity ratio from 44.2% to 26.1% over five years, and maintains satisfactory net debt levels at 16%. However, earnings have declined by 10.5% annually over the past five years and recent growth is negative (-17.8%). While short-term assets cover both short- and long-term liabilities adequately (CN¥2.2B each), the company's low return on equity (1.8%) and high share price volatility may raise concerns for investors seeking stable returns.

- Dive into the specifics of Xinjiang Xinxin Mining Industry here with our thorough balance sheet health report.

- Gain insights into Xinjiang Xinxin Mining Industry's historical outcomes by reviewing our past performance report.

Yechiu Metal Recycling (China) (SHSE:601388)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yechiu Metal Recycling (China) Ltd. operates in the aluminum alloy recycling industry across Asia and the United States, with a market capitalization of CN¥6.63 billion.

Operations: Revenue Segments: No specific revenue segments are reported for Yechiu Metal Recycling (China) Ltd.

Market Cap: CN¥6.63B

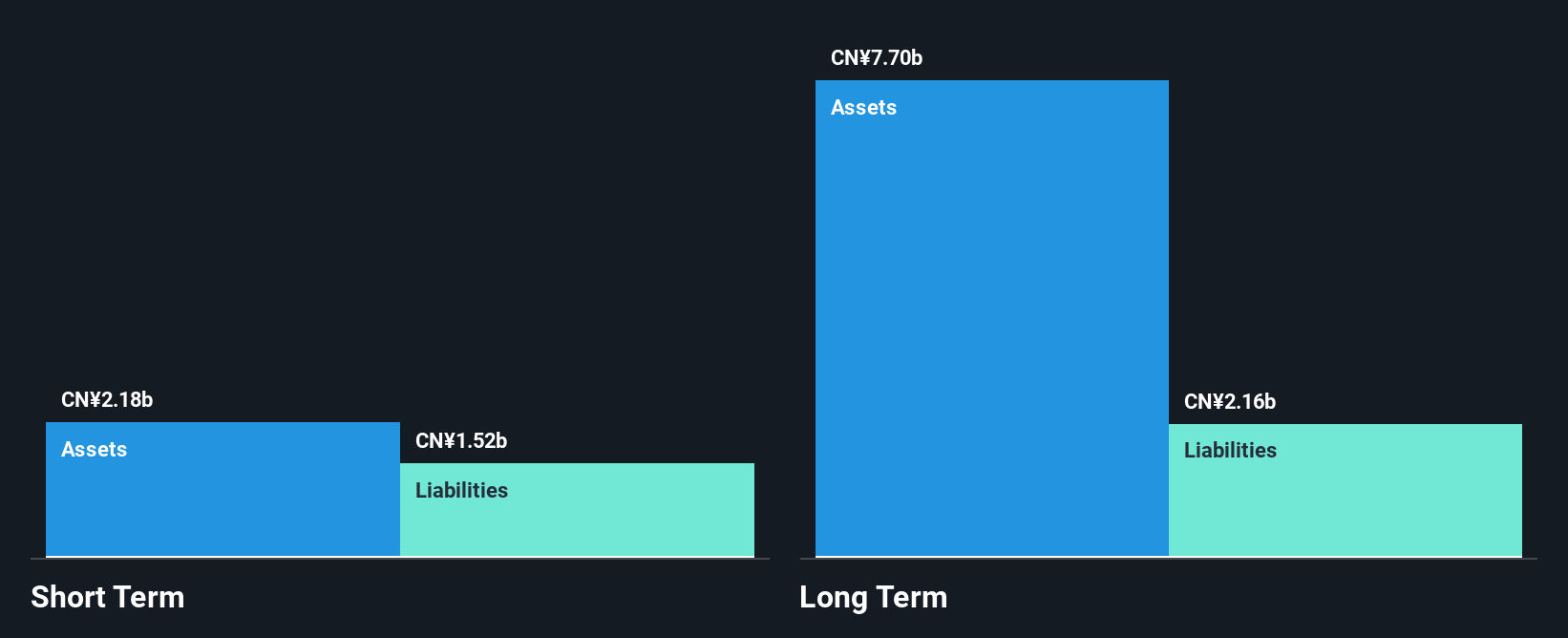

Yechiu Metal Recycling (China) Ltd., with a market cap of CN¥6.63 billion, presents a mixed picture for penny stock investors. The company reported revenue growth to CN¥5.59 billion for the nine months ending September 2025, up from CN¥5.04 billion the previous year, and net income increased to CN¥97.51 million from CN¥77.27 million. Despite this growth, challenges remain as profit margins have decreased to 0.5% from 1.3%, and earnings have declined by 45% annually over five years. While short-term assets exceed liabilities significantly, low return on equity at 0.8% and insufficient operating cash flow coverage of debt may concern cautious investors seeking robust financial health in volatile markets.

- Navigate through the intricacies of Yechiu Metal Recycling (China) with our comprehensive balance sheet health report here.

- Understand Yechiu Metal Recycling (China)'s track record by examining our performance history report.

Turning Ideas Into Actions

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 965 more companies for you to explore.Click here to unveil our expertly curated list of 968 Asian Penny Stocks.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal