Discovering Canada's Undiscovered Gems This December 2025

As 2025 comes to a close, the Canadian market has been shaped by strategic sector shifts, with investors advised to focus on energy, industrials, and materials while exercising caution in technology and consumer sectors. In this dynamic environment, identifying promising stocks requires a keen eye for diversification and potential growth within sectors poised for resilience amidst changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.62% | 30.86% | ★★★★★★ |

| Itafos | 20.68% | 9.86% | 37.00% | ★★★★★★ |

| Soma Gold | 37.84% | 26.84% | 22.13% | ★★★★★★ |

| Mako Mining | 5.29% | 37.41% | 60.51% | ★★★★★★ |

| Melcor Developments | 47.67% | 8.75% | 12.05% | ★★★★☆☆ |

| Corby Spirit and Wine | 54.56% | 11.67% | -4.04% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.68% | -3.30% | -0.82% | ★★★★☆☆ |

| Dundee | 1.46% | -35.04% | 52.59% | ★★★★☆☆ |

| Kiwetinohk Energy | 23.09% | 21.68% | 30.98% | ★★★★☆☆ |

| Grown Rogue International | 37.38% | 28.22% | 14.92% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Alphamin Resources (TSXV:AFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Alphamin Resources Corp., along with its subsidiaries, focuses on the production and sale of tin concentrate, with a market capitalization of CA$1.52 billion.

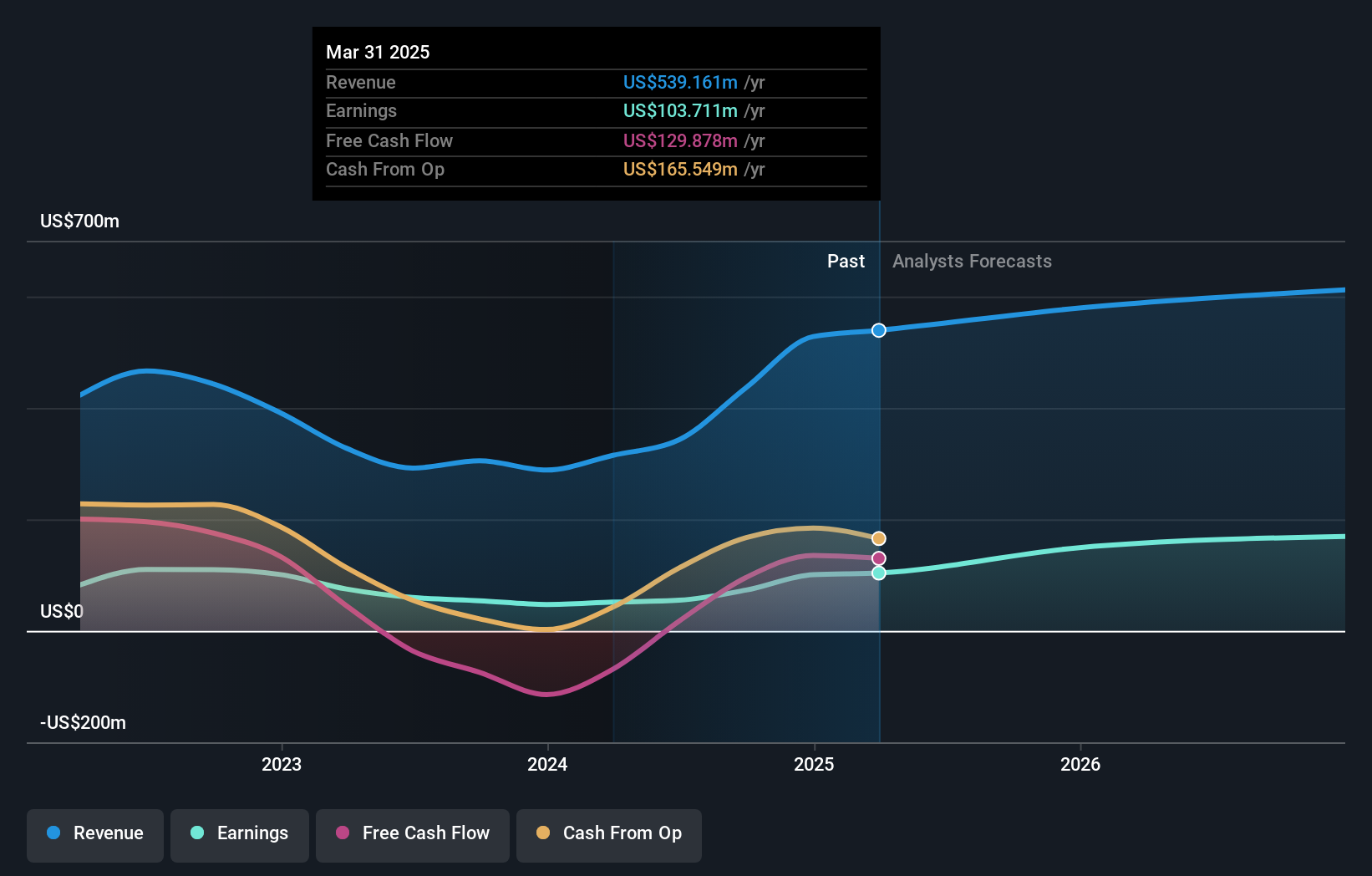

Operations: Alphamin Resources generates revenue primarily from the production and sale of tin concentrate, amounting to $574.22 million. The company's net profit margin is 33%, reflecting its profitability in the tin market.

Alphamin Resources, a dynamic player in the mining sector, has demonstrated robust financial health with high-quality earnings and a solid cash position exceeding its total debt. Over the past five years, earnings have surged by 29% annually, underpinned by a favorable price-to-earnings ratio of 9.3x compared to the broader Canadian market at 16.5x. Despite recent challenges affecting quarterly tin production due to security concerns, Alphamin's operations have rebounded with production guidance for FY2025 now set between 18,000 and 18,500 tonnes. The company's net income for Q3 rose to US$35 million from US$32 million last year.

- Click to explore a detailed breakdown of our findings in Alphamin Resources' health report.

Understand Alphamin Resources' track record by examining our Past report.

Mako Mining (TSXV:MKO)

Simply Wall St Value Rating: ★★★★★★

Overview: Mako Mining Corp. is involved in gold mining and exploration operations in Nicaragua, with a market capitalization of CA$701.29 million.

Operations: Mako Mining generates revenue primarily from gold production and exploration activities, amounting to $126.93 million.

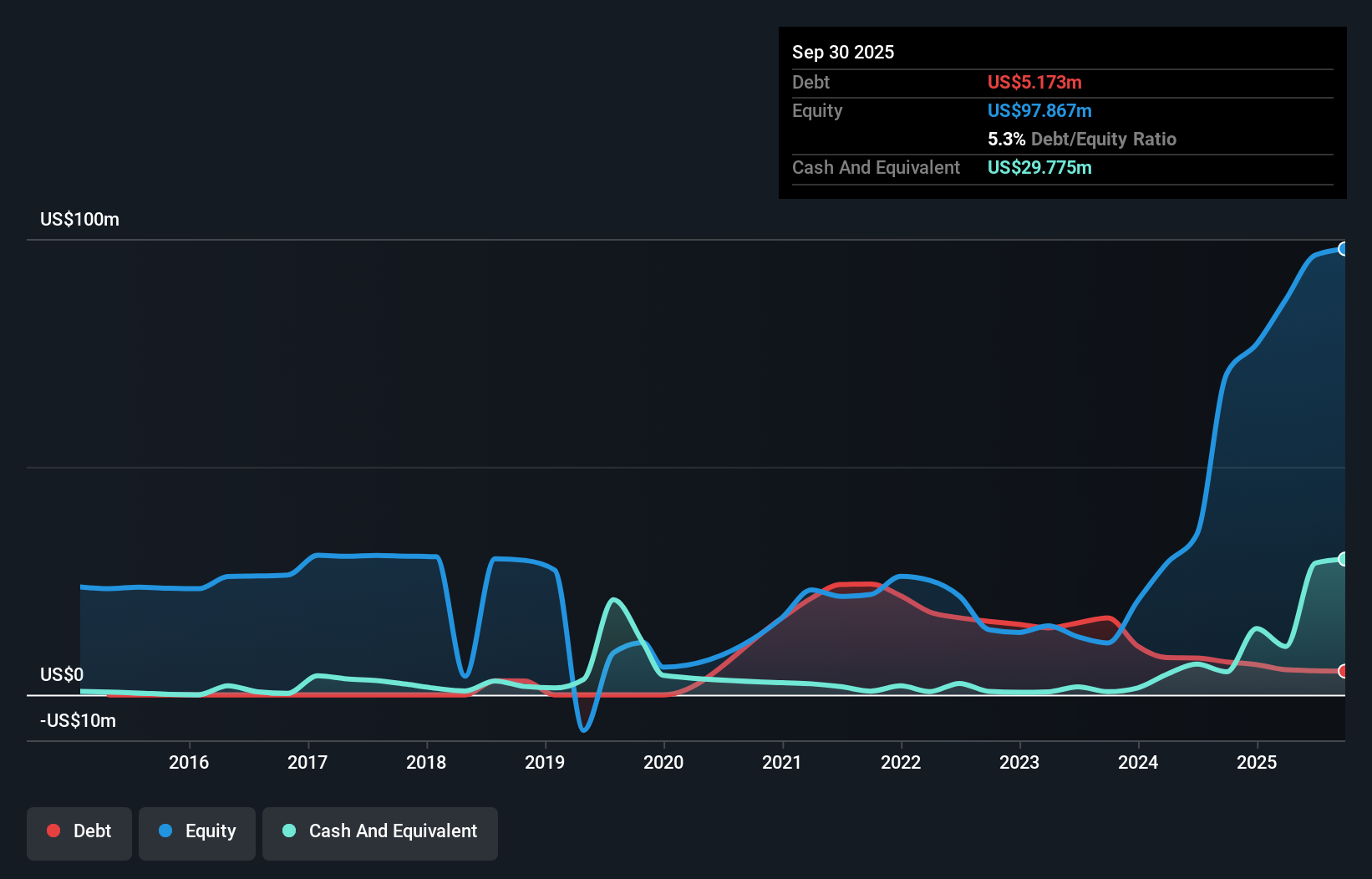

Mako Mining, a nimble player in the mining sector, has been making waves with its strategic maneuvers. Over the past five years, earnings have surged 60.5% annually while reducing its debt to equity ratio from 89.1% to 5.3%. This company is trading at a significant discount of 72.3% below estimated fair value, showcasing potential for investors seeking undervalued opportunities. Recent initiatives include a share repurchase program for up to 4,350,450 shares and an acquisition of the Mt. Hamilton Gold-Silver Project in Nevada without issuing new equity—moves that underscore Mako's commitment to growth and shareholder value enhancement.

- Delve into the full analysis health report here for a deeper understanding of Mako Mining.

Gain insights into Mako Mining's historical performance by reviewing our past performance report.

Santacruz Silver Mining (TSXV:SCZ)

Simply Wall St Value Rating: ★★★★★★

Overview: Santacruz Silver Mining Ltd. is involved in the acquisition, exploration, development, production, and operation of mineral properties in Latin America and has a market capitalization of approximately CA$1.23 billion.

Operations: Santacruz Silver Mining generates revenue primarily from its mineral properties, with notable contributions from Zimapan ($93.41 million) and SAN Lucas ($89.89 million). The company also derives significant income from Bolivar and Caballo Blanco Group, contributing $73.25 million and $75.48 million, respectively.

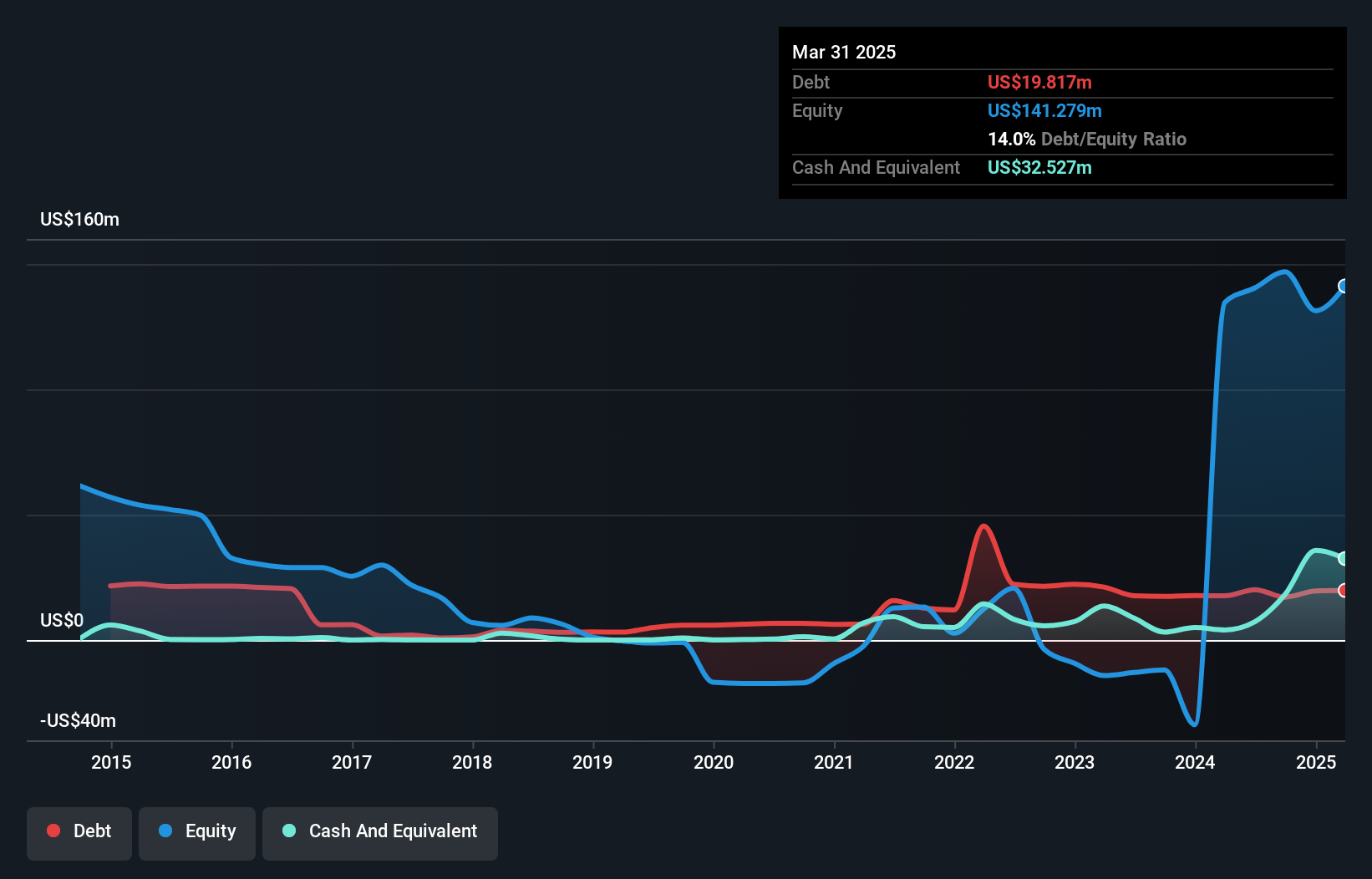

Santacruz Silver Mining, a small player in the mining sector, has been navigating a challenging landscape with mixed results. Despite its revenue forecast to grow 12.49% annually and trading at 28.7% below estimated fair value, the company faced negative earnings growth of -57.6% over the past year compared to an industry average of 63.4%. Its net profit margin dropped from 54.4% last year to 19.5%, yet it remains profitable with more cash than debt and interest payments well covered by EBIT at a robust 107x coverage ratio. Recent insider selling might raise eyebrows among investors looking for stability in this volatile market segment.

- Unlock comprehensive insights into our analysis of Santacruz Silver Mining stock in this health report.

Evaluate Santacruz Silver Mining's historical performance by accessing our past performance report.

Summing It All Up

- Discover the full array of 48 TSX Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal