Why Investors Shouldn't Be Surprised By Papoutsanis S.A.'s (ATH:PAP) 29% Share Price Surge

Papoutsanis S.A. (ATH:PAP) shareholders have had their patience rewarded with a 29% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 64%.

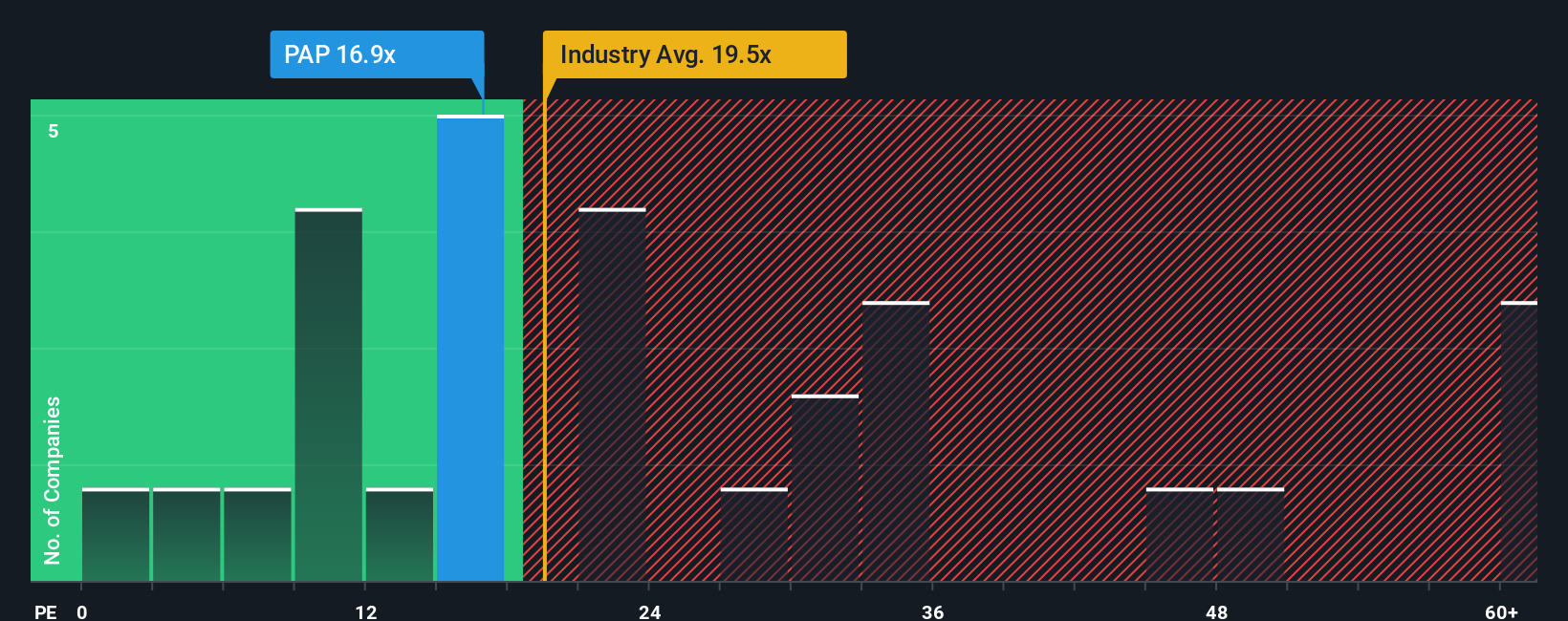

Following the firm bounce in price, Papoutsanis' price-to-earnings (or "P/E") ratio of 16.9x might make it look like a sell right now compared to the market in Greece, where around half of the companies have P/E ratios below 14x and even P/E's below 9x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

With earnings growth that's superior to most other companies of late, Papoutsanis has been doing relatively well. The P/E is probably high because investors think this strong earnings performance will continue. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Papoutsanis

Is There Enough Growth For Papoutsanis?

There's an inherent assumption that a company should outperform the market for P/E ratios like Papoutsanis' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 33% gain to the company's bottom line. EPS has also lifted 28% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 11% per annum as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 7.2% per year growth forecast for the broader market.

In light of this, it's understandable that Papoutsanis' P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

The large bounce in Papoutsanis' shares has lifted the company's P/E to a fairly high level. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Papoutsanis' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 3 warning signs for Papoutsanis you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal