3 Asian Dividend Stocks To Consider Yielding Up To 6.2%

As Asian markets experience varied economic signals, with Japan's stock surge driven by AI optimism and China's steady growth despite headwinds, investors are increasingly looking at dividend stocks for stable returns. In such a dynamic environment, identifying dividend stocks with strong fundamentals and consistent payouts can offer a measure of stability and income potential amidst market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.69% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.32% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.04% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.03% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.23% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.72% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.89% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.73% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.37% | ★★★★★★ |

Click here to see the full list of 1010 stocks from our Top Asian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

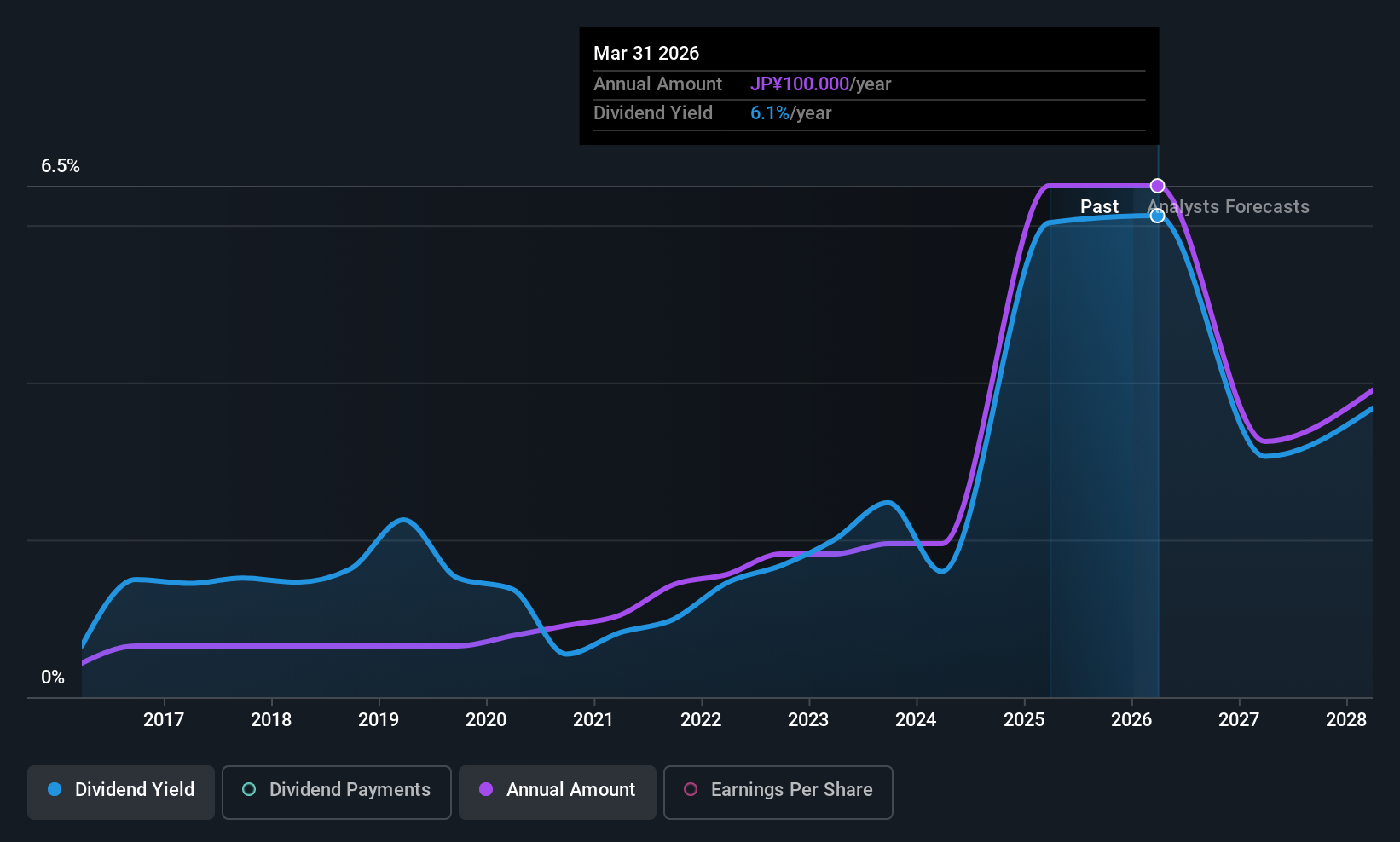

ITmedia (TSE:2148)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ITmedia Inc. focuses on developing and operating internet-only media that offers information on diverse topics in Japan, with a market cap of ¥31.27 billion.

Operations: ITmedia Inc. generates revenue through its B to B Media segment, which accounts for ¥6.62 billion, and its B to C Media segment, contributing ¥1.55 billion.

Dividend Yield: 6.2%

ITmedia's dividend yield of 6.21% ranks in the top 25% of Japanese dividend payers, yet its sustainability is questionable due to a high cash payout ratio of 136.9%. Despite stable and growing dividends over the past decade, these payments are not well covered by earnings or cash flows. Recent guidance forecasts net sales at ¥8.5 billion and operating profit at ¥2.1 billion for fiscal year ending March 2026, indicating potential growth but not necessarily improved dividend coverage.

- Unlock comprehensive insights into our analysis of ITmedia stock in this dividend report.

- Our expertly prepared valuation report ITmedia implies its share price may be too high.

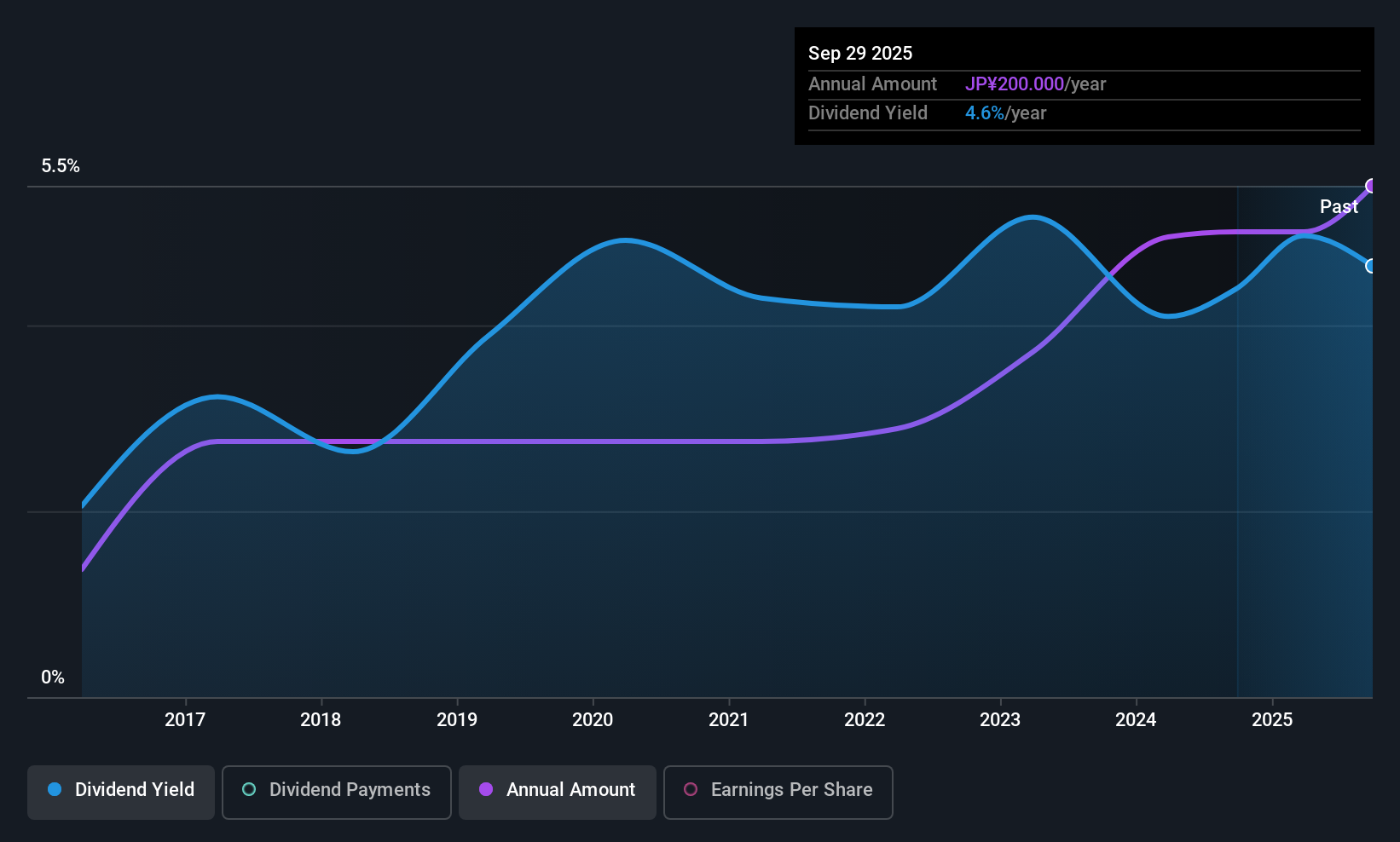

Toyo Kanetsu K.K (TSE:6369)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Toyo Kanetsu K.K. operates in plant and machinery, material handling systems, and other businesses across Japan, Southeast Asia, and internationally with a market cap of ¥39.74 billion.

Operations: Toyo Kanetsu K.K. generates revenue from its operations in plant and machinery, as well as material handling systems, serving markets in Japan, Southeast Asia, and beyond.

Dividend Yield: 3.9%

Toyo Kanetsu K.K.'s dividend yield of 3.91% places it among the top 25% of Japanese dividend payers, but its sustainability is challenged by a high cash payout ratio of 179%. While dividends have grown over the past decade, they remain volatile and not well covered by cash flows. Recent developments include a share split effective January 2026 and revised dividend guidance to ¥50 per share due to this split, reflecting ongoing adjustments in their financial strategy.

- Click to explore a detailed breakdown of our findings in Toyo Kanetsu K.K's dividend report.

- Our valuation report unveils the possibility Toyo Kanetsu K.K's shares may be trading at a premium.

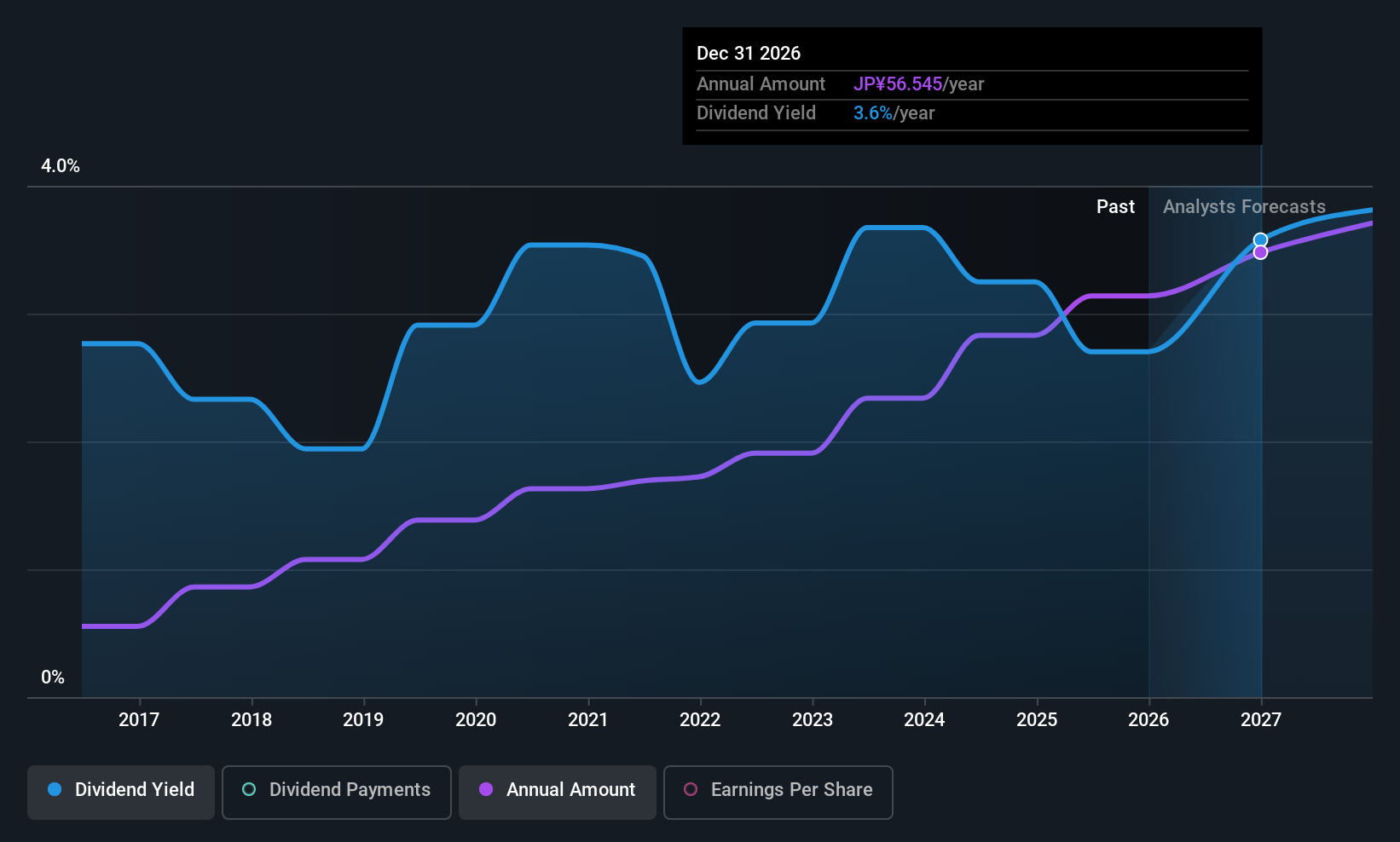

Aoyama Zaisan Networks CompanyLimited (TSE:8929)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Aoyama Zaisan Networks Company, Limited offers property consulting solutions to individual and institutional asset owners in Japan, with a market cap of ¥38.13 billion.

Operations: The company's revenue is primarily derived from its Property Consulting Business, which generated ¥47.83 billion.

Dividend Yield: 3.2%

Aoyama Zaisan Networks Company Limited offers a stable dividend profile with a payout ratio of 36.5%, ensuring dividends are well covered by earnings. The company has maintained reliable and growing dividends over the past decade, though its yield of 3.21% is below the top tier in Japan. With earnings growth of 26.8% last year and trading at a significant discount to estimated fair value, it presents an attractive option for income-focused investors seeking stability in Asia's market.

- Take a closer look at Aoyama Zaisan Networks CompanyLimited's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Aoyama Zaisan Networks CompanyLimited shares in the market.

Key Takeaways

- Navigate through the entire inventory of 1010 Top Asian Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal