Abu Dhabi Aviation And 2 Promising Middle East Stocks With Strong Potential

As Gulf markets experience gains driven by expectations of further Federal Reserve interest rate cuts, investor sentiment is cautiously optimistic despite subdued oil prices impacting overall market mood. In this environment, identifying stocks with strong fundamentals and resilience to economic shifts can be crucial for investors looking for promising opportunities in the Middle East.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Qassim Cement | NA | 4.02% | -11.40% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Baazeem Trading | 10.02% | -1.27% | -1.66% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| Sönmez Filament Sentetik Iplik ve Elyaf Sanayi | NA | 54.80% | 42.62% | ★★★★★☆ |

| Gür-Sel Turizm Tasimacilik ve Servis Ticaret | 4.69% | 36.04% | 53.41% | ★★★★★☆ |

| Birikim Varlik Yonetim Anonim Sirketi | 59.38% | 42.42% | 36.01% | ★★★★☆☆ |

| Bosch Fren Sistemleri Sanayi ve Ticaret | 36.11% | 41.59% | 7.72% | ★★★★☆☆ |

| Blume Metal Kimya Anonim Sirketi | 4.78% | 36.99% | 42.99% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Abu Dhabi Aviation (ADX:ADAVIATION)

Simply Wall St Value Rating: ★★★★★☆

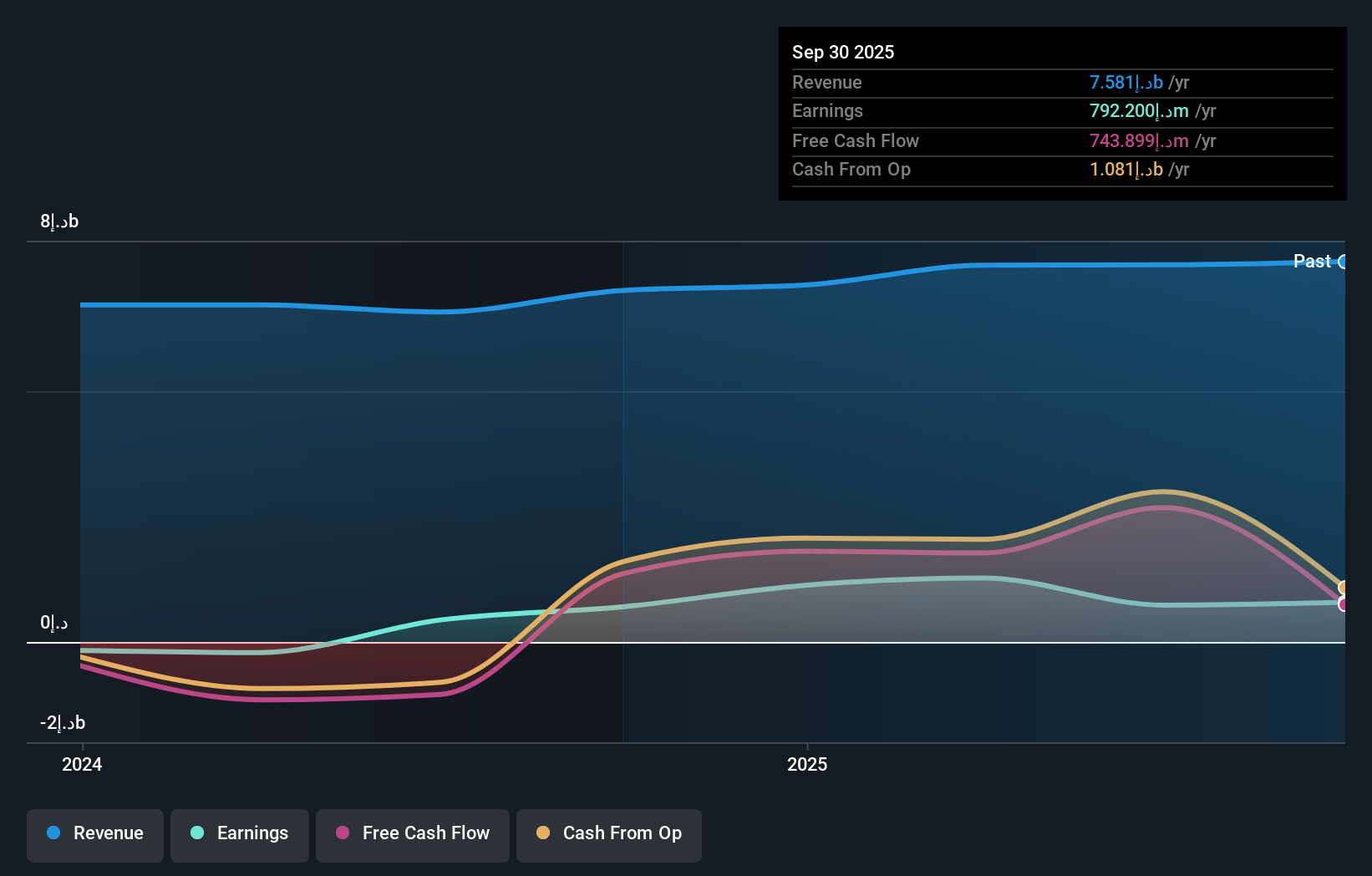

Overview: Abu Dhabi Aviation Co. operates helicopters and rotary and fixed-wing aircraft for civil and military aviation sectors both in the United Arab Emirates and internationally, with a market capitalization of AED5.82 billion.

Operations: The primary revenue streams for Abu Dhabi Aviation Co. include General Aviation and Maintenance Repair and Overhaul, generating AED1.04 billion and AED6.62 billion respectively. The company also reports investment income of AED27.98 million.

Abu Dhabi Aviation, a notable player in the Middle East's aviation sector, showcases strong financial health with earnings growth of 13% over the past year, outpacing industry averages. The company trades at nearly 30% below its estimated fair value, suggesting potential undervaluation. Recent financial results highlight a rise in third-quarter sales to AED 1.91 billion and net income to AED 248 million compared to last year. Despite these gains, nine-month net income saw a dip from AED 904 million to AED 566 million. The company's robust cash position surpasses total debt levels, indicating sound financial management amidst fluctuating earnings figures.

- Click here and access our complete health analysis report to understand the dynamics of Abu Dhabi Aviation.

Evaluate Abu Dhabi Aviation's historical performance by accessing our past performance report.

Aryt Industries (TASE:ARYT)

Simply Wall St Value Rating: ★★★★★★

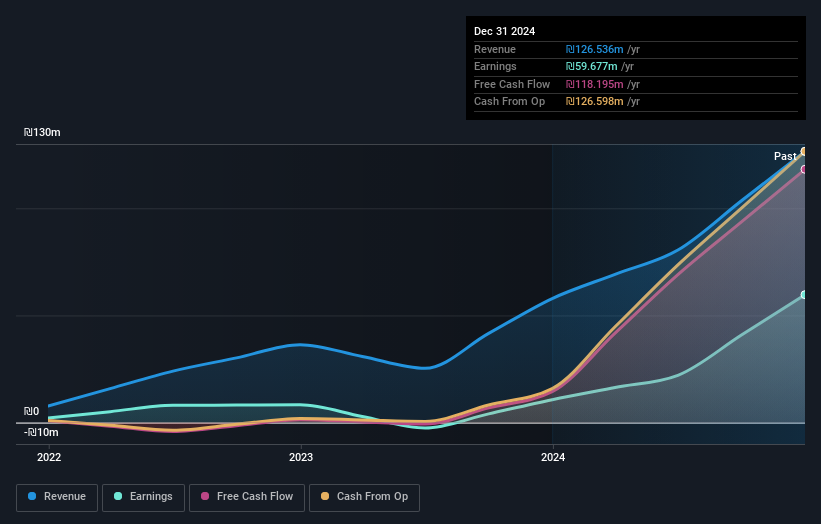

Overview: Aryt Industries Ltd. is engaged in the development, production, and marketing of electronic fuses for the defense sector in Israel, with a market capitalization of ₪4.30 billion.

Operations: Aryt generates revenue primarily from its detonators segment, which contributed ₪252.36 million. The company's market capitalization is approximately ₪4.30 billion.

Aryt Industries, a player in the Aerospace & Defense sector, has caught attention with its impressive earnings growth of 578.7% over the past year, outpacing the industry average of 58.2%. Trading at 60.6% below its estimated fair value, Aryt seems undervalued and potentially attractive for investors looking for hidden opportunities. Despite recent share price volatility, Aryt's financial health appears robust with no debt on its books and positive free cash flow reported as US$176.60 million by mid-2025. The company recently filed a shelf registration to possibly leverage future capital opportunities while maintaining high-quality earnings performance.

- Unlock comprehensive insights into our analysis of Aryt Industries stock in this health report.

Gain insights into Aryt Industries' historical performance by reviewing our past performance report.

I.E.S Holdings (TASE:IES)

Simply Wall St Value Rating: ★★★★★★

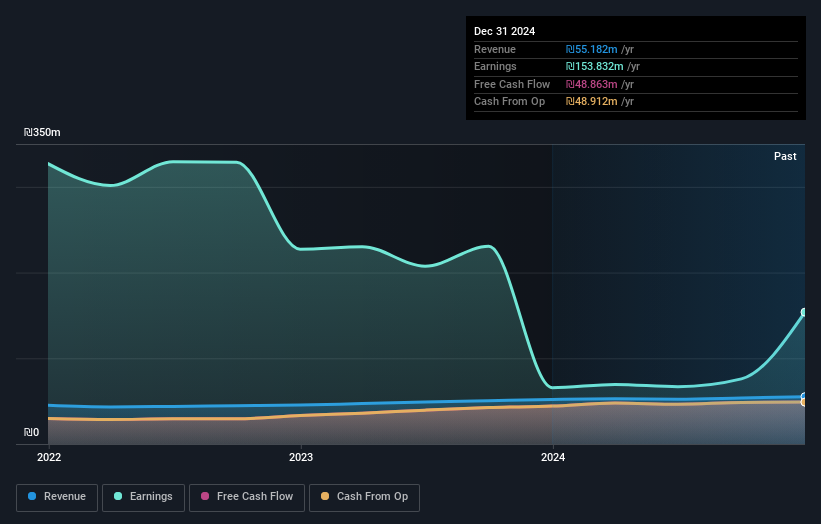

Overview: I.E.S Holdings Ltd focuses on real estate investment operations in Israel, with a market capitalization of ₪2.26 billion.

Operations: The company generates revenue primarily from investment real estate, amounting to ₪61.68 million.

IES Holdings, a compact player in the real estate sector, has shown impressive earnings growth of 117.9% over the past year, outpacing the industry's 10.4%. Despite a notable one-off gain of ₪124.7M impacting its recent financials, the company appears to be on solid ground with more cash than total debt and a reduced debt-to-equity ratio from 0.3% to 0.09% over five years. Its price-to-earnings ratio stands at an attractive 13.6x compared to the IL market's 15.9x, suggesting potential undervaluation for savvy investors seeking opportunities in emerging markets like Israel's real estate scene.

- Take a closer look at I.E.S Holdings' potential here in our health report.

Understand I.E.S Holdings' track record by examining our Past report.

Summing It All Up

- Reveal the 180 hidden gems among our Middle Eastern Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal