Top Dividend Stocks To Consider In December 2025

As the U.S. stock market wraps up a holiday-shortened week with notable gains across major indexes, investors are eyeing opportunities in dividend stocks amid an environment of rising precious metal prices and steady economic indicators. In such a landscape, selecting dividend stocks can offer a balance between income generation and potential capital appreciation, making them an attractive option for those looking to navigate the current market dynamics.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.72% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.37% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.70% | ★★★★★★ |

| First Interstate BancSystem (FIBK) | 5.23% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.98% | ★★★★★★ |

| Ennis (EBF) | 5.47% | ★★★★★★ |

| Douglas Dynamics (PLOW) | 3.54% | ★★★★★☆ |

| Dillard's (DDS) | 4.95% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.04% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.43% | ★★★★★★ |

Click here to see the full list of 116 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

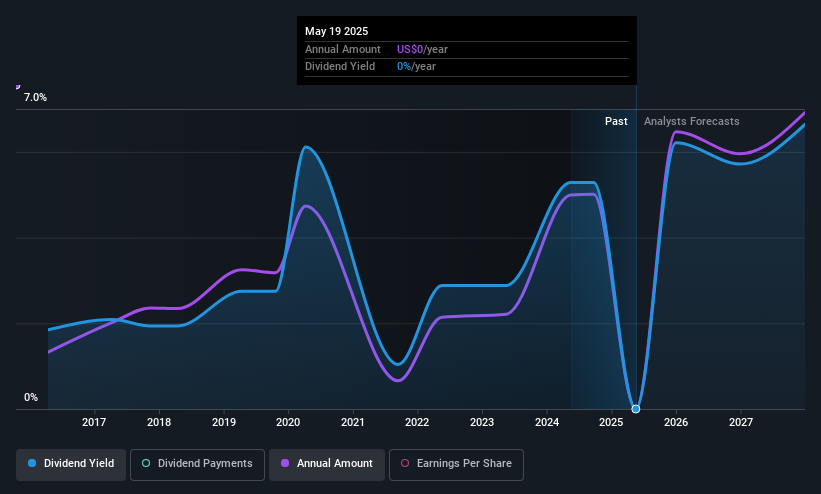

Qfin Holdings (QFIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Qfin Holdings, Inc. operates an AI-driven credit-tech platform under the Qifu Jietiao brand in China, with a market cap of approximately $2.60 billion.

Operations: Qfin Holdings, Inc. generates revenue from its AI-driven credit-tech platform under the Qifu Jietiao brand, with revenue segments amounting to CN¥19.59 billion.

Dividend Yield: 7.6%

Qfin Holdings' dividend yield of 7.6% ranks in the top 25% of US dividend payers, supported by a low cash payout ratio of 12.8%, indicating strong coverage by cash flows. However, its dividend history is unstable and volatile, having been paid for only four years with significant fluctuations. The company trades at a considerable discount to its estimated fair value but faces challenges with declining earnings forecasts over the next three years.

- Unlock comprehensive insights into our analysis of Qfin Holdings stock in this dividend report.

- Upon reviewing our latest valuation report, Qfin Holdings' share price might be too pessimistic.

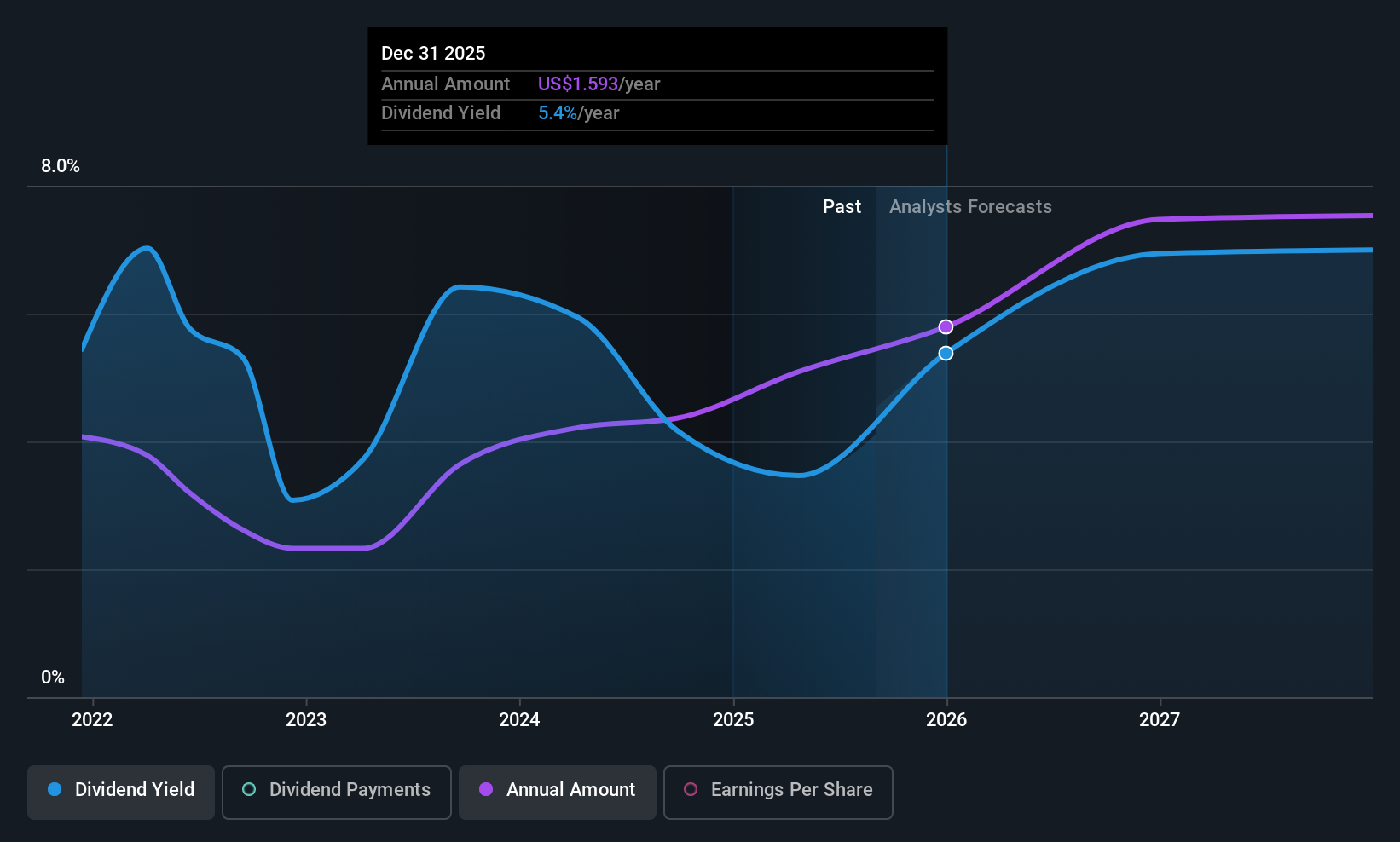

Credicorp (BAP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Credicorp Ltd. operates as a provider of financial, insurance, and health services in Peru and internationally, with a market capitalization of $23.14 billion.

Operations: Credicorp Ltd.'s revenue segments include Universal Banking through Banco De Crédito Del Perú with PEN 14.38 billion, Microfinance via Mibanco at PEN 1.79 billion, Insurance and Pension Funds from Pacífico Seguros and Subsidiaries totaling PEN 2.16 billion, Investment Management and Advisory contributing PEN 993 million, additional microfinance operations in Colombia including Edyficar S.A.S. at PEN 362 million, Insurance and Pension Funds from Prima AFP at PEN 581 million, and Universal Banking through Banco De Crédito De Bolivia providing PEN 330 million.

Dividend Yield: 3.8%

Credicorp's dividend yield of 3.77% falls short of the top US dividend payers, yet its payout ratio is a manageable 49.1%, suggesting dividends are well covered by earnings. Despite past volatility in payments, dividends have grown over a decade. Credicorp trades at a discount to its estimated fair value but faces challenges with high non-performing loans at 4.9%. Recent earnings growth reflects improved financial performance, potentially supporting future dividend stability.

- Get an in-depth perspective on Credicorp's performance by reading our dividend report here.

- Our expertly prepared valuation report Credicorp implies its share price may be lower than expected.

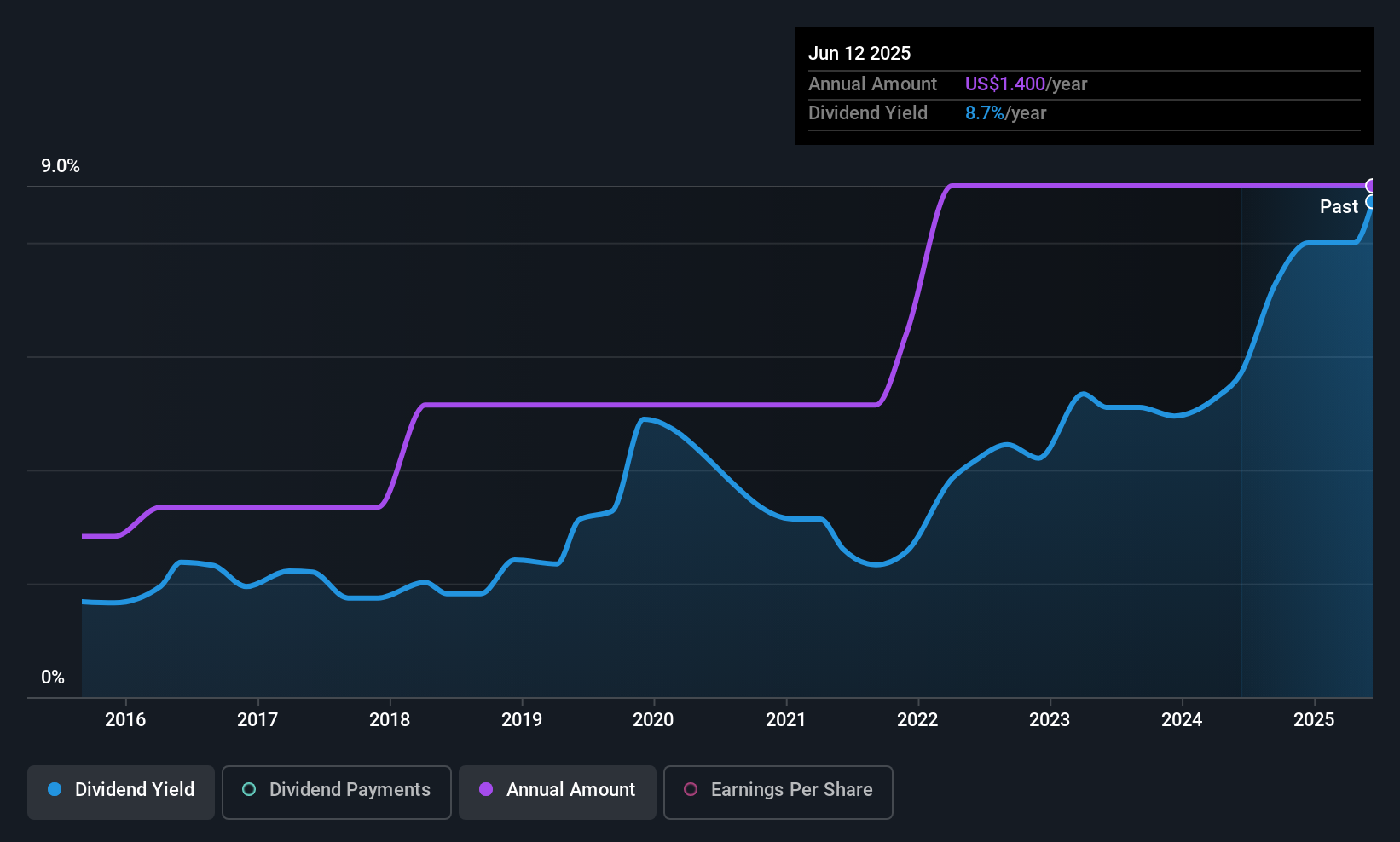

Movado Group (MOV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Movado Group, Inc. designs, sources, markets, and distributes watches globally with a market cap of $462.24 million.

Operations: Movado Group, Inc. generates revenue through its Company Stores segment, contributing $100.01 million, and its Watch and Accessory Brands segment, which accounts for $561.20 million.

Dividend Yield: 6.7%

Movado Group's dividend yield of 6.71% ranks in the top 25% of US payers, though its high payout ratio of 141.3% indicates dividends aren't covered by earnings, raising sustainability concerns. Despite a history of volatility, dividends have grown over the past decade and are currently supported by cash flows with an 88.1% cash payout ratio. Recent earnings improvements show net income rising to US$9.58 million in Q3, potentially aiding future dividend payments stability.

- Click here and access our complete dividend analysis report to understand the dynamics of Movado Group.

- The analysis detailed in our Movado Group valuation report hints at an inflated share price compared to its estimated value.

Turning Ideas Into Actions

- Gain an insight into the universe of 116 Top US Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal