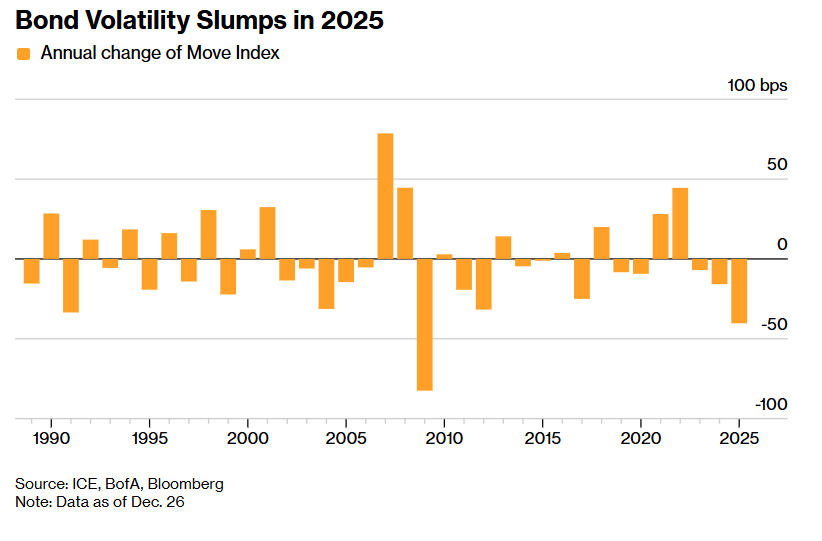

Is the volatility of US bonds about to hit the biggest annual decline since 2009, the “anchor of global asset pricing” and embarking on a downward trajectory?

The Zhitong Finance App learned that an indicator that measures the volatility of the US Treasury bond market is moving towards the largest annual decline since the aftermath of the financial crisis. At the same time, the Fed's new round of interest rate cuts began in October to curb the downside risks of the US economy. This also means that the volatility of the US bond market in early 2026 will also be biased towards a moderate downward process.

As volatility continues to decline, if the Trump administration strives to limit the potential upside in 10-year US bond yields, which have the title of “the anchor of global asset pricing,” in 2026, thereby choosing to reduce the scale or issuance ratio of long-term treasury bonds and actively switch to issuing short-term bonds, 2026 may be a “reversal year” for US bond assets with a ten-year term or more that have been ignored by capital in recent years and are weak. If capital continues to appear in US bonds with a term of 10 years or more, it means that the “anchor of global asset pricing” is expected to continue to decline. This expected trajectory can be described as a major favorable factor for stocks, cryptocurrencies, and high-yield corporate bonds.

According to the latest statistics, the ICE BofA MOVE Index, a core measure of the expected volatility of the bond market, fell sharply to about 59 by the close of last Friday, the lowest level since October 2021. The volatility measurement index has dropped sharply from a historically high level of about 99 points at the end of 2024, and is expected to record one of the steepest annual declines since statistics officially began in 1988, second only to the sharp decline in 2009 after the financial crisis.

As shown in the chart above, the volatility of the US Treasury bond market can be described as falling sharply as 2025 comes to an end.

Since April, when aggressive global tariff policies initiated by US President Donald Trump disrupted the market, this volatility rate once soared. Since then, as global tariffs were drastically cut, the Trump administration's tariff position changed to sanity, and expectations of the Federal Reserve's interest rate cuts continued to heat up, the volatility index showed a sharp downward trend in the bond, currency, and stock markets. A series of moderate economic data suggests that the US economy is getting closer to the “soft landing” of the Fed's mentality — including gradually cooling inflation, a resilient labor market and the strongest third-quarter GDP growth data in two years, as well as the Federal Reserve's interest rate cuts to ensure the steady development of the labor market, have helped reduce huge uncertainty in the financial market.

John Briggs, senior US interest rate strategy director from Natixis Corporate and Investment Banking, said, “We really haven't experienced any extremely troublesome data that would trigger drastic market fluctuations.” The strategist also pointed out that volatility is often very low at this time of year.

Since September, as the labor force, which has been resilient for a long time, has shown significant signs of cooling, the Federal Reserve has announced interest rate cuts three times in a row to prevent the labor market from falling into continuous negative growth, which has greatly dragged down the prospects for a “soft landing” of the US economy. Bond traders and interest rate futures traders are actively pricing another two 25-basis point interest rate cuts in 2026, and it is expected that the first move will take place at the June monetary policy meeting.

“The Federal Reserve's loose monetary policy path has now been fully conveyed, and there is still controversy even at the moment. The Wall Street consensus still focuses on lower policy interest rates in 2026 and a slightly steeper yield curve. This pattern can coexist with low volatility while market debates over inflationary stickiness, economic growth resilience, and the risk of budget deficits at the fiscal level continue to heat up.” Brendan Fagan, a senior macro strategist from Bloomberg Strategists, said.

The week between the 2025 Christmas holidays and the 2026 New Year holidays lacked significant data that could drive the volatility of the bond market, so traders expect that the beginning of 2026 would also lead to a moderate decline in bond market volatility due to a significant decrease in trading activity.

Briggs expects the US bond market to remain historically low until the beginning of the new year. Briggs added in the interview: “It's important to note that January sometimes brings surprises or challenges widely held market consensus views.”

Has long-term US debt finally ushered in a good allocation opportunity? Is the “anchor of global asset pricing” preparing a new downward trajectory?

If the US Treasury does reduce the net supply of long-term bonds of 10 years or more in 2026 to drastically reduce the “maturity premium” as expected by the market, and use short-term bonds (T-bills) to act as a “buffer” for more financing, it may cause the price performance of US bonds with a ten-year or more term, which has been much sluggish in recent years compared to short-term bonds, to show better price performance, and even become a candidate scenario for a “reversal year.”

US Treasury Secretary Bezent and Trump himself have stated that the 10-year US Treasury yield is their main focus, so this data is related to US long-term financing cost pricing and risk-free yield trends. This is why bond market traders recently generally expect that the Treasury led by Benzent will clearly increase the share of short-term US bonds issued in the US Treasury bond market of more than 30 trillion US dollars in order to reduce long-term US bond yields in the context of the continued rise in the size of US debt.

Therefore, as volatility continues to decline moderately in 2026, if the Trump administration shifts to significantly increase the share of short-term US bonds issued rather than issuing long-term US bonds on a large scale as in the past few years, US bonds with a term of 10 years or more will show allocation value beyond short- and medium-term US bonds.

Daniel Ivascyn, fund manager from Pimco, recently stated: “Lower interest rate expectations in the US market and rising global economic uncertainty will fully push risk-averse investors who wait and see the currency to fully push the US Treasury bond market with fixed returns.” “As the Federal Reserve relaxes its policy, you'll see a situation where credit risk in some economies may continue to rise while your cash returns continue to decline. And this may continue to support high-quality long-term fixed income assets, such as 10-year US Treasury assets.”

According to Wall Street's top investment institutions' strategic outlook for the 2026 bond market, long-term US bonds in 2026 will have more investment prospects than short-term US bonds. The logic behind it is mainly that the rise in prices brought about by the tariff policy will eventually prove to be a temporary inflationary disturbance in the first half of 2026, that Trump's upcoming nomination of the Federal Reserve Chairman's position will be biased towards dovish, and that short-term US bonds have overvalued interest rate cut expectations while long-term US bonds will continue to be subject to “term premium” fluctuations caused by deficit expectations in 2025.

Furthermore, compared to short-term US bonds, long-term US bonds of 10 years or more do not fully price the Federal Reserve's 2026 interest rate cut path, and the long-term US bond supply reduction path brought about by the Treasury's tendency to issue short-term US bonds — at least the market clearly sees that the Trump administration does not want to see long-term US bond yields continue to be high, and can also see the Trump administration's intention to gradually reduce the budget deficit. Plus, the long-term period around 4% yield is extremely attractive in 2026, when the “AI bubble storm” could strike at any time, so long-term US bonds are extremely attractive compared to 2026, when the “AI bubble storm” may strike at any time. Short-term bonds, which have continued to be strong in recent years, are more flexible.

Generally, in large-scale panic events similar to the bursting of the Internet bubble, long-term treasury bonds with higher yields are more attractive than short-term bonds. This is why the huge flow of safe-haven funds brought about by the AI bubble that swept the world from the end of October to November is once again rushing back into US bonds with a 10-year term and longer term.

Wall Street financial giant Morgan Stanley recently stated that in 2026, the market transaction logic may fully return to “bad news is bad news”, and that 10-year and more long-term US bonds, which have advantages in price elasticity and yield, will return to the position of portfolio ballast stones in the 20 years before the pandemic. This also means that long-term US bonds are expected to enjoy the influx of safe-haven funds brought about by major mood swings such as the “AI bubble” in 2026, as well as the “Golden Girl style soft landing narrative” of the US economy (that is, the “Golden Girl style soft landing narrative”) OK, maintain GDP and Long-term institutional capital flows brought about by a moderate “moderate increase” in consumer spending and a long-term stable “moderate inflation trend” (at the same time, the benchmark interest rate is on a downward trajectory).

According to the latest forecasts from Wall Street asset management giants Franklin Templeton Investments and TD Securities, the 10-year US Treasury yield by the end of 2026 may fall below 3.5%, which means that strong demand is expected to drive prices to continue to rise. Therefore, if global capital continues to rise in US bonds with a term of 10 years or more, it means that the “anchor of global asset pricing” is expected to continue to decline. This expected trajectory can be described as a major favorable factor for stocks, cryptocurrencies, and high-yield corporate bonds. As of the close of US stocks last Friday, the 10-year US Treasury yield closed around 4.15%.

From a theoretical perspective, the 10-year US Treasury yield is equivalent to the risk-free interest rate indicator r on the denominator side of the DCF valuation model, an important valuation model in the stock market. Other indicators (especially the molecular side's cash flow expectations) have not changed significantly — for example, during the earnings season, the molecular side is in a vacuum due to lack of active catalysts. At this time, if the denominator level is higher or continues to operate at a historically high level, the valuations of risky assets such as technology stocks, high-yield corporate bonds, and cryptocurrencies closely linked to AI are facing a collapse.

Conversely, if there is no major macroeconomic fundamentals or major negative news at the AI computing power industry chain level, the 10-year US Treasury yield enters a new round of downward curve, and the global stock market is likely to move towards a new round of stock market bullish trajectory, led by large technology giants such as Nvidia, Meta, Google, Oracle, TSMC, and Broadcom, as well as the strong “AI bull market narrative” of AI computing power industry chain leaders.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal