Hasbro And 2 Other Stocks That May Be Priced Below Their Estimated Value

As the U.S. stock market navigates a holiday-shortened week, major indices like the Dow Jones, S&P 500, and Nasdaq have seen slight declines following a previous upward trend. In this fluctuating environment, identifying stocks that may be undervalued can offer potential opportunities for investors looking to capitalize on discrepancies between current prices and estimated intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Zymeworks (ZYME) | $26.87 | $52.65 | 49% |

| UMB Financial (UMBF) | $118.90 | $233.21 | 49% |

| Sportradar Group (SRAD) | $23.10 | $45.62 | 49.4% |

| SmartStop Self Storage REIT (SMA) | $31.52 | $61.42 | 48.7% |

| Schrödinger (SDGR) | $18.31 | $35.46 | 48.4% |

| Perfect (PERF) | $1.73 | $3.43 | 49.5% |

| Nicolet Bankshares (NIC) | $123.66 | $242.21 | 48.9% |

| Dingdong (Cayman) (DDL) | $2.88 | $5.76 | 50% |

| Community West Bancshares (CWBC) | $22.69 | $44.11 | 48.6% |

| Columbia Banking System (COLB) | $28.59 | $56.94 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

Hasbro (HAS)

Overview: Hasbro, Inc., along with its subsidiaries, is a toy and game company operating in various regions worldwide, with a market cap of approximately $11.59 billion.

Operations: The company's revenue is primarily derived from Consumer Products at $2.60 billion, Wizards of The Coast & Digital Gaming at $2.08 billion, and Entertainment at $127.9 million.

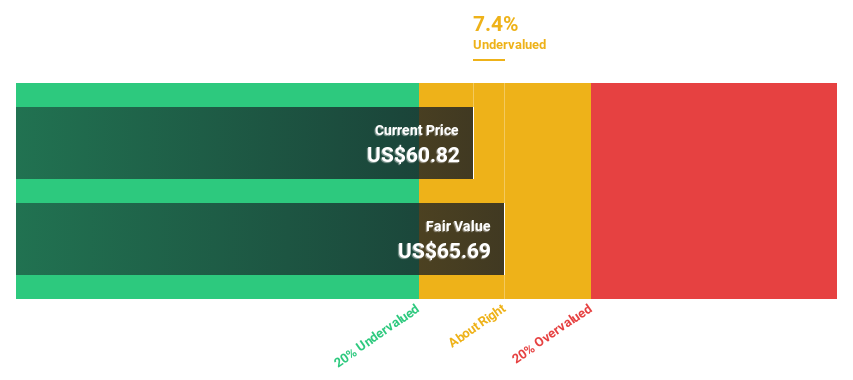

Estimated Discount To Fair Value: 44.2%

Hasbro appears undervalued based on cash flow analysis, trading at US$82.56, significantly below its estimated fair value of US$147.89. Despite a high debt level and slower revenue growth forecast compared to the market, the company is expected to achieve profitability within three years with earnings projected to grow substantially each year. Recent collaborations and product launches suggest strategic initiatives that may support future cash flows despite current challenges in dividend coverage by earnings.

- Our growth report here indicates Hasbro may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Hasbro's balance sheet health report.

MercadoLibre (MELI)

Overview: MercadoLibre, Inc. operates online commerce platforms across Brazil, Mexico, Argentina, and internationally with a market cap of $101.68 billion.

Operations: The company generates revenue from its Internet Software & Services segment, totaling $26.19 billion.

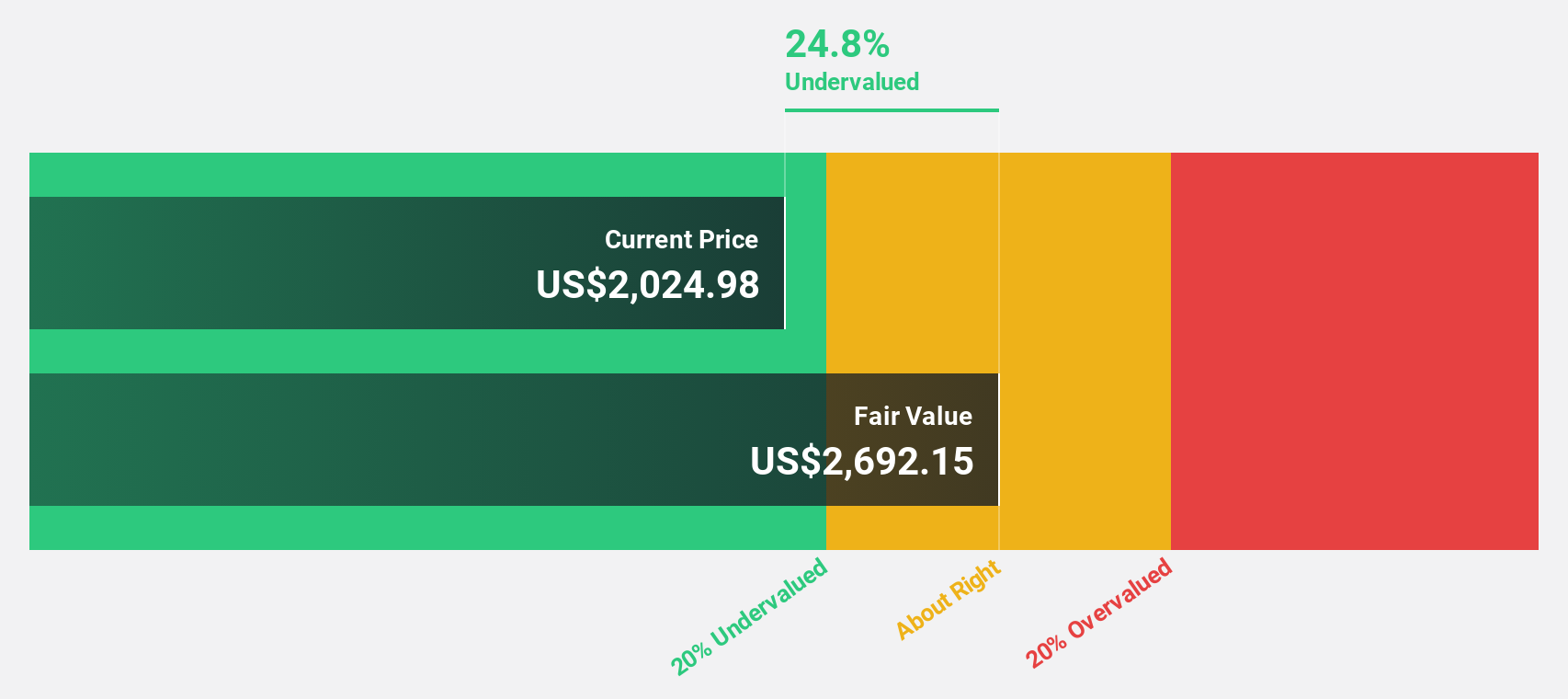

Estimated Discount To Fair Value: 30.9%

MercadoLibre is trading at US$2005.71, significantly below its estimated fair value of US$2903.83, reflecting potential undervaluation based on cash flows. With earnings projected to grow substantially over the next three years and a recent successful issuance of US$750 million in senior unsecured notes, the company demonstrates strong cash generation capacity despite high debt levels. The new partnership with Agility Robotics may enhance operational efficiency, potentially supporting future cash flow improvements amidst significant insider selling recently.

- Our expertly prepared growth report on MercadoLibre implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of MercadoLibre with our detailed financial health report.

Roblox (RBLX)

Overview: Roblox Corporation operates an immersive platform for connection and communication globally, with a market cap of $57.71 billion.

Operations: The company generates revenue of $4.46 billion from its Internet Information Providers segment.

Estimated Discount To Fair Value: 13.3%

Roblox, trading at US$82.22, is undervalued based on discounted cash flow analysis with an estimated fair value of US$94.83. Despite a net loss of US$255.63 million in Q3 2025, revenue grew significantly year-over-year to US$1.36 billion. Strategic alliances with Universal Music Group and Mattel aim to boost engagement and revenue through innovative content integration, potentially enhancing future cash flows amidst forecasted high revenue growth rates above market averages.

- Insights from our recent growth report point to a promising forecast for Roblox's business outlook.

- Dive into the specifics of Roblox here with our thorough financial health report.

Seize The Opportunity

- Unlock our comprehensive list of 205 Undervalued US Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal